By Peter Weill and Stephanie L. Woerner

The popularity of the smartphone has exploded, and continues to do so. The ever-growing usage of the latest mobile technology across all demographics provides businesses in any type of industry with unique opportunities to reach their customers. But a lot of these opportunities are left untapped. In this article, Peter Weill and Stephanie L. Woerner discuss how all businesses can invest in mobile apps and create further success for their firms.

Mobile changes everything. People typically love their mobile devices and creating an app that keeps customers engaged pays big dividends. In our survey of 334 companies globally, the companies that achieved high customer engagement goals via mobile apps also had net margins and revenue growth significantly higher than their industry average. To generate this premium, engaging customers via mobile apps is a muscle all firms need to develop. As important as mobile apps are to enhancing a company’s current strategy, they are also an important change strategy because they introduce a new customer channel and a way to deeply engage with customers – particularly younger customers. In this piece we describe how to build mobile app muscle based on case studies and our global survey. We describe 5 different strategies and success stories from Westpac, Dunkin’ Donuts, Johnson & Johnson, Garanti and Woolworths to help us all learn how to succeed with mobile apps.

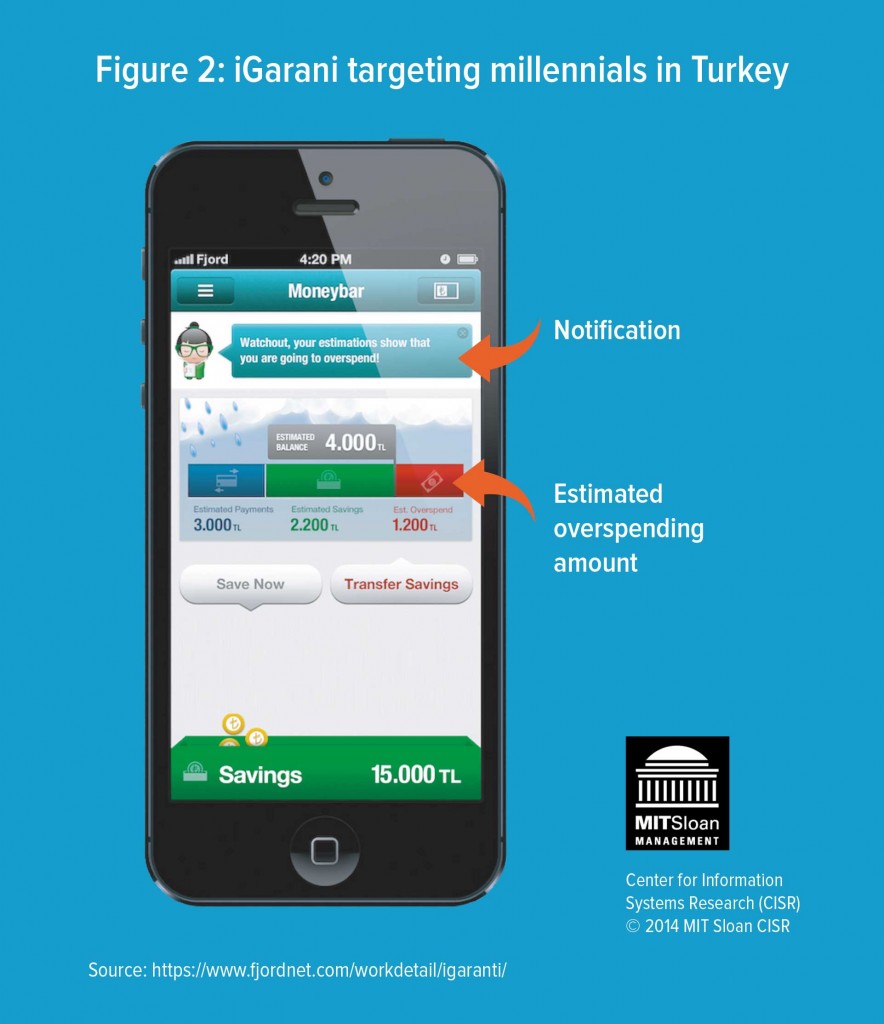

Turkey’s second-largest private bank, Garanti (generating a ROA of 1.7%, twice the industry average), decided that to successfully target new young customers would require a different approach than relying on their 1000 branches. iGaranti was born – a smart financial coach mobile app that addresses the everyday financial needs of millennials. The multi-award winning iGaranti introduces some ground breaking features including:1

