By Peter Weill and Stephanie Woerner

The Internet of Things is one of the many inevitable changes happening in our digital world. In this article, the authors provide key factors that will help a business thrive in an IoT-driven market. More importantly, they pose the question, will you be leading – or participating?

There is currently a battle waging for your home. Which enterprise is going to lead the Internet of Things (IoT) network in your smart home? Phillips and Flux produce IoT-enabled light bulbs, Motorola and Belkin produce connected cameras, Honeywell and Nest produce IoT-enabled environment management and much more. There are IoT-enabled locks by Schlage and August, IoT televisions by Sony and Vizio and IoT-enabled everything else is on the way. Which enterprise will you trust to coordinate all of those assets – and the associated data – from a single app on your mobile device? That enterprise will likely lead the IoT network in your home and see your data. Notice in each of the examples above there is a traditional player and new entrant vying for leadership – more digital disruption. It’s no surprise Apple has announced Apple Home Kit to coordinate your smart home. But what about Amazon Alexa, Microsoft Cortana, Google Home, and ADT and AT&T and the many others – all these companies converging, many from different industries, vying to be the controller of your smart home – and lead that IoT network.

This battle of who will lead the IoT network will play out in every commercial setting – both B2B and B2C. We studied what it takes to generate new revenues with an IoT strategy across 400+ companies globally. Success requires a strong commitment to IoT in four areas and the impacts are spectacular. We found enterprises in the top quartile of IoT commitment had strong new growth – averaging 50% of revenues from new products introduced in the last 3 years. In this paper, we describe what differentiates the IoT successes – those enterprises that committed to IoT in four areas and outperformed their competitors.

What It Takes to Succeed with IoT

We have a sense that IoT is currently at the peak of the hype cycle. What comes next is the hard job of committing to get value from the new opportunities – which touches every part of the company. For example, Schneider Electric, founded as a producer of iron and steel, has evolved to become a global leader in energy management, shifting its strategic focus in 2009 from “manufacturer and distributor of electrical products” to “provider of intelligent energy management solutions”. From a customer perspective, Schneider’s offerings have evolved into a customised system of connected devices – loaded with sensors, processing power, storage, displays, and different kinds of network connections – that deliver an energy solution. These solutions constantly monitor the environment and the systems, detect faults or changes needed, and take action.

IoT is critical to Schneider’s move toward becoming an integrated energy- management solutions provider, developing new products with digital components that are connected to each other and connect back to a central control centre. These connected products allow Schneider to offer energy-management services that solve customer problems. But with the move from selling products to offering services, Schneider needed to change the way it engaged with customers. The company therefore designed a set of customer “journeys” to guide its business units to engage in more digital customer interactions when providing services.

To connect better with its customers and add value to the customer interaction, Schneider’s mobile apps and mobile-enabled websites allows users to plan their own product specifications. These apps include a voltage optimisation calculator, a power-factor-correction calculator, and a product configurator that allows home owners to select wiring accessories (like switches and sockets). The mySchneider app is the customer-care app that gives customers access to support 24/7 and lets them tailor alerts and download documentation.1

To understand what it takes to succeed at IoT we surveyed senior executives at 413 enterprises globally – both B2B and B2C businesses. We learned there is a strong relationship between the degree of enterprise commitment to IoT and the generation of new business revenues. As at Schneider, commitment extends to all parts of the company including: new vision with new sources of revenue, new levels of connectedness and technical capability, new types of customer offerings, new levels of integration across silos and willingness to lead and change.

