By Sarah Hewitt

They have the confidence, they have the ability, but research shows that women entrepreneurs around the world face systemic barriers to growing their businesses. Sarah Hewitt, Director of the Strive Women program, details some specific issues and discusses how systems should be changed in order to break down those barriers.

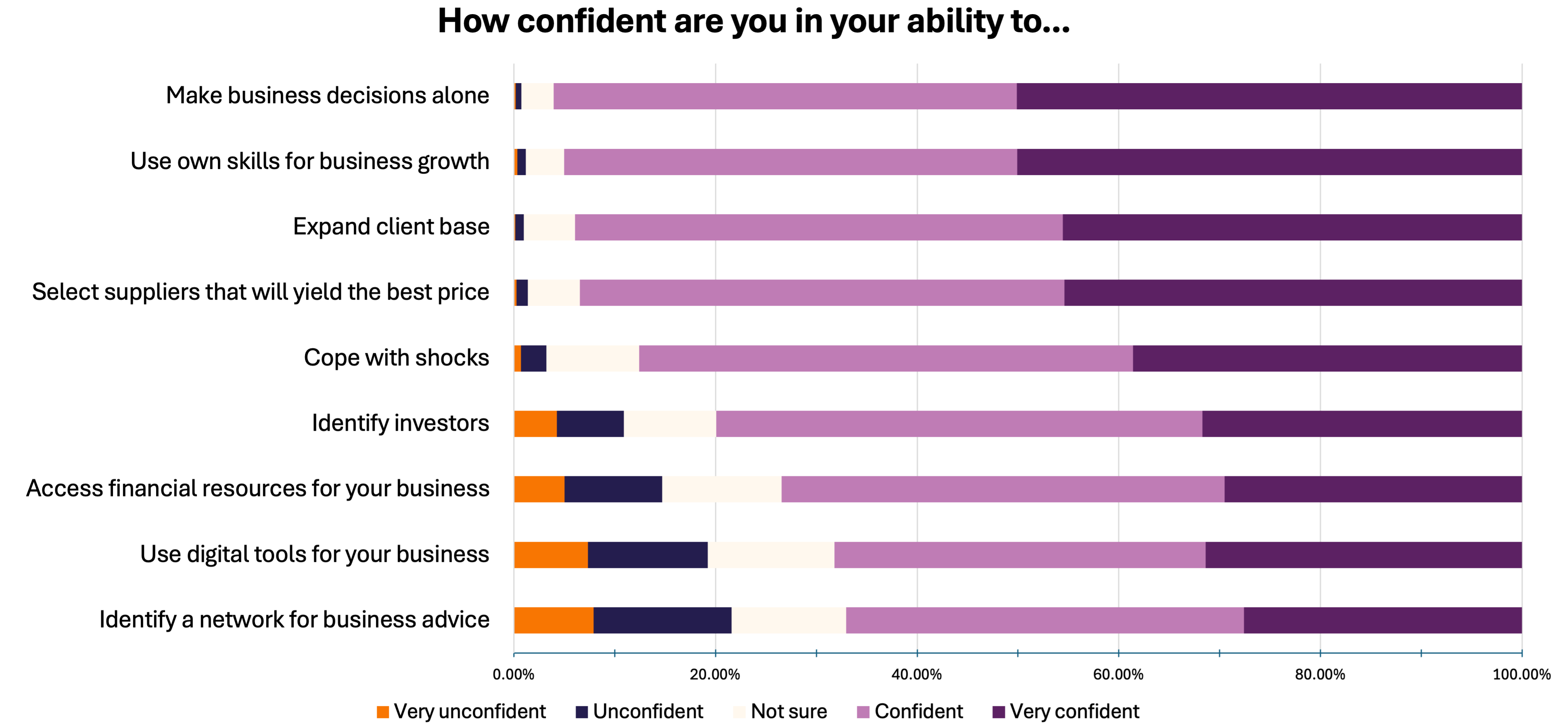

Women entrepreneurs are deeply confident in their own abilities and goals, as we have revealed through new research from CARE’s Strive Women program. They are strategically expanding their client bases, building supplier networks, and making critical business decisions. In fact, 96 per cent of women entrepreneurs surveyed across Peru, Pakistan, and Vietnam described being confident in their ability to manage and run their operations, while 87 per cent expressed ambitions to grow their businesses.

Research indicates that confidence directly improves business outcomes and profitability.

These high levels of confidence reported by women entrepreneurs point to significant economic potential. Research indicates that confidence directly improves business outcomes and profitability. Yet, without the systems and market actors to support them, women entrepreneurs remain blocked from their full potential. And this gap is costly; by some estimates, providing equal business opportunities to women could add $6 trillion to the global economy.

“Women entrepreneurs have long been self-assured and know how they want to make decisions for their businesses,” said Maria José Huamani, a business owner from Lima, Peru. “Who can do that? Only someone with self-confidence,” she adds. Maria José created her brand, Murats Bags, out of necessity during the pandemic when she and her husband, Cristian, were looking for productive ways to generate income while at home. Seeing the increasing use of bicycles as people avoided public transportation, Cristian created a bike-friendly leather fanny pack which immediately became popular. Maria José saw the potential in expanding their offerings and decided to pivot their business interests towards producing leather handbags for women – and so Murats Bags was born.

Yet Maria José has faced significant barriers as a woman entrepreneur, in both professional and social settings. She recalls people questioning her ability to run a business that required substantial investment: “People didn’t trust me or believe in my work. They didn’t believe a young woman could start a business.” At networking events, she often found herself sidelined, with potential partners speaking only to her husband, even though Murats Bags is her creation. And at banks, she’s found it difficult to take out a loan required to grow the business. “They don’t trust [women],” she says, “but statistics show women are the most responsible when it comes to credit. Banks should take a closer look at who their best clients are so they can offer the right financial products.”