1. Recognition of favorite brands based on spending patterns and making targeted and exclusive offers often based on GPS location.

2. Monthly budget estimates with warnings and advice regarding spending and potential shortfalls.

3. Social connections via Facebook, etc. with peer-to-peer money transfers.

4. Digital wallet capabilities.

5. Drag and drop tiles to customise the App.

6. Voice input and output with an avatar.

Garanti found a way to reinvent banking for a new generation by moving to a mobile engagement-centric strategy from their traditional branch-based product-centric approach. With record take-up from millennials, iGaranti will hopefully create a new generation of life-long customers for the bank. The combination of data-rich interactions and a direct-to-the-customer channel allows Garanti to create and deliver more targeted offers and build a tailored relationship with each millennial. How is your company thinking about mobile?

What Is Your Mobile Strategy?

Most companies we talked to, whether B2C or B2B businesses, had or were working on customer mobile apps. But only a few companies are putting significant dollars and senior management attention into their efforts. In a recent MIT CISR poll only 20% of companies reported spending more than 11% of their IT development budget on mobile apps; a far greater number, 46%, spent less than 1% of their IT budget on apps. But as always with technology, success depends not just on how much you spend, but on how clearly you define your strategy and how effectively your organisation executes.

So far we’ve identified five distinct mobile app strategies (we’d love to hear from you if you have a different approach!). They are listed in our estimated order of increasing impact on the strategy – if successful:

• Brand Enhancement – increase customer engagement by providing a useful, typically free, service that enhances the brand – e.g., Johnson & Johnson’s 7-Minute Workout app

• Omnichannel – improve the customer experience integrated across channels – e.g., Woolworths’ supermarkets shopping app

• Targeted Segment – create a unique offering for an important segment – e.g., iGaranti for millennials app

• B2B2C – connect to end customers directly for companies who typically sell to end customers via another company, e.g., Dunkin’ Donuts app

• Mobile First – launch all innovations on the mobile channel, e.g., Westpac and USAA mobile banking apps

Brand Enhancement

The goal of a brand enhancement mobile app strategy is to increase customer engagement with the brand and companies have been very creative with how they use this strategy. Typically a brand enhancement strategy deploys a mobile app that is complementary to the company’s products and services. For example, Johnson & Johnson, with more than 250 businesses, has a number of mobile apps designed to enhance their corporate brand, including:

• Care4Today Mobile Health Manager Supports and reminds user to stay on schedule with medications. Allows sharing of medication schedule with others.

• Digital Health Scorecard Calculates a personal “health score.” Estimates likelihood of developing common chronic diseases such as diabetes, heart or respiratory diseases or cancer.

• Donate a Photo For every user photo shared, Johnson & Johnson donates $1 to a cause the user supports.

• Johnson & Johnson Official 7 Minute Workout Features a high-intensity aerobic and resistance training with video, tracking and customisation, using only body weight and a chair.

Brand enhancement is a particularly attractive strategy for companies – often B2B companies – who want to make a first strategic entry into engaging their customers directly via mobile, but not focus on selling their products.

