By Stijn Viaene

Professor Stijn Viaene sheds light on the essential role of strategy in the digital age. The article further elaborates on what really constitutes a successful digital transformation. Is it simply launching yourself to the plethora of digital disruptions around you? Or does doing so might bring you to your own “death”?

The technology hype cycle has a new flavour of digital every year. There is a constant temptation to jump onto the technology bandwagon out of hope, or fear of being left behind. Hope and fear are strong drivers but make for bad advisors. If your so-called digital transformation1 only focusses on the exciting, new digital technologies, and not on the whole business ecology, you will quickly find you have spent yourself to death. Launching a bunch of digital initiatives that go in all sorts of directions does not constitute transformation.

Thus, digital leaders reimagine their business strategies for the new digital realities. Strategy, not technology per se, drives successful digital transformations. Without high intention at the outset, even the most sincere efforts won’t make your transformation work. The ability to make bold, though wise strategic choices of many alternatives, against the backdrop of a volatile, uncertain, complex and ambiguous (VUCA) world catalysed by digitisation, separates the winners from the losers.

The Case for Radical Action

Balancing the need to stay ahead of the changes and adapt rapidly, with the need to deliver results can be overwhelming and can lead businesses to rash decisions. To move into the digital economy with confidence, executive teams need to see and feel the inadequacy of their current enterprises competing in the way they have done before.

Recognising that there is a set of new realities driving competition should be the starting point for any digital transformation impetus:2

• Customer experience is value. Customers want to take control over their lives’ journeys – and digital allows them to do so. Winners use digital to design great customer experiences connecting the physical and the digital worlds seamlessly.

• Customers are moving targets. With digital, customers switching between competing value propositions is the rule rather than the exception. Winners use digital to successfully staple themselves to the customer’s digital self to stay relevant and appealing.

• Business ecosystems co-create value. No single organisation owns all of the data, digital skills and capabilities to compete for today’s demanding and dynamic digital customer. Winners bring partners to the table to grow the pie by competing together.

• Digital platforms boost value co-creation. Your digital innovation capability depends on how effective you are at combining your digital assets with those of others. Today’s most valuable business ecosystems are enabled by digital platforms – carefully managed architectures of reusable digital assets.

Take your time to understand the true nature of value creation in the digital space, the critical capabilities that need to be built, both technological and business, and the new skills that need to be developed in view of these four realities. Go out on discovery missions, let others inspire you with their scouting assignments, listen to the markets, experience the new normal. Invite external challengers, consultants, entrepreneurs and experts to act as drivers and disrupt traditional thinking. Celebrate when you find confrontational data that challenges constraints and the status quo.

As an executive, don’t just accept what others oracle or preach. Do your own critical environment analysis, get involved, be a scout, and then, as an executive team, make your own synthesis. Use this case for action to set high ambitions and ramp up the heat for business transformation.

[ms-protect-content id=”9932″]Multiple Possible Futures

It is one thing to understand that the world around your organisation is transforming, it’s an entirely different thing to cope with it effectively.

Whilst there are many frameworks for business strategy, the idea behind strategising is always the same: develop an informed, ambitious point of view on the future over a certain period of time – your winning aspiration – pull it back to the present and make choices about where and how to play to win.

Formulating a business strategy fundamentally revolves around what you think will be winning resource allocation choices. However, in a VUCA world the future is hard to predict: stability is the exception and turbulence the rule. Once you have accepted this, you don’t want to commit yourself to one future, but look at multiple possible scenarios of the future, and be ready to win when one or the other materialises. Sustained competitive advantage is no longer about positioning yourself for one future, but about making and keeping yourself ready to act in multiple possible ones.

Working with future scenarios is a powerful way of allowing executive teams to steer a course between the false confidence of a single strategy and the ambiguous hesitation of turbulent times. By developing alternative views of the future you will evolve broader perspectives, challenge conventional strategic choices and realise that you may be completely wrong. Leaders will learn to accept that they don’t have a crystal ball and that the future is uncertain. This is why you shouldn’t commit to a possible future too easily.

Design possible courses of strategic action for each of the identified future scenarios. Some of them you will choose to activate, others will be put in the waiting room, still others will be dismissed. Build into your strategising routine a constant awareness of next strategic options for mid-term success, even if you have only just launched your latest strategy. Become vigilant for signals revealing themselves that will help you steer in one direction or another.

Mini-Case: KBC Bank Tackles Disruption with Strategic Vigilance

In 2014 KBC, one of the leading European banks, chose for a strategy that tackled the disruptive impact of digital technologies. The company decided to spend 250 million Euro over the period 2014-2020 in Customer 2020, a digital programme for its Belgian home market. 3

Prior to making this commitment, and with the intention to formulate a comprehensive strategic answer, the bank spent several months scrutinising its environment. They invited trend watchers, technology gurus, consultants and academics to challenge the management team’s ideas about digital disruption.

