If you’re currently considering an alternative form of investment, there’s no better time to begin looking at the space sector. As a relatively new area for investing, your choice of options and the ways you can invest are increasing all the time.

There are now more ways than ever to become a part of this new movement and reap the potentially astronomical gains that will come your way as the sector expands. I’m going to outline some of the various methods you can use to invest, and what you should look out for when investing in space technology.

Why invest in space sector technology?

You’re probably already aware that the new space race is propelling this industry into one of the fastest-growing investment sectors globally. Morgan Stanley estimates potential revenues from this sector could surpass $1 trillion by 2040. Right now, we’re at the stage where this industry is beginning to blossom. This leads to start-ups and established companies all jostling for a piece of what may become a hugely lucrative pie.

Currently, plenty of money is already flowing into space-related businesses. According to the latest Space Capital investment report, over $252.9 billion of global equity investments has poured into the space economy during 2021. Another figure worth taking note of is the notable $14.5 billion worth of private investment into space infrastructure. This is more than a 50% increase from the $9.8 billion invested during 2020.

All of this investment and funding is going to drive growth and lead to massive leaps in the application of the innovative technology being used. These technological strides for space companies could very well then spill over into other industries.

How do you invest in start-ups and companies within the space sector?

There are plenty of options available if you’re looking to invest in space-related businesses. Some of the main routes you can go down involve:

- Direct investment in individual companies and stocks

- Purchasing ETFs that focus on specific space themes

- Investing in Venture Capital (VC) funds

- Periphery industry investments

- Pure play start-up

Here’s a quick breakdown of these investing methods:

1. Direct Investment

This carries the potential for the greatest gains, but it also comes with the most risk. By investing privately or purchasing shares in individual space companies, you will have a stake in that business.

Direct investment can lead to fantastic returns if you’re able to pick out the winners. But as this industry is still in its infancy, there will be plenty of companies who fall to the wayside over time.

So, this is a solid option if you understand the industry and are happy to carry out your own research. It may also suit you if you’re looking for a high-risk, high-reward investment to keep as a small part of your portfolio. If you’d like some inspiration, check out these 11 space stocks that hedge funds are buying. Though at least one company on the list, AST SpaceMobile, has shown signs of decline lately, investors still seem to have trust in it.

2. Space ETFs

Investing in a space-related ETF (exchange-traded fund) is a much broader and more accessible way of putting your money into this sector. There are a number of funds available right now that track certain space themes. Some popular examples include:

- Ark Space Exploration and Innovation ETF (ARKX)

- Procure Space ETF (UFO)

- SPDR Kensho Final Frontiers ETF (ROKT)

- iShares U.S. Aerospace and Defense ETF (ITA)

The benefit of investing this way is that you’re getting automatic diversity. Because most of these ETFs will contain multiple companies, you’re not putting all your eggs in one basket.

This is still concentrated within the space sector. But it means that rather than trying to pick out who will eventually succeed, you can spread your capital amongst a variety of companies with one single investment.

Taking this route will lower your risk as an investor. However, it also means the returns would not be as astounding compared to backing individual firms who go on to do great things. So, you need to weigh your willingness to accept risk against your desire for high returns.

3. Venture Capital (VC) Funds

Certain Venture capital funds are laser-focused on this industry. However, to become involved and benefit from their expertise, you will have to be willing to invest a substantial amount.

This method isn’t accessible for those who are not high-net-worth individuals. But for those of you that are, this can be an excellent point of entry. You get the benefit of direct private investment without involving too much legwork or research on your part.

Funds such as Space Capital, Seraphim Space, and Skyrora Ventures have teams that work around the clock figuring out the next smart money moves. It’s also important to realise that investing in the industry this way with large sums still does carry obvious risks.

4. Related Fringe Investments

It’s not all brand new businesses that are set to benefit from space technology advancements and sector growth. There are plenty of well-established firms set up right now that will act as key suppliers within the space ecosystem. Here are a few significant companies that already have a foothold in the sector:

- Boeing (BA)

- Lockheed Martin (LMT)

- Northrop Grumman (NOC)

- Raytheon Technologies (RTX)

- Honeywell (HON)

You could also consider investing using an ETF like the SPDR S&P Aerospace & Defense ETF (XAR) which tracks and invests in lots of similar companies that fit this criterion.