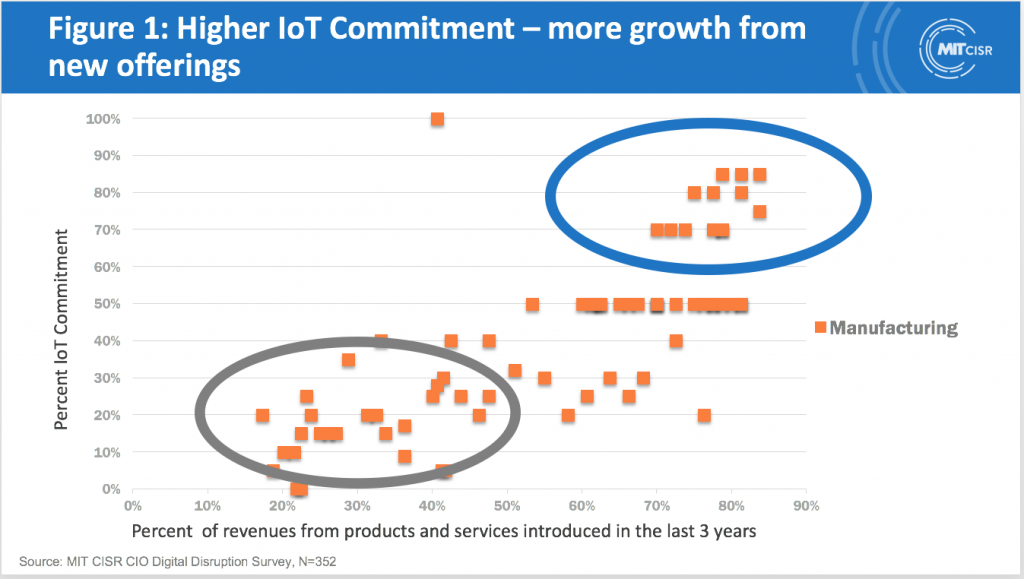

Figure 1 shows the stark contrast between enterprises that have strongly committed to IoT and those that haven’t. There’s a cluster at the top right of the chart in the blue ellipse. These enterprises have made a significant commitment to IoT (70% or higher) and generate between 60 and 90% of their revenues from new products or services introduced in the last three years. In contrast, the enterprises in the bottom left (grey ellipse), have a much lower commitment to IoT (40% or lower) and generate as little as 10% of their revenues from new products introduced in the last three years. It’s striking how strong the relationship is between commitment to IoT and new revenues – the more commitment to IoT the higher the growth from innovation. We are only showing manufacturing firms in this figure for simplicity but the results were the same in all industries.

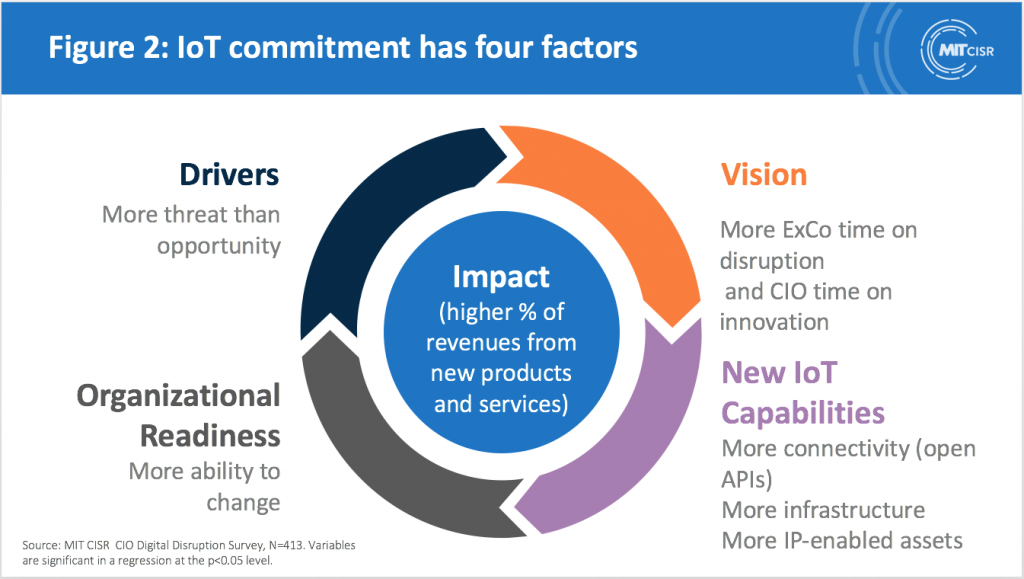

There are four important components that comprise an enterprise’s commitment to IoT and contribute equally to our score out of 100% (see Figures 1 & 2):

1. Driver: Enterprises that perceived an above industry average threat from digital disruption were more motivated to commit to IoT as a growth or survival strategy.

