Many Americans are familiar with 401(k) and 403(b) defined contribution plans through their employers. The Thrift Savings Plan (TSP) was established in 1986 by the Federal Employees Retirement System Act. TSPs are similar accounts but for federal workers. TSP is a retirement savings plan for federal employees and members of the military. It has numerous benefits, such as tax-deferred growth and various investment options. But what most important, this retirement plan allows you to invest in physical gold and silver, so you’re protected against economic downturns, currency devaluations and financial collapse.

Brief context:

- Birch Gold Group Review – the best gold IRA custodian overall.

- Augusta Precious Metals Review – the best gold IRA company in 2021-2022.

- Goldco Review – the best customer support, the team of professionals and financial advisors.

- Things you should know about the TSP to gold IRA rollover.

- Ways to rollover your TSP.

- Some tips for a successful TSP to gold IRA rollover.

- Interesting facts about the topic.

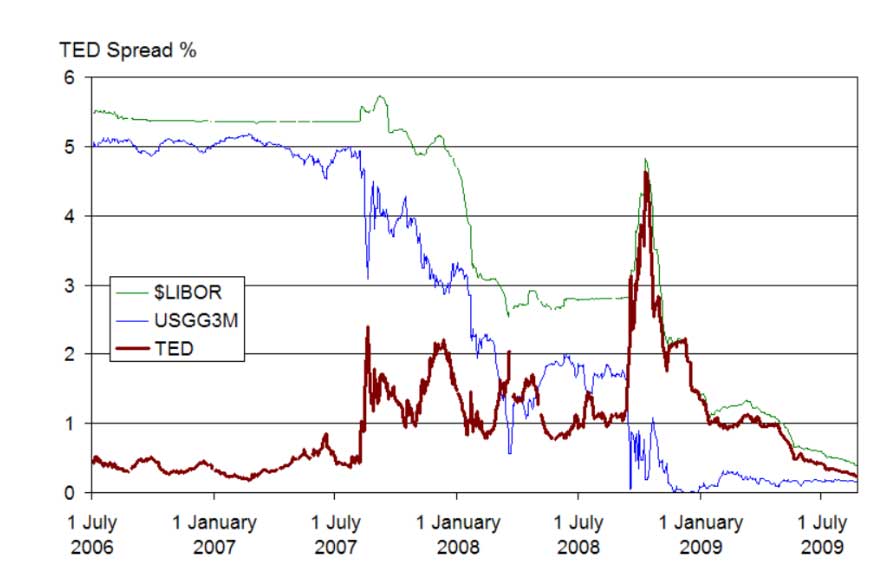

Why is it so important? I’ll tell you. Can you remember 2008?

The crisis in 2008 hit people hard, causing many to lose their jobs, homes and investments. However, those who had invested in physical gold and silver through the TSP were able to weather the storm and come out on top. Nobody wants this story to repeat, don’t they?

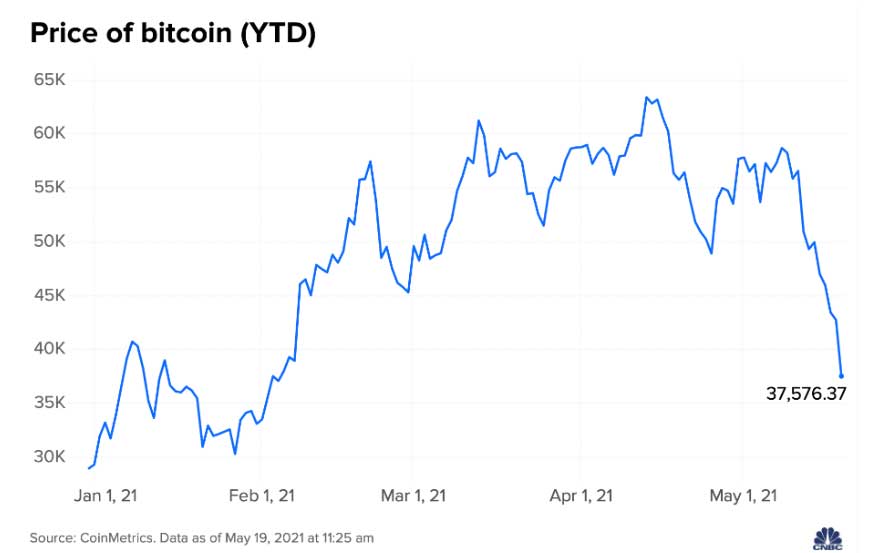

Some have taken refuge in cryptocurrencies as a stable investment for their portfolio. However, as 2021 has shown us, cryptocurrency is a market with high risks and an even higher chance to make or lose large amounts of money quickly.

