By Omar Toulan and Niccolò Pisani

How has the digital disruption affected the way customers shop and the factors that influence their decisions? One need look no further than how we have traditionally shopped for one of the most common purchases – shoes. Until recently, customers might see a print or television advertisement that would prompt them to go to a shoe store where the shop experience and effectiveness of the sales staff could have a major impact on the likelihood of a purchase. Perhaps they would go to a few different stores to compare prices, but comprehensive price comparisons were often not worth the effort. What does that process look like today? While the traditional process is still followed by many, today’s customers are exposed to a much wider variety of influencers that can impact their purchase decisions. For example, customers can browse the internet, read the recommendations of bloggers, seek the opinions of friends on social media, and compare prices online. One of the biggest concerns of companies is that most of these digital influencers lie beyond the company’s control compared to traditional physical influencers. In addition, the number of sales channels customers can access has multiplied. While a customer may go to a physical store, there is no guarantee that the final purchase will be made in-store rather than online through Amazon. Though the traditional retail channel has by no means disappeared, companies are faced with the fact that the digital disruption has simultaneously broadened the customer experience and increased the number of channels through which purchases can take place.

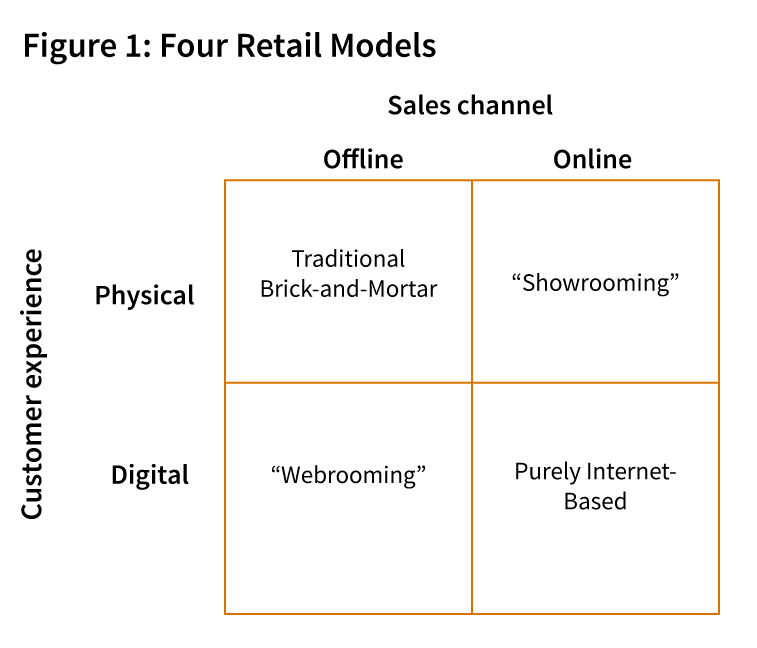

To better understand the retail models that companies have at their disposal today, it is essential to appreciate the multi-dimensionality of the digital disruption, taking into consideration both the customer experience and sales channel. Whereas the former takes the form of either a physical or a digital experience, the latter can be either offline (in-store) or online. While many have considered these dimensions individually, we argue that it is critical to consider them simultaneously, thus, leading us to identify four distinct retail models that companies must proactively manage. In particular, two of the four models we identify – namely “Showrooming” and “Webrooming” – are key in today’s retail environment.

[ms-protect-content id=”9932″]

When it comes to the customer experience, today’s technology has dramatically increased the number of influencers. Traditional retailers that have relied primarily on physical influencers are facing the challenge that, in the near term the web will influence nearly half of all retail transactions. What this also implies, though, is that half of all retail channels are still impacted almost exclusively by physical influencers. Therefore, it is critical that firms proactively manage the digital and the physical components as one eco-system that contributes to the customer experience. As the number of tools available on the digital side continues to increase, companies will have to be ready to embrace these innovations, while at the same time not forgetting the important role played by traditional mechanisms, such as sales personnel, in the customer’s experience and buying decision.

The digital disruption has also dramatically changed the buying process, including where and when purchases take place. In the past, the vast majority of purchases could only be made in-store; in the digital era, customers can shop online 24/7 from any location. Today while online sales account for roughly 11% of total retail sales in the U.S., they have been growing at a rate of 15% per year. At this pace, they will account for roughly 25% of overall retail sales by 2025. As with the customer experience, it is important to remember that brick-and-mortar sales still account for the largest percent of retail sales and will continue to do so for many years to come. While companies must develop an active online sales strategy, they cannot do so at the expense of their traditional offline outlets.

