Return on Investment (ROI) is one of the most critical metrics in business, serving as a universal benchmark for evaluating the profitability of investments. Whether you’re a startup assessing a new product, a corporation weighing expansion, or an investor analyzing potential ventures, ROI offers a clear, quantifiable measure of financial performance. But improving ROI isn’t just about increasing profits—it’s about optimizing decision-making, efficiency, and strategic growth.

In this article, we’ll break down the fundamentals of ROI, why it matters, and the key strategies businesses can use to maximize their returns while making informed, strategic choices.

Understanding ROI and How to Calculate It

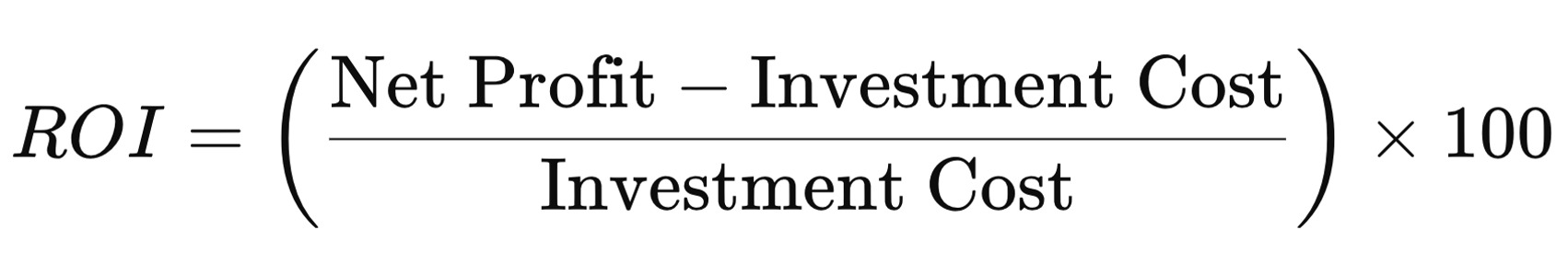

At its core, ROI measures the profitability of an investment relative to its cost. The formula is straightforward:

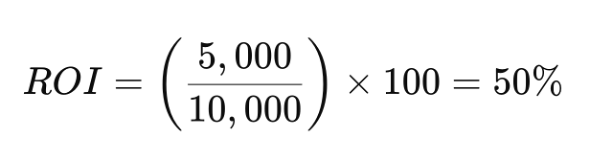

For example, if you invest $10,000 in a marketing campaign and generate $15,000 in revenue, the net profit is $5,000. Using the formula:

This means you earned a 50% return on your investment. The higher the ROI, the more profitable the investment.

ROI is commonly used in:

- Marketing: Assessing the effectiveness of advertising campaigns.

- Product Development: Evaluating the return from launching a new product.

- Real Estate & Investments: Comparing returns across different investment opportunities.

- Operational Efficiency: Identifying cost-saving measures that increase profitability.

While the formula is simple, interpreting ROI can be complex. Factors such as time frame, market conditions, and indirect costs should be considered for a complete analysis.

Why ROI Matters for Business Decisions

ROI is not just a number—it’s a strategic tool for decision-making. Here’s why it matters:

1. Helps Prioritize Investments

Businesses have limited resources, and ROI helps determine which projects, campaigns, or products are worth pursuing. If two initiatives require the same investment but one has a projected ROI of 20% and the other 50%, the latter is the better choice.

2. Measures Success and Efficiency

ROI allows businesses to measure the effectiveness of past investments. If a marketing campaign yields a low ROI, adjustments can be made to optimize spending.

3. Supports Risk Management

Investing in a new venture comes with risks. ROI analysis helps assess potential returns against the risks involved, guiding businesses toward informed decisions rather than speculation.

However, ROI alone isn’t sufficient. It should be evaluated alongside factors such as customer satisfaction, brand reputation, and long-term growth potential.

How to Enhance ROI for Sustainable Growth

To improve ROI, businesses must focus on efficiency, cost management, and strategic investments. Here are three key ways to optimize ROI:

1. Optimize Marketing Spend

Marketing is one of the most ROI-sensitive areas. Businesses can improve ROI by:

- Using Data-Driven Strategies: Analyzing customer behavior helps allocate marketing budgets effectively.

- Investing in High-Performing Channels: If social media ads outperform traditional marketing, shifting funds accordingly can boost ROI.

- A/B Testing: Running multiple versions of campaigns helps identify the most effective approach.

2. Improve Operational Efficiency

Reducing waste and optimizing resources can significantly impact ROI. Consider:

- Automation: Implementing AI tools or software solutions can reduce manual work and increase productivity.

- Cost Control: Regularly evaluating expenses ensures that investments are aligned with profitability.

- Employee Training: A skilled workforce contributes to higher efficiency and better ROI on labor investments.

3. Focus on Long-Term Gains

Short-term ROI can be misleading if it sacrifices future growth. Businesses should:

- Invest in Customer Retention: Retaining customers is more cost-effective than acquiring new ones.

- Build Strong Brand Value: A well-known, trusted brand can command higher prices and customer loyalty.

- Consider Scalability: Investments in technology, infrastructure, or talent should support long-term growth.

Conclusion

ROI is a fundamental metric for evaluating business success, guiding investments, and ensuring profitability. By understanding how to calculate it, recognizing its importance, and implementing strategies to maximize it, businesses can make smarter, more informed decisions. While ROI shouldn’t be the sole factor in decision-making, it remains a powerful yardstick for measuring success and driving sustainable growth.