By Omar Toulan and Niccolò Pisani

The economic turbulence spurred on by the COVID-19 pandemic has had a devastating impact on the retail sector. On and off lockdowns, as well as store customer restrictions, have pushed many brick and mortar retailers to the brink, and at the same time dramatically hastened the importance of e-commerce sales. Those who have survived best are those who were able to rapidly shift to and accommodate online sales. Making this transition, however, has not proven to be equally feasible for all firms. One key differentiator appears to be the growth strategy which the firm has adopted when it comes to its retail footprint. Firms have historically chosen among three primary retail growth strategies: company-owned, franchised, and wholesale/third-party. The question we pose is: What are the implications for the firm when it comes to building its e-commerce business depending on the growth strategy it has adopted? How easy is it to incorporate online sales and manage the digital customer experience if one has chosen to grow through company-owned vs. franchised vs. third-party stores?

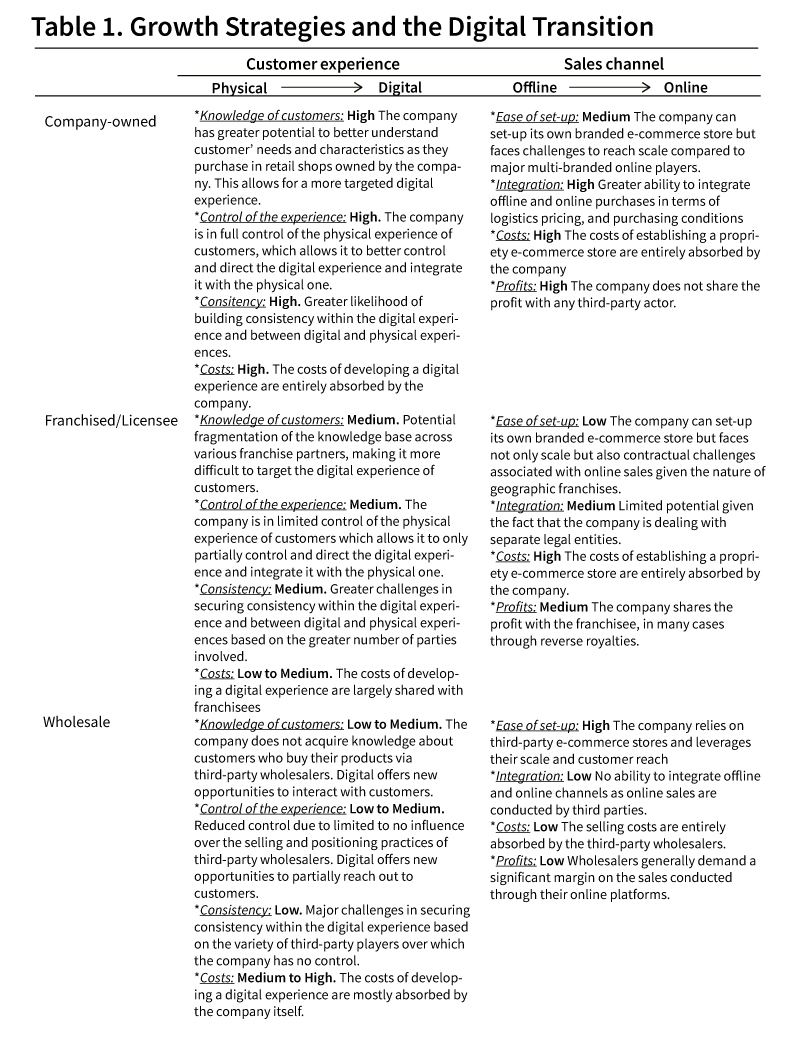

In a traditional brick and mortar world, the principal variables that impacted the choice of growth strategy were controlled vs. cost/risk. E-commerce, however, has made that choice inherently more complicated. To better compare the ability of the three different retail growth strategies to deal with digitalization, we look at the impact of moving the customer experience from physical to digital, and the sales channel from offline to online. In doing so, we highlight the experiences of three leading firms which represent each of the three retail models: Hermès (company-owned); Aldo (franchised); and Shiseido (wholesale).

