By Fang Liu and Willem Smit

The battle between Coca-Cola and Pepsi1 has been one of the longest and most arduous in the history of brand competition. Over the years, these cola wars have been fought over distribution, mass-advertising via in-store competition, sports event sponsorship and video game integration. Now, with the emergence of social media, the war reignites on a new battlefield. We present the cola war in social media in two countries – the U.S. and China – and draw insights for companies trapped in a social media dilemma on how to compete with your rivals, build a consistent and coherent brand image online and offline, adapt your social media strategy in different cultures and aim for both short-term and long-term return.

Reasons to invest in social media marketing

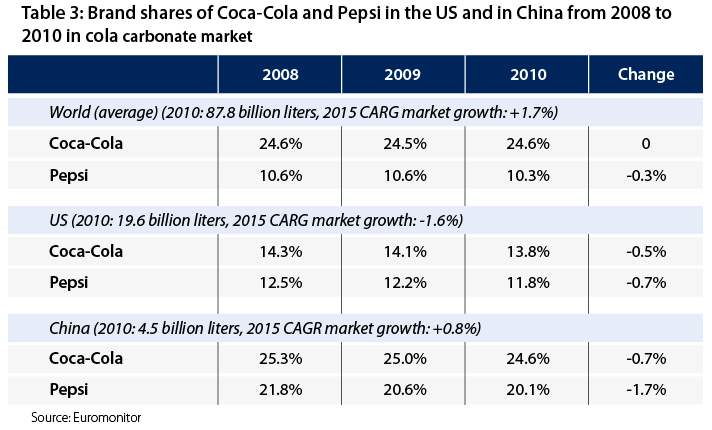

Globally, the golden age of the cola carbonate market is over. Traditional cola drinking countries such as the U.S. still have high consumption per capita but have seen and will see negative volume growth since the beginning of the millennium. In traditionally low consumption countries, the growth rate is expected to slow, as in China where, although the volume growth was plausible – 7% from 2005 to 2010, the growth rate is forecast to slow down to less than 1% and the consumption per capita is only one twentieth of its U.S. consumers. (See Table 1)

Understandably, to generate further growth, both Coca-Cola and Pepsi have diversified into the healthier drinks market, with drinks such as tea, but neither of them is ready to give up the cola market yet. The cola market is their signature product and a strong position here is important to reflect both firms’ corporate umbrella brand. Future growth in the cola category needs to come from higher value and higher prices and market share increases. Branding will play an important role in creating a superior image and extracting that intangible value. These are not reasons to let the strong positions in these cash cow markets erode.

As two marketing giants, Coca-Cola and Pepsi are also leaders in social media branding. We shall discuss their practices in the U.S. and China – two totally different competition environments – and their relative successes and failures in pioneering social media marketing.

[ms-protect-content id=”9932″]

Defending the turf in the US

In 2010, Pepsi surprised the marketplace by withdrawing sponsorship of the Super Bowl and investing 50% of its U.S. branding budget into the “Pepsi Refresh Project.” Through social network sites, the project encourages people to suggest ideas and/or vote for various social causes to “refresh the world.” Pepsi will then make financial donations for the ideas that receive the most votes.

In the meantime, Coca-Cola’s Expedition 206 campaign approached social media in a different way. Three Coca-Cola “happiness ambassadors” visited 206 countries over a period of 12 months, communicating Coca-Cola’s “optimistic and happy” brand image to the rest of the world. The ambassadors visited the 2010 Olympic Games in Vancouver and also broadcasted news live from the Shanghai World Expo.

Yet, in spite of this, Pepsi’s former VP of marketing, Ralph Santana, admitted that in addition to having a cultural idea tapping into a mass sensibility, Pepsi should get more brand exposure in social media. In the example of “refresh the world”, Pepsi managed to attract a very specific group of consumers, but far less visibility than it could have generated among the mass majority. Similarly, Coca-Cola’s Expedition 206 attracted a disappointing number of fans and followers, and the attention was also limited. The initiative of combining online and offline activities is innovative but the number of consumers who are willing to follow an event that lasted as long as 206 days is small. The challenge to create media “buzz” produces the biggest obstacle in achieving social media marketing success.

The battlefield in China

China’s growth of 30 million liters cannot compensate for the 300 million liters that the U.S. market will lose annually. China remains the world’s third largest cola carbonate market behind the U.S. and Brazil, with a volume of about 4,500 million liters in 2010, one fourth of the market size of the U.S. Coca-Cola has a net advantage in the Chinese market in terms of its entry time and distribution network, which has secured its position as market leader. Pepsi, as the challenger brand, arriving in China three years later than Coca-Cola in 1982, kept its differentiation strategy of focusing on the young generation.

