Although governments around the world have made commitments to achieving net zero, it is clear that more is needed if these ambitions are to be realised. Laurits Bach Sørensen of Nordic Alpha Partners argues that universities have a vital role to play in developing the required talent.

This article is a follow-up on “Economic Sustainability in a Time of Impact and Regulation”. In the previous article, I argued that there were three overall principles within the economic sustainability logic:

- The world is not rich enough to rely only on government and regulation to lead the world to net zero.

- Heavy regulatory measures can create ineffective solutions and an artificial market environment.

- The most efficient way to net zero is Identifying and scaling the technologies and companies that will drive the green transformation, not because it is green or subsidised, but because it is better, cheaper, simpler to adopt and more available (BCSA).

Having created the foundation for the battleground and presented the mission towards net zero in my previous article, I will now redirect the focus and showcase how visionary economic sustainability experts or warriors, equipped with the right competencies and toolbox, are able to drive and harness the power of free market hyper-growth and rapid technology transformation.

By now, it is well documented that the world will not reach net zero through government regulation or green impact funding alone1.

Neither will we become CO2-neutral by going paperless, by not eating meat, or by committing capital to various early-stage ESG funds. The impact is simply not high enough, relative to the capital deployed.

We can also factor in that, over the next three decades, we will welcome three billion people to the middle-class income bracket, people who will request middle-class goods such as ribeyes, iPhones, and Teslas and, as a result emit, between 600 per cent and 2,400 per cent more CO2 than the lower-income bracket2.

I have spent the last 10 years working as both an entrepreneur in green technology businesses and as a fund manager, spotting and hyper-scaling the transformative solutions that are accelerating the green transformation based on the principals of economic sustainability

Along the way, I learned that the world is in no way lacking the innovations needed to deliver net zero. Neither does the world lack seed or early-stage investment capital. The problem is a lack of competences able to manage the complexity and intense capital requirements in the difficult scaling phase for transformative greentech companies, resulting in a greentech Valley of Death that unfortunately kills great greentech companies on their journey to becoming real global successful companies making a real impact.

The main factor is that the green transformation is based on hardware and hard technology, which requires factories, complex supply chains, and high levels of working capital. This is very unlike what most unicorns and transformative companies have needed or relied on over the last decades, and so it has left many executives and boardrooms without a proper understanding of the new dynamics.

Rapidly scaling hard tech vs software is a completely different and substantially more complex process. It takes longer and is a far more expensive mission, requiring a different toolbox from conventional growth, along with much more advanced skills and capabilities at a much earlier stage on the growth journey , compared to software for example.

The complexity of this toolbox is essentially why, over the last 30 years, I have worked on developing and crystallising a methodical approach and a set of models that could work on a large scale which will all soon be available in a book titled “Changing The Math”.

My proposition is that the same methods can now enable others to spot early, and rapidly develop, the technologies and solutions that can lead hyper-growth. In a transformative market, following this approach ensures that one makes investment and strategic decisions based on the principles of economic sustainability that hence have impact while being financially viable and independent from subsidies.

The toolbox is today the core DNA of private equity firm Nordic Alpha Partners’ value creation model and investment approach. It is also why we are one of the very few SFDR Article 9 growth funds in Europe.

Via our approach, we will have reduced global CO2e emissions by 1 million tons through our investments in 20233.

We have also successfully managed to gear our own direct investment capital with a factor of $3 per $1 invested4.

In Denmark alone, we accounted for one-third of all publicly raised capital in the last two years, illustrating how much appetite there is for our management strategies and for economic sustainability5.

However, before one can create the volumes of traction needed for the tech solutions to compete and become a viable option compared to regulatory and policy-based approaches, one needs a critical component—and that is talent.

I don’t just mean experienced business leaders, I mean “economic sustainability warriors” with a dedication and mentality towards leading market-driven transformations equipped with the weapons of logic from Nordic Alpha Partners’ effective and methodical value-creation arsenal.

The powerful mathematics of an ES warrior

The general language and logic of both corporate thinking and the youth today is, unfortunately, mostly based on offsetting or reducing individual CO2e footprints, meaning that the solutions look inward rather than outward.