Serious about making a compelling case for action, the executive leadership mandated a team of some 75 members from a variety of departments to assess KBC’s digital readiness compared to emerging trends and best-in-class beyond the boundaries of the banking industry. The scouting team put together a set of fact books (including customer behaviour, competitor analysis and technology trends) that helped build a credible and robust case for change.

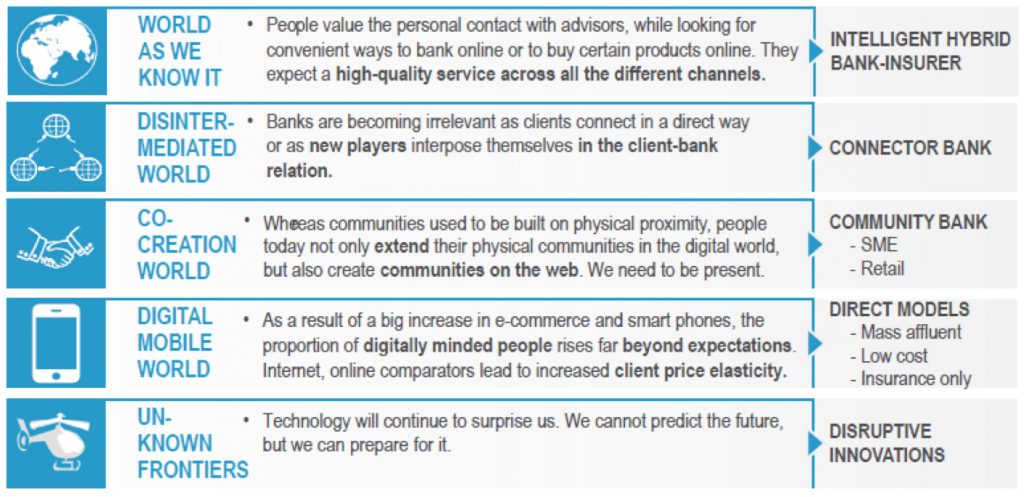

From the analysis, the management concluded that the challenge for the company was to defend its leading position as well as to embrace new opportunities for the future. The scouting team put forward five alternative world views. Each of the scenarios corresponded with a possible strategic response option (see Figure 1).

Source: KBC, 2014

Figure 1: Alternative Banking Business Scenarios

The executive team decided to focus its digital efforts on strengthening and extending its existing branch-based model to an omni-channel proposition, emphasising convenient access and tailored solutions (Intelligent hybrid bank-insurer). At the same time, however, the bank decided to launch a selection of strategic experiments addressing alternative future scenarios.

Strategy as a Portfolio of Real Options

Business strategy reimagined for a turbulent digital world materialises as a portfolio of real options. Why real options? Because strategic decisions are no longer based on precognitive, static business cases followed mindlessly, but rather involve learning by doing, active decision making. In this paradigm, strategy frames future decisions through compelling, robust business visioning and choosing purpose but at the same time builds in the opportunity for intervening based on actual feedback.

Some of the options you make real in your strategic response portfolio will be closer to the current core, others will be further off. You can look at this portfolio as composed of three broad categories, with the risk-reward profile of each quite different: (1) strengthening the core (defend and grow the current core business), (2) extending the core (create adjacent new growth), and (3) self-disruption (create radically new growth). Your company’s choice of options, or bets, and resource commitments for each of the portfolio’s compartments is a matter of ambition and strategy.

Self-disruption requires you to be in an opportunistic mode, positioning yourself completely outside the box. Your current business is no longer the context for strategising. You allow yourself to think and act like a new entrant with an ambition to disrupt, grow a radically new core business. Alternatives two and three, by contrast, are intent on building off current strengths. While strengthening your core demands more of an improvement or re-engineering mode, extending your core calls for more of a leveraging, option-taking mode, identifying existing digital (or digitisable) assets that can be used in new growth opportunities adjacent to your current core.

Should you put “evolution” before “revolution” in allocating resources? It is often worthwhile to start by thinking evolution in order to prepare for big results with more revolutionary options. Looking at a portfolio of strategic bets brings benefits. A company can try to build on the competitive advantages it has built up over the years, seeking profits and growth from its current core, while buying itself time for self-disruptive new ventures to grow. Just as wise investors diversify their financial portfolios, so will companies combine different digital strategic response options. The fundamental strategic choice then becomes what proportion of resources to allocate to each option.

