As President Donald Trump begins his new term, it’s critical to evaluate the current state of the U.S. stock markets. Trump’s political agenda, outlined in his inaugural address, is expected to trigger significant market volatility — both positive and negative.

While the specifics of his plans remain unclear, particularly regarding the scope and targets of proposed tariffs, it is evident that these policies could greatly impact international trade. For now, understanding market movements depends on identifying the key driving forces based on available data. Currently, the dominant factor shaping U.S. stock markets is inflation.

Market Recovery Driven by Inflation Data

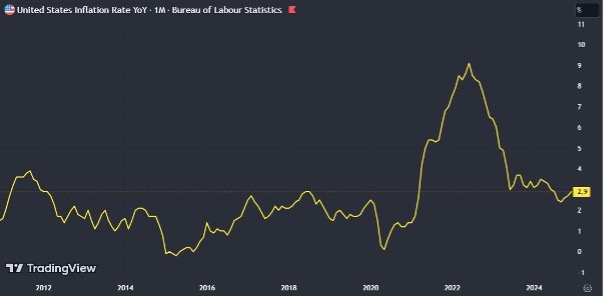

Following weeks of declines, the market rebounded from its recent low after the release of December’s inflation data. The data revealed a slight decline in inflation compared to the stagnation observed in November, which raised concerns.

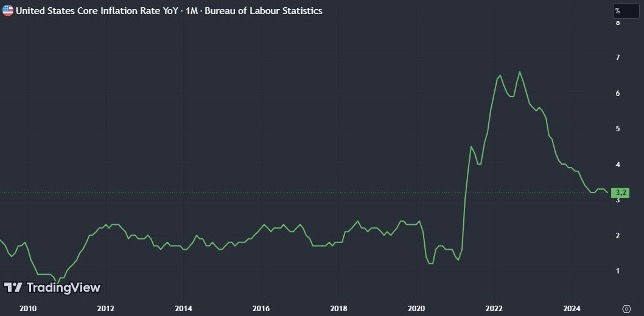

Key Factor: Core Inflation

The most promising development was the decline in core inflation, affecting durable goods. Core inflation is calculated by excluding food and energy prices, as these are more volatile and subject to short-term supply shocks. This measure offers a clearer perspective on the true pace of price increases. For the first time in months, core inflation decreased, though it remains above the Federal Reserve’s target range of 2–3%.

A closer look at the overall inflation data reveals that service and rental prices are still uncomfortably high, while food inflation seems to be under control.

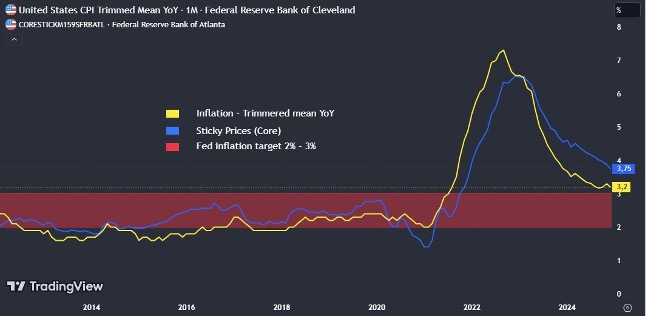

The Federal Reserve monitors two additional metrics to guide interest rate decisions:

- Sticky prices: These measure prices that are slower to change.

- Trimmed mean inflation: This metric excludes outliers from the overall inflation data to provide a more balanced view.

Both indicators declined in December but remained above the Fed’s target range.

Federal Reserve Chairman Jerome Powell has made it clear that further interest rate cuts are unlikely until inflation is firmly under control. While trends appear to be heading in the right direction, current data still presents challenges.

Tariffs vs. Inflation: A Potential Conflict

In his inaugural speech, Trump reiterated his commitment to imposing import tariffs and tackling inflation. However, these two objectives may be at odds:

- Tariffs: High tariffs could lead to increased prices, adding to inflationary pressures.

- Anti-inflation measures: A strong focus on reducing inflation might make it politically difficult to justify price hikes on imported goods.

Balancing these priorities could have far-reaching consequences for markets, which are already considered some of the most expensive in history. Investors and traders should closely monitor these developments as they unfold.

Currently, markets are awaiting January’s data release. Another decline in inflation could push stock indices including the S&P 500, the Dow Jones index, and the tech-heavy Nasdaq Composite to new all-time highs, despite the Federal Reserve’s cautious stance at the end of last year. The Fed is unlikely to ease interest rates, especially given the continued strength of the labor market.

Economic data will remain a major driving force as 2025 unfolds. Staying informed about upcoming economic calendar releases will be critical for effectively navigating market movements.

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)