By Jean-Marc Ollagnier, Philippe Roussiere, and Praveen Tanguturi

Powered by recent investments, European companies are on pace to collectively lead the world in artificial intelligence by 2024. But if the continent’s firms are to achieve their full AI ambitions, they’ll need a more comprehensive approach to scaling the technology.

During this time of great stress and economic uncertainty in Europe, artificial intelligence is shaping up to be a vital tool supporting much-needed gains in efficiency and innovation—in the region and across the world. Yet even in the past few years, we’ve seen glimpses of AI’s huge potential to influence society and business.

We witnessed AI’s influence on public health: Mainz, Germany-based BioNTech harnessed AI to develop life-saving Covid mRNA vaccines in a fraction of the time that it takes to produce traditional jabs. We saw AI’s impact on corporate revenues: our research shows that the share of European-headquartered companies’ revenue that is AI-influenced more than doubled between 2018 and 2021 (from 10% to 23%, on average).

We observed the positive signal that AI sends to investors, too: our research revealed that when European business leaders mentioned AI on their earnings calls in 2021, their firms’ respective share prices were 49% more likely to increase. European business leaders, for their part, are no less bullish on AI. Of the more than 500 European company C-suite executives we recently surveyed, 38% said that their AI initiatives thus far had exceeded expectations, while fewer than 1% said their AI efforts had not met expectations.

The question now is whether European companies are well prepared to increase the value they’re getting from AI in the coming months and years. Most business leaders expect to: our recent survey also found that 72% of organizations in Europe have already re-worked their strategy and cloud plans to achieve AI success. Their intent is to scale AI broadly and quickly.

In fact, modeling based on their inputs shows that AI-related revenues could rise to 32% of all revenues by 2024 (tripling the level reached in 2018). Even more impressive, our analysis indicates that Europe’s companies are on pace to have the highest level of AI maturity of any world region by 2024.

This is the rosy side of the continent’s AI story. However, our deeper research into AI readiness and deployment across Europe revealed another, less flattering, tale.

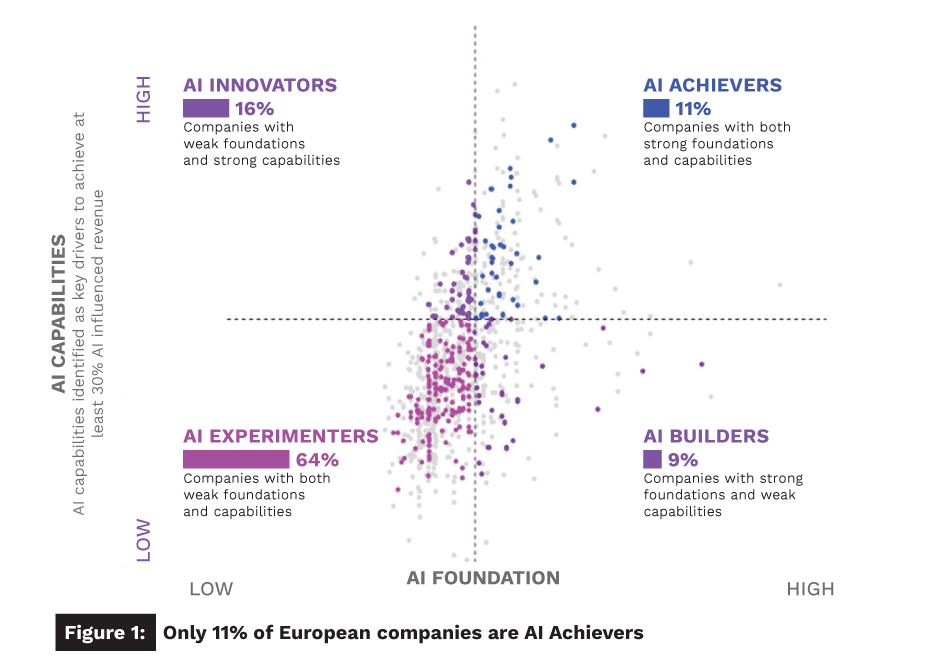

Despite broad attention to AI investment, we found that just 11% of large European enterprises appear to have the AI maturity needed to scale quickly and effectively and reach their revenue goals. Specifically, these select companies possess both strong AI foundations (such as cloud platforms and tools, as well as data platforms, architecture, and governance) and differentiated AI capabilities (like a robust AI strategy and C-suite sponsorship). The rest of the organizations we studied possess one or the other strength, or neither.

