RSM International is the seventh largest global network of independent audit, tax and advisory firms. Below, a comparative study examines the impact of the global financial crisis on businesses across diverse global economies.

As one of the world’s largest networks of independent audit, tax and advisory firms, with 700 offices in over 100 countries, RSM International (RSM) is ideally placed to take the pulse of economic well-being in key markets around the world.

Knowing that business creation is one of the most telling indicators of economic vitality, we decided to conduct a comparative study of business births and deaths across the world. Drawing on data collected by 35 RSM International member firms, and a wide variety of statistical sources, our paper examines global, regional and national trends in the entry and exit of companies. It reviews the extent to which economies are creating and sustaining new businesses, identifying what some governments are doing to encourage entrepreneurship, and comparing the impact of the global financial crisis on business creation across diverse global economies.

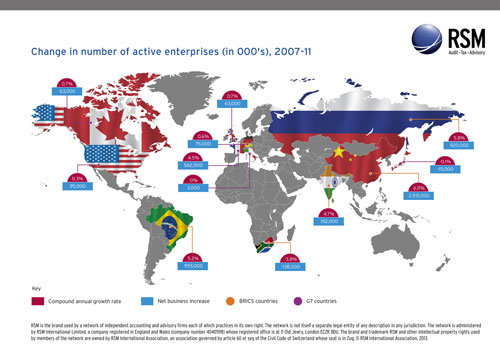

Our research shows that the net rate of business creation among the BRICS has been over seven times faster than the G7 since the financial crisis. Over the last five years1 the G7 countries2 have seen a net gain of 846,000 businesses, representing an annual compound growth rate of 0.8 per cent in the number of active enterprises. By comparison, the BRICS3 have surged ahead. Over the same period, the BRICS have produced a net gain of 4.8 million enterprises, a compound annual growth rate of 5.8 per cent per annum. (See exhibit)

Governments around the world have been looking for ways to stimulate entrepreneurship in the wake of the financial crisis, but our research clearly shows that, with many businesses facing tax rises and struggling to access finance, more needs to be done to boost business creation and survival.

Of the 35 countries sampled, Hong Kong exhibited the fastest rate of new business creation over the last five years – 9.9% on an annualised basis, from 655,000 to 956,000 – while South Africa has seen the steepest decline in the number of active enterprises, – 3.8% per annum, from 956,000 to 817,600.

The research shows that Mexico has seen one of the fastest rates of increase in the total number of active businesses over the last five years, from 1.1 million to 1.4 million. The country was hit hard by the financial crisis but the recovery has been equally dramatic, with economic growth now outpacing Brazil. As Chinese labour and shipping costs rise, Mexico is becoming a more attractive destination for businesses supplying the US market.

At the other end of the table Portugal has seen the number of active businesses decline by 0.8% on an annual compound basis, from 616,000 to 596,000. Portugal is struggling with its deepest recession since the 1970s. The government is, however, looking at ways to make Portuguese businesses more competitive and attract foreign investment, such as slashing the corporate tax rate, which currently stands at 24 per cent.

One of the most interesting contrasts thrown up by the data is the relative strong performance of European countries compared to North America (the US and Canada). Over the last five years, EU countries (12 were included in the research) produced a net gain of 1.2 million businesses, a 1.4 per cent annual growth rate over the five-year period of the study. By contrast, North America has added just 158,000 new enterprises, representing a 0.4 per cent annual rate of increase between 2007 and 2011.

In this context, France is an interesting anomaly. France – often criticised as statist and lacking in business dynamism – has created new businesses four times faster than the G7 average over the period of the study (4.5 per cent compound annual growth rate). France is ranked quite highly for ease of starting a business, and the introduction of the auto-

entrepreneur system in January 2009, which has cut paperwork and taxes for new entrants, has led to a sustained rise in the number of active enterprises.

Amid a global financial crisis and recession of historic proportions, entrepreneurs around the world have launched new companies in a wide range of industries. A number of these start-up companies did not survive the post-recession period, as continuing limits on growth capital and a weak global recovery forced the closure of newly-formed enterprises. Our research shows that the surviving start-ups provide a strong foundation for economic growth in coming years: the new enterprises that managed to withstand the recent economic and financial headwinds are the ones possessing the competitive assets (skilled managers, strong technology, superior products and services) requisite for sustained growth. It is these enterprises that have the potential to deliver an outsized impact on productivity growth and job creation and where governments should target any supportive legislative measures to enhance their development and help them to realise their true potential.

To read the full report, or find out more about RSM’s global network of independent audit tax and advisory services and how we might help you, visit www.rsmi.com

Download the digital edition of The European Business Review from Zinio.

References

1.2007-11 (most recent data available)

2. Canada, France, Germany, Italy, Japan, UK and US

3. Brazil, Russia, India, China and South Africa