Research Phenomena

China is the second largest market for luxury goods in the world, behind the US and before Japan1. More than half of exported Swiss made watches are currently sold to the Chinese. Mercedes sold 193,339 of their cars in China last year – up 30.8% compared to 2010 – whereas in the US, their growth was 13.3%2. Louis Vuitton own 36 stores in China and generate more than half of their sales from the Chinese3. All these sales statistics show that China is an El Dorado for luxury goods. However, if one looks at the GDP per capita of this country, it remains at a very mediocre level: around USD 4,428 per capita in 2010 and ranked at 98th in the world after Macedonia and before Angola4 in contrast to the US ranking 10th worldwide with USD 47,199 per capita.

Research Problem

Luxury items became a necessity in PRC because of the social rejection of Chinese new wealth in the political system and socialist market economy under a multiple factors effect.

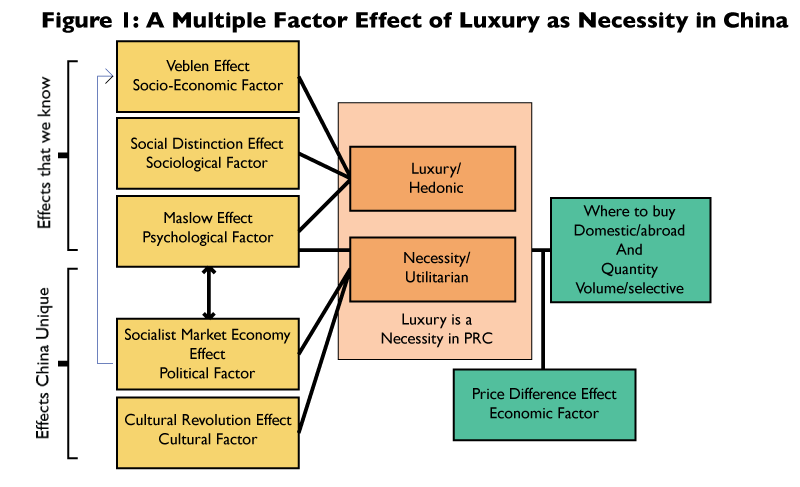

Luxury is a necessity in mainland China and motivations are based on functional utilities. The Veblen effect about conspicuous consumption can no longer be used to explain this new economic phenomenon. In this article, we identify six factors and formulate a multiple factor effect model to solve this problem. Among the six factors, three are existing economic theories related to luxury goods consumption, and three are factors unique to China related only to the Chinese business environment. Before we analyze the decisive factors, we must clarify that there are two possible roles that each factor may play: luxury for hedonic or/and necessity for utilitarian5. The conceptual model is summarized in Figure I.

Factor 1: socioeconomic effect/Veblen effect (Veblen, 1899).Institutional economists suggest that wealth increase boosts te conspicuous consumption.6 The last 30 years of GDP growth per year of PRC (1980-2010) is 9.9%.7 The general living condition of the average Chinese citizen is vastly improved from a US$182 level of GDP to US$4,428 level, in the last 30 years. When people have money in a relatively short period, they want to show off and adopt display behavior. The most efficient way to show off new wealth is through luxury brands consumption, even if the price of the luxury branded product is significantly higher than that of a product providing the same functions but having a mass market positioning. This is the famous Veblen effect. But under this effect, luxury goods remain as luxury, and only available for the new wealth class.

Factor 2: sociological effect/social distinction effect (Bourdieu, 1984). Sociologists suggest that an increase in social capital boosts people make self-distinction.8 After the implementation of opening and reform policies in 1978, the economy moved from being centrally planned to market-oriented. Private sector started to flourish. People had different rates of increase of social capital, such as personal wealth, education resources and family resources. The needs of social distinction change social structures from a flat equal system to a vertical distinctive system. The most efficient way to distinguish oneself in society was through luxury consumption for its rareness and superiority.

Factor 3: psychological effect/Maslow effect (Maslow, 1970). Maslow pyramid suggests after solving basic needs, people looking for higher needs, such as self-esteem.9 The dominant values in the Chinese contemporary value system are achievement, success and being respected by others.10 This accelerates luxury consumption for the symbolic meaning of superiority in society.

