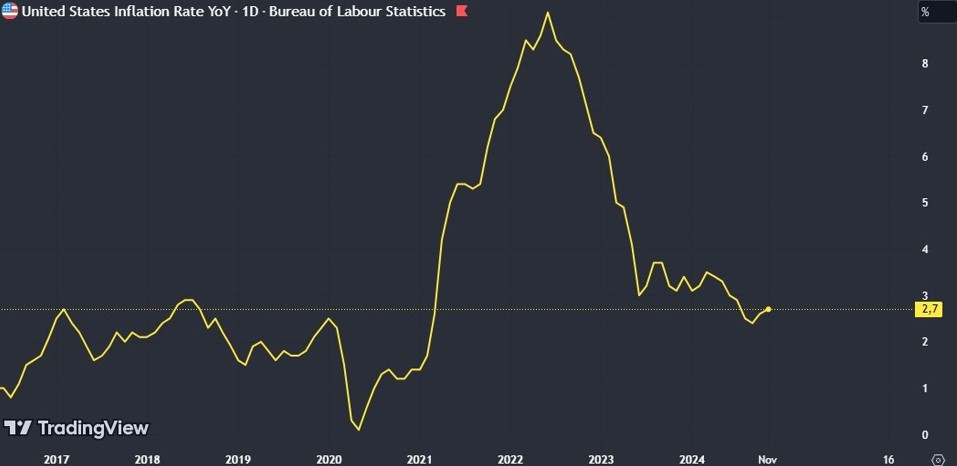

On the evening of December 18th, the stock market experienced a sharp downturn at the end of the trading session following the Federal Reserve’s decision to cut interest rates by a quarter of a percentage point — the third consecutive reduction. However, what truly rattled the markets were the remarks from Fed Chair Jerome Powell, who stated there would be no further cuts until inflation falls back below the 2% threshold.

While the 25-basis-point rate cut was widely expected by analysts, November’s inflation data—released in December—showed a slight increase, with the core component remaining stubbornly above the Fed’s maximum tolerated level. The market reaction was not confined to equities. The Dollar Index also saw increased volatility. Initially, the rate cut put pressure on the dollar, but Powell’s hawkish remarks reversed the trend, pushing the index higher as expectations for future cuts dwindled.

The stronger dollar poses challenges for exporters and multinational companies, as it makes U.S. goods more expensive abroad and reduces the value of foreign earnings when converted back to dollars. This, in turn, weighed on stock valuations, contributing to the S&P 500’s 3% drop during the session. Small-cap stocks, represented by the Russell 2000, suffered even more significant losses, dropping 4.4%, marking the worst “Fed Day” since March 2020, when the central bank implemented an emergency rate cut over a weekend in response to the COVID-19 pandemic.

The market had priced in expectations for 2-3 rate cuts next year, but now it seems there may only be one. With stocks — particularly in the tech sector—trading at high valuations reminiscent of the 2000 dot-com bubble, investors seem eager to sell and lock in profits ahead of the holiday season.

This Fed Day may simply serve as a catalyst, as many investors were likely already planning to close positions to secure gains from this record-breaking year in the stock market. In the short term, it is reasonable to expect the top-performing assets of the year could face the steepest declines.

From a longer-term perspective, the likelihood of just one rate cut next year suggests higher inflation and elevated interest rates for an extended period. This would weigh on stock valuations, increase borrowing costs, and worsen the federal deficit.

The VIX, commonly known as the “fear index,” which gauges implied volatility of S&P 500 options saw a notable spike. While the increase wasn’t as dramatic as the early August sell-off triggered by margin closures on leveraged yen positions, the levels reached remain concerning.

In the weeks ahead, it will become clear whether this Fed Day was merely a trigger for traders to close positions they were already planning to wind down before the holidays or the beginning of a broader market correction heading into early 2025. If the latter is the case, heightened attention should be given to highly volatile assets, including Bitcoin, which could also face significant declines.