By Alfredo De Massis and Federico Frattini

Family firms represent a highly ubiquitous form of business organisation globally and are the backbone of many industrialised and developing world economies. This article discusses how can family firm managers use Family-Driven Innovation and unlock the innovation potential of the organisations in which they work.

Family firms are businesses “governed and/or managed with the intention to shape and pursue the vision of the business held by a dominant coalition controlled by members of the same family or a small number of families in a manner that is potentially sustainable across generations of the family or families” (Chua et al., 1999). Family firms represent a highly ubiquitous form of business organisation globally and are the backbone of many industrialised and developing world economies (Villalonga and Amit, 2009).

From decades of theoretical and empirical research (e.g., De Massis et al., 2012), we know that family firms have a highly distinctive behaviour in areas such as internationalisation, entrepreneurship, diversification, financing. This peculiar behaviour – which differs from that of non-family businesses – stems from the involvement of one or more controlling families in ownership and management structures and their orientation to ensure sustainability of the business across generations. This has profound impacts on the choice of the organisational goals to be pursued (Kotlar and De Massis, 2013), the level of acceptable risk in strategic choices (Gómez-Mejía et al., 2007), and the length of the time horizons along which investment decisions are evaluated (Lumpkin and Brigham, 2011).

[ms-protect-content id=”9932″]Innovation is defined as the “successful implementation of novel and useful ideas for new products, processes, services, business models, and structures” (Amabile, 1988), and it is now acknowledged as a critical source of competitive advantage and an important determinant of superior firm performance (Calantone et al., 2006).

Given the prominence of family firms and the importance of innovation for competitive advantage, it is not surprising that much has been written about innovation in family firms in the last years. In particular, innovation and family business scholars have paid special attention to understanding whether family firms invest less or more in innovation, and whether they are more or less innovative, compared with their non-family counterparts (De Massis et al., 2013). This notwithstanding, we have relatively limited knowledge about how innovation is managed in family firms and what are the good practices that work in this particular organisational form.

Very recently, theoretical and empirical research has pointed to the existence of a paradox in family firm innovation (Chrisman et al., 2015), whereby family firms are characterised at the same time by:

a lower willingness to start innovation projects, due to their risk aversion, lack of skills in the family, desire to not share control with nonfamily managers who might have such skills, and inclination to minimise the use of external financing.

a higher ability to successfully complete innovation projects, due to their greater discretion to act resulting from personalised control, low levels of formalisation and bureaucracy, long-term investment horizons, patient capital, altruism, and interest alignment between owners and managers.

Put it another way, family firms seem to innovate less, despite their ability to innovate more than their non-family counterparts. This has raised a very important question: how can family firm managers resolve this paradox and unlock the innovation potential of the organisations in which they work?

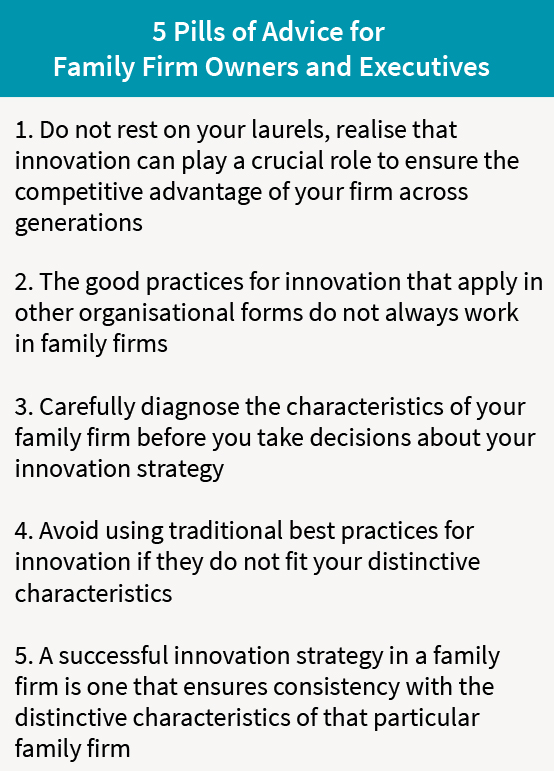

In the last years, we have conducted extensive empirical research to provide an answer to this question. Our analysis indicates that the family firms that find a way to resolve the innovation paradox are those that design and embrace innovation strategies that are aligned and consistent with their most salient idiosyncratic characteristics. Instead, adopting innovation strategies that work well in other organisational forms is likely to result in hampered innovation performance.