Factor 4: cultural effect/cultural revolution effect (China uniqueness). A vacuum in refined, artistically produced items in the Chinese domestic market boost the consumption of international luxury brands. There are two facts: first, international and Chinese studies have shown that the “Made in China” label is always associated with poor quality and cheap price; foreign brands often have better design, better quality and attractive brand awareness, thus better meet the needs of Chinese consumers.11 Second, the Cultural Revolution (1966-1976) destroyed tradition and culture-based light industry. Cultural-related products and craftsmanship were destroyed and abolished from society. The need for refined products boost luxury consumption in China. For example, estimated at 10-15 thousand dollars, a blue and white porcelain Meiping vase with Qianlong Mark sold for $7.7 million – 600 times its estimate. It was purchased by mainland Chinese collectors, demonstrating the high demand for imperial porcelain.12

Factor 5: political effect/socialist market economy effect (China Uniqueness). Mental Rejection: Entrepreneurs in the private sector have no voice and no power in the political system, and thus cannot gain formal social acceptance from the societal system. This situation creates social rejection which further increases and stimulate their desire for money13 and luxury consumption. In order to gain social acceptance, self-concept and social respect, , new wealth has a higher desire for money to substitute the needs of social recognition. The function of showing off to gain social power via the status created by displayed luxury goods is a means for Chinese new wealth to survive in a socialist market economy environment, in both business and social activities. The New wealth have to use visible luxury brands to create credentials and gain trust in their daily activities. Thus luxury brands are creating new functional values, potentially more valuable than the products themselves. The social rejection of new wealth in the socialist market economy boosts constantly luxury consumption. Because gaining money cannot only decrease the mental pain created by rejection (Zhou et al., 2009), but also gain social trust and acceptance through luxury consumption. If you are rejected by your social peers, buying luxury goods is a way of overcoming this rejection and ultimately leads to your acceptance in society.

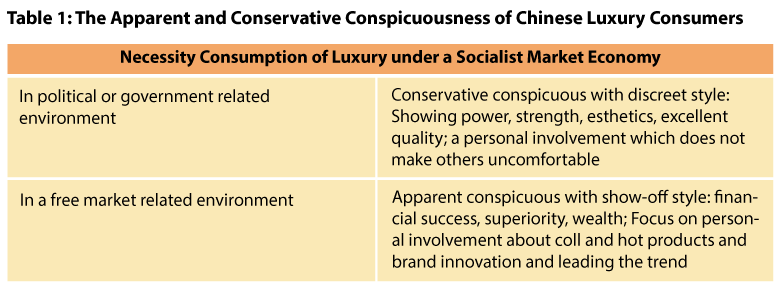

Conservative Conspicuous Behavior: In the socialist market economy environment, two categories of conspicuousness are formed: appearance conspicuousness and conservative conspicuousness. The appearance conspicuousness refers to the classical display behavior of new wealth in a free market environment. The typical consumers are the new wealth in private sectors and non-state-owned enterprises. The conservative conspicuousness can be understood by the unique socialist system within Mainland China’s market-driven economy. The conflict of having a centralized power structure versus liberty and an openness of the market creates individual wealth while limiting the expression of wealth and status. Those consumers who are typically found in politics or a government-related environment are said to be luxury intellectuals14. In this setting, wealth should not be overtly expressed or shown off to others. Products that are discreetly designed, such as ties, scarves, business suits, or handbags without logos are most popular. Alternatively, if an individual outside of politics consumes luxury products, it is most likely that he or she is a luxury lover or follower.

Democratization of Luxury: In Mainland China, one may see a person carrying an authentic Louis Vuitton bag while riding a crowded, public bus somewhere in the rural countryside. Luxury goods are consumed on a mass level, and are not confined to a select few. The central cause for an increased consumption of luxury products results from the country’s socialist value system. During the transitional period from a pure planned system to a market-driven economy, consumers inherently retained the idea of equality. Socialist government authorities also try to maintain and communicate that equality in Mainland China is crucial to national identity. Based on steady economic development and a newfound consumer confidence towards the future’s potential, Mainland Chinese consumers believe that they are, in essence, the same as each other. Even if they cannot afford a luxury brand item today, they will save up several months of savings to eventually have it.

