What businesses consider to be an uncollectable debt may not always be as clear cut as is the case when a customer is declared bankrupt…The lesson is that some businesses often write off their debts before they actually need to.

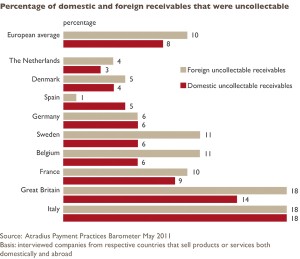

A recent survey of businesses across nine European countries has uncovered a considerable variation, by country, in the percentage of trade receivables that businesses write off as uncollectable.

The survey – the Atradius Payment Practices Barometer, published in May 2011 – collected information from Belgium, Denmark, France, Germany, Great Britain, Italy, the Netherlands, Spain and Sweden, and from businesses with annual turnovers from under €1 million to over €1 billion. Those businesses represent a cross section from 22 industries, including sectors as diverse as construction, pharmaceuticals, food & drink, financial services and steel & metals.

While, on average, the businesses surveyed wrote off almost 10% of trade receivables, when analysed by individual country, the picture was much more varied. For instance, the Danish and German businesses surveyed recorded around 4-6% as uncollectable, and the Dutch and Spanish even less. But Italian businesses reported that they would not be able to recover 18% of their trade debts, with Great Britain close behind that figure with 14% of domestic debts and 18% of foreign debts deemed to be unrecoverable.

[ms-protect-content id=”9932″]What Does this Tell Us?

Denmark’s and Germany’s low level of write offs surely reflects those countries’ effective credit management skills, good payment morale and current economic stability. While facing many of the same post-crisis problems as EU neighbours, Denmark’s fiscal situation is among the strongest in Europe. According to a March 2011 report by Jyske Bank, inflation is under control at 2.3% and expected to fall to 1.8% next year. Germany has profited hugely from surging demand – especially from China – for its specialised goods: industrial machinery, prestige cars, electronics and consumer goods. As a result of this positive export-led performance, expectations are that Germany’s budget deficit will reach 2.5% of GDP this year – below the Maastricht threshold of 3%. As a result of the strength of their economies, businesses in both Denmark and Germany feel able to continue to stipulate relatively short credit periods to their customers in their payment terms, which may reduce the risk of payment default that can rise during that credit period.

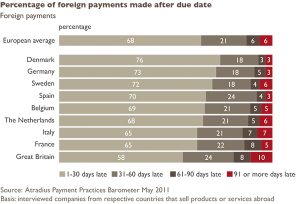

By contrast, businesses in those countries suffering more in the wake of the global downturn may be offering longer credit periods to stimulate sales growth.

Great Britain’s high percentage of unrecoverable debts suggests that its economy still has some way to go before it can claim to have recovered from the economic crisis, and that Europe’s economic health is not simply a case of a ‘north-south’ divide. Its recession was deeper than many of its European peers and so far its recovery has been weaker than most other large economies. The IMF has recently downgraded its expectations of UK growth in 2011 (including Northern Ireland) from 2% to 1.7%, with public spending cuts set to dampen domestic demand.

Are Businesses too Ready to Write Off Debt?

What businesses consider to be an uncollectable debt may not always be as clear cut as is the case when a customer is declared bankrupt (and even then there may still be hope). In many instances, it is simply that creditors have exhausted what they deem to be their available courses of action – effectively, they run out of ideas and feel that their scarce credit management resources would be better employed in assessing new business opportunities rather than chasing old debts. This is particularly true of sales to customers in foreign countries because, when faced with the apparent complexities of the legal system in the debtor’s country, the supplier may write off a debt in despair. That is understandable, since every country has its own laws governing legal and insolvency proceedings, the filing of debts, and the settlement of disputes between buyer and seller – and these proceedings may be conducted in the debtors language, not yours.

In the face of such obstacles, an alternative to write off is to outsource the collection of the debt to a collection agency. But, just as a supplier should vet a potential customer to assess whether they are likely to fullfill their end of the contract, so should that supplier ensure that their chosen collection agency has the skills and resources to act successfully on their behalf. Is the agency well versed in the language, law and business culture of the debtors country? Preferably, does it have people based in that country who can deal rapidly with issues and obstacles as they arise? Can I monitor the agencies actions and progress to ensure that otherwise good business relations aren’t soured by a single debt? Atradius Collections’ comprehensive and regularly updated International Debt Collection Handbook (downloadable from www.atradiuscollections.com) serves as a useful guide for exporters and as a ‘checklist’ of key aspects of debt recovery on which to assess agencies before outsourcing collections.

What Can a Collections Agency Achieve?

A major collections agency , especially one, like Atradius Collections, that is allied to a leading credit insurer, can add weight to the collection process in a way that would be impossible for an individual creditor. The agency may well be acting for a number of clients – whether credit insured or not –and can thus more effectively negotiate settlement as the buyer’s refusal to pay one supplier may impact the availability of credit insurance and consequently the willingness of many other suppliers to offer credit terms to the buyer. If, as often happens, the buyer is disputing the existence of the debt, for instance on the grounds of the quality of the goods delivered, the agency will be best placed to seek a resolution to that dispute and establish the extent of the agreed debt.

Even in the case of a debtor’s insolvency, when, for unsecured creditors, the chances of a sizeable settlement may not be great, a credible collection agency will take on the arduous and lengthy process of registering the debt and monitoring progress towards a payout to creditors.

The lesson is that some businesses often write off their debts before they actually need to.

Nevertheless, a late payment – even one that can eventually be recovered – can have a serious impact on a business’s profits and cash flow. It can even impair the businesses ability to finance future trade. For that reason alone, protecting cash flow by insuring your credit sales is a wise move. Look at it this way: if you incur a payment default of €50,000 and operate on a 10% profit margin, you would have to successfully sell another €450,000 worth of goods or services simply to recoup your capital loss. On a 5% margin, that €450,000 jumps to €950,000.

Is it worth the risk?

About the Author

Andreas Tesch is the Senior Director of Global, Oceania and New Markets for Atradius Credit Insurance. Atradius is a leading global provider of credit insurance, collections and surety solutions for B2B transactions with a presence in 40 countries across the world. Credit insurance is a credit management tool that provides businesses with protection against the risk that their customers default on payment when purchasing products or services on credit.

[/ms-protect-content]