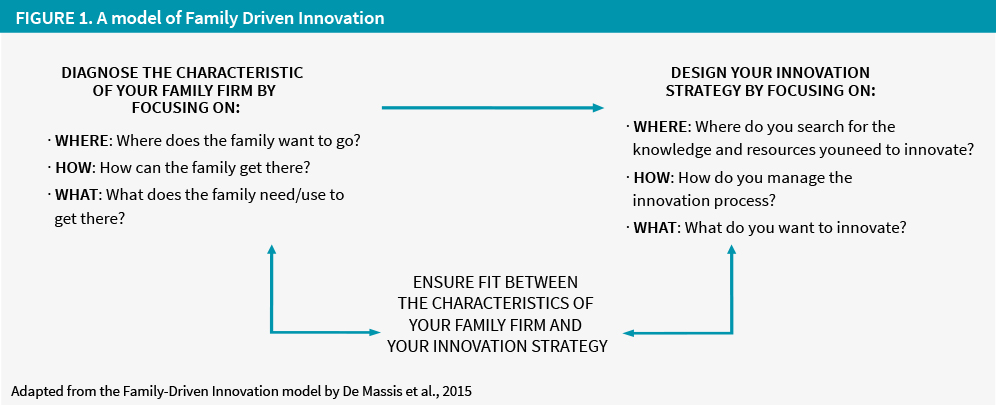

We call this approach to innovation – which is based on the fit between the characteristics of a given family firm and the components of its innovation strategy – Family-Driven Innovation (FDI). In the following we provide a more detailed explanation of the FDI concept (for more details please see De Massis et al., 2015).

Designing an innovation strategy requires any firm to take decisions along three main dimensions:

The where of an innovation strategy. This decision refers to the directions in which a firm looks for the resources and knowledge it needs to feed the innovation process. A firm may search into its existing knowledge basis, across novel and unfamiliar technology domains, or into knowledge resources pertaining to the past and to the tradition of the firm or the controlling family.

The how of an innovation strategy. This dimension concerns the approaches a firm uses to develop and commercialise its innovations, ranging from how it organises its innovation projects, whether and to what extent it accesses knowledge from outside sources – by following an open innovation model -, to how it motivates and rewards the employees involved in innovation projects.

The what of an innovation strategy. This refers to the different types of innovations that a firm decides to invest in. A firm may choose to focus its efforts toward innovating its products/services or changing its business model, and toward pursuing incremental or radical innovations.

According to the FDI framework, the decisions a family firm makes along these three dimensions should be consistent and aligned with its distinctive characteristics. A way to map the most salient characteristics of a given family firm is to focus on:

The where of a family firm. This dimension captures the family owners’ goals and intentions and responds to the question where do we want to go? For example, some family firms may be more oriented to pursuing family-oriented goals such as family harmony, social status and identity linkage, whereas others may be more oriented to pursuing nonfamily-oriented goals such as pure profit maximisation.

The how of a family firm. This refers to the authority of the family to direct, allocate, add to or dispose of a firm’s resources and responds to the question how can we get there? For example, the family’s strategic control of a firm’s assets relative to its ownership may be enhanced through the establishment of pyramids, cross-holdings and dual voting class shares, and the family may be able to bypass the board when making strategic decisions.

The what of a family firm. This dimension refers to the type of resources that the controlling family owns and needs to pursue its goals and lead the firm in the desired direction, responding to the question what do we use/need to get there? This dimension emphasises the role of the family firms’ unique resources and capabilities – in terms of higher or lower stocks of social, human and financial capital – in influencing behaviour

As shown in Figure 1 (see figure 1 below), only when the decisions taken along the three dimensions of an innovation strategy are aligned with the characteristics of a given family firm – as mapped along the “where”, “how” and “what” dimensions mentioned above – FDI will be possible and the ability and willingness paradox in family firm innovation will be resolved. We summarise hereafter some examples taken from our empirical research, which illustrate how the FDI framework works.