Counterfeit-Educated Consumer. Although both sellers and buyers of counterfeited products are legally and ethically wrong, counterfeiting is still a worldwide phenomenon including in China and in the U.S. The consequence of counterfeiting activities for luxury brands, besides commercial loss and image damage is the advertising effect of said brand to the masses. Previous research shows that consumers for counterfeited products and for genuine brands are two distinct groups that do not overlap. However, new research on counterfeit luxury consumption both in Europe and in China shows that an overlap between the two groups exist because of significant quality improvement and a higher speed of distribution of counterfeited luxury brands in the market. The availability of counterfeited product is an effective indicator of the establishment of an attractive premium image in the Chinese market, for example, North Face and Ralph Lauren. However, it does not mean the legal fight against counterfeit activities should be eased at all.

Factor 6: economic effect/pricing difference moderator effect (China Uniqueness). There is a significant retailing price difference between the domestic and international markets, and this boosts Chinese luxury consumption outside of China. Because of import duty and VAT, the same product of the same brand has a 30% automatic difference of retailing price based on the same currency. For example, a Tiffany ring selling at USD XXX in Fifth Avenue will sell for USD XXX at the Tiffany store in the Beijing China World mall. If we take into account currency changes, the stronger local currency (RMB) against USD inflates the price difference between the domestic and international markets, e.g. the RMB appreciated 30% against USD from 2005 to 2012. This encourages the Chinese to go abroad to buy luxury goods and increases the global sales record of stronger brands in China. Combining with factor five, using cheaper priced same product and brand bought outside of the market create more utility inside of the market with much higher price.

The existence of Hong Kong as a tax-free zone makes the effect more significant; as it takes a shorter distance to acquire the luxury, the cost of buying is lowered, thus further increasing the price different effect. From this point, we can conclude that the Veblen effect is not the only reason which explains the Chinese luxury consumption phenomenon – we also need to factor in utilitarian logic. Thus conspicuousness is not the only factor for boosting luxury consumption in China.

Table 2 below is a summary of the six factors:

Conclusion and Discussion

Based on the six factors, the general conclusion is that luxury goods are no longer for pure hedonic consumption in China. Luxury combines not only the classical, social and personal-oriented needs but also Chinese specialties and uniqueness in its social and economic system. It became a functional product under special conditions related with complex cultural, political, social and economic motivations. Luxury brands have to consider these complex reasons in the commercialization process in China than they would in a capitalist business environment where wealth is respected in social and political systems.

The following five marketing strategies are formulated for international brands to build a luxury brand business model in China.

Strategy #1: Be premium and build a luxury brand image. International brands, for fashion-related products but also for electronics, should build a luxury brand image in China in order to appeal to Chinese affluent consumers. For middle range or mid-high end products in the US market, a repositioning strategy should be adopted in the China consumer market. For example, Nautica is a mass market leisure-sports brand in the U.S., but adopts a premium brand strategy in China and has successfully built a high-end and affordable luxury brand image by opening independent retailing stores on the ground floor of high-end shopping malls to successfully target the affluent Chinese buyer. Apple built up its premium and luxury image through opening flagship stores in the most trendy commercial areas and shopping malls all over China, such as Sanlitun Village in Beijing and Nanjing Road, Huaihai Road and IFC in Shanghai. Its products have successfully become indispensable luxury items, as was proved by the recent Qingming festival where paper effigies of the iPhone and oPad were burnt for sacrifice.

Strategy #2: Control retailing networks to maintain a luxury image and to do massive extension at the same time. There are two reasons to do this. First, there is no nation-wide professional retailer or distributor system to apply a selective distribution policy as in other mature markets for international brands. Local multi-brand store chains have not emerged. Relying on Chinese manufactures or unprofessional agents is too risky both for the brand image and product quality. Second, the physical store location and merchandising is crucial for sales and for branding as Chinese people have a higher shopping frequency than Americans. The Chinese spend on average 9.3 hours per week on shopping whereas Americans spend on average 3.6 hours per week.15 Thus, international brands should control and develop the retailing network in China for short- and long-term success in this market.

Strategy #3: Adopt premium pricing. The price is the direct indicator of product value and of brand positioning. The ideal price structure would be that the retailing price in China be slightly higher than that in the home country or other markets. There are two benefits: first, this strengthens the luxury brand image through higher pricing in China.. Second, the domestic-international retailing price difference will stimulate and generate extra sales outside China from Chinese affluent outbound travelers.