2. Vision: Enterprises more committed to IoT had executive committees that dedicated more time to digital disruption and CIOs who spent more time on innovation.

3. New IoT capabilities: Enterprises more committed to IoT had a higher percentage of key capabilities enabled by APIs for internal use and for external connections with partners, a higher percentage of digital spend that was shared and standard (as infrastructure) across the enterprise, and a higher percentage of IP-enabled assets.

4. Organisational Readiness: The more committed the enterprise was to IoT, the more capacity they had to make the challenging organisational changes needed (e.g. culture, structure, skills, integration, incentives).

Enterprises in the top quartile of IoT commitment had significant growth in new areas with 50% of their revenues from new products introduced in the last 3 years. In contrast, enterprises in the bottom quartile of IoT commitment had only 16% of revenues from new products introduced in last three years. A key strategic decision for most leadership teams is whether to lead an IoT network or participate in several IoT networks led by others. Executives who commit their enterprises to lead IoT networks will need to build world-class capabilities in all four areas as we see in the example below.

[ms-protect-content id=”9932″]IoT Commitment at Schindler

The Schindler Group manufactures, installs and maintains escalators, elevators and moving walkways.2 Schindler is active in more than 100 countries with over 58,000 employees and 2016 revenues of US$9.8B, with above industry average return on assets. Schindler is one of the world’s most innovative enterprises,3 filing over 100 patents annually.4 Schindler has strongly committed to lead an IoT network for their customers:

Driver: The threat is high as the products Schindler makes are sold into increasingly price-sensitive markets. And constant innovation is demanded, particularly in the Asian market where 60% of new installations occur. Maintenance accounts for 50% of industry revenues and about 75% of operating profits. And maintenance can be provided by a local enterprise that didn’t install the elevator, but can typically compete strongly on price.

Vision: Over the last decade, Schindler transformed from a product-focussed engineering enterprise to a customer-oriented service provider. Schindler combines several digital technologies such as sensors and mobile technologies, coupling them with analytics, to enable a global proactive and predictive service model. Schindler has focussed on several changes: 1) providing a whole new level of optimised services built around service technicians; 2) working on better, enriched elevator and escalator products; and 3) providing a great customer experience through apps that combine data from sensor-enabled equipment and Schindler’s responses.

New IoT Capabilities: The new capabilities include:

• Sensors on elevators that send 200+ million messages a day on elevator performance,

• A business rules engine and predictive analytics to analyse sensor data for insights and then take action, and

• A customer web portal and mySchindler app to provide real-time information to customers and service technicians.

Sensors, which can collect as many as 750 to 1,000 points of data from an elevator, are now deployed on the vast majority of new lifts, and the enterprise is retrofitting older lifts. Schindler uses this data to learn about impacts, such as temperature on the elevator environment, and then enhances elevator and escalator products using the insights. In addition, complex algorithms in the business rules engine use sensor data to predict equipment problems including failure, and spare part demand. Schindler has also invested heavily in the passenger experience with its “PORT Technology,” which decreases passenger wait times by applying authentication and smart algorithms to optimise elevator routes.

Organisational Readiness: To facilitate increased digital innovation and move toward implementing their IoT business model, Schindler made both organisational and technological changes:

• Brought together their digital capabilities into one unit – Schindler Digital Business AG, created in 2013 – by combining several parts of the enterprise, including R&D, IT, service and installation, industrial design and gaming.

• Created a matrix organisation across multiple functional groups for knowledge sharing and synergies.

• Developed a global business platform called SHAPE (Schindler Harmonized Applications for Process Excellence) to make sense of data available across all business processes.

• Drew on techniques used in startups to involve users directly in the design of solutions.

• Began rapid innovation cycles by creating minimal viable products, rather than complete solutions with many different options.

• Created a separate unit specifically to look at new business options, the New Installations and Supply Chain and Service Business Incubation unit

These changes will help Schindler lead a completely IoT-connected solution to customers from sales to service. For example, Schindler Dashboard offers customers instant, comprehensive information on all elevators and escalators in their portfolio under Schindler maintenance.

