By David Dubois and Gilles Haumont

Organisations today have massive amount of data at their disposal. However, not all C-level executives have clear typology of the digital data that can help marketing strategists unlock value. Discover how this issue can be addressed towards an enhanced analytics capability, strengthened data management and the creation of tangible value for your business.

With a few exceptions, the bulk of brands to date have mostly leveraged big data for short-term purposes. For instance, companies have learnt how to manage their online reputation by creating social media command centres that can detect and react to consumer chatter in real time. They’ve also learnt to track the recent online behaviour of customers, which has helped them run more targeted advertisements. But this makes C-level executives at best very effective bill posters (when they manage to attract their customers’ attention), at worst spammers (when their messages are misplaced or even worse, irritate customers).

This is due in part to the hype around big data, a less than adequate moniker for what’s just the acceleration of data collection and processing capabilities as a result of digital connectedness. Because big data is multi-formed, the initial approach of business thinkers and commentators was to break it into volume, variety and velocity.

Beyond these descriptive features, C-level executives lack a clear typology of the digital data that marketing strategists can leverage to produce novel and important competitive insights. This leaves them with steep challenges in how to think about these data and act on them.

The 3S typology

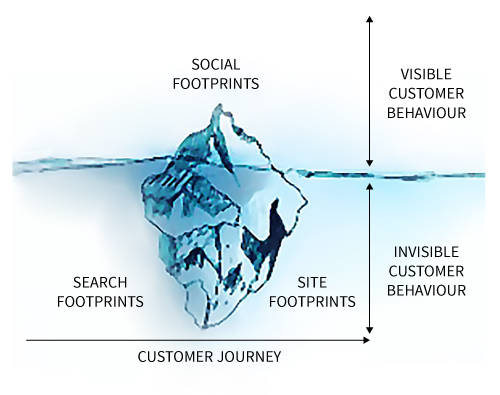

What kinds of big data can best unlock value? In practice, we observe three broad types of big data that really matter in helping CMOs get a deeper understanding of their customers and competitive ecosystems: Social, Search and Site (Figure 1).

[ms-protect-content id=”9932″]

1. Social footprints

The first type of big data comprises consumers’ and companies’ footprints on social media and other public platforms, such as Twitter, Facebook, company websites, media or blogs.

Massive by the sheer amount of content produced daily – for instance, one hour of video is uploaded every second on YouTube alone – this body of content is the visible part of the iceberg: what people say and share in public or semi-public contexts. It contains very rich information, from public interest in a brand (reflected in the number of likes or comments) to consumers’ perceptions of a brand (expressed through emoticons or even competitive information). Practically speaking, these data can be easily collected via social media analytics solutions, such as those offered by Digimind, NetBase or BrandWatch, and are often shared within brand teams as dashboards.

Social footprints reveal “public sentiment” around brands. While important to know, such visible content doesn’t always reflect actual behaviour. For instance, research shows that some product categories, e.g. cosmetics, yield a disproportionally high amount of online chatter, compared to other categories.

2. Search footprints

The second type of big data, even more massive, comes from search behaviour. Representing two trillion searches per year across all major search engines such as Google or Baidu, these data typically reflect users’ personal interests and thus form an essential part of the iceberg under water. From this perspective, understanding groups of consumers’ search journey can provide extremely valuable information on their interests. In practice, aside from Google Trends, Google AdWords and their equivalent at Baidu or Bing, many SEO or SEM solutions such as KWFinder offer treasure troves of information about up-to-date and (often) geography-specific search volumes and associated keywords. More radical data-mining solutions involve directly tapping into millions of search behaviours to identify consumers’ needs, attitudes and even values for purposes of segmentation, profiling or activation.

3. Site footprints

The third type of big data comes from site footprints left by consumers, and to begin with, those on companies’ websites. More generally, HTTP cookies or IP trackers collect (anonymously) logs of users’ history across devices during a certain time frame. Essentially, they collect path information revealing individuals’ behaviour on the web. Cookies can provide very specific information on how a sub-segment of consumers get to an outcome (e.g. online purchase).

An important source of revenues for personalised retargeting companies such as Criteo, the collection of site footprints is increasingly challenged due to privacy concerns – a momentum championed by Apple and its move to prevent cookies from being collected by default on the latest version of Safari.

A promising alternative used by Tsquared Insights involves directly collecting detailed online logs of consumer panels accessing tens of millions of consumers’ digital activity on search engines, but also marketplaces such as Amazon, non-profit websites such as Wikipedia and company websites. This data can then be used to maximise campaign effectiveness, optimise customer journeys but also assess brands’ health across different segments.

From spammer to detective

So what does this mean for CMOs? They will need to become agile detectives. Like Sherlock Holmes who relied on loosely linked cues to solve enigmas, CMOs must now navigate social, search and site inputs to generate long-term, novel insights about customers and keep their brands ahead of competitors. To crack this puzzle, business leaders should recognise the biases of big data and properly use each type of footprint astutely: social footprints to unlock qualitative insights on emerging trends or brand sentiments, search footprints to unveil how and why customers get interested in their products or services, and site footprints to unpack the customer journey around, before and after online purchases.

In general, we identify six golden rules for CMOs to master these streams of big data. First, focus on key audiences. Big data enables marketing heads to segment consumer groups with unprecedented granularity. Second, engage customers by identifying their real interests in the category but also outside of it. Third, choose the influencers your audience bonds with, not those you feel are generally influential in all settings. Fourth, move quickly to adapt to new trends. Fifth, don’t rest on your laurels. Tracking your brand’s digital health is a continuous process. And sixth, share digital consumer insights within your organisation, placing them where they should be: at the heart of the decision-making process.

This article was first published on the INSEAD Knowledge

[/ms-protect-content]About the Authors

David Dubois (left) is Associate Professor of Marketing at INSEAD and Programme Director of Leading Digital Marketing Strategy, one of the school’s executive development programmes. You can follow him on Twitter @d1Dubois. Gilles Haumont (right) is Vice President, Luxury & Strategy, at TSquared Insights.

David Dubois (left) is Associate Professor of Marketing at INSEAD and Programme Director of Leading Digital Marketing Strategy, one of the school’s executive development programmes. You can follow him on Twitter @d1Dubois. Gilles Haumont (right) is Vice President, Luxury & Strategy, at TSquared Insights.

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)