Achieving growth is enormously challenging in today’s complex and fast-changing business environment. But growth opportunities do exist for companies with the skill and will to find them. The rise of “big data,” the explosion of sales over digital platforms, and the professionalization of sales management mean that both the art and science of selling are undergoing a fundamental shift.

“This is not a time to ignore sales; it’s a time to reassess and reinvent it,” says Marc Benioff, founder and CEO of salesforce.com. “As technology evolves and makes the world closer, more global, and more interconnected, I have only become more convinced of the importance of sales and the need for companies to implement the right strategies and right services to get better at selling.”

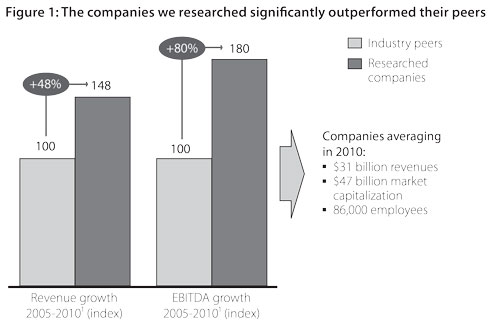

McKinsey’s new book, Sales Growth, is based on analysis and interviews with more than 120 top sales executives. It shares their experiences of finding and capturing growth, and discusses how they build the capabilities to keep growing in the future. The stakes are high: the best sales organizations we researched outstrip their peers by 50 to 80 percent in terms of revenue and profitability. In other words, companies that put sales management at the heart of their agenda have captured astonishing growth opportunities. (see Figure 1)

[ms-protect-content id=”9932″]

Winners follow one or more of the following five strategies: they get to growth before competitors do, sell the way customers want, turn sales operations into an engine of growth, focus on their people, and lead sales growth from the top. A company that excels in at least two or three of these areas can make a mark as a sales leader.

Get to growth opportunities before competitors do

For a company striving to outsell the competition, it’s a tremendous advantage to find customers first. To do that, successful sales organizations take three steps: they look ahead to understand coming market developments, drill down into existing markets to reveal untapped pockets of growth, and scour extensive datasets to develop new, and often real-time, insights into customer preferences and behavior. Reps and managers exclusively focused on meeting short-term sales targets will need to shift their mindset, because companies that put these perspectives at the core of their business steal a march on competitors and lock in customers.

To look ahead, sales winners monitor megatrends—and they’re looking two years out, not two months. Shifts in demographics, environmental changes, regulations, technology… the list of areas that merit analysis is long. The best companies invest 2 to 4 percent of their sales budget in the more distant growth these trends can reveal.

For success, companies need to bring together a wide variety of datasets. EMC, a global IT and data solutions provider, works with cutting-edge customers, its own engineers, a business development team, and research universities. This variety is crucial, notes vice-chairman William J. Teuber, because “trends don’t appear clearly from any one source. They come into focus only when you bring a mixture of perspectives together.”

It’s one thing to knowing the forecast calls for sunny weather and another to order in more cold drinks. World-class sales organizations quickly translate the trends they identify into top-line impact. As the 2008 financial crisis unfolded, South Korean automaker Hyundai saw that economic uncertainty would make consumers skittish about buying cars. On January 2, 2009, it announced a program that let customers return their cars without penalty if they lost their jobs. In the immediate wake of the program launch, automotive consumer research organization Edmunds reported that “purchase intent shot up 15 percent … and has remained at 7 percent above its seasonal norm.” Hyundai became the only major car manufacturer to increase U.S. sales in 2009.

The second component of getting to growth first is drilling down to find untapped growth. Top sales companies break down markets into small discreet units, analyzing their growth potential and the competitive landscape, and adjust resources accordingly.

By taking such an approach, one global chemicals and services provider increased the growth rate of new accounts from 15 to 25 percent in just one year. Its big breakthrough was adopting a more granular view of the market. Instead of looking at current sales by region, as it had always done, the company developed a far more revealing view by examining its share within customer industry sectors within specific U.S. counties. This deeper level of analysis revealed that although the company had 20 percent of the overall market, it had up to 60 percent in some micro-markets, while in others, including some of the fastest-growing segments, its share was as low as 10 percent.

Sales leaders acted fast. They began including forward-looking opportunity data at a much finer level of analysis when allocating resources and ensured that reps were equipped to win in the opportunity hot spots.