One of the family firms that we studied manufactures and sells bio-medical devices. A few years ago, the newly appointed R&D manager (who was not a member of the controlling family) convinced the top management team to start an open innovation program, according to which the firm would systematically search for technologies, patents and know-how from outside the organisational boundaries, and acquire them (mostly through in-licensing agreements) to feed innovation projects. After about a year from the start of this program, the firm experienced poor performance due to unexpected cultural barriers, which slowed down the utilisation of the technologies bought from outside. Our analysis shows that the family managers did not support the open innovation program because they feared to lose control over the new product development trajectory, which was perceived as a loss of the family’s ability to exercise unconstrained authority, influence, and power over all aspects of the business, and a threat to the achievement of non-economic goals such as maintaining control and strengthening the identification of the family with the products of the firm. After the poor performance that the firm experienced, the controlling family decided to come back to a more traditional, closed approach to innovation development, and to acquire external technologies only for non-strategic innovation projects with a strong intellectual property (IP) protection, ensured by a careful use of patents and other forms of IP rights. This change ensured a closer alignment between the goals of the family and the approach used in innovation development, resulting in higher innovation performance.

Another family firm in our sample working in the sporting goods industry was struggling with the organisation of the new product development (NPD) teams involved in the ideation and realisation of the new product portfolio. In a first stage – by following established good practices in innovation studies – they decided to use cross-functional teams to create, develop and commercialise their new products. However, this resulted in continuous tensions and animated discussions between department heads and team leaders, with negative impacts in terms of resource duplication, complex information flows, problems of accountability and cost control. Therefore, by following the suggestions of an external consultant, they decided to change approach and move toward a departmental organisation, where personnel from different departments of the firm were assigned to work part-time on the innovation projects, while continuing to perform most of their regular duties and reporting to the department heads. Surprisingly, this organisational approach worked much better and delivered more positive returns. Our analysis shows that this was due to the fact that a departmental organisation was consistent with the strong interpersonal bonds, internal social capital, and tacit knowledge characterising that firm. Thanks to this particular resource endowment, the departmental organisation favoured information flows and preserved the cohesion of the existing departments, while at the same time allowing sufficient autonomy to the NDP teams.

A firm active in the furniture industry provides another example of how FDI works. The firm was suffering from declining market shares and profitability, because of its inability to radically innovate the product portfolio. This was due to the low risk propensity of the controlling family, their unwillingness to use external financial capital, and the intention to preserve the control of the family across generations, something perceived as non-compatible with radical innovation efforts. The radical innovation approach the firm was trying to apply – although without positive tangible results – was based on introducing advanced, high-tech materials and components in their new products, to enable superior performance compared with competing solutions. The approach changed when the newly hired innovation manager realised that using extremely advanced and complex technologies – which often came from very distant fields – was perceived by family managers as too much of a risk. Instead, he identified an opportunity to bring to market something radically new, but without colliding with the goals of the controlling family. This opportunity required innovating the products of the firm by re-using designs, materials, and concepts belonging to the historical tradition of the furniture industry, combined with the most modern manufacturing technologies, to deliver state-of-the-art products. The new products based on this approach elicited very strong interest among prospective customers, because they revolutionised the reason why one would buy a piece of furniture, and made it an iconic good, embedding a set of values belonging to the past. This approach to radical innovation was consistent with the goals of the controlling family (geared toward non-economic utilities, instead of profits and other forms of economic wealth), and therefore was not obstructed by family managers who, instead, saw in it the opportunity to counterbalance declining shares and profits without loosing control of the firm, and maintaining risk at an acceptable level. At the very end, this change in the radical innovation strategy had very positive impacts on business performance.

In sum, family firm owners and executives should recognise that when there is misfit between innovation decisions and family firm characteristics, creating a competitive advantage through innovation in family firms is unlikely. Conversely, if innovation decisions match the characteristics of the family firm, then Family-Driven Innovation is possible and can lead to the creation of competitive advantage through innovation. Our research (e.g., De Massis et al., 2016) has shown that achieving this fit between innovation decisions and family firm characteristics can often lead family firms to avoid the standard best practices that are typically recommended in innovation management handbooks if these do not match their distinctive characteristics.