This is not an option for those who seek stability. That’s why in this article we’ll talk in detail about the TSP rollover to the gold IRA.

Donald J. Trump once said: “Clients who pay close attention to details often make better decisions and come up with superior projects”. So, let’s dive into.

Things you should know about the TSP to gold IRA rollover

With a defined contribution plan (TSP), you can only contribute up to a set limit. This is different from a defined benefit plan, in which you know exactly how much your pension will be worth. In other words, a defined contribution plan involves more risk, and your retirement income depends on the success of your investments.

The TSP is one of the most popular retirement accounts in America, and it allows you to invest in physical gold and silver. However, the TSP does not provide you with an easy way to rollover your money into a Gold IRA.TSP works similarly to a 401(K) in that you can defer your compensation and instead have the money put into your retirement account, which is called Thrift Savings Fund. A board of presidential appointees oversees the TSP fund. Did you know that your employer may offer matching funds for your program?

As an employee, you can either invest in a Lifestyle fund based on your estimated retirement date or formulate your own investment mix from these five individual funds: government securities funds, common stock index funds, small-cap stock index funds, international stock index funds, fixed income index funds.

Gold and silver are not included in this list because you cannot own physical precious metals in your TSP account. Gold bullion and other similar precious metals, such as silver, platinum and palladium, are only allowed in a few types of retirement accounts. These include an individual 401(k) (for self-employed workers) or a Gold IRA. You also are unable to invest in gold stocks or gold exchange-traded funds through a TSP. However, there’s a cheat. After you retire from your government job, you can move your TSP to another eligible employer plan or IRA without paying taxes.

Ways to Rollover Your TSP

Way # 1 – Rollover

When you do a rollover, you take the money out of your TSP and put it into one or more IRAs. You have to specify that it’s a rollover deposit instead of just a regular contribution – which is only up to $6,000 per year ($7,000 if over 50 years old).

The rollover method also has its downfall, as you only have 60 days to complete it or the IRS views it as a withdrawal. This unfortunately leads to taxes being put on the money that was meant for your retirement nest egg.

Way # 2 – trustee-to-trustee transfer

A trustee-to-trustee transfer is when the TSP assets or cash are moved directly to one of more IRAs. The money goes directly into the new account(s), so you don’t have to handle it. Additionally, you won’t need to worry about the 60-day deadline with the direct method – which is superior anyway.

It’s essential to remember that you can have more than one IRA. With this knowledge, it becomes simpler to share your retirement funds between a traditional and Gold IRA. You have the choice to invest any percentage of your assets into precious metals. However, most experts agree that you should spend at least 10 percent on gold and silver.

If you want to convert some of your TSP into a Gold IRA, be sure that the gold dealer is both reputable and well-known. And let’s talk about this a little.

Birch Gold Group Review – The best gold IRA custodian overall

Birch Gold Group, established in 2003 and based in Burbank, California, offers its clients educational resources to help them diversify their savings – especially for retirement. With an in-house IRA Department and dozens of Precious Metal specialists, they have the team that can help you with all your needs. After IRA’s, 401(k)’s and other retirement accounts lost value in the stock market crash, this company stepped in to help thousands of Americans move their savings into physical gold and silver. Because they understand the importance of IRA’s, BirchGold company prides themselves on being the specialists of Precious Metal IRAs.

To learn more about how to protect your savings, visit their website or give one of their professionals a call today!

Pros

- They are partners with depositories

- Huge variety of precious metals available

- Financial experts in their team

Cons

- They don’t work with conventional IRAs

Augusta Precious Metals Review – The best gold IRA company in 2021-2022

Looking to buy or invest in gold and silver? Augusta Precious Metals company is your one-stop shop, offering both cash purchases and precious metal IRAs. You have plenty of options when it comes to choosing a place to store your precious metals. You can pick from several depository locations and multiple custodian choices. Augusta offers lifetime customer support for gold and silver investments, allowing customers to buy gold and silver for home shipment or an IRA. Augusta’s custodian and storage options are impressive, but its order minimum can make investing difficult.

If you’re looking for a reliable gold IRA custodian that can handle your TSP transfer, then Augusta Precious Metals should be at the top of your list. Their customer service team is knowledgeable and experienced, and they offer excellent discounts on gold purchases.