It is great that CO2 is on the conscience, but the problem is that it is far from sufficient. Remember the three billion middle-class people that I mentioned earlier?

Even if every Danish teenager decided to go vegan, it would not move the needle on Denmark’s overshoot6 day (the day Denmark uses up its resources), which is the end of March, putting Denmark in the top five countries on the planet in terms of resources spent.

The data from the overshoot day proclaims that if European and Nordic teens want to try and save the world via behaviour, they only need to adopt the lifestyles of Jamaica, whose overshoot day is 20 December, making it the most sustainable country in the world in terms of living within their means and the resources that their country provides.

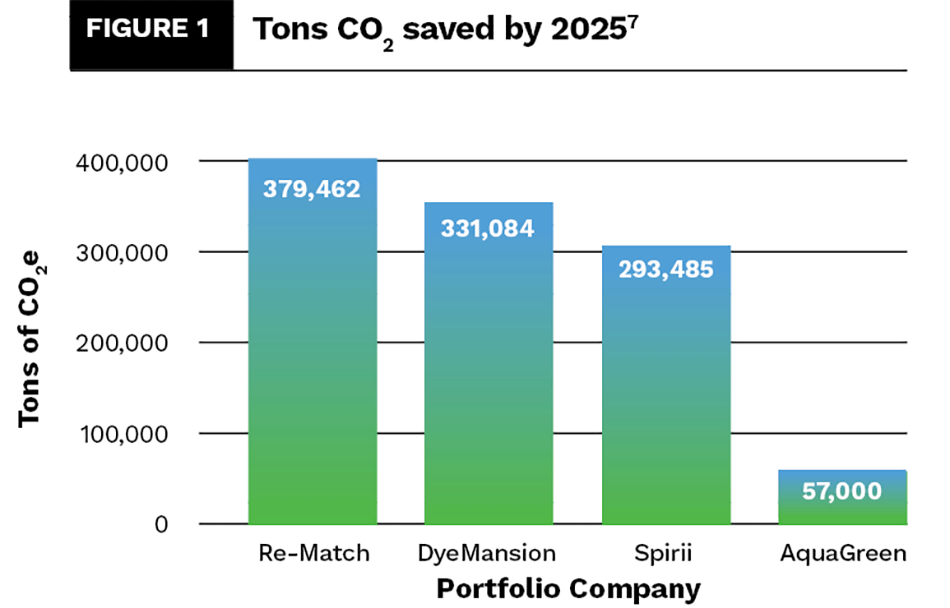

For all countries to adopt the consumption levels of Jamaica is obviously unrealistic and, luckily, also unnecessary, if you look at the maths behind the ES-warrior logic. Let’s exemplify the powerful logic based on the maths of the five investments that I personally have made in the last four years: Re-Match, DyeMansion, Wiferion, AquaGreen, and Spirii.

These five assets are all highly transformative technology companies, all of them today positioned as the global leaders within their space and on track to either eradicate polluting alternatives or to technologically accelerate large-scale

These five assets are all highly transformative technology companies, all of them today positioned as the global leaders within their space and on track to either eradicate polluting alternatives or to technologically accelerate large-scale

transformations within electrification, e-mobility, sustainable manufacturing, and recycling.

They are performing this well, not because they are simply green or sustainable, but because their solutions are “BCSA”, i.e., better, cheaper, simpler to adopt, and available to support large-scale adoption.