5. Pure Play Start-Up

This is probably best left to the billionaires like Musk and Bezos because the barrier to entry for pure plays into the space industry is set pretty high. That being said, it’s a vastly diverse sector that’s continually expanding.

You may have a particular area of expertise, perhaps mechanical or electrical engineering, that you could leverage to start a company and become a player within the industry. This would mean involving yourself first-hand instead of indirectly with an investment.

What are the space sectors attracting the most investment?

Now that you’re aware of the various ways in which you can invest in this sector, I’m going to walk you through the areas that are currently attracting the greatest amount of private and public investment.

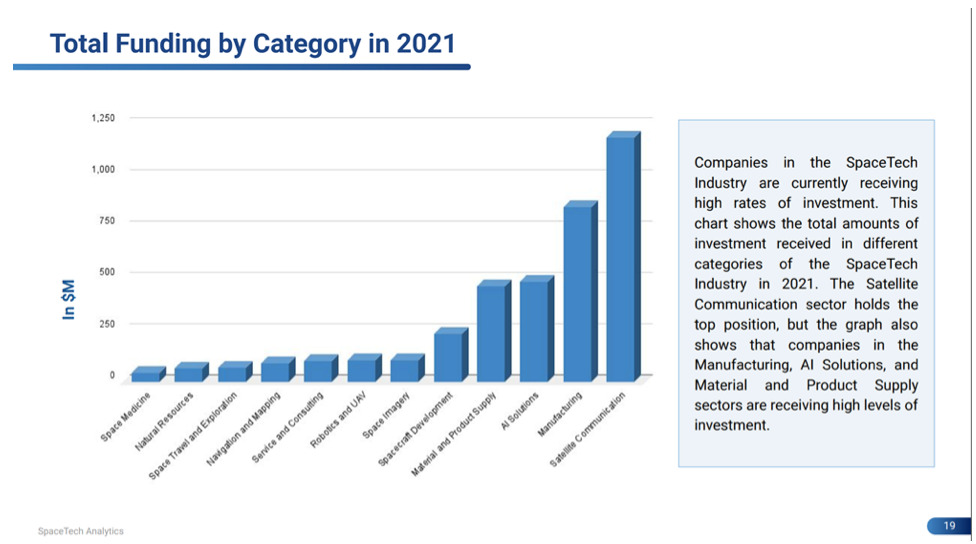

According to a recent SpaceTech Analytics report, the two largest niches right now is space manufacturing and satellite communication. Here’s a graph to show how much money each sub-sector is currently attracting:

What are the main barriers for investors?

Although there’s plenty to get excited about with space-related investments, it’s worth being realistic. You need a complete understanding of the entire picture. When it comes to space investments, it’s important to weigh up the risk versus opportunity.

The industry is receiving a lot of attention right now, which is leading to a lot of hype and possible overvaluations. However, most markets and industries are currently sitting at lofty valuations with high growth multiples across the board.

Many businesses in this industry are yet to return a profit. It’s a sector that requires a vast amount of investment for returns that are likely to be a lot further down the road. The processes involved in creating and testing the technology can be extremely arduous, due to the meticulous skill, care, and precision that must take place.

Should you invest in space tech right now?

This will depend entirely on your goals. If you’re looking to make a quick return, then this probably isn’t the sector for you. Like with any fast-growing group of assets, there are of course fears of a space bubble, drawing parallels to the dot-com boom.

However, if you’re a long-term investor looking to put your money into the industries and technologies that will fuel our world of tomorrow, then this sector definitely deserves your attention. Your options for investing right now are still fairly limited, but there are still a number of accessible paths for most people.

You may decide to wait a while and see how things unfold, but this could of course mean potentially missing out on explosive growth. Areas like space tourism may be light-years away, but the rapidly advancing tech being utilised in the sector is likely to have plenty of real-world application within the coming years.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.