Strategy #4: Use local Internet and social media to target the Chinese public. China has 513 million Internet users and 300 million Weibo (microblog) users,16 more than in the U.S. The majority of these only read Mandarin, thus are not concerned with foreign language based websites and contents. Hot trends and news about brands and products in the English-speaking world is not automatically validated for China. International brands should build up local teams for the decoding and execution of integrated marketing communication strategies inside of China.

Strategy #5: Creating buzz through events and celebrities. Luxury brand image needs to be built through successful marketing events in order to generate sales online and offline. The Chinese consumer needs to be impressed to create the mental anchor for the high-end brand image. Local celebrities are highly needed for the commercial propose of international brands. For example, Yao Ming, the Chinese NBA basketball player, created a TV audience of billions of Chinese people for American NBA games. All NBA-sponsored brands, such as Nike, Adidas, McDonald’s, Toyota etc. benefit from him in the Chinese market.

Concluding Remarks

Building a premium brand image in China is strategic and extremely important for international brands to build a global system which benefits from Chinese consumers domestically and internationally.

Brands considering doing marketing or business in China need to take into account the factors unique to China and put all variables into the socialist market economy background before making any judgments and conclusions. The risk of decisions based on imagined assumptions about China is much higher than the risk of reality itself, as mental biases are much more difficult to correct than mistakes based on facts.

As far as China maintains its stability and economic growth, domestic and overseas consumption will continue to grow and form a more consumerist economy. As long as the socialist market economy is maintained and social wealth continues to grow, the need for luxury consumption will be a necessity and maintain its high demand until tension is released.

The author would like to express the appreciation for the supports of National Social Science Foundation of China (project no. 11CGL033) and National Natural Science Foundation (key project no. 70832001 and key project no. 71232008) for his research projects.

About the Author

Pierre Xiao LU, Phd, Marketing Professor at School of Management in Fudan University in Shanghai, Visiting professor of LVMH Chair at ESSEC Paris-Singapore. He is specialiszed in luxury brand management, luxury consumer behavior and selective retailing. He is the author of “Elite China, Luxury Consumer Behavior in China” and co-author of “Luxury China, Market Opportunities and Potentials“, at the same time consulting international and Chinese luxury brands.

References

1. Selling Luxury to the Chinese Masses, The Wall Street Journal, May 20, 2010. http://online.wsj.com/article/SB10001424052748703866704575225303288815256.html

2. Mercedes-Benz Cars Reach All-Time High with Sales of 1,362,908 Units in 2011 http://www.daimler.com/dcco /0-5-7153-1-1452153-1-0-0-0-0-0-8-7145-0-0-0-0-0-0-0.html

3. Swiss Horloger Report 2011, Dameler Annual Report 2011, LVMH Annual Report 2011

4. World Development Indicators database, World Bank. Accessed on December 21, 2011.

5. R. Dhar and K. Wertenbroch, Consumer Choice Between Hedonic and Utilitarian Goods, Journal of Marketing Research, 2000

6. Veblen, T.B. (1899). The Theory of Leisure Class, (1994) Penguin twentieth-century classics. New York, N.Y., U.S.A.: Penguin Books

7. Lin, J.Y. The China Miracle Demystified, The World Bank

8. Bourdieu, P. (1984). Distinction: a Social Critique of the Judgment of Taste, trans. Richard Nice, Harvard University Press

9. Maslow, A.H.(1970), Motivation and Personality, New York: Harper and Row, 2nd edtion.

10. Lu, P.X. (2008). Elite China, luxury consumer behavior in China, (Singapore: Wiley & sons, 2008); What Exists behind the Facade of New Wealth? The European Business Review, September-October 2010, pp. 53-56

11. L.X.Zhou ; L. Zhu et al.

12. Economic Bizarrity: Antique Chinese porcelain a hot commodity? August 26, 2011. http://www.businesspundit.com/economic-bizarrity-antique-chinese-porcelain-a-hot-commodity/

13. Zhou, X., Vohs, K.D. and Baumeister, R.F. (2009), The symbolic power of money, reminders of money alter social distress and physical pan, Psychological Science, June, Vol. 20, No. 6, 700-706

14. Lu, P.X. and Pras, B. (2011) Profiling mass affluent luxury goods consumers in China: A psychographic approach,

Thunderbird International Business Review volume 53, issue 4, year 2011, pp. 435 – 455

15. Shanghai Daily, 2 August 2007

16. CNNIC report 2012.