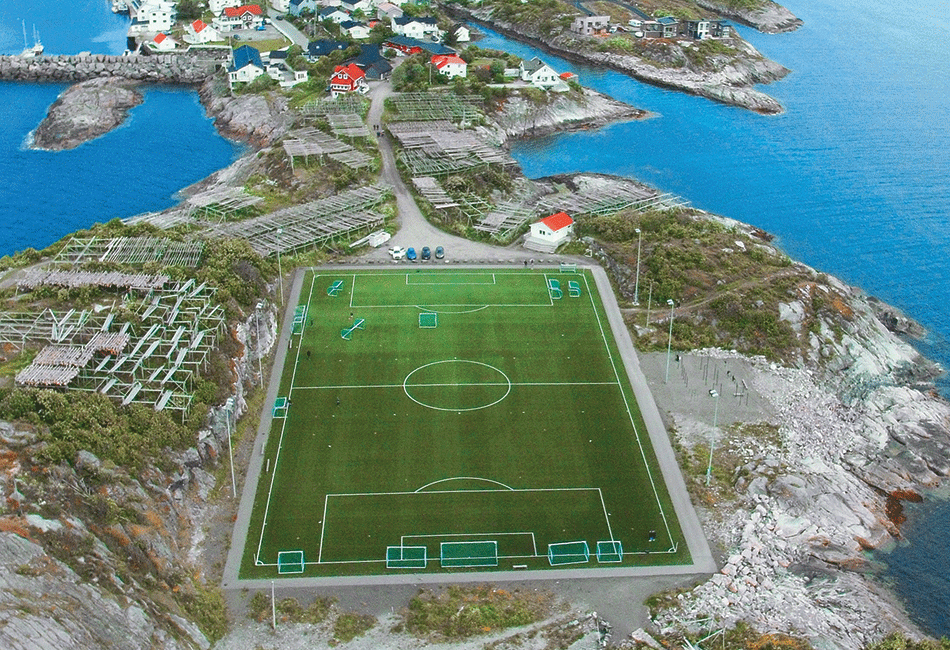

Re-Match: Global technology and market leader within recycling of artificial sports turf, an industry that generates more than 15 million tons of waste annually.

DyeMansion: Global leader within 3D print post-processing, enabling large-scale industrialisation of 3D print, and the sustainability transformation of the $330bn plastic moulding industry.

Wiferion: (Recently acquired by Tesla) Global leader within industrial wireless charging of robots and forklifts, enabling the fast-paced adoption of industrial electrification and, eventually, EV charging.

Spirii: Spearheading the global e-mobility transformation by offering a new standard of highly flexible end-to-end charge infrastructure platform. Spirii has just been named world’s best greentech startup.

AquaGreen: Technologically pioneering wet biomass circulation (sludge / manure), enabling scarce phosphorus recovery, reduction of CO2 emissions and energy production.

My experience also tells me that it only takes around five dedicated ES warriors to scale a business from proven technology to true global leader, meaning that these five companies are home to a small army of around 25 ES warriors.

These 25 individuals are leading the battle with Nordic Alpha Partners, growing the companies consistently with a combined CAGR of +100 per cent annually and accumulated CO2e abatement reaching above 1 million tons in 2025.

To put this into perspective, the total CO2e footprint of a Danish person is 5 tons per year8, and the average individual impact of an ES warrior within these five companies is 13,676 tons of CO2e abatement, meaning that the 25 executives in NAP’s portfolio companies are offsetting the footprint of 68,380 Danish people in 2023. The abatement effect of each NAP warrior within the above companies will abate 42,000 tons annually by 2025, meaning that it will offset the footprint of 207,500 Danes by 2025.

To put this into perspective, the total CO2e footprint of a Danish person is 5 tons per year8, and the average individual impact of an ES warrior within these five companies is 13,676 tons of CO2e abatement, meaning that the 25 executives in NAP’s portfolio companies are offsetting the footprint of 68,380 Danish people in 2023. The abatement effect of each NAP warrior within the above companies will abate 42,000 tons annually by 2025, meaning that it will offset the footprint of 207,500 Danes by 2025.

My point is not that we should stop considering our footprint, but that the massive effort and focus we are dedicating to this type of relatively ineffective reduction has only little effect on the world’s actually reaching net zero.

Looking at Denmark as a whole, its 5.8 million citizens emit 30 million tons of CO2 annually. Using the figures from above and projecting it forward, it should only require 700 ES warriors by 2025 to offset the entire footprint of the country.

Working with the universities to establish an army of ES warriors

In Denmark, roughly 40.000 students are admitted to a business academy degree or professional bachelor degree programme per year9, with the largest capacity being the Copenhagen Business School.

Institutions like this are the most important nesting and talent development platform for future ES warriors.

Looking at the average impact maths of the five NAP investments that I run, the solution to offsetting Denmark is actually not that difficult, as we only need to educate and convert 700, or 2 per cent, of one single year of the 40,000 new business students in Denmark to enlist and engage in the economic sustainability battle.