We believe it’s worth looking at how this group of leading companies—call them “AI Achievers”—compares with other European firms on AI maturity. We also believe the approach of AI Achievers suggests a rapid path to improvement for others.

AI Achievers stand out

To understand why Achievers’ actions matter, consider our map of European companies’ AI maturity (see Figure 1). At a high level, AI maturity measures the degree to which organizations have mastered their AI-related foundations and capabilities in the right combination to achieve high performance for customers, shareholders, and employees. To test for it, we ran so-called Lasso regression models (a statistical technique that uses machine learning, itself a type of AI) on our survey results, which comprised half a million data points and 80 variables potentially correlated with AI maturity.

As Figure 1 shows, AI Achievers represent the 11% of European companies that have strong AI foundations and differentiated capabilities. However, a large majority (64%) of companies, “AI Experimenters”, lack both of those strengths. The rest are either “AI Innovators” (the 16% of companies with weak foundations) or “AI Builders” (the 9% with weak capabilities).

As Figure 1 shows, AI Achievers represent the 11% of European companies that have strong AI foundations and differentiated capabilities. However, a large majority (64%) of companies, “AI Experimenters”, lack both of those strengths. The rest are either “AI Innovators” (the 16% of companies with weak foundations) or “AI Builders” (the 9% with weak capabilities).

These distinctions matter and are readily visible: Achievers are 3.5 times more likely than Experimenters, for instance, to see their AI-influenced revenue surpass 30% of their total revenues. Achievers also score 8% higher than Experimenters on customer-experience metrics. What’s less visible, though, are the differences in how these companies have approached AI, to land where they are now.

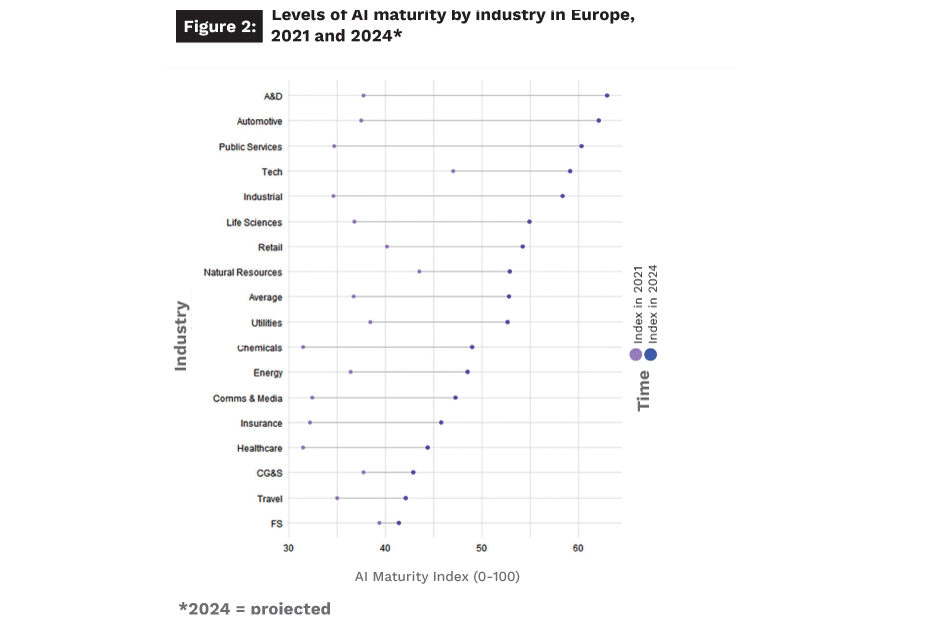

As our research found, industry also makes a difference in the likelihood that a company will be more or less mature in its AI readiness today—and in 2024. Europe’s tech industry, for example, has been a leader in AI maturity across the region, but others are projected to close the gap quickly. Indeed, as Figure 2 highlights, industries such as aerospace and defense (A&D) and automotive, which have made rapid advances in their deployment of tools like robotics and automation, are expected to leapfrog tech in their AI maturity by 2024.