Company-owned retail growth strategy

Company-owned retail growth provides the benefit of full control of both the sale and the customer experience as well as the internalization of margins normally absorbed by intermediaries. However, it requires extensive financial resources and may be slower and limited in scale. Nevertheless, this strategy is adopted by many firms, particularly those for whom managing the brand image is paramount. When moving from company-owned brick and mortar stores to company-owned online channels, the firm has the freedom to design the site in the way it best sees fit. However, it faces the challenge of reaching the scale offered by using third-party online sites (see Table 1 for greater elaboration).

Company-owned growth also brings advantages and disadvantages when moving from the physical to digital customer experience. Fully controlling both the physical and digital points of sale opens the door for firms to acquire a better knowledge of their customers’ purchasing habits and preferences, which in turn allows for greater control and a more targeted digital experience. It also accommodates greater consistency within and across the physical and digital customer experiences. The main downside, however, is the high cost of developing the digital experience, which is fully absorbed by the company.

A clear exemplification of the pros and cons of a company-owned retail growth strategy is offered by the French luxury goods producer Hermès. A truly iconic brand in the world of luxury, Hermès does not own a portfolio of brands like its fashion rivals LVMH and Richemont—all its products are sold under the Hermès brand name.[i] The Hermès strategy is based on limited distribution, exclusivity, and controlled marketing. This implies that the distribution of its products has always been limited to its own brick and mortar stores. A clear advantage of this retail strategy is the absolute control of the physical customer experience. In the online space, Hermès has followed the same strategy based on exclusivity and limited distribution—customers can in fact purchase Hermès products uniquely via the hermes.com online shop. While this retail growth strategy may work very well for a brand like Hermès, which is able to capture the value generated by the “limited edition” concept, it may turn into a very expensive and inefficient strategic alternative for those brands that need to reach a much larger scale to remain profitable. Following the onslaught of the COVID-19 pandemic, Hermès saw a major boost in its online business that, at least partially, counterbalanced the losses from brick and mortar sales. The control over the customer experience – also in the online space – gave Hermès the unique opportunity to directly engage with those clients that switched to its online shop, 75% of which were in fact new to the brand.[ii] Thus, despite the short-term losses caused by the sudden closures of its stores around the world, Hermès was able to establish direct contact with an entirely new segment of customers via online sales.

Franchised retail growth strategy

Many firms have used the franchised approach to grow their retail footprint. One of the primary advantages of this retail growth strategy is the reduced level of capital required. It also has the benefit, compared to a wholesale-based strategy, of having tighter oversight of the physical customer experience. Store appearance and advertising is generally required to be consistent across locations, and franchise partners must purchase all merchandise from the firm.

When it comes to moving from offline to online sales, however, a franchise strategy has several challenges. How does one approach online sales when one has given control to someone else? If the firm sets up a global online platform to sell its products, it potentially will cannibalize sales from its local franchise partners. Furthermore, how does it distribute those products? Via its partners’ stock or through an independent distribution center? One option is to offer its franchise partners the right to establish their own online portals. In this case, though, the firm may end up with a collage of portals and differing services. Alternatively, the firm can establish its own centralized site, but then pay the local franchisees a reverse royalty for sales in their regions, as part of those sales may be due to “showrooming” behavior and pirate brick and mortar sales.

A franchise strategy also presents challenges in moving from a purely physical to digital customer experience. While the firm is acquiring the skills to better influence the digital experience of its customers, its franchise partners may also be initiating their own activities in this domain, making it more difficult to collect information on customers and control the overall experience. While the franchised retail growth strategy may have held many advantages in the brick-and-mortar-dominated world, its attractiveness is challenged with the addition of online sales and digital customer experiences.