Will You Lead or Participate with IoT?

Several years ago, Jeff Immelt, then CEO of GE, announced a major change in strategy: to help create and manage the “Industrial Internet”. One of the authors was at a senior executive summit when he described this new vision – and the reaction was awe and admiration for its boldness. Many changes followed at GE including the creation of a software business and an IoT platform called Predix. GE sees Predix as a way to offer internal GE businesses and clients “connectivity as a service” and has recently partnered with Schindler who are using Predix to implement their IoT model.5 But IoT leadership is a long-term strategy and we will see if GE stays the course with John Flannery as CEO.

At a recent workshop we facilitated on IoT for about 45 CEOs, the difference between leading and participating became very clear. A CEO of an energy enterprise said “Our goal is to design, invite participants to join, and lead an IoT network that delivers complete energy solutions to our customers.” By contrast, the CEO of an enterprise that makes electric motors said, “Our goal is to participate in as many IoT networks run by other enterprises to ensure our motors are used everywhere.”

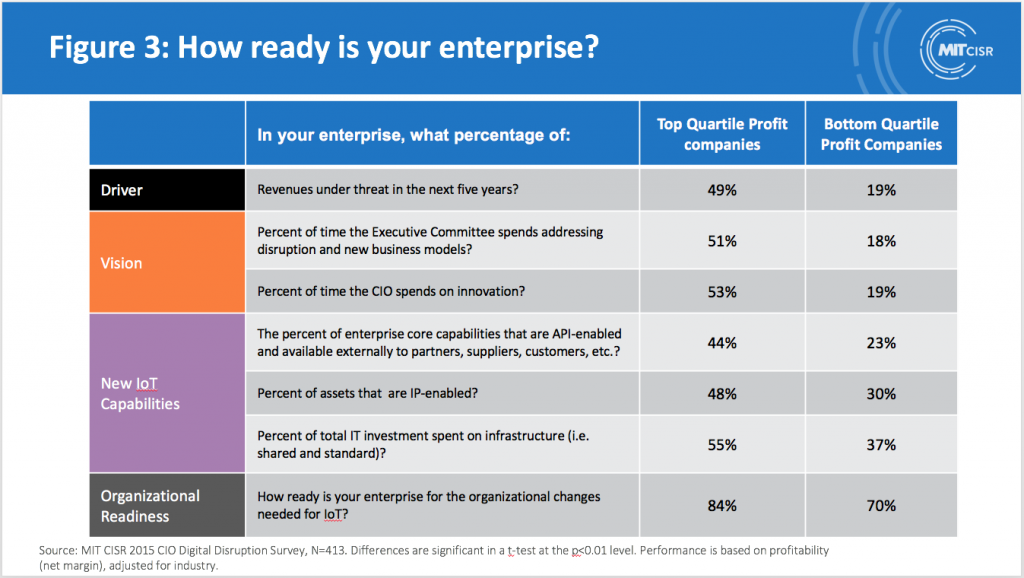

The key strategic decision required right now for most leadership teams is whether to lead an IoT network or participate in several IoT networks led by others – the differences nicely articulated by the two CEOs’ comments above. Doing nothing about IoT is not a viable option. Executives who commit their enterprises to lead IoT networks will need to build world-class capabilities in all four areas: recognising the Driver, creating the Vision, building the new (technical) IoT capabilities and developing the Organizational Readiness. Enterprise that want to participate in IoT networks led by other enterprises will also need at least an industry average level capability in these four areas. The two companies above had very different levels of commitment to IoT and the energy company will likely grow much faster by adding revenues from the participants in the IoT network they lead. But the energy company will need to world-class in all four areas. To provide some sense of what’s required in Figure 3 we show benchmarks for four important components that comprise an enterprise’s commitment to IoT – for top and bottom quartile performers. How do you compare?

The catch is: we believe, unlike the second CEO above, that every large enterprise will need to be a leader of at least one IoT network and participate in other networks led by other enterprises to thrive in this digital era. How much will you commit to IoT and what will be your area of IoT leadership?