Mini-Case: Deseret News’ Dual Transformation

The internet changed everything for Deseret News, a 150 year old newspaper published in Salt Lake City (US). By 2008 internet newcomers, such as Craigslist, Google and free news websites were eroding every part of its revenue base. From 2008 to 2010, Deseret News lost almost 30% of its print display advertising and 70% of print classified revenues. Still, at a time when several big-city newspapers were closed, Deseret News managed to dodge the bullet.

Deseret travelled a dual track, which CEO Clark Gilbert referred to as Transformations A and B. 4 Transformation A aimed at transforming the newspaper’s core to keep only those aspects that guaranteed profitable growth. Deseret cut operation’s costs of the print business by 42%. It also came at a cost: in 2010, 57 full-time and 28 part-time employees were made redundant.

Next to that, Deseret Digital, a new organisation, was set up to take advantage of the higher-volume lower-margin opportunities offered by the internet (Transformation B). The idea was to create tomorrow’s growth by focusing on new customers’ needs and learning how to address them. By combining a number of in-house produced pieces with crowdsourced material from external contributors it could produce content at a fraction of the traditional price. The digital offerings focused on the same key subjects that had built the paper’s reputation, but in ways that had no analogue in print. In addition to online news content, Deseret Digital developed new products, such as a media guide to which readers contributed movie appraisals, generating revenue through syndication.

To enable this future growth engine, they created a “resource exchange”, a new capability that allowed the two transformation efforts to share sources and leverage them without interfering with each other’s operations. The two transformations would be operated distinctly but still be linked. The idea was that by sharing these content resources with the core, the new business could gain a competitive advantage over independent start-ups. Deseret News and Deseret Digital shared a brand, editorial content, marketing resources and data about customers and their reading behaviour.

It was the smart combination of Transformation A and B that allowed Deseret to survive. They successfully extended the life of the core, granting the future growth business time to establish itself, without, however, completely decoupling the two businesses.

Your Digital Operating Model

It is important that executives strategise about their organisation’s digital operating model: they need to make choices pertaining to sharing digital resources (data, services, processes) between different strategic bets in their growth portfolio. Are they sharing customer and product data, and if so, under which conditions? Will they have shared commitments to digital platform choices? Do they share key partners? Etc.

The operating model defines the relationship between the digital growth ventures at the highest level, determining decision discretion and resource allocation dependencies between the portfolio’s bets. It frames business model and organisational architecture decisions for the different ventures.

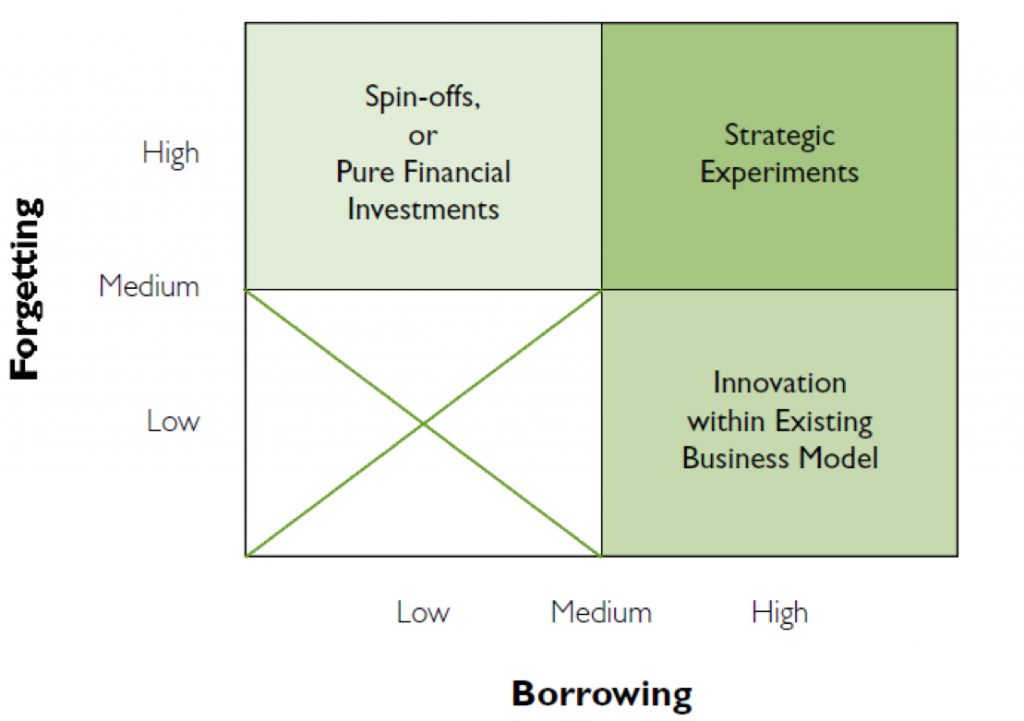

A useful lens for established organisations deciding on digital growth options and their relationship to the current core business (CoreCo) is the borrow, forget and learn model by Govindarajan and Trimble.5 The central idea is that for every new growth venture (NewCo) one needs to decide how its business model will be connected to the current core business:

• Which CoreCo strategic assumptions must NewCo forget to win?