Beyond unearthing and tapping micro-segments within the markets they serve, the most advanced sales companies target even smaller units – individual customers. Thanks to “big data” – the use of enormous datasets, often incorporating real-time or location-based data – companies can uncover hidden growth. These “big data” techniques help with sentiment analysis, customized cross-selling, and—with the rise of smartphones and other mobile data devices—location-based selling.

Big data is changing sales management in multiple ways. It’s speeding up the performance management cycle from monthly to daily; it’s creating new touch points and leads across both digital and traditional channels; and it’s affecting core elements of sales management, such as sales operations and training, which have to gear up for its demands.

Gaining access to data from partners and other outside sources requires new kinds of relationships; no one wants to give up something of value for nothing. Procter & Gamble CEO Robert McDonald explains that in forging relationships with partners and other organizations, “data becomes part of the currency for the relationship. When we do joint business planning, getting data becomes a big part of the value for us, and it’s a big part of how we work together. We have analytic capabilities that many retailers don’t have, so often we can use the data to help them decide how to merchandise or market their business in a positive way.” In other words, a supplier’s big data capabilities will become part of its competitive advantage when building relationships with selling partners.

Sell the way customers want

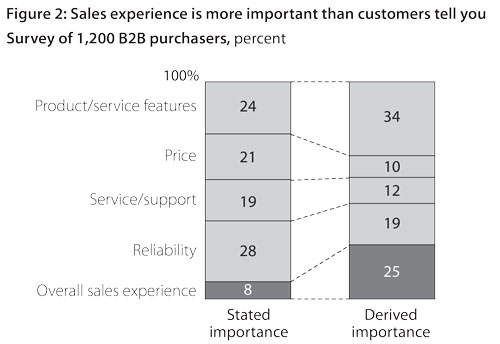

Crafting a sales experience that makes customers happy seems like an obvious win. However, sales executives often invest lots of energy on the product and price dimensions of the offering. These aspects certainly matter, but our research shows that the sales experience can be at least as important. Furthermore, sales leaders seeking to evaluate this experience can’t rely on what customers tell them, since what customers say does not always match what they do. Across both business and consumer markets, customers tend to state that price is more important and sales experience matters less, but the way they act suggests otherwise.

In a survey, McKinsey asked 1,200 B2B purchasers what drove their purchasing decisions. “Overall sales experience” emerged as the least important category. We then asked the same customers to rate their suppliers’ performance and also asked for each supplier’s share of their business. Correlating supplier performance with actual purchases revealed a startlingly different picture: sales experience was three times more important than stated. (Figure 2)

So, sales experience matters, but figuring out what will make it satisfying is anything but simple. Online and mobile technologies have opened up entirely new ways for buyers and sellers to communicate, and consumer expectations and behavior have evolved too. Customers demand faster, more seamless, and even enjoyable sales experiences; they want more information and more value, and they want it now. To meet these demands, companies must orchestrate a number of channels. This is increasingly true in emerging markets as well as in established ones, although the mix and approach is likely to vary from one market to another.

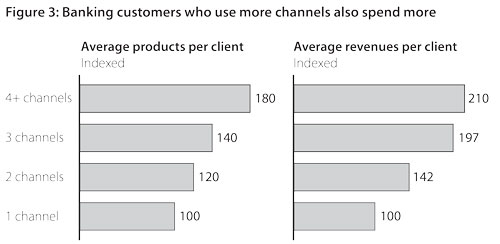

Yet few companies have truly mastered multichannel sales, even though the payoff can be tremendous: companies that get it right generally enjoy larger profit margins and revenue growth. For example, in banking, product penetration and revenue per client can be about twice as high when customers are served across more than four channels, compared to customers that are served only through one channel. More generally, recent McKinsey research shows that consumers who shop across a number of channels—physical stores, online, catalogs—spend about four times more annually than those who shop in just one. (Figure 3)

To serve its highly diverse customers, Electronics manufacturer Samsung orchestrates all its distinct yet linked channels—telecommunications operators, consumer electronic retailers, IT resellers, a direct sales force, and the Samsung.com website. “Our approach is to build depth of expertise, processes, and relationships with multiple channels and take advantage of our product portfolio, innovation, and design synergies across channels,” says Gregory Lee, the company’s President and CEO for Asia.