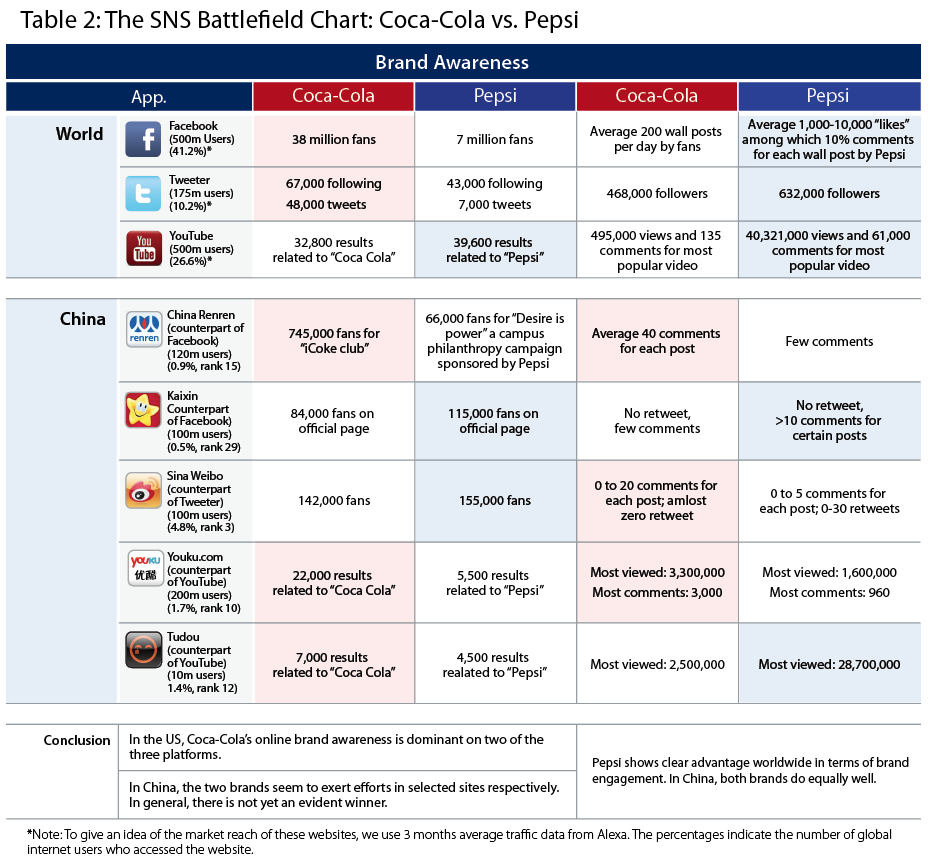

The social media opportunity in China is great due to its size – 400 million Internet users and the world’s largest mobile phone user base with approximately 1 billion users, among which 300 million are smart phone users. But it is also a complex and fast-changing market, more fragmented than in most other countries – without the presence of Facebook, the two local rivals, Renren with 120 million users and Kaixin (100 million users), are competing for the top position. Also, YouTube’s counterpart Youku, with 200 million users, is competing with Tudou, which has 70 million. To see where the two cola brands currently stand, we examined their “fan pools” on SNS in Table 2.2 Colleagues from MIT, Donna Hoffman and Marek Fodor3, suggest the effectiveness of social media efforts should primarily be measured by the brand awareness and brand engagement they generate. Brand awareness refers to the brand’s online exposure, such as the number of fans on a brand’s Facebook page. A more active measure is brand engagement, which aims to capture the intensity of interaction between the brand and the Internet users, such as number of comments, wall-posts and re-tweets.

We collected brand measurements for Coca-Cola and Pepsi on Facebook, Twitter and YouTube applications, as well as on their counterparts in China, including Renren, Kaixin, Tudou, Weibo and Youku. Worldwide (excluding China), the results show that Coca-Cola enjoys a much bigger fan pool than Pepsi: 22 million Coca-Cola Facebook fans versus 3 million fans of Pepsi on Facebook. Coca-Cola leads for both brand awareness and engagement. Pepsi, for its part, is ahead on video-generated content. The numbers also show that on the fragmented SNS scene in the Chinese market, neither brand should rest on its laurels as far as brand engagement is concerned. In Chinese cyberspace, Coca-Cola does not appear to have such a strong competitive advantage.