TEBR is partnering with the authors on their next research project on digital ecosystems. To participate please go to https://survey.qualtrics.com/jfe/form/SV_cYhgYkTorZEn7aB

[/ms-protect-content]

About the Authors

Peter Weill is a Senior Research Scientist and Chair of the Center for Information Systems Research at the MIT Sloan School of Management. Weill has co-authored best-selling books published by Harvard Business School Press, and his award-winning books, journal articles, and case studies have appeared in the Harvard Business Review, the Sloan Management Review and The Wall Street Journal. Peter and Stephanie have a Harvard Business School Press book forthcoming in early 2018 entitled What’s Your Digital Business Model? Six questions to help you build the next generation enterprise.

Peter Weill is a Senior Research Scientist and Chair of the Center for Information Systems Research at the MIT Sloan School of Management. Weill has co-authored best-selling books published by Harvard Business School Press, and his award-winning books, journal articles, and case studies have appeared in the Harvard Business Review, the Sloan Management Review and The Wall Street Journal. Peter and Stephanie have a Harvard Business School Press book forthcoming in early 2018 entitled What’s Your Digital Business Model? Six questions to help you build the next generation enterprise.

Stephanie L. Woerner s a Research Scientist at the Center for Information Systems Research (CISR) at the MIT Sloan School of Management. Her research centres on how companies manage organisational change caused by the digitisation of the economy. In 2016, she was a subject matter expert on enterprise digitisation for the Wall Street Journal CEO Council Conference. She has a passion for measuring hard-to-assess digital factors such as connectivity and customer experience, and linking them to firm performance.

Stephanie L. Woerner s a Research Scientist at the Center for Information Systems Research (CISR) at the MIT Sloan School of Management. Her research centres on how companies manage organisational change caused by the digitisation of the economy. In 2016, she was a subject matter expert on enterprise digitisation for the Wall Street Journal CEO Council Conference. She has a passion for measuring hard-to-assess digital factors such as connectivity and customer experience, and linking them to firm performance.

References

1. Schneider case draws on: 1. Interviews and conversations with senior Schneider Electric; 2. N. Fonstad and J. Ross, “Building Business Agility: Cloud-Based Services and Digitized Platform Maturity”, MIT CISR Research Briefing, Vol. XV, No. 2, February 2015; 3. A. Karunakaran, J. Mooney, and J.W. Ross, “Accelerating Global Digital Plat- form Deployment Using the Cloud: A Case Study of Schneider Electric’s ‘bridge Front Office’ Program”, MIT Sloan CISR Working Paper No. 399, January 2015; 4. S. Scantlebury “Redesigning Schneider Electric’s Operating Model,” MIT Sloan CISR Case Vignette 2015; 6. www.schneider-electric.co.uk/en/work/support/apps/ 7. Connect – Company program for 2012-2014,” Schneider Electric press release, February 22, 2012.

2. Schindler case draws on: 1. “The Schindler Group: Driving Innovative Services and Integration with Schindler Digital Business AG” MIT CISR Vignette by Ina M. Sebastian and Jeanne W. Ross, April 2016. 2. www.schindler.com/com/internet/en/about-schindler/vision-and-values/vision.html. 3. www.schindler.com/com/internet/en/media/press-releases-english/press-releases-2015/schindler-wins-mit-sloan-cio-leadership-award-2015.html; 4. www.schindler.com/com/internet/en/mobility-solutions/success-stories/technology-in-schindler/collaboration-with-apple.html; Schindler 2104 Annual Report; 5. www.cio.com/article/2993292/big-data/cio-is-pushing-the-right-buttons.html

3. Forbes named Schindler to its 100 Most Innovative Enterprises list in 2011, 2012 and 2013. The German newspaper Handelsblatt, along with University of St. Gallen and Capgemini honored Schindler with the Digital Business Innovation Award in 2015 (www.schindler.com/com/internet/en/media/press-releases-english/press-releases-2015/schindler-wins-digital-business-innovation-award-2015.html).

4. schindler.com/content/dam/web/com/pdfs/career/Schindler-Your-First-Choice-Brochure.pdf

5. ge.com/digital/blog/you-can-t-outsource-digital-transformation