As our research found, industry also makes a difference in the likelihood that a company will be more or less mature in its AI readiness today—and in 2024. Europe’s tech industry, for example, has been a leader in AI maturity across the region, but others are projected to close the gap quickly. Indeed, as Figure 2 highlights, industries such as aerospace and defense (A&D) and automotive, which have made rapid advances in their deployment of tools like robotics and automation, are expected to leapfrog tech in their AI maturity by 2024.

As for their relative performance against firms headquartered in other regions, we found that European companies are more likely to “industrialize”, or scale, AI (specifically: applying AI for asset performance management, for optimizing operations, for workforce alignment and augmentation, and for infrastructure and network process insights and automation). For instance, 35% of the European enterprises we surveyed use AI for the four aforementioned purposes, compared with 34% of all the companies we surveyed worldwide that do so. Nevertheless, the tiny share of companies that have managed to scale AI for those same purposes (just 2%, both in Europe and globally) illustrates how much work remains to be done.

The Achievers’ approach

Which brings us to individual companies’ behaviors. What are Europe’s AI Achievers, which exist across the industries we studied, doing differently or better than their peers? Some things that Achievers do well, like securing senior sponsorship for their AI efforts, are both essential and unsurprising—transforming an organization, after all, almost always needs strong support from the top. However, we also discovered four behaviors that tend to get overlooked, but are no less critical to developing AI maturity.

Behavior 1: Building your AI “core”

One of the biggest AI-related challenges companies face is a proliferation of data across platforms and systems; on-site legacy systems mix awkwardly with firms’ growing cloud presence. The unhappy result is that data is frequently not accessible in the right form and context. Such firms, in turn, struggle mightily to scale AI across their organizations.

Achievers, on the other hand, build so-called AI cores—i.e., operational data and AI platforms that tap into companies’ talent, technology, and data ecosystems, allowing firms to balance experimentation and execution. Achievers in Europe, we found, are 33% more likely, on average, than Experimenters to have scaled their data-management and governance practices (efforts that are essential for building strong AI cores).

Further downstream, an AI core helps organizations do many beneficial things, such as swiftly productizing their AI applications or integrating AI into their other apps. As for how to build AI cores, we learned that Achievers harness the full power of internal and external data, while making that data trustworthy and storing it in a single enterprise-grade cloud platform—complete with appropriate usage, monitoring, and security policies.

In 2019, for example, Swiss pharmaceutical giant Novartis began scaling its AI governance and data-management practices by creating “Insight Centers”, which offer real-time visibility on the firm’s manufacturing operations and distribution points. Novartis also prioritized efforts to make the powerful data-processing technology available at these centers compatible with the platforms and tools used elsewhere in the company. In the process, Novartis greatly improved its capacity to develop and manufacture personalized medicines in small quantities—on time and at lower cost.

Behavior 2: Sustaining your AI investments

Achievers understand that their AI investment journeys don’t have a finish line. There is, they frequently note, no “peak AI”. This understanding fuels another critical, if often overlooked, behavior: Achievers get more out of AI because they sustain—and often increase—their investment in AI over time, even as their AI maturity improves. In 2018, for instance, Achievers in Europe devoted 14% of their total technology budgets to data and AI, while in 2021 they devoted 27%. In 2024, they expect to devote 33%.

For Achievers, sustained investment often involves expanding the scope of AI to deliver maximum impact, while “crosspollinating” AI solutions and redeploying resources along the way. Wiener Netzen, for example, invested heavily in AI-powered digital twins (i.e., real-time, virtual simulations of physical objects or systems) in recent years. These investments allowed the Austrian energy firm to better serve clients, such as the City of Vienna. Among other advantages, the firm’s digital twins modeled demand for heating and cooling services more accurately than its previous systems did; the digital twins were also better at estimating the short-term costs and long-term energy savings of various initiatives, like upgrading thermal insulation and replacing fossil-fuel heating with greener heating pumps.

Yet far from resting on its laurels, Wiener Netzen is investing in AI today as aggressively as ever. This allows the company to continue delivering exceptional value to clients: government planners in Vienna and elsewhere, for instance, now access user-friendly 3D models of their cities to reliably forecast the environmental and economic effects of different energy policies.