This is particularly true for privately owned firms such as the Canadian footwear retailer Aldo. When the firm first tried to grow its international operations following a traditional brick and mortar model in the early 2000s, one of the challenges it faced was a limited resource base. Given its private ownership, it did not have the resources for rapid global expansion using only its own stores. Therefore, it adopted a dual strategy, whereby North American stores would be company-owned and international ones would be run by national franchise partners. This allowed the firm to rapidly expand in 94 countries from 2000–2015, with all but one being franchised. In 2017, it operated more franchised international stores than company-owned North American stores (1200 vs. 800). Given its franchised-based strategy abroad, Aldo was not originally organized nor did it necessarily have the marketing skills to target the digital experience of its international customers. Therefore, in 2015 it adopted a more proactive approach to the world of bloggers, Instagram, and the like. However, the firm faced challenges in collecting information from its franchise partners about its international clients and devising a homogenous strategy aimed at enhancing the digital experience of its customers worldwide.[iii] With the arrival of COVID-19 in early 2020 and the resulting lock-downs, the necessity to rely on e-commerce was just too much for Aldo, which filed for bankruptcy protection in May 2020 and plans on closing up to half of its brick and mortar stores.

Wholesale retail growth strategy

Growing through third-party retailers has traditionally been the fastest and least resource-intensive form of expansion. The wholesale strategy brings with it the opposite benefits and drawbacks of a company-owned strategy; while being low in capital intensity, it sacrifices control over the relationship with the customer and how the brand is positioned.

Moving from traditional to online wholesalers presents both opportunities and challenges. On the one hand, going through an online wholesaler can leverage the site’s economies of scale and be the simplest and fastest approach. On the other hand, doing so places the firm at a disadvantage compared to the other growth strategies when it comes to the ability to integrate offline and online sales. While the cost of online sales may be low when using online wholesalers, the profits are also reduced, with very large online retailers such as Amazon appropriating a large portion of them.

When it comes to the customer experience, one of the biggest challenges faced by firms is that acquiring customer knowledge is constrained as most of their sales are through third parties. This dilemma exists for both online and offline sales. Furthermore, control and consistency of the experience can suffer from the same issue. However, digital can potentially allow the firm to be more active in the customer experience, though not to the same extent as in the previous two growth strategies. While a wholesale-based strategy may come with the lowest cost in terms of setting up the channel, the firm is still on the hook for investing in the digital experience of the customer as it cannot expect that the wholesalers will do so.

Japanese cosmetics producer Shiseido presents an insightful example of a wholesale retail growth strategy. Cosmetics have traditionally been sold through a wide range of distribution channels including department stores, supermarkets, pharmacies, and multi-brand cosmetics stores. In the pre-digital retail world, this allowed Shiseido to grow its scale rapidly. The drawbacks, however, lay in losing direct contact with the consumer as well as control over the in-store customer experience. In terms of sales channels, the growth of online third-party wholesalers presents the same pros and cons as the offline wholesale model. As for the customer experience, though, while digitalization has created a number of new influencers lying beyond Shiseido’s control, it has also given the company potential avenues to connect directly with its consumers. Shiseido’s recent purchase of a makeup app that scans a user’s skin to create a personalized foundation is one such avenue. It has also digitalized the in-store experience by launching a digital counseling mirror which collects personal information that customers (and Shiseido) can access at a later time.[iv] The COVID-19 disruption has further accelerated this transformation encouraging Shiseido to heavily invest not only in its e-commerce presence, but also tech-enabled shopping experiences. In China, for instance, the beauty company has started training beauty consultants to use livestreaming and social media, something it expects to adopt worldwide going forward.

As highlighted here (and in Table 1), each retail growth strategy comes with its own advantages and disadvantages when it comes to addressing the impact of digitalization on both the sales channel and customer experience. Furthermore, it is important to remember that many firms will use a combination of growth strategies. While we have classified firms based on their primary growth strategy, many use a combination and as such must be attuned to the pros and cons of each strategy in devising their overall plans to expand their retail footprint.

Key Implications

This article aims to identify and analyze the interaction between the retail growth strategy the firm has chosen and its ability to react to increased digitalization pressures spurred on by the COVID-19 pandemic. To this end, we have examined the main challenges of managing both the physical and digital experiences as well as the offline and online sales channels for each of the three primary retail growth strategies: company-owned, franchised, and wholesale. Our analysis suggests that company-owned growth may allow for greater control over the sales channel and customer experience but will come with higher costs and limitations on scope. The wholesale model by contrast may be less costly and reach a greater audience but at the sacrifice of control of the experience and positioning. Finally, the franchised approach can be seen as either having the best of both or the worst of both depending on how the franchising agreements are established.