Even if we only generate 100 new ES warriors annually from CBS or Aarhus School of Business, it will only take seven years to build the “army” that will deliver the impact that will comfortably offset Denmark and lead to net zero.

However, the skill set to manage and harness the power of greentech hyper-growth scaling and transformation stands in great contrast to the conventional and corporate business theory that is being taught at Danish business institutions.

This is why Nordic Alpha Partners has initiated and set up a cooperation with Copenhagen Business School, CBS Climate Club, and also the Technical University of Denmark, to ensure that the theories, models, and methodologies that we have developed and crystallised over the last three decades are rooted into the next generation of leaders and entrepreneurs coming out of these institutions.

Why? Because we at Nordic Alpha Partners fundamentally believe that our advanced methods of scaling should not only be the source of NAP’s success and the benefit of NAP investors, but that the sharp weapons and tactics should benefit everyone.

Danish ES warriors might be a larger export resource for Denmark than technology

While Denmark has played a pioneering and visionary role in green transition globally, and despite DTU being one of the leading technology institutions, forefronting Denmark’s export of patented green solutions, Denmark has not been able to replicate the success of the wind turbine.

Of course the Danish universities, the strong early-investor environment, and Nordic Alpha Partners will continue to create many new greentech exports, but overall I believe that Denmark could be exporting something that is far more valuable and hundreds of times more impactful than the next Vestas — and that is the export of ES warriors.

Denmark is the perfect training ground for such a global army. It has the tradition, the capital, the leading incumbents, and fantastic technology and education institutions and a great early-investment environment.

I believe every country can exceed the impact currently generated through technology if that country starts to see itself as a nesting place that creates the leaders of tomorrow based on the ES warrior mindset and toolbox.

It does not necessarily have to focus on leading the country to net zero, but instead focus on furthering the green transition across the world via a new export of intellectual capital.

Nordic Alpha Partners is looking forward to supporting the Danish universities with the talent development programmes discussed, enabling talents from all over the world to deliver real impact and create global change. I am also looking forward to soon release a book titled “Changing The Math” focused on how to create, de-risk and manage the complex dynamics of technology transformations, effectively creating a new language and toolbox around hardtech hypergrowth.

About the Author

Laurits Bach Sørensen is the co-founder and senior partner of private equity fund Nordic Alpha Partners https://napartners.dk/. He previously held executive positions at HP EMEA, as well as being CEO of Aastra Telecom Denmark and CEO and chairman of greentech business MicroShade. He has led exits from Wiferion, Ipvision and Optiware. He currently sits on the board of four cleantech companies: Re-Match, AquaGreen, DyeMansion, and Spirii. Overall, he has over 20 years of experience spearheading venture businesses, value creation, exits, and IPOs. He holds an MSc in Management of Innovation & Business Development from Copenhagen Business School.

Laurits Bach Sørensen is the co-founder and senior partner of private equity fund Nordic Alpha Partners https://napartners.dk/. He previously held executive positions at HP EMEA, as well as being CEO of Aastra Telecom Denmark and CEO and chairman of greentech business MicroShade. He has led exits from Wiferion, Ipvision and Optiware. He currently sits on the board of four cleantech companies: Re-Match, AquaGreen, DyeMansion, and Spirii. Overall, he has over 20 years of experience spearheading venture businesses, value creation, exits, and IPOs. He holds an MSc in Management of Innovation & Business Development from Copenhagen Business School.

References

- https://about.bankofamerica.com/en/making-an-impact/finance-for-transition-net-zero

- https://www.brookings.edu/blog/future-development/2022/10/21/the-forgotten-3-billion/

- Klinkby Enge-provided figures.

- NAP internal calculations.

- According to Nasdaq Denmark data.

- https://www.overshootday.org/newsroom/country-overshoot-days/

- Based on third-party calculations by certified environmental consultancy firm Klinkby Enge and NAP’s own data.

- https://data.worldbank.org/indicator/EN.ATM.CO2E.PC?locations=DK

- https://ufm.dk/uddannelse/statistik-og-analyser/sogning-og-optag-pa-videregaende-uddannelser