Omnichannel

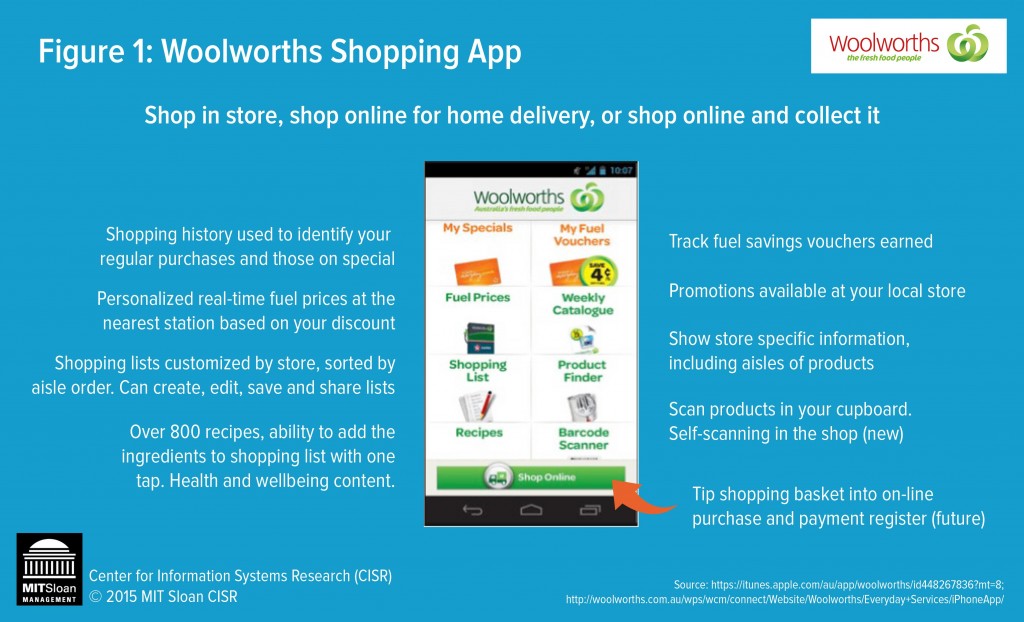

The goal of an Omnichannel mobile app strategy is to enhance the overall relationship with the customer by providing a seamless cross-channel experience, better than either physical or digital channels alone. Woolworths is the largest retail company in Australia, with 3000 stores and multiple brands spanning food, liquor, gas, and general merchandise. In 2014, it had revenues of AUD$60.8 billion (US$55.9 billion) and a net profit margin of 4.2%. Rather than target only online shoppers – whose purchases comprise just a fraction of its overall revenues – Woolworths launched a mobile app to enhance the shopping experience for all its customers with a smartphone (see Figure 1).

The feature-laden app helps build a shopping list (e.g., by scanning barcodes), reorders the shopping list based on the aisle layout in the store a customer is visiting, highlights special offers based on customers’ past loyalty card purchases, and tracks fuel discounts. Shoppers who can’t get to the store or who would rather buy online can press a single button to purchase all or part of their shopping list with same-day delivery in the major city areas. In a country of 22 million people, the Woolworths app has been downloaded more than two million times.

The impact is impressive with mobile app users spending 65% more than physical store only shoppers, illustrating that enhanced customer engagement on mobile apps can drive more total sales than relying on the physical channel alone.

Targeted Segment

iGaranti was designed to target digital natives – ages 18 to 28 – who live on their mobile devices. The goal was to attract young customers who didn’t have a banking relationship and slowly grow their portfolio of products and services, by building strong engagement via the mobile app, and then make them loyal customers for life. A fresh design was used to create an emotional connection with the customer by making the app easy, social, proactive and cool!! Figure 2 shows the money bar that tracks spending patterns and then sends notifications and recommendations to the customer. There has been strong engagement, with 43% of ever-logged in customers being active users. 10% of customers have applied for a loan in the first year. (see Figure 2)

B2B2C

In a B2B2C model, the company historically hasn’t connected directly with the end customer because they sell through another business, often a B2B business. Using mobile apps the company can now make a connection with the end customer more effectively. For example, P&G found that 83% of their customers decide before going to the store what product they want to buy. Given that P&G historically rarely knew or connected directly with their 4.5 billion end customers, mobile apps are a chance to establish that connection. P&G began with websites like Pampers.com and now have mobile apps like Pampers Reward – all designed to increase the customer’s engagement with the brand and influence the purchase decision.

