By Ina Sebastian, Peter Weill and Stephanie Woerner

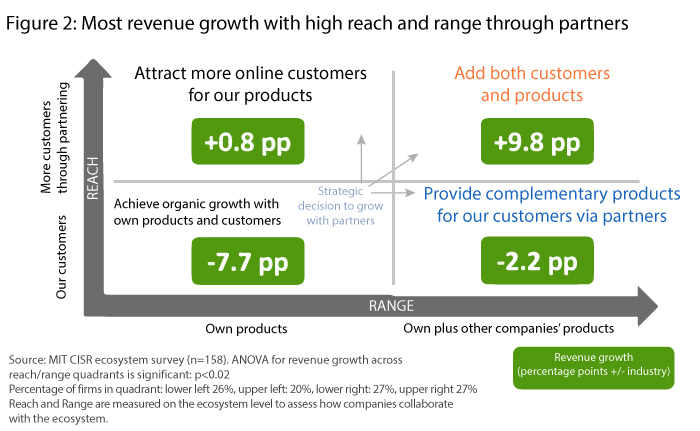

For many companies today the most important goal is growth. One of the big opportunities for achieving growth is digitally partnering with other companies to seamlessly find new customers or to offer more products and services to existing customers. We found that companies which added more reach (new customers) and range (new products and services) via digital partners have significantly more revenue growth. Companies who added both reach and range via digital partners grew at 9.8 percentage points above industry average, while companies who do not partner grew at 7.7 percentage points below industry average.1 Therefore the stakes are high to get partnering right to grow in the digital era.

What is Digital Partnering?

Digital partnering is increasing reach and range via digital connections. These connections make it possible for partnerships to become plug-and-play, with less overhead than in the past – think of digital marketplaces and app stores that offer products and services by many partners with a single sign-on. This means you can have more partners and develop a variety of unique value propositions seamlessly, while focusing on what you do best.

Bayer is a great example of growing via digital partnering. Bayer’s subsidiary The Climate Corporation, a digital agriculture company, digitally partners with more than 65 companies to grow its subscription service called Climate FieldView™ which offers farmers a single place to go to manage their crop yield per square meter of land. The range of Climate’s digital agriculture platform has expanded rapidly as they have added partners who provide integrated services like satellite imagery, drone mapping, data analytics based on crop sensors, an online grain marketplace, soil monitoring, insurance, grain marketing, and farm equipment. These partners plug into the platform via digital connections and enrich Climate’s core offering of agronomic recommendations. The reach of the FieldView platform has increased rapidly from five million paid acres in 2015 to over 95 million paid acres in 2019 in the US, Latin America, and Europe.2

In this article , we share insights on growing with digital partnering from more than 200 companies based on an MIT CISR survey (N=158) and interviews with more than 70 executives in 2018/19.

Three Digital Partnering Strategies

We found three strategies to grow with digital partnering: increasing your reach, range, or both.

- Reach: Companies with a unique product or service but few distribution channels tend to focus on reach first. Digital partnering helps them grow by building a presence, gaining access to new customers, and building reputation by association. PayPal, a born digital company, started out with the goal to grow by partnering with big companies that would offer their product – payment services – to their customers. PayPal designed their payment services to work with any ecosystem. The company has achieved 41 percent growth in total payment volume in 2018 from their top 20 marketplaces and partners, which include Uber, Lyft, Aibnb, Etsy and others.3 Companies focused on increasing reach need digital connections (typically APIs) that describe their product and can plug and play into almost any ecosystems and legal jurisdiction.

- Range: Incumbents with a large, established customer base tend to focus on increasing range first by adding complementary products or services from partner companies, helping provide customers with broader solutions that address their “life event” needs. For example, Fidelity Investments has created digital marketplaces where partners provide complementary services. In Personal Investments, partners add services like tax preparation, student lending, ID protection, and legal advice, that offer additional value to Fidelity B2C customers as they face a life event like sending a child to college. In the institutional business, partners provide services like digital advice or customer relationship management to B2B customers. Companies focused on increasing range need digital connections (typically APIs) that describe: their customers, their customer’s needs, and their customer’s existing products.4

- Reach + Range: To achieve growth via both reach and range, companies frequently start or acquire new ventures like Bayer’s Climate FieldView™. These new ventures – often ecosystems with platform models – grow beyond the established company’s customer and product base by using digital partners to increase both reach and range. The Climate Corporation has created its own innovative new subscription service for farmers and developed a diverse ecosystem of partners. The partners provide integrated products to the farmers and data to Climate that improve Climate’s agronomic recommendations. Partners like crop insurance companies may also offer Climate access to new customers as the companies partner to simplify crop insurance reporting.5

Revenue Increases with More Reach and Range through Partnering

We found that the fastest growing companies use partnering to increase both reach and range (see Figure 2). Often, there is a mutually reinforcing relationship between the additional products and customers – it’s about creating opportunities like a one-stop shop meeting more needs for more customers. To achieve these premium growth rates requires a great customer experience, including a single sign-on and easy payment for all purchases, and easy-to-use search and recommendations.