• Which assets must NewCo borrow from CoreCo?

• What must NewCo (be allowed to) learn to win in its uncertain new market?

The distinct-but-linked approach of “strategic experiments” advocated by Govindarajan and Trimble involves both forgetting and borrowing (see Figure 2). Deseret Digital serves as a case in point. In general, borrowing and forgetting is a difficult combination to do. Borrowing from CoreCo aims at fuelling NewCo growth, but inevitably means coordinating and influencing which, if not lightweight enough, jeopardises the need for NewCo to forget. Forgetting is required to allow it to explore the new growth markets’ customer needs and learn how to solve their problems.

Source: Govindarajan & Trimble, 2005

Figure 2: Strategic Experiments Require Borrowing and Forgetting

Technology innovations in areas such as cloud computing – and complementary innovations in enterprise architecture and software service management – enable us to share digital assets across an enterprise’s different digital ventures in a more loosely-coupled way than ever before. Data and services can be reused and combined with others more quickly and efficiently, possibly without human intervention. With this, the number of potentially interesting distinct-but-linked new venture possibilities increases exponentially.

However, just because ventures can share assets does not mean that the value of sharing exceeds the cost. The tension between borrowing and forgetting needs to be anticipated, and carefully pondered. Despite enabling innovations such as the cloud and open source big data technologies, coordination costs between asset sharing ventures may be deceptively high.

Out of a multitude of possible digital asset-leveraged ventures, which ones are actually worthwhile pursuing? First, an existing organisation needs to know which of its assets have the potential to deliver real business value compared to their cost. So, do you have a good view of your digital asset base? Second, the value generated by an asset to a venture depends on its importance in that venture’s business model. So, do you focus on leveraging those digital assets that fit winning business models? Third, leveraging an asset only makes sense if it fits the organisation’s overall growth strategy. So, ask yourself if your investment in leveraging a digital asset helps you position yourself for the type of growth you really desire?

Conclusion

What’s the essence of a creating a vigilant strategic routine for digital transformation? You kick it off by growing a profound appreciation for the new competitive realities that are out there driving business success. Decide and articulate your overall winning aspiration for the digital world. Give yourself a strong sense of purpose. Then develop a matching growth portfolio of real options for alternative future scenarios, making investment course corrections as regularly as required by using actual feedback and by continuously monitoring uncertainties in the environment. Consider options for strengthening and extending the core as well as options for self-disruption. Carefully evaluate your operating model choices in the process of strategising about digital transformation and future growth.

Strategy continues to be about making tough choices, deciding about where and how to allocate scare resources. The best companies make the cycle of challenging their strategy from the outside-in go faster, with the aim of remaining in sync with the rate of significant change on the outside. Taking options when the opportunity arises, lifting and scaling the best ones quickly, anticipating or countering possible threats, killing options that prove no longer interesting early, even though the latter may be particularly difficult. They make strategic vigilance part of their resource allocation routine.

[/ms-protect-content]About the Author

Stijn Viaene is a Full Professor and Partner at Vlerick Business School in Belgium. He is the Director of the school’s Digital Transformation strategic focus area. He is also a Professor in the Decision Sciences and Information Management Department at KU Leuven.

Stijn Viaene is a Full Professor and Partner at Vlerick Business School in Belgium. He is the Director of the school’s Digital Transformation strategic focus area. He is also a Professor in the Decision Sciences and Information Management Department at KU Leuven.

References

1. Digital transformation was defined as “a form of end-to-end, integrated business transformation where digital technologies play a dominant role” in Viaene, S. (2017). What Digital Leadership Does. The European Business Review, May-June.

2. Viaene, S. & Danneels, L. (2015). Driving Digital: Welcome to the ExConomy. The Journal of Financial Perspectives, 3(3).

3. Verweire, K., Viaene, S. & De Prins, P. (2017). KBC’s Digital Transformation: a Strategic Response. In: Janes, A. & Sutton, C. Ed. Crafting and Executing Strategy, 2nd International Edition. London: McGraw-Hill Education.

4. Gilbert, C., Eyring, M. & Foster, R.N. (2012). Two Routes to Resilience. Harvard Business Review, December.

5. Govindarajan, V. & Trimble, C. (2005). Organizational DNA for Strategic Innovation. California Management Review, 47(3).