This model is also very useful for franchise companies. For example Dunkin’ Brands has 18,000 restaurants in 60 countries which are 100% percent franchised. Dunkin’ is a highly successful operator with 2014 net profit margin of 23.5% compared to an industry average of 14.1%. Dunkin’ launched its first mobile app in August 2012, and soon it became an important way to interact with its end customers. This was an opportunity – perhaps for the first time – to really create a relationship with, and deeply understand, their end customers. Dunkin’s rewards program called DD Perks, which offers targeted promotions and incentives to guests, drove adoption of the app. The app and DD Perks has helped cut seconds off service speed, increased cross-selling, enabled payments and raised the average size of the order.

The app creates a win-win-win for Dunkin’, its franchisees and the customer. This strategy provides a rare opportunity for franchise owners to connect directly with customers and build loyalty across the network of operators who are often independent small businesses. Perhaps for the first time, franchise operators like Dunkin’ Brands can effectively create a relationship with the end customer and use the data collected to improve services.

Mobile First

At Westpac, which views mobile as the front door to its organisation, “Mobile First” is a commitment to a new way of doing business. One of the four large banks in Australia, Westpac had 2014 revenues of AUD$19.9 billion (US$18.3 billion) and net profit margin of 23.4%. As part of its business strategy, Westpac declared that all new product and service offerings will be introduced in the mobile channel first. Westpac has delivered more than 45 mobile and tablet apps across its four major brands. The results of Westpac’s focus on mobile have been impressive, with 7.5% of the company’s customers now interacting with the bank on mobile only, and with 20% of simple products – credit cards, simple loans, certificates of deposit, etc. – now sold on its mobile channel. Customers are clearly delighted, with Westpac achieving a mobile Net Promoter Score (NPS) of 63, compared to the average US bank 2014 NPS of 34.2 NPS is one of many techniques companies use to assess the customer experience.

A key strategic opportunity of mobile is to create very fast feedback from the customer and effectively amplify the customer voice inside the enterprise. Mobile First is a significant strategic change requiring not only a commitment to mobile but also typically requires organisational surgery to realign the existing products and businesses with mobile being the front door to the company. For most companies this means rethinking – and reorganising – how the physical channels will be used in a Mobile First strategy.

The Payoff from Mobile Customer App Engagement

The good news is that mobile apps for customers can pay off handsomely. However, companies need to focus on what mobile does best: letting them get to know their customers better. The bottom-line results are very encouraging.

We found that 71% of the companies set high goals for mobile customer engagement. The companies that achieved their high goals (43% of the total sample) also had net margins and revenue growth 5.5 percentage points and 6.1 percentage points higher than their industry average. These top-performing companies set high goals for increasing customer engagement; decide on a clear mobile app strategy and pursue that strategy to achieve their goals. We learned from our case studies that initial successes encourage more extensive use of the mobile channel to engage customers, with increasingly significant investments and organisational commitment. The result is a reinforcing positive spiral of mobile channel success.

What now?

We believe every company – yes, every company – needs to get great at mobile apps. Countless companies have used mobiles apps to their advantage and succeeded with their efforts. In fact, mobile apps can even become the ticket to any business’s long-term success in the industry. But there are challenges. Before a business can introduce a flawless mobile app to their target audience, they have to go through a complex process first. This process can become more challenging for small businesses or businesses who are unfamiliar with mobile apps.

Here are four actions every company should be doing now to create great impact from their customer apps:

- Use mobile apps to ensure you have a great customer-centric strategy. Mobile changes everything and allows companies to be much more focused – and get great data – on their customer needs. You should never create a mobile app just to ride the bandwagon – you should use this platform to connect and engage with your customers. Almost all human beings in the world use mobile apps, which means that it’ll be very easy for your business to create professional relationships with your target audience using this platform.

