By Alan Thorogood and Stephanie L. Woerner

When undertaking a sizable project, a large organization might consider partnering with a small company in order to leverage their greater agility. However, such partnerships bring risks as well as benefits. How to get your head around the issues? What about a case study?

In a digital world, no organization can thrive alone, and partnerships with xTechs – nimble small companies – present large companies with powerful opportunities to innovate quickly. An xTech offers speed, agility, and lower cost for developing and implementing innovations, because xTechs don’t face large organizations’ processes, scale, and governance. In exchange, the large organization provides significant capital, revenue, and cash flow to the xTechs. This article will discuss what motivates large organizations to work with xTechs and three practices that help the partnerships succeed while managing the risks. We will use the Bendigo and Adelaide Bank case to illustrate our findings.

Motivations and challenges of partnerships with xTech

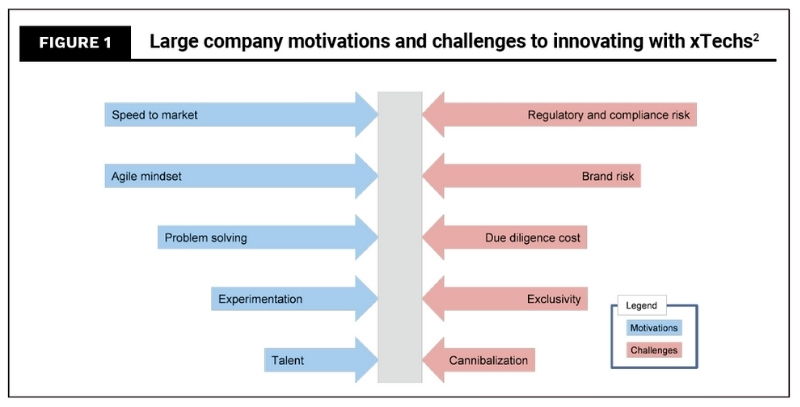

We started this research by asking senior executives from large organizations what they hoped to achieve by engaging with xTechs as part of the innovation process.1 They identified faster speed to market and the internal adoption of an agile mindset as the desired outcomes.

At the same time, the executives were primarily concerned with regulatory, compliance, and brand risks that could arise from working with xTechs. Over half of the interviewees reported that the due diligence necessary to ensure compliance and protect the brand was extensive and expensive.

We then surveyed to understand what kinds of mechanisms large firms can use to increase their rate of innovation in their partnerships with xTechs. Our analysis identified three mechanisms associated with an increased rate of innovation:

- Create collaborative innovation teams with members from the large organization and the xTech who have decision rights. Building such teams requires a clear vision of the innovation process and desired outcome, solid and straightforward guardrails, and direct access to executives.

- Bake risk management into the innovation process when setting up the project and leverage existing processes to maintain alignment between the organization and the xTech.

- Partner with xTechs where there are existing relationships and trust. Typically, the project scope can increase when there is a stronger relationship.

Innovating with xTechs at Bendigo and Adelaide Bank

In a digital world, no organization can thrive alone, and partnerships with xTechs present large companies with powerful opportunities to innovate quickly.

Bendigo and Adelaide Bank (Bendigo Bank) is a midsize retail bank in Australia with a reputation for excellent customer service. For over 165 years, the bank has been providing customers with services and products to meet their financial goals. It has also been named Australia’s most trusted bank by Roy Morgan, an Australian market research company. Bendigo Bank’s total 2023 revenues were AU$1.9 billion, a 14 per cent increase over 2022 while investing in substantial digital transformation.

Up, a New Digital Banking App

In 2016, Bendigo Bank recognized it could serve more customers in the 18–35 age bracket, but it would need new technology. To develop a new banking app for these customers, the bank joined forces with Ferocia, an xTech that had previously designed and built the bank’s mobile banking app. Ferocia, a software engineering company with a staff of 27 people at the time, had skills in customer-centricity, product design, continuous delivery, and agility. Ferocia defined its mission as improving people’s financial well-being.

In 2018, Bendigo Bank began offering its new smartphone-only banking service, Up. Up was designed to encourage ongoing customer engagement and improved customer financial outcomes. The colorful and quirky interface stimulated interest and supported fast referrals and setup, enabling rapid customer acquisition by word of mouth. Ferocia and Bendigo Bank, using design principles, built gamification features into Up. ‘Savers’, for example, encouraged saving. Up customers could instantly create Saver accounts from their smartphones, each associated with a financial desire. Customers gave each Saver a name, an emoji, and a goal. Most of Up’s customers are under 35 and engage a lot. More than one-quarter of Up customers log in over 100 times per month, and the customer churn rate steadily sits in the single digits.

