By Olli-Pekka Lumijärvi, Olga Nissen and Alexandra Oborina

Every company’s strategy aims to grow revenue, profit, and market capitalization. When global economy was accelerating, these ambitions were feasible. However, COVID-19 urged companies to re-think their strategic priorities and to take immediate actions to keep promises.

We analyzed 1,963 public companies in Nordics (Denmark, Finland, Norway and Sweden) through their top line, profitability, and market capitalization over 2016-2020. Nordic countries, characterized by export driven economies, were following a global economy trend with a GDP growth rate of 2% in 2016-2019 and 2.1% GDP drop in 2020.

There are winners in COVID-19 crisis

Out of 1,963 listed companies we found out that in 2016-2020

- 9% increased revenue annually,

- 0.4% increased profit every year,

- 3% increased market cap annually,

- One company increased revenue, profit,

and market cap every year.

Looking on the same metrics for 2020: 40% increased revenue, 20% improved profit, 39% grew market cap, and 8% (160 companies) hit all the metrics.

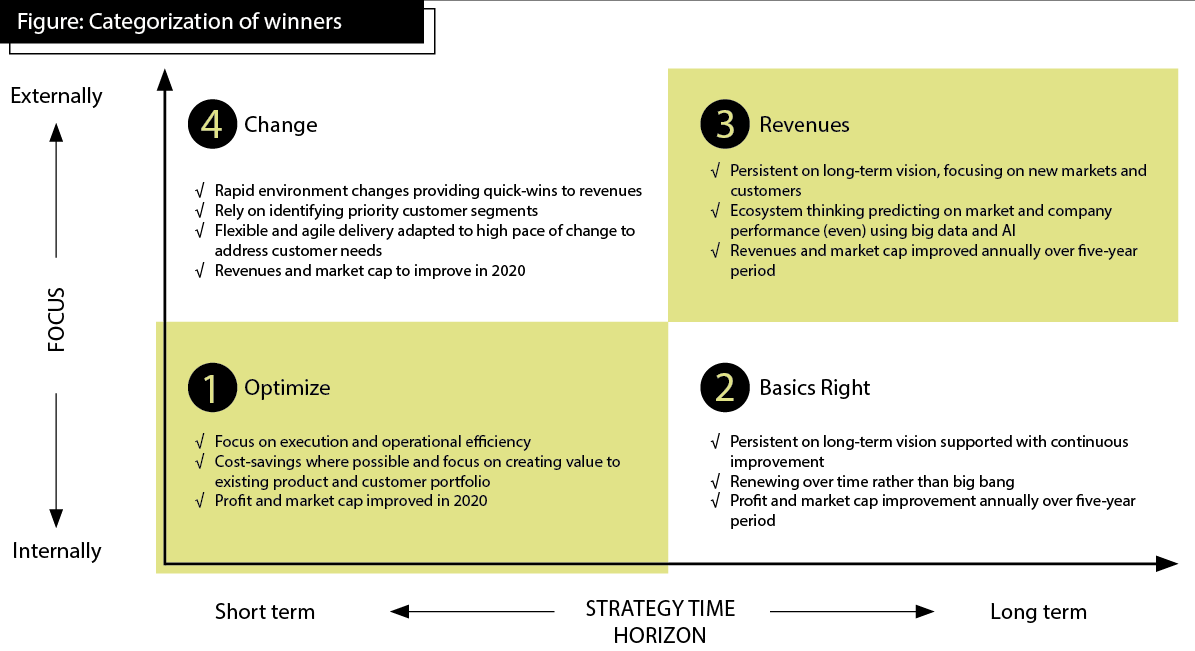

Our analysis shows that winners can be categorized in four groups depending on company’s focus and time horizon of strategic actions (see Figure).

I. Optimize – profit and market cap improved in 2020

Companies with successful cost savings approach were able to improve their internal efficiency, profit, and market cap. We found 12% out of 1,963 listed companies were cost-focused companies.

Case Fiskars – EVP Tuomas Hyyryläinen: “Our product and market portfolio was well balanced for COVID-19 and we accelerated our e-commerce efforts”

Fiskars Group is the global home of design-driven brands for indoor and outdoor living. The company’s brands include Fiskars, Gerber, Iittala, Royal Copenhagen, Moomin by Arabia, Waterford, and Wedgwood, and they are present in more than 100 countries. Due to challenges in 2019 Fiskars Group launched a restructuring program – it changed its organizational structure and the CEO in 2020. COVID-19 hit hard for retail operations when brick-and-mortar stores were temporarily closed in many markets, but Fiskars Group reacted quickly. The first measures were taken already in January 2019 in the supply chain organization to ensure continuity in manufacturing, and early in the pandemic, Fiskars Group made a major shift to e-commerce. They were able to manage costs such as marketing, sales and travel and invested in their direct e-commerce and product availability. EVP Tuomas Hyyryläinen says: “In early March, we moved to remote work and pivoted our focus to those markets, customers and channels that were still open for business.” As COVID-19 expanded and people were staying at home, the demand increased substantially in some of the categories and the team ensured good product availability and transitioned to the e-commerce channel which, in addition to being the preferred option for many consumers, was also a cost-effective sales channel. As a result, Fiskars Group improved its profit margin by 37% compared to 2019 and its market cap increased by 33% in 2020. This profitable and sustainable growth continued in 2021.

II. Basics Right – profit and market cap improved in 2016-2020

Capacity-focused company improved profit every single year in 5-year period. Market appreciated performance and market cap improved every year. One company in Nordics was able to do that.