About the Authors

Alfredo De Massis is Professor of Entrepreneurship & Family Business at Lancaster University Management School (UK) and Director of the School’s Centre for Family Business. He serves on the Editorial Boards of ET&P, FBR, SEJ, JFBS, and as Chair of the Family Business Research SIG at the European Academy of Management. In September 2015, Family Capital ranked him among the world’s top 25 star professors for family business. Alfredo currently serves as advisor, coach and educator to family enterprises and is the former Chairman of the European Leadership Council and Global Board Member of the Global STEP Project for Family Enterprising at Babson College, USA.

Alfredo De Massis is Professor of Entrepreneurship & Family Business at Lancaster University Management School (UK) and Director of the School’s Centre for Family Business. He serves on the Editorial Boards of ET&P, FBR, SEJ, JFBS, and as Chair of the Family Business Research SIG at the European Academy of Management. In September 2015, Family Capital ranked him among the world’s top 25 star professors for family business. Alfredo currently serves as advisor, coach and educator to family enterprises and is the former Chairman of the European Leadership Council and Global Board Member of the Global STEP Project for Family Enterprising at Babson College, USA.

Federico Frattini is Associate Professor at the School of Management of Politecnico di Milano (Italy). He is the Director of the MBA & Executive MBA programs at MIP, the Graduate School of Business of Politecnico di Milano. His research area is innovation and technology management. He has published more than 160 articles in edited books, conference proceedings, and leading journals such as Academy of Management Perspectives and California Management Review. In 2013, Federico was nominated among the Top 50 Authors of Innovation and Technology Management Worldwide by IAMOT, the International Association for Management of Technology.

Federico Frattini is Associate Professor at the School of Management of Politecnico di Milano (Italy). He is the Director of the MBA & Executive MBA programs at MIP, the Graduate School of Business of Politecnico di Milano. His research area is innovation and technology management. He has published more than 160 articles in edited books, conference proceedings, and leading journals such as Academy of Management Perspectives and California Management Review. In 2013, Federico was nominated among the Top 50 Authors of Innovation and Technology Management Worldwide by IAMOT, the International Association for Management of Technology.

References

• Amabile, T.M. (1988). A model of creativity and innovation in organizations. Research in Organizational Behavior, 10, 123-167.

• Calantone, R.J., Chan, K. and Cui, A.S. (2006). Decomposing product innovativeness and its effects on new product success. Journal of Product Innovation Management, 23(5), 408-421.

• Chrisman, J.J., Chua, J.H., De Massis, A., Frattini, F. and Wright, M. (2015). The ability and willingness paradox in family firm innovation. Journal of Product Innovation Management, 32(3), 310-318.

• Chua, J. H., Chrisman, J. J., & Sharma, P. (1999). Defining the family business by behavior. Entrepreneurship Theory and Practice, 23(4), 19-39.

• De Massis, A., Sharma, P., Chua, J. and Chrisman, J.J. (2012). Family business studies: an annotated bibliography, Edward Elgar.

• De Massis, A., Frattini, F. and Lichtenthaler, U. (2013). Research on Technological Innovation in Family Firms: Present Debates and Future Directions. Family Business Review, 26(1), 10-31.

• De Massis A., Di Minin A., and Frattini F. (2015). Family-driven innovation: resolving the paradox in family firms. California Management Review, 58(1), 5-19.

• De Massis, A., Kotlar, J., Frattini, F., Chrisman, J.J., and Nordqvist, M. (2016). Family governance at work: Organizing for new product development in family SMEs. Family Business Review, forthcoming.

• Gómez-Mejía, L.R., Haynes, K.T., Núñez-Nickel, M., Jacobson, K.J.L. and Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52, 106-137.

• Kotlar, J. and De Massis, A. (2013). Goal setting in family firms: goal diversity, social interactions, and collective commitment to family-centered goals. Entrepreneurship Theory and Practice, 37(6), 1263-1288.

• Lumpkin, G.T. and Brigham, K.H. (2011). Long-Term Orientation and Intertemporal Choice in Family Firms. Entrepreneurship Theory and Practice, 35, 1149-1169.

• Villalonga, B. and Amit, R. (2009). How are U.S. family firms controlled?. Review of Financial Studies, 22, 3047-3091.

[/ms-protect-content]