In terms of absolute numbers, partially due to the fragmentation of the social media market, not a single Chinese media site is yet able to compete with Facebook, Twitter or Youtube. Nevertheless, we think the following two examples are noteworthy on how to create “media buzz” in a different culture.

In May 2007, Pepsi launched a campaign called “I want to be on Pepsi!” People could upload their photos to a database and visitors to Pepsi’s website could vote for their favorites. The winners’ photos were then printed on Pepsi bottles just like celebrities. In collaboration with the instant messenger QQ4 and Tudou.com (one of the largest video websites in China) and other social media portals, the campaign attracted 1.33 million people to participate and 200 million votes were generated. This campaign is successful because it captured precisely the fact that celebrity endorsements are enormously popular in branding, and more individualistic young people have a dream of being celebrities. In such a context, the campaign no doubt created an excellent media buzz.

In 2008, Coca-Cola linked their social media to the Olympic Games, using the Olympic Torch Relay to gain cyber momentum. The company had already paired up with the games in July 2001, when it released a special Olympic-themed bottle just hours after China won the bid. To retain its links with the Olympics, at the start of the games Coca-Cola launched “Coca-Cola virtual Torch Relay” on QQ. Users were able to participate in the virtual relay by simply clicking on the button “I want to participate.” The campaign attracted 17 million participants in two weeks. This is another successful campaign, as it reacted extremely fast and grasped the perfect moment of amplified Chinese patriotism, and leveraged the campaign with the most popular online chatting tool – QQ. Strictly speaking, QQ was born much earlier than Facebook and cannot be defined as social media tool. But in China, its influence is bigger than any other social media sites mentioned above, with almost 1 billion registered users.

Should you care too much about the ROI?

The hesitation to invest in social media marketing is mainly over return on investment. Top executives are concerned about whether any additional return could be generated from social media marketing. Our answer to this question is – don’t lose too much time on calculating the ROI of your social media marketing investment, notably revenue, profit and market share. Marketers have spent years trying to figure out the ROI of traditional marketing. In 2005, a CMO council survey of senior marketing executives found that more than 80% were dissatisfied with their ability to measure marketing ROI.5 When they finally managed to measure marketing ROI more precisely with sophisticated models, metrics and tools, it transpired that the millions of dollars they had previously invested were actually thrown into water – the ROI turned out to be very disappointing. These opinions among top marketing decision makers have not changed, as IBM recently reported in their worldwide survey among 1,734 CMOs, “[q]uantifying ROI is still unclear.”6

Yet, no company would be willing to bare the risk of giving up marketing completely. If a marketing budget is there anyway, while traditional TV and poster advertising is becoming less effective, why not try investing the budget into the new marketing channel – social media marketing? After all, there is not a lot to lose given the extremely low ROI of traditional marketing. Actually, some industry experts have argued that social media marketing is cheaper than traditional marketing, making it a welcome feature in an economic crisis where marketing budgets are being tightened. The Pivot team and the Hudson Group surveyed 181 brand managers, agency professionals and experts and found that more companies are now committing resources to social marketing. Companies that are willing to invest 5% to 50% of their marketing budget in social marketing have increased from 39.2% in 2011 to 48.6% for 2012, admitting that better understanding of the benefits of social media has triggered their move beyond experimentation in social marketing.7 In February 2012, both P&G and Unilever, two (traditional) marketing giants, announced that they were going to cut the budget and headcounts of their marketing department. However, they would be investing more in online marketing. Unilever announced a 15% increase in digital spending budget this year. Its CMO Keith Weed also claimed that some of its digital programs have produced $3 in revenue for each dollar spent.8

In the case of Coca-Cola and Pepsi, even though both seem to be losing market share in the U.S. and in China (See table 3), both companies have not ceased their social marketing effort. They may be looking for alternative return from social marketing, including “Return On Influence”, referring partially to brand awareness and brand engagement.

Return on Influence could generate long-term benefits, like any investment in brands. It takes time for an increase in awareness and engagement to convert into sales growth. Investing in social marketing is investing in future generation consumers. More importantly, as with all previous battles in the cola wars, companies just cannot afford not to do it. If only one company does, chances are that the other may lose. The anticipated regret forces companies to follow each other swiftly.