While the Up launch was successful, Bendigo Bank needed to address its legacy systems and, at the same time, continue innovating with Up and increase its customer share. In 2019, Bendigo Bank’s Managing Director, Marnie Baker, appointed Ryan Brosnahan as the bank’s chief transformation officer to lead Up and Bendigo’s digital transformation. Growth by merger and acquisition had left Bendigo Bank with eight core banking platforms, complex technology silos, and IT spaghetti. The goal of the digital transformation was to reduce costs and increase flexibility. Brosnahan noted, “We are in the midst of unwinding the labyrinth of technology we have and rebuilding it in a way that is digital-first, run in the cloud, API-enabled, and driven by microservices.“”

Innovation Teams with Allocated Decision Rights

Fast delivery was in Ferocia’s genes. However, the cadence and velocity of the Up innovation team – composed of both Bendigo Bank and Ferocia staff – differed from that of the core bank. Enabling the team to maintain this speed when working with the core bank required substantial delegations to the collaborative team. Partitioning the Up team from the bank development teams also helped the bank to focus its core teams on the transformation.

Bendigo Bank set the innovation team up for success by articulating a clear vision, setting up guardrails for project decision-making, and giving access to senior executives. Baker and Brosnahan made sure the vision for Up – helping 18–35-year-olds achieve financial well-being – was clear to its team by reinforcing the message. The Up team had the authority to make decisions about product features, launch dates, and requirements but within specific guardrails, such as using only a prebuilt set of APIs to link to the core banking engine and complying with cybersecurity. Finally, the Up team reported directly to Brosnahan, rather than indirectly through the bank’s product, distribution, technology, and operations teams. An advisory group was also established for Up that included CXOs to enable rapid feedback loops and fast decision-making.

Risk Management Baked into the Process

Brosnahan knew that managing a large-scale digital transformation at the same time as innovating a project like Up would increase the risks for both the transformation and Up. The Up team had to move fast and the bank had to deliver on the transformation. Further, the Up product had to conform to regulatory requirements for financial services and customer privacy regulations and protect Bendigo Bank’s reputation.

In Up’s initial setup and design stages, the bank managed credit and technology risks upfront. During the design stages for the Up home loan product and before product feature elaboration, management made credit risk management a central requirement for the new home loan to increase confidence in the assessment of Up loan applications.

Similarly, technology risk requirements were part of the initial setup for Up. The bank wanted to avoid creating another technology silo, so it required that Up operate on the core technology architecture under development as part of the bank’s digital transformation project. Limiting access to existing APIs and requiring requests for technological changes to operations to go through the Jira ticketing system were among the mechanisms the bank used to achieve this. Although the Up team initially found these constraints frustrating, it adapted quickly.

Temporary staffing assignments were another point of risk management for the bank. Baker approved assigning one product and risk person to the Up collaborative team, making those communities more comfortable with the Up team’s working methods. Cybersecurity and marketing people also took part in Up team sprints.

Project Scope Reflected in the Relationship’s Strength

Partnering with other organizations is an established practice at Bendigo Bank and it has produced decades-long relationships with numerous small businesses. The bank’s relationship with Ferocia began in 2012, when Ferocia developed the bank’s mobile banking app. Marnie Baker was Bendigo Bank’s chief customer officer at the time and championed Ferocia as a partner to the bank. Following that first successful engagement, the scope of the partnership grew.

When the bank set out to grow its under-35 market share, interpersonal trust, a belief that their strategies aligned, and substantial goodwill strengthened the partnership between Bendigo Bank and Ferocia. Shared confidence in the alignment between the companies allowed the scope to expand, leading first to a joint venture to develop Up and then to the bank’s eventual acquisition of Ferocia.

More than one-quarter of Up customers log in over 100 times per month, and the churn rate steadily sits in the single digits.

To build on the Up product offering, the bank engaged two other xTechs – Tiimely for home loan origination and Wise for international transactions, which were well known to Bendigo Bank. Tiimely, an xTech with a product that reduces the time to approve a mortgage, linked its online approval service to Up. After some tweaks, the results were so successful that Bendigo Bank’s core bank adopted Tiimely’s new services with its digital mortgage process for its BENexpress product. Approving mortgages quickly is a significant competitive benefit, because people buying a home compete with other buyers who may also be arranging a mortgage. The first to make a committed offering to the seller is at an advantage. In this way, Bendigo’s core mortgage offering became more attractive to home buyers. Wise, a UK xTech, helps Up offer market-leading experience and foreign exchange rates.