Whatever form their particular channel mix takes, companies must unleash the full potential of their digital channels to power sales. Digitalization causes many executives to worry about relinquishing too much power to customers. Margo Georgiadis, Google’s President for the Americas, points out that, in fact, “the digital age represents a huge moment of empowerment for companies,” allowing them to “provide precise and relevant information at times the customer chooses and when they are most receptive.”

“The digital age represents a huge moment of empowerment for companies,” allowing them to “provide precise and relevant information at times the customer chooses and when they are most receptive.” Margo Georgiadis, Google.

Indeed, leading organizations see sales and conversion rates skyrocket when they get online and mobile platforms right. In 2009, Tesco’s South Korean subsidiary, Home plus, installed a billboard in a subway station that replicated the aisle of one of its supermarkets. Commuters could scan the quick response codes of the items pictured with their phones and have their groceries shipped to their homes. “Let the store come to the people,” the ad read, proposing to turn “waiting time into shopping time.” Two years later, 760,000 buyers had downloaded Home plus’ mobile app. The company’s online user base jumped by 76 percent, and online sales increased by 130 percent from 2009 to 2011.

To power digital sales, sales leaders skillfully employ social media. Pharmaceuticals giant Novartis offers a good example. When a competitor drug was threatening TOBI, its inhaler-based treatment for cystic fibrosis (CF), Novartis launched a multipronged social media campaign. First, it monitored CF forums and websites and talked to leading CF bloggers to understand what customers were saying about the new competitor. It then set up channels across a range of social media, including Twitter, YouTube, and Facebook, with content and tools geared to CF patients in different age groups. Thanks to this engagement with patients, TOBI has maintained its social media share of voice.1

As they embrace the new possibilities of today’s highly digital environment, sales leaders are also reinventing tried-and-true sales methods like direct sales. The best involve customers early on in discussions of how to solve business problems and adapt products and services to provide better solutions. All this effort leads to sales—eventually—but the focus is on a collaborative problem-solving experience.

Vodafone works closely with groups of customers in Germany on different levels to understand how the industry is developing and the specific challenges they face. “Our Customer Executive Board consists of senior executives from 12 large and medium-size customer organizations,” explained Jan Goldmacher, Vodafone’s Chief Commercial Officer, Enterprise. “In this forum, we discuss issues such as regulatory changes or new technologies and how they affect our customers.” A further set of 260 customers looks at more specific topics, such as product features, service-level agreements, and price points. These groups are just one aspect of a comprehensive sales experience that treats every business customer as an individual. As Vodafone works with its customers, it compiles ‘lessons learned’ that form the basis of the content for its Vodafone Business School. Furthermore, the company creates very precise hiring profiles aligned with these findings.

Turn sales operations into an engine of growth

Even the most visionary sales leaders can’t deliver growth by waving a magic wand. Success on the front line – either with the company’s own sales force or channel partners – requires equipping reps with the right tools and back-office support. When sales managers look at back-office operations, they are usually out to cut costs. True, cost improvements of 20 to 30 percent are not unusual, but the best sales organizations never forget that good sales support also translates into happier customers and more productive sales reps. An effective back office can boost revenues by 10 to 25 percent by giving frontline sales teams 50 percent more time to sell. Customers, meanwhile, love the smoother fulfillment and faster turnaround time.

At financial messaging company SWIFT, the first step in overhauling sales operations was customer segmentation. When executives saw that the top 15 percent of clients generated 75 percent of revenue, they assigned top-performing sales reps to these high-value segments and entrusted smaller customers to certified partners. At the same time, a lean management approach streamlined core sales processes. Together, these improvements lowered FTE costs almost a third. Tapping the full potential of the support function was also key. “Our support people talk to customers daily to help them resolve problems, so we brought them into the selling process,” says Alain Raes, Chief Executive for EMEA. Thanks to the transformation, notes Raes, “we have greatly improved how we work together, even across distributed teams.” Every day, teams of reps and sales support get together for 15-minute meetings around a whiteboard. These daily briefs help people plan their activities, and the whiteboard itself charts performance and tracks progress. This process leads to a much more efficient and disciplined work day for everyone.

A good place to start when overhauling sales operations is to find out how much time frontline salespeople actually spend selling. The results are invariably eye-opening. Before SWIFT introduced its lean management approach, for example, sales reps were spending just 18 percent of their time dealing directly with clients. Three months later, this leapt to 40 percent. The key is to break down sales activities into discrete tasks, and assign each task to the group that can perform it most efficiently and effectively. Such an approach transforms sales operations into a factory that smoothly processes leads into sales.