Furthermore, waiting until more is known about the effectiveness of social media, without experimenting yourself, would only give competitors the chance to surpass you. It is better to start social media marketing earlier than later. The results may not be seen in the short-term, but when the current young generation grows up, the gradual influence of brand image will play a major role in their purchase decision, a concept which is similar to many longstanding brands such as Nivea and BMW. Brands that are not involved with social media today will be forgotten tomorrow.

Coca-Cola and Pepsi have also taught a good lesson on how to localize social marketing efforts in different culture contexts. In this sense, the common practice of “think globally, act locally” still applies to social marketing. Consistency of brand image is necessary on a global scale, but it is equally important to leverage the local social media platforms and understand the local consumers in order to carry out successful and efficient campaigns.

Some hands-on tips

1.Understand the difference between social media platforms

When it comes to choosing social media platforms, the first thing that companies should know is that they are targeting multiple consumer segments with varying platform usage habits. For example, somebody who registered both on Facebook and Twitter probably does not use them for the same purpose. The saying that “Facebook is on the social graph and Twitter on the interest graph” still holds. It is generally believed that Facebook friends are interested in the person while Twitter followers are interested in the topic, not necessarily the person. Twitter is more open and dynamic than Facebook, but tweets also fade into the crowd faster. If one carefully checks Coca-Cola and Pepsi’s Facebook and Twitter pages, one would discover that they do not have the same style at all. The Facebook page of Coca Cola is a place for anybody to express any feeling, while Pepsi’s page is neatly managed by a team, aiming to elicit dynamic interactions with the consumers which correspond closely to Pepsi’s fun image.

Other social platforms such as Youtube have even looser connections, but can attract users with a different manner. Companies should analyze these platforms carefully and choose the correct strategy which corresponds to their brand image and company vision.

2.Understand what the followers want

One thing that social media practitioners complain a lot about is the low average response rate. The difficulty lies in getting to know what the fans or followers want. According to Brian Solis’ aforementioned report, many companies believe that they know what fans are looking for from them, while in reality, there is often a mismatch of ideas. We do not argue that companies should always send out messages that will please fans, like promotional information, but occasional media buzz will bring more benefits than harm.

3.Online and offline

Another useful tip for creating media buzz is to smartly combine online and offline events. Coca-Cola’s previously mentioned online torch relay campaign is a perfect example. Companies can choose to launch both offline and online campaigns separately, such as Coca-Cola’s Expedition 206. This gives companies full control of the event, but it is also costly. Alternatively, jumping at opportunities such as the torch relay is less costly, and they also have great visibility.

4.Match to your competitors

The last piece of advice we would give is to benchmark your social media performance against your strongest competitors’ and learn even faster. Identify the social media platforms and continuously monitor brand awareness and brand engagement of your own brand and that of your competitors. The SNS battlefield table, like those for Coca-Cola and Pepsi, and P&G and Unilever, are examples of such a benchmarking exercise. It will help pinpoint strong and weak points and will help you better adjust your social media campaign so as to win against your competitor.

About the authors

Fang Liu ([email protected]) is Research Associate at IMD. Her main research interest includes innovation and marketing. She is also actively involved in research on China and Chinese companies, notably on topics such as innovation and entrepreneurship, as well as their future potential in the global marketplace.

Willem Smit, PhD, is adjunct professor in Strategic Brand Management at the Lee Kong Chian School of Business, SMU, Singapore. Based in South East Asia, he is affiliated to IMD as research fellow. His research interests include strategic marketing decisions, such as branding, channel collaboration and new market creation.

References

1.Both Coca-Cola and Pepsi in this article refer to the cola carbonate drink only, not Coca-Cola Company or PepsiCo.

2.Numbers collected in January 2012.

3.Donna L. Hoffman and Marek Fodor. “Can You Measure the ROI of Your Social Media Marketing?” MIT Sloan Management Review, Vol. 52, Iss. 1, 2010: 41–49.

4.QQ is the most popular IM (Instant Messenger) in China with 300 million users. Companies can advertise on QQ by buying space for panel publicity but there is no function as fan page.

5.K. J. Clancy and R. L. Stone, “Don’t blame the metrics”, Harvard Business Review, June 2005.

6.IBM CMO C-Suite Study (2011) From Stretched to Strengthened, Insights from the Global Chief Marketing Officer Study

7.Brian Solis, (2011) « The state of social marketing, 2011- 2012 », Pivot conference, taking place October 2012. Early report published on Social Media Today site.

8.http://adage.com/article/news/cost-cuts-store-p-g-unilever/232539/

[/ms-protect-content]

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)