As of 2024, the bank continued partitioning its core business from the Up team. Even though Up shares its governance and management processes with Bendigo Bank, the Up team maintains its own culture and ways of working.

The relationship between Bendigo and Ferocia began a decade before Up launched a mortgage offering. The scope grew as trust grew and the partners got to know each other – again a robust mechanism that the survey results show works for others.

Leapfrogging Competitors

Bendigo Bank reports that it has a fraction of the investment budgets of the large banks in Australia. But spurred by high customer advocacy (i.e., customer brand promotion), with a market leading NPS, and following on its ranking as Australia’s Most Trusted Bank, its customers expect a superior experience and proposition. The most recent results3 show that digital mortgages have grown from 8.9 per cent of settlements a year earlier to 16.3 per cent. The digital deposits in Up ($1.7bn) surpassed the main bank’s digital deposits ($0.9bn). The bank does things differently from its competitors by realizing and sustaining high customer satisfaction and advocacy levels.

The bank will continue to partner with xTechs to accelerate customer and employee experience improvements and increase execution speed and adaptability while improving its risk posture. The next stage for Bendigo Bank is to leverage the success of its innovations further with xTechs. Bendigo is using the shared capabilities it has developed with xTech partners such as Ferocia and Tiimely to innovate quickly, safely, and at scale to help accelerate the digital transformation of the broader Bendigo Bank proposition.

Partnering to Accelerate Transformation

Executives want xTech partnerships to deliver innovation quickly. So, be fast by giving the xTech collaboration team authority to make decisions, access to executives, and clear guard rails. And manage the downside by identifying and baking key mitigation into the innovation process and relationship and include the xTechs and your risk professionals in the management framework. Finally, trust takes time, so don’t rush to engage in projects with a large scope; instead, focus first on smaller-scale projects that can be delivered quickly. Trust will grow with success.

About the Authors

Alan Thorogood, PhD, is a researcher at MIT CISR. Based in Sydney, Australia, he works with sponsor organizations in Asia-Pacific. His research draws on his background in financial services, the public sector, and multinational consulting companies. He is also a Senior Visiting Fellow at UNSW, where he teaches and supervises research.

Alan Thorogood, PhD, is a researcher at MIT CISR. Based in Sydney, Australia, he works with sponsor organizations in Asia-Pacific. His research draws on his background in financial services, the public sector, and multinational consulting companies. He is also a Senior Visiting Fellow at UNSW, where he teaches and supervises research.

Stephanie L. Woerner, PhD, is a Principal Research Scientist at the MIT Sloan School of Management and Director of MIT CISR. She is a renowned researcher and speaker, and coauthor of Future Ready: The Four Pathways to Capturing Digital Value and What’s Your Digital Business Model? Six Questions to Help You Build the Next-Generation Enterprise, both published by Harvard Business Review Press. Stephanie studies how companies use technology and data to create more effective business models as well as how they manage the associated organisational change and governance and strategy implications. Stephanie’s research has appeared in MIT Sloan Management Review, Harvard Business Review, CNBC, Forbes, Chief Executive, and CIO.

Stephanie L. Woerner, PhD, is a Principal Research Scientist at the MIT Sloan School of Management and Director of MIT CISR. She is a renowned researcher and speaker, and coauthor of Future Ready: The Four Pathways to Capturing Digital Value and What’s Your Digital Business Model? Six Questions to Help You Build the Next-Generation Enterprise, both published by Harvard Business Review Press. Stephanie studies how companies use technology and data to create more effective business models as well as how they manage the associated organisational change and governance and strategy implications. Stephanie’s research has appeared in MIT Sloan Management Review, Harvard Business Review, CNBC, Forbes, Chief Executive, and CIO.

References

-

This research is based on interviews and surveys from 2021–3. The Bendigo Bank case study was written in 2023 (also reported in Kwong, C., Van Toorn, C., & Thorogood, A. (2022, July). Banks responding to FinTechs in the Digital Era. In Pacific Asia Conference on Information Systems (PACIS)). The mechanisms identified in the survey analysis were significant in regression with innovation as the dependent variable. Innovation was measured as the percentage of revenues from products and services introduced in the last three years.

-

The longer the arrow, the more influential the motivation as drawn from qualitative analysis of interviews with senior executives in financial services who work extensively with fintechs. The analysis used a five-point Likert scale and a structured Delphi technique to verify the findings.

-

See Results Presentation, February 19, 2024.