However, reach- or range-dominant strategies should not be discounted, as they also yield significant performance improvements. Companies grow at 0.8 percentage points above industry average when focusing on increasing reach via partners – often a good way to start your digital partnering efforts.

We do see companies move beyond a reach-dominant strategy. As PayPal has grown, they added an ecosystem of partners to reach new customers and became “stickier” with their current customers by offering easy access to a broader range of products. For example, PayPal Business is “a one-stop shop for businesses” to access PayPal and partner services.

Companies grow at 2.2 percentage points less than industry average when focusing on growing by range alone, but this is still much higher growth than companies that don’t digitally partner. A challenge with revenue growth in a range-dominant strategy is value capture. Many executives we talked to mentioned that increasing range has been important for meeting customer expectations for more choice, and customers are often delighted with the unique value provided by partners. But this approach has not necessarily meant a big increase in revenue. It may be that the extra services are seen as part of an existing subscription, or they may have been offered for free or at minimal cost. A key question is how to charge for these extra services.

Partnering Strength is Key to Success

So what does it take to be effective in digital partnering? All three strategies to grow with digital partnering require what we call Partnering Strength. Companies in the top quartile on Partnering Strength grow revenue at 9.7 percentage points higher than industry average, while companies in the bottom quartile grow revenue at 6.8 percentage points less than industry average.

Partnering Strength assesses how effectively you coordinate with digital partners. Partnering Strength has three parts: creating joint goals, sharing benefits, and sharing information.

- Creating joint goals establishes a shared vision and value creation model with partners. It takes joint ambition or at least complementary goals to create value together, and partners have to be clear on who creates what value. This is not always easy to achieve or maintain when there are some digital partners that may also be competitors.

- Effective sharing of benefits reinforces joint goals by clarifying who captures what value and creating mutually beneficial relationships. Companies with large customer bases who want to increase their range, offer increased reach to partners, and vice versa. For many companies in our research, customer stickiness, customer engagement, and visibility are important shared benefits – in addition to revenue – in digital partnerships. Being clear about who creates what value and then who captures what value is a recipe for successful partnering.

- Finally, partnering is more successful when companies share information that help each other create value. Effective information sharing includes negotiating who gets what data and analytics and how it is shared digitally. Digital partnerships have enormous potential to surpass traditional partnerships’ scale and scope with automation, self-service models, and data, which help all digital partners add value. But to be successful information has to be shared equitably. The CEO of Adidas Kasper Rorsted explains “For us, getting access to the data is fundamental. Not only in the context of being able to engage directly with the consumer from a commercial standpoint, but getting the appropriate feedback for the creation of the next generation of products. That, of course, we’re working on. It’s a battle we have with Amazon.” 6

In our survey, companies that grow both reach and range through digital partners have the highest Partnering Strength. Often new ventures that focus on both reach and range have big visions for value creation with partners and offer seamless, integrated solutions to customers. Climate wants to help all the world’s farmers to increase their productivity through the use of digital tools. Farmers get an integrated report that optimizes outcomes for their farmland with Climate and partner data. Working together effectively in such a model requires more Partnering Strength than a range-dominant strategy, such as connecting to partner products at a discount or a reach-dominant strategy of adding distribution partners.

Fidelity and Okta Build Partnering Strength Following Different Growth Strategies

Let’s look at two companies – one born physical and one born digital – and how they built Partnering Strength.

Fidelity is an asset management company in the US with a large customer base. Their goal is to increase range by building a trusted ecosystem of digital partners. These partners offer complementary products for more choice, better prices, and ultimately one-stop solutions that meet more customer needs.

In 2018, Fidelity launched marketplaces in their different businesses. For example, the marketplace in Fidelity’s Personal Investments business with more than 30 million customers has digital partners in tax preparation, student lending, ID protection, legal advice and other categories – and plans to scale. The institutional business with more than 13,000 financial advisory firm customers offers more than 100 third-party technology solutions (such as for customer relationship management, financial planning, and analytics) via their WealthscapeSM Integration Xchange storefront marketplace. Fidelity ensures joint goals by curating partners based on their customers’ current needs and best value. Partnerships are mutually beneficial, because they enable access to Fidelity’s large customer base as they increase Fidelity’s range. The marketplace teams work on automation for fast and easy partnering and sharing benchmarking data with partners to help them create better offerings.

Okta is a born-digital company providing identity and access management services for enterprises in the cloud. As a start-up, they began with one service – single sign-on – and continuously built on it, looking for partners that could help them extend reach. As their customer base grew, Okta partnered with companies to increase their range by enabling seamless access to partner apps and technology services. Curation plays a smaller role in Okta’s ecosystem, because the value proposition is different from Fidelity’s – Okta wants to work with as many apps as possible. All more than 6,500 digital partners in the Okta Integration Network meet a minimum bar to entry so customers can deploy the applications with ease.7 A self-service model makes it easy to get listed in Okta’s catalog. In addition, strategic partnerships, typically with larger companies like Microsoft, align roadmaps and sales to increase reach for both partners. Important shared benefits include revenue, stickiness by creating more value for customers jointly, and visibility by associating with other companies. The partner community and the Annual Partner Summit encourage information sharing and help partners create value.

How Will You Grow?