Overall, Augusta Precious Metals is one of the best gold IRA companies in 2021-2022.

Pros

- You have a guarantee for lifetime support as a customer

- You have three options for custody.

- At-a-glance purchase information

Cons

- They do not accept online orders, to make an order you’ll have to find their representative near you

- no orders under $50,000 accepted

Get Your Free Gold IRA Guide

Goldco Company Review – The best customer support, the team of professionals and financial advisors

Goldco allows clients to maintain their current retirement savings by transferring it from an IRA, 401(k), 403(b), 457(b) or other qualified retirement account into a Gold IRA. A+ rated by the Better Business Bureau and Triple-A rated by the Business Consumer Alliance, Goldco is a privately held firm specializing in wealth and asset protection.

Their superior service, dependability and ethical business practices have earned us rave reviews from customers. To learn how safe haven precious metals can help you build and protect your wealth, and even secure your retirement call today. At Goldco, they assist consumers in setting up and managing their self-directed retirement accounts through investing in gold and silver, which is perfect for those who made a decision to rollover their TSP to gold IRA accounts.

Pros

- Protect your savings by diversifying with a gold or silver IRA.

- Here are some great retirement resources that won’t cost you a dime.

- You can be consulted online or over the phone by financial experts from Goldco.

Cons

- Pretty poor options: gold and silver only.

Some tips for a successful TSP to gold IRA rollover:

- Choose the right custodian – it is essential that you choose an experienced, trustworthy and reliable gold IRA custodian to handle your investment. Companies like Birch Gold Group, Augusta Precious Metals, and Goldco offer top-notch services and customer support. They will help you find a dependable SDIRA custodian and gold storage depository, as well as facilitate the set up process from start to finish.

- Make sure your gold IRA custodian supports TSP transfers – not all gold IRA custodians offer this option as some may not be approved by the IRS to accept TSP transfers. Check with your custodian first before initiating a transfer.

- Understand the rules of the TSP – you should read and understand the rules of the TSP before initiating a gold IRA rollover. This will ensure that you comply with all regulations and avoid costly fines and penalties.

- Follow the proper transfer procedure – make sure to follow the correct transfer procedure for your TSP funds to be rolled over into a Gold IRA without any tax consequences.

- Consider the fees – you should be aware of all fees associated with transferring your TSP funds into a gold IRA. Make sure to compare and contrast the different fees charged by each custodian, so that you can make an informed decision.

- Pay attention to tax implications – pay close attention to any potential tax consequences when rolling over your TSP funds into a gold IRA.

- Invest in quality assets – invest in high-quality assets such as gold and silver, so you’re protected against economic downturns, currency devaluations and financial collapse. Not only will these precious metals help you preserve your wealth for the long term but also make sure that your retirement income is safe.

Interesting facts about the topic

- The IRA rules are clear about which types of coins and bars you’re allowed to own. The Eagles from the U.S. Mint and Maple Leafs from the Canadian Mint are two of the most popular options.

- There are certain requirements that precious metal bars must meet for purity. Coins, on the other hand, are much more convenient to purchase and you know exactly what you’re receiving. Also, keep in mind that you can’t put numismatic coins into an IRA–only bullion.

- You can also buy paper gold in an IRA, but beware of confusing it with physical metal. Although the gold mining shares you purchase are indirectly linked to the price of gold, their value can drop significantly if there is a strike or cave-in.

When investors try to sell ETFs all at once or buy them very quickly, it can cause big problems because the value of an ETF doesn’t always move in step with gold. If the economy ever dips, rest assured that gold and silver will always be accepted forms of payment for necessities–no questions asked.

So, there are 2 methods to rollover your TSP to a gold IRA. A direct rollover means that you tell the TSP to send your existing assets from your old employer’s plan directly to your new employer’s plan, or an IRA account. This way, you never have to touch the money yourself. An indirect rollover begins when you request a lump-sum distribution from TSP. After that, it’s your responsibility to finish the transfer process.

Now that you know about the TSP rollover to Gold IRA, you can take steps to safeguard your retirement savings and ensure a comfortable future. Investing in gold and silver is an excellent way to protect your wealth and make sure that it grows over time, no matter what happens in the economy.

Consider consulting with a reputable financial advisor if you need help with the process. The top 3 companies we are confident in we have provided your above, so you can feel free to apply and ask for your free gold IRA investment kit! Good luck!

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.