Case Valmet – CEO Pasi Laine: We don’t change our vision and strategy all the time; we do minor changes, and the big picture is stable

Valmet is a Finland based global developer and supplier of technologies, automation and services for the pulp, paper, and energy industries. In the 5-year period its profit margin grew from 4.6% to 8.2%, sales from €2.9 to €3.6 billion, and market cap from €2.1 to €3.5 billion. Valmet’s success is in its consistency and continuous improvement. Says Valmet CEO Pasi Laine: “When we launched our still existing must-wins – Customer excellence, Leader in technology and innovation, Excellence in processes, and Winning team – in 2014 we wanted every person in Valmet to be part of the strategy implementation. We said that if everybody improves their performance a bit every year the result is huge.” Since then, they have implemented hundreds of projects as part of these must-wins. In addition, Valmet launched Growth Accelerators such as Industrial Internet and Digitalization few years back. CEO Pasi Laine says: “We started to focus on Internet of Things (IoT) already five years ago, but our people were skeptical. In 2020 we were able to do a lot of work remotely and COVID-19 gave IoT a real boost. For example, we supported the start a tissue paper machine remotely in 2020. Earlier, that would have been unheard of.”

III. Revenues – revenue and market cap improved in 2016-2020

Time is required to build new revenue streams and scale them up. Market-focused companies, 1% (24 companies), were able to improve their revenues and market cap every single year in 2016-2020.

Case Castellum

Castellum is one of the largest listed property companies. It develops flexible workplaces and smart logistics solutions. In five-year period, Castellum improved market capitalization by 22.3% and operating revenue by 11.3%. At the same time its revenues grew from €0.48 to €0.6 billion and market cap from €3.6 to €5.8 billion. The main reasons for success were new operating model with re-shaped footprint strategy, strong revenue growth in the construction industry and portfolio restructuring. Strong financial performance was supported by advancing sustainability theme towards climate neutrality – even in 2020 large solar cells were installed at several premises. “In 2020, we proved that we could continue to grow under difficult circumstances” says Henrik Saxborn, the CEO of Castellum in 2020.

IV. Change – revenues and market cap improved in 2020

Revenue growth in the short term is never easy. Changed-focused companies, 23% (457 companies), were able to change their market focus successfully and increased their revenues and market cap in 2020.

Case Vestas

Vestas is the energy industry’s global partner on sustainable energy solutions. Vestas designs, manufactures, installs, and services wind turbines across the globe. It has installed more wind power than anyone else. In 2020 Vestas’ deliveries were up 34% compared to 2019 and 59% compared to 2018. In addition, Vestas’ service revenue grew by 10% and it entered a new country with a long-term service agreement. As a result, revenue increased by 22% in 2020 compared to the previous year. It also had an all-time high order backlog. Although its profit decreased, its market cap increased over 100%. “Among the most important milestones, in 2020 we managed to scale our business to meet demand” says CEO & President Henrik Andersen.

Conclusion

Sudden shock like COVID-19 is a challenge for any company and not the only one on the global scale. Companies increasingly need to build in resilience in the day-to-day operations to deal with high level of uncertainty. The strategy of resilience can deploy either internally or external levers or both. Group I and II companies are concentrating on the execution and operational efficiency. These companies focus more on the profitability and the growth of the company value. Group III and IV are focusing more on their topline. Two alternatives exist: either market segment is growing, or company finds new markets for its services and products.

Hundreds Nordic companies improved their performance in 2020. Continuously improve performance over five year-period is challenging. Out of 1,963 Nordic companies, 25 were able to improve either their revenues or profit margin jointly with their market cap. However, only one company, Valmet, improved its revenue, profit margin and market cap every single year during 2016-2020.

Message to the leaders:

A resilient company succeeds. Keep the long-term strategy as an overall direction and adapt actions based on change of the market drivers. Growth and improvement pockets exist even during tough times.

Improving a revenue, a profit and a market cap simultaneously is challenging. Re-evaluate your business model – consider your company’s ecosystem including partners, competitors, and suppliers.

A quick way to improve your company performance is to optimize costs. Assess your options with data-driven AI approach and utilize historical and predicted benchmarks.

Finding new market in a short-term is tough. If your market is growing, use the tail wind during an economic shock.

There is always a room to advance your sustainability agenda. The new norm is to measure success of the strategy by soft factors such as a progress towards climate neutrality.

Our study proves that market rewards good performance also during tough times.

About the Authors

Olli-Pekka Lumijärvi, Ph.D. (Econ.), is a Senior Advisor, a former Managing Director at Accenture, he is based in Boston

Olga Nissen, Ph.D. (Computational Mathematics and Cybernetics), Director of Center for Data-Driven Management at Skolkovo Business School, Moscow, a former Partner at McKinsey Digital and Accenture’s Head of European technology M&A and Private Equity practice, she is based in Copenhagen

Olga Nissen, Ph.D. (Computational Mathematics and Cybernetics), Director of Center for Data-Driven Management at Skolkovo Business School, Moscow, a former Partner at McKinsey Digital and Accenture’s Head of European technology M&A and Private Equity practice, she is based in Copenhagen

Alexandra Oborina, D.Sc. (Elect. Engineering), MBA, PwC’s lead of Intelligent Procurement, and a former strategy senior consultant at Danske Bank and Accenture, she is based in Helsinki

Reference:

- World Bank, Orbis company database, annual reports, company presentations, senior executive interviews