Behavior 3: Training your workforce to become AI-savvy

Achievers understand that AI is most effective when it operates seamlessly with human workers. That’s why Achievers excel at developing proactive AI talent strategies to stay at the forefront of industry trends. In addition to their AI-focused hiring, Achievers often partner with, or acquire, specialist companies to fill critical roles (such as data or behavioral scientists, social scientists, and ethicists).

Achievers are also far more likely to have mandatory AI training for most employees, from product-development engineers to C-suite executives. And because Achievers prioritize efforts to build AI literacy in their workforces, their employees inevitably become more proficient in AI-related skills than do their peers at other firms.

Such efforts collectively make it easier to scale human and AI collaboration and ensure that AI permeates the enterprise. A large European energy company, for example, created a “digital factory” to help empower employees to use analytics and AI-driven insights in their daily jobs. Among other initiatives, the digital factory trains field engineers to work with, and improve, machine-learning models. The factory also provides compulsory data and AI training to all managers, as well as reskilling and upskilling support to the firm’s entire workforce.

Thanks to the organization’s increased investment in AI-savvy talent, its business department now receives new, AI-powered apps within five months of initiating their development—compared with an 18-month wait, on average, before the digital factory was built. More broadly, by 2025, the company expects its digital factory to boost its bottom line by $1.5 billion annually.

Behavior 4: Creating your responsible AI framework

As companies deploy AI for a growing range of tasks, adhering to laws, regulations, and ethical norms is becoming an increasingly critical behavior for developing AI maturity. Indeed, the ability to demonstrate high-quality, trustworthy AI systems that are “regulation ready” will give early movers a significant advantage in both the short- and long-term, enabling them to attract new customers, retain existing ones, and build investor confidence. Yet only 9% of the European companies we surveyed—nearly all of them Achievers—told us that when they begin designing AI, they take the time to make it responsible as well as efficient.

When organizations don’t create responsible AI frameworks, they create numerous risks for themselves and their customers, such as algorithmic bias (i.e., the danger that AI trained on data that reflects historical discrimination will perpetuate such discrimination). To reduce the risk of algorithmic bias, Allied Irish Banks (AIB), for instance, conducts multi-layered “algorithmic-fairness” assessments of its AI models. Such assessments incorporate research into the causes of bias in data and algorithms; they also define and apply quantitative measures of fairness, including by proposing data collection and modelling methods that make algorithms more equitable.

In addition, AIB’s algorithmic-fairness assessments require extensive collaboration between the retail bank’s diverse workforce: designers, data scientists, compliance professionals, and business analysts are all asked to share views and offer their unique expertise. AIB’s focus on training employees to become AI-savvy is vital to the bank’s efforts to create a responsible AI framework, too. The payoff for AIB is an enhanced ability to deliver the kind of trustworthy banking that keeps customers coming back—and new ones coming in.

Getting AI right

European companies know that leadership in AI will increasingly offer new ways to compete, innovate, and build efficiencies. That’s why they’re investing heavily in artificial intelligence. But our research also revealed that many of these same organizations are underestimating the changes they need to make now to get more from their AI investments.

The good news is that the behaviors that distinguish the most AI-mature firms from the rest are readily imitable, with the right leadership and know-how. If they seize the opportunity today, Europe’s business leaders will position their firms to flourish in tomorrow’s AI-driven future.

Acknowledgment: The authors thank David Kimble, Regina Maruca, and Yuhui Xiong for their contributions to this article.

About the Authors

Jean-Marc Ollagnier is the chief executive officer of Accenture in Europe and a member of Accenture’s global management committee.

Jean-Marc Ollagnier is the chief executive officer of Accenture in Europe and a member of Accenture’s global management committee.

Philippe Roussiere is the global lead for innovation and AI at Accenture Research. He co-authored the recent Accenture report, “The art of AI maturity: Advancing from practice to performance”.

Philippe Roussiere is the global lead for innovation and AI at Accenture Research. He co-authored the recent Accenture report, “The art of AI maturity: Advancing from practice to performance”.

Praveen Tanguturi is the global applied intelligence research lead at Accenture and was the research director for the aforementioned “Art of AI maturity” report.

Praveen Tanguturi is the global applied intelligence research lead at Accenture and was the research director for the aforementioned “Art of AI maturity” report.