Manage performance and build capabilities

McKinsey analysis shows that top sales reps outperform the stragglers by a factor of three. Successful sales leaders understand that motivating staff is not just a question of money. Winning at sales means taking the time to coach rookies into rainmakers. At the companies that do this best, managers spend upwards of 60 percent of their time on coaching. They also set the right tempo for reporting and intervention.

Sales executives we spoke to emphasized that the most important players in such coaching efforts are first- and second-line managers. They interact with reps daily and constantly reinforce good or bad behavior. If these frontline managers provide coaching and support to inculcate new behaviors and processes, transformations take root. Too often, organizations underinvest in these managers and undermine the success of rep training.

Würth, the global market leader in assembly and fastening materials, is one company that has made sales rep coaching a priority. Its sales force – which accounts for almost half of its 66,000 employees – is critical to this success. Mario Weiss, Executive Vice President, believes in the credibility that managers have as coaches. “Our area managers are the most important people for coaching,” he said. “They are our ‘champions of success.’” Most of this coaching occurs during “ride-alongs,” when an area manager spends a whole day with a sales rep, accompanying him in his customer visits and providing immediate feedback and input. Coaching mechanisms vary from company to company, but all top sales organizations think about the role managers at each level of the hierarchy should play in building an effective sales culture. At one consumer services company, for example, sales managers perform the bulk of one-on-one coaching, while area sales managers act as champions and role models at a broader level. In many sales organizations, managers who rise up through the ranks view themselves as “super reps”—but they contribute more when the culture encourages them to become “super coaches” instead. Indeed, the best reps may not make the best coaches, so identifying early on who’s Jose Mourinho and who’s Lionel Messi will certainly pay off. (see Figure 4)

Drive growth from the very top

Great sales leaders know that everyone in their organization takes a cue from them. They use this position and influence to challenge the status quo, galvanize their team, act as role models for change, and demand results.

Hubert Patricot, President of Coca-Cola Enterprises in Europe, embodies many of these sales leadership qualities. Beyond his involvement in sales planning and strategic decision making, he is a regular visitor to the front line. “I spend a lot of time in the field, sometimes even taking members of the board with me,” he explained. By being there where sales happen, he can “make sure that our ‘Coca-Cola Enterprises’ way of selling is being used with every customer every time.”

Less than a third of change programs actually achieve their targets, and sales transformations are no exception. No implementation will work without steadfast support from the very top. Only a committed leader can compel executives from across the organization to sit down, share data, and talk openly about what’s not working. Achieving this level of exchange requires overriding internal politics, seeing the big picture, and focusing on the best solution regardless of past practices. Without such strong leadership, any growth program will founder.

Most companies have conducted major programs to boost productivity and improve operations, but haven’t put sales under the same microscope. Yet there’s a much bigger gap between the best and the worst companies when it comes to selling than to areas like supply chain management, finance, or purchasing.

As the five strategies we’ve identified show, sales leaders that want their companies to be among the best can pursue a host of actions. But the single most important step toward winning at sales is starting a conversation about the need for change and the vision for achieving it. Such a discussion will naturally consider a range of specific questions, but the overriding theme should be: how can sales management help the company beat the market? Beating the market requires more than good products and services—it takes a robust, sustainable advantage in selling, too. Sales leaders with the courage to take this step can transform their companies into sales champions.

About the authors

Thomas Baumgartner is a partner in McKinsey & Company’s Vienna office, leader of McKinsey’s Sales practice and the co-author of Sales Growth: Five Proven Strategies from the World’s Sales Leaders.

Maria Valdivieso de Uster is a Senior Expert in Sales & Channel in McKinsey’s Miami office and part of the Sales Growth book’s editorial board.

Sales Growth: Five Proven Strategies from the World’s Sales Leaders (Wiley) is now available from Amazon (http://amzn.com/1118343514) and in bookstores. Visit here (www.salesgrowth.mckinsey.com) for more information. For ongoing content: @McK_CMSOforum; Chief Marketing & Sales Officers Forum: cmsoforum.mckinsey.com

Note

1.CLIO Awards; CFVoices.com; Doctors.net.uk; PharmaExec.com.