- Begin building mobile app muscle today. Mobile capability needs to be learnt and will challenge the power status quo in your company. This is especially true for companies who have never made or used mobiles apps in the past. For example, a great mobile strategy will often raise the question of which group in the company is now responsible for the customer experience. Some companies will also have to assign a group that will solely work on improving and monitoring the performance of the mobile app. All of these things should be managed first before you decide to introduce a mobile app to the public.

- Pick the one of the 5 mobile app strategies that is best for your company. Depending on the size of your business and the complexity of your mobile app, you can undergo marketing attribution first to determine which among your strategies are appealing to your target audience. This process will help you narrow down your options and end up with strategies that can bring the most customers and profits. Set a high goal for increasing customer engagement and then execute. This will help gain the confidence of senior management to support further mobile customer engagement.

- Debate whether to have one or many mobile apps – so far, we see no best practice around how many mobile apps a line of business needs and how they link – just a lot of interesting experiments. However, if this is your first time to implement mobile apps, it’s best if you start with one first. This will make it very easy for you to audit your mobile app and determine if it’s giving you the results you were expecting. Using one mobile app will also help you assess your areas for improvement so you can create a better mobile app moving forward.

- Start the conversation of what a successful mobile app strategy will mean for your other assets – people and physical. For example for banks, retailers, universities and other physical asset heavy, hi-touch business models, mobile is likely to drive a different use of these physical hi-touch channels – with a slow and steady reduction in their use.

As you finish this piece please take a moment to reflect on how important mobile is to your strategy today. Are you a leader? Or a follower? Are you cashing in the bottom line benefits we reported above? Whose job is it to oversee mobile? And how can you energise the young people in your company to help lead the charge – they really get mobile. You don’t have time to wait.

About the Authors

Peter Weill is a Senior Research Scientist and Chair of the Center for Information Systems Research at the MIT Sloan School of Management. Weill has co-authored best-selling books published by Harvard Business School Press, and his award-winning books, journal articles, and case studies have appeared in the Harvard Business Review, the Sloan Management Review and The Wall Street Journal. His co-authored book Place to Space: Migrating to eBusiness Models (2001), was named by Library Journal as one of the best business books of the year, and was reviewed by The New York Times.

Peter Weill is a Senior Research Scientist and Chair of the Center for Information Systems Research at the MIT Sloan School of Management. Weill has co-authored best-selling books published by Harvard Business School Press, and his award-winning books, journal articles, and case studies have appeared in the Harvard Business Review, the Sloan Management Review and The Wall Street Journal. His co-authored book Place to Space: Migrating to eBusiness Models (2001), was named by Library Journal as one of the best business books of the year, and was reviewed by The New York Times.

Stephanie L. Woerner is a Research Scientist for the Center for Information Systems Research at the MIT Sloan School of Management. Her current research focuses on distributed collaboration in organizations and the use of emerging technologies, especially the use of Web 2.0 technologies, to enable and support that collaboration. In addition, she manages the CISR survey, an annual effort that collects IT financial data and performance metrics from over 500 international companies.

Stephanie L. Woerner is a Research Scientist for the Center for Information Systems Research at the MIT Sloan School of Management. Her current research focuses on distributed collaboration in organizations and the use of emerging technologies, especially the use of Web 2.0 technologies, to enable and support that collaboration. In addition, she manages the CISR survey, an annual effort that collects IT financial data and performance metrics from over 500 international companies.

References

1. Sources: Interviews with Garanti senior management, company documents and Garanti web site.

2. NPS=% of Promoters – % of Detractors; Promoters are loyal enthusiasts who will keep buying and refer others to your site and Detractors are unhappy customers who can damage your brand and impede growth. (http://www.netpromoter.com/np/calculate.jsp).