Building on our analysis, we articulate five key implications for companies looking to grow their retail presence post-COVID-19:

- Understand your ability to leverage digitalization depending upon your retail growth strategy. Companies must carefully evaluate the impact of digitalization on the specific retail growth strategy they have chosen. This may in certain cases encourage the firm to adopt a portfolio of different growth strategies.

- Address the organizational challenges associated with each retail growth strategy. Each of the growth strategies described entails different organizational challenges when moving from a physical to a digital customer experience and from offline to online sales. Central to these challenges is a realignment of incentive and reward systems as one moves to more of an omni-channel approach.

- Rethink what it means to be a retailer. As described by a leading retail executive, “the industry has witnessed a movement from multi-brand retailers to single brand retailers to single brands.”[v] With the demise of multi-brand retailers, single brand retailers are being further challenged to move from conceptualizing themselves as retailers to thinking of themselves as brands which are available at multiple points of sales rather than stores.

- Reallocate scarce resources. Firms must decide how to spread their monetary and managerial resources across the digital and physical customer experiences as well as online and offline sales channels. And when adopting a portfolio approach to growth, companies need to determine how much attention they will dedicate to each of the growth strategies.

- Recognize that change is constant. Technology has revolutionized today’s retail sector with COVID-19 accelerating this transformation. At the same time, firms must expect the arrival of new devices and apps to which they must adapt their retail strategies and understand that we have only begun to appreciate the effects of digitalization.

Digitalization, spurred on by COVID-19, has fundamentally altered the world of retailing. What we have heightened here is that in order to understand the challenges they will face, firms need to do so in the context of their adopted growth strategy. One cannot look forward without acknowledging the past.

About the Authors

Omar Toulan is Professor of Strategy and International Management at IMD Business School in Switzerland. Professor Toulan holds his PhD from the Sloan School of Management at MIT. His areas of expertise include strategic management, international business, growth strategies, and managing the multinational. Prior to entering academia, Professor Toulan worked as a management consultant for McKinsey and Company, as well as a researcher at the U.S. President’s Council of Economic Advisers.

Niccolò Pisani is Professor of Strategy and International Business at IMD Business School in Switzerland. He holds a PhD in Management from IESE Business School. Among the topics of his scholarly enquiry are global strategy, sustainability, and offshoring. His research has been published in top-tier academic journals and practitioner-oriented outlets. Prior to entering academia, Professor Pisani worked several years for Sanlorenzo, one of the world’s leading manufacturers in the luxury yachting industry. He also worked as a researcher for Merrill Lynch in its San Francisco office.

Niccolò Pisani is Professor of Strategy and International Business at IMD Business School in Switzerland. He holds a PhD in Management from IESE Business School. Among the topics of his scholarly enquiry are global strategy, sustainability, and offshoring. His research has been published in top-tier academic journals and practitioner-oriented outlets. Prior to entering academia, Professor Pisani worked several years for Sanlorenzo, one of the world’s leading manufacturers in the luxury yachting industry. He also worked as a researcher for Merrill Lynch in its San Francisco office.

Notes

[i] “Hermès – The Strategy Insights behind the Iconic Luxury Brand,” June 1, 2017, www.martinroll.com.

[ii] Financial Times, “Luxury Industry: Top-down Fashion,” July 30, 2020, www.ft.com

[iii] Aldo top executives, meetings with authors and several presentations at McGill University, 2012–2017.

[iv] Fortune, “Shiseido Just Bought a Makeup App That Scans Your Skin and Creates Custom Foundation,” Jan. 18, 2017, www.fortune.com; and “First in Japan. Next Generation Cosmetics Counter with Digital Counseling Mirror,” July 28, 2017, www.shiseidogroup.com.

[v] Retail executive presentation, March 2017.