Maria José’s story is one of thousands of women business owners who have the confidence and tenacity to succeed and want to make business decisions on their terms, but are continually faced with systemic and cultural barriers. As part of Strive Women, CARE talked to more than 2,000 women entrepreneurs to study attitudes around business confidence and decision-making.

Key findings from the research highlight that

Access to finance is crucial

While confidence in business leadership is high, 27 per cent of women entrepreneurs report a lack of access to adequate financial resources. Sixty per cent of respondents are unable to access loans with a lower interest rate, while 21 per cent list too-small loan sizes and 19 per cent indicate that short-term loan periods act as barriers to usage. For many, trust in financial institutions remains a challenge, while others describe the unfair treatment they face when seeking financial products and services. CARE’s qualitative research shows that when women have equal access to fair financial resources, their businesses can thrive. Yet barriers persist.

Support networks are essential

A trusted network can provide both non-financial support and business advice. Women entrepreneurs benefit from connections with others who understand their unique challenges and goals and provide informal yet essential support. However, 34 per cent of women entrepreneurs lack this vital network. This extends to critical decision-making as well; 59 per cent of respondents currently make decisions about their business jointly.

Digital technology divide

The rapid advancement of technology, and financial technology, can become a barrier for women entrepreneurs if they are not upskilled and unless they anticipate and adapt to these changes. One-third (33 per cent) of women entrepreneurs said they do not feel they have enough digital technology skills to suit their business needs. This skills gap limits opportunities.

The next step – change the market systems to work for women entrepreneurs

When market actors design products and services intentionally for women entrepreneurs, they are better able to access and use financial services, business support networks, and digital tools that are critical to the growth of their business.

Looking at financial services specifically, this is not just about women entrepreneurs opening bank accounts; it’s about fostering an environment where women can access credit, insurance, and other financial products that are tailored to their unique needs so they can be resilient and grow. It’s about taking a women-

centered design approach that involves actively listening to women, testing products and services with them, and iterating based on their feedback.

Another businesswoman from Lima, Peru, explains, “I was surprised that when I went to look for a loan, that me being young or a woman, they didn’t take me seriously and they told me that I would have to ask my husband.” Financiera Confianza, a microfinance institution (MFI) in Peru serving women entrepreneurs like these, is working to address this. “We launched Emprendiendo Mujer in 2021 with the objective to reduce the gap that we have in Peru to financing women. […] One of the key features of Emprendiendo Mujer is that this product does not require the husband’s signature to access the credit. This is critical because it ensures our clients’ financial independence.”

Despite the obstacles that women entrepreneurs face, the issue is not a lack of confidence; it’s the absence of fair and supportive market systems.

Access to essential resources like financial services, formal and informal support networks, and digital tools and skills training is important. But we must go beyond this to ensure that these resources are right-fit, available in-market, and incentivized for uptake. Strive Women, led by CARE and supported by the Mastercard Center for Inclusive Growth as part of its Mastercard Strive program, addresses the specific barriers that women face by working with local market actors using women-centered design to deliver tailored financial products and support services, such as digital skills building and strengthening women’s networks. Taking a women-centered design approach has led women entrepreneurs to see an 81 per cent increase in their sales, with 79 per cent reporting that digital tools and training had helped their businesses grow. The combination of financial and non-financial services proves to be a powerful approach to unlocking business growth and financial health for women entrepreneurs.

About CARE

Founded in 1945 with the creation of the CARE Package®, CARE is a leading humanitarian organization fighting global poverty. CARE places special focus on working alongside women and girls. Equipped with the proper resources, women and girls have the power to lift whole families and entire communities out of poverty. In 2024, CARE worked in 121 countries, reaching 53 million people through 1,450 projects. To learn more, visit www.care.org.

About Strive Women

Mastercard Strive is a portfolio of philanthropic programs supported by the Mastercard Center for Inclusive Growth and funded by the Mastercard Impact Fund. With programs around the world, Mastercard Strive aims to support 18 million small businesses to go digital, get capital, and access networks and know-how. Strive Women started in 2023 as an evolution of the Ignite program and uses women-centered design to deliver tailored financial products and support services, such as digital skills building and strengthening women’s networks. The program addresses the unique barriers faced by women-led businesses in Pakistan, Peru, and Vietnam. Strive Women aims to reach over 6 million entrepreneurs through its campaigns.

To multiply the success stories of women entrepreneurs like Maria José and her small business, public and private sector actors must come together to make market systems work better for women entrepreneurs by:

- Shifting the narrative on women-led businesses to showcase that women entrepreneurs already have high confidence and know what their businesses need

- Investing in research and asking women entrepreneurs what they need; consider them as clients, suppliers, and business leaders

- Designing products and services that meet their needs, fuel their confidence, and support women’s decision-making – on their terms

- Challenging harmful social norms by celebrating the economic contributions of women entrepreneurs.

Despite the obstacles that women entrepreneurs face, the issue is not a lack of confidence; it’s the absence of supportive market systems. The notion that women simply need more self-belief distorts reality. Hundreds of millions of women worldwide are already leading businesses with resilience and purpose, despite enduring systemic discrimination and cultural barriers. As Maria José dreams of expanding her brand, opening a factory, and leading Peru’s leather industry, her words reflect the determination of countless women entrepreneurs: “When I believe in myself, nothing can stop me – I can conquer the world!” She is not the one holding herself back – but systems are.

Sarah Hewitt

Sarah Hewitt