We found strong evidence that faster-growing companies digitally partner more successfully. You need to decide on your company’s growth strategy and build partnerships and Partnering Strength. Ask yourself: How important is growth to our company? How will we grow with partners – reach, range or both – and in which businesses?

- If you are a company with a great product but few distribution channels, partner for reach, but then look for opportunities to increase range via partners as you grow.

- If you have a large customer base, a great starting point is to add range by adding products via partners to co-sell more to your customers. But how will you capture the value created – charge more? To whom?

- If growth is urgent or you are developing an ecosystem with a platform model, do both at the same time. But it’s higher risk with a potentially higher return.

- Whichever partnering growth strategy you adopt, start building Partnering Strength now – developing shared visions, win-win partnerships, and APIs that enable effective information sharing among partners. We found that companies with more of their core capabilities service-enabled via APIs grew faster.

- Ask who leads partnering in your organization. The partnering lead should be a senior executive who represents your company’s reach and range aspirations – not the purchasing department.

About the Authors

Ina Sebastian, PhD, is a research scientist at MIT CISR. Ina studies how large enterprises transform for success in the digital economy. Her current research areas are digital partnering, and value creation and value capture in digital models. In previous research projects at MIT CISR, Ina focused on ecosystem business models, digital strategies and organizational redesign, and digital workplace and talent. One of her ongoing research interests is leveraging digital technologies for coordination in health care systems, within and across organizational boundaries.

Ina Sebastian, PhD, is a research scientist at MIT CISR. Ina studies how large enterprises transform for success in the digital economy. Her current research areas are digital partnering, and value creation and value capture in digital models. In previous research projects at MIT CISR, Ina focused on ecosystem business models, digital strategies and organizational redesign, and digital workplace and talent. One of her ongoing research interests is leveraging digital technologies for coordination in health care systems, within and across organizational boundaries.

Peter Weill, PhD, is an MIT senior research scientist and chair of the Center for Information Systems Research (CISR) at the MIT Sloan School of Management, which studies and works with companies on how to transform for success in the digital era. MIT CISR has approximately 100 company members globally who use, debate, support and participate in the research. Peter’s work centers on the role, value, and governance of digitization in enterprises and their ecosystems. Ziff Davis recognised Peter as #24 of “The Top 100 Most Influential People in IT” and the highest ranked academic.

Peter Weill, PhD, is an MIT senior research scientist and chair of the Center for Information Systems Research (CISR) at the MIT Sloan School of Management, which studies and works with companies on how to transform for success in the digital era. MIT CISR has approximately 100 company members globally who use, debate, support and participate in the research. Peter’s work centers on the role, value, and governance of digitization in enterprises and their ecosystems. Ziff Davis recognised Peter as #24 of “The Top 100 Most Influential People in IT” and the highest ranked academic.

Stephanie L. Woerner, PhD, is a research scientist at MIT CISR. Stephanie is an expert on how companies use technology and data to create more effective business models and manage the associated organizational change. She has a passion for measuring hard-to-assess digital factors such as connectivity and customer experience, and linking them to firm performance. Stephanie is the coauthor, with Peter, of What’s Your Digital Business Model? Six questions to help you build the next generation enterprise (Harvard Business Review Press, 2018).

Stephanie L. Woerner, PhD, is a research scientist at MIT CISR. Stephanie is an expert on how companies use technology and data to create more effective business models and manage the associated organizational change. She has a passion for measuring hard-to-assess digital factors such as connectivity and customer experience, and linking them to firm performance. Stephanie is the coauthor, with Peter, of What’s Your Digital Business Model? Six questions to help you build the next generation enterprise (Harvard Business Review Press, 2018).

References

1. MIT CISR ecosystem survey 2017, n=158. The combined regression of reach and range with revenue growth is significant (p=0.015).

2. “FieldView: The leading brand and platform for growers,” Bayer Crop Science R&D Pipeline Update, February 13, 2020, page 29, https://www.investor.bayer.de/securedl/17662.

3. “We are growing together with our partners,” Investor presentation January 30, 2019, page 11, https://investor.paypal-corp.com/static-files/d7789358-2196-4799-8e0e-a3c3355407f3.

4. Digital partner offerings featured in life events, https://www.fidelity.com/life-events/overview. “Fidelity® adds new third-party integrations to WealthscapeSM platform,” April 24, 2019, https://clearingcustody.fidelity.com/app/literature/press-release/9889823/fidelity-adds-new-third-party-integrations-to-wealthscape-platform.html.

5. “Advancing the Digital Transformation,” Bayer Capital Markets Day Investor Handout December 2018, page 211, https://www.investor.bayer.com/en/downloads/2018/. “The Climate Corporation partners with Farmers Mutual Hail, simplifies crop insurance reporting to U.S. farmers,” November 19, 2018, https://climate.com/newsroom/climate-corporation-farmers-mutual-hail.

6. “Adidas CEO explains why the company’s relationship with Amazon can be a ‘battle’,” October 14, 2018, https://www.businessinsider.com/adidas-ceo-amazon-partnership-2018-10.

7. Okta Integration Network: https://www.okta.com/okta-integration-network/.