Retail models

As mentioned, the digital disruption has not only increased the number of customer influencers but also diversified the sales channels. While each dimension on its own is a critical success factor for retailers, it is essential for companies to appreciate and understand how the two interact with each other. This leads us to identify four distinct retail models that companies must proactively manage (Figure 1).

Quadrant 1 (Traditional Brick-and-Mortar) identifies the primary domain of most traditional retailers and still represents the largest portion of retail sales today. In this model, the sale is completed in-store and the customer is mainly influenced by a combination of the store experience, effectiveness of the sales force, store design, and traditional media outlets. By contrast, in Quadrant 2 (“Webrooming”), the digital experience primarily influences the customer’s purchase decision. However, the final purchase still takes place in an offline channel. Conversely, in Quadrant 3 (“Showrooming”), the customer leverages the offline sales channel to experience the product first-hand. However, the customer then purchases the product online, in most cases at a lower price. Finally, in Quadrant 4, the Purely Internet-Based model leads the digital customer to make an online purchase.

Key implications

Today most attention has tended to focus on the rise of the Purely Internet-Based model with its digital experience and online sales at the expense of the Traditional Brick-and-Mortar model. However, in reality, “Webrooming” and “Showrooming” represent a critical and growing proportion of customer sales. On the one hand, this implies that companies can no longer restrict their focus to the two ends of the retail spectrum. On the other hand, this means that companies must be able to proactively manage all four models to remain competitive, especially the two hybrid models of “Webrooming” and “Showrooming.” What does this mean for senior managers?

- Segment your customers correctly based on the multi-dimensionality of both the customer experience and sales channels. Whereas in the past most customers were exposed to the same kind of experience, today they may have completely different experiences depending on the mix of physical and digital elements. This highlights the importance of segmenting and understanding customers by the experience that leads to and includes the purchase, rather than simply by traditional demographics or the type of product they buy. Once segmented according to the models described above, firms must then develop targeted approaches leveraging all the tools, physical and digital, at their disposal to shape the customer experience and final purchase.

- Acknowledge the shift in power. Companies must realize that today the customer determines what the retailer will sell rather than the retailer deciding what the customer will buy. People now enter the store knowing what they want and are not as easily swayed as in the past. Furthermore, the customer journey has become increasingly complex and non-linear. With the increase in the number of retail models from which to choose, customers have consequentially increased their relative power vis-à-vis retailers.

- Enhance the in-store customer experience. To better leverage their brick-and-mortar footprint, retailers must find creative and value-adding ways of interacting with their customers. Nike, for instance, has equipped their New York flagship store with a basketball court, treadmills, and a soccer area to allow customers to try out the active wear before making their final purchase. They have also recruited in-store stylists to provide fashion advice.

- Proactively manage all four retail models. Whereas the focus has historically been on the Traditional Brick-and-Mortar model, the emphasis today seems to have switched to the Purely Internet-Based model. However, one must not forget that “Showrooming” and “Webrooming” models are crucial, as many customers now fall into one form of hybrid retail models. Furthermore, more and more of today’s customers can be found operating in multiple models depending on the specific purchase. As such, it is increasingly important that as a retailer, one proactively manages all four models simultaneously.

- Coordinate across the different models. Not only does the in-store experience and sales channel need to be enhanced, they also need to be integrated with the digital experience and online sales channel. This is critical to not only maintain a consistent image but also prevent pricing arbitrage by customers, as well as improve the use of inventory across the various channels. Firms such as Alibaba have also shown the importance of having the physical work in conjunction with the digital as illustrated by the leveraging of the Singles Day Gala to support over $38 billion in online sales in just 24 hours in 2019.

The new face of retail is both increasingly complex and multi-dimensional. If firms are to remain competitive, they must embrace these changes and adapt to the new reality.

[/ms-protect-content]

About the Authors

Omar Toulan is Professor of Strategy and International Management at IMD Business School in Switzerland. Professor Toulan holds his PhD from the Sloan School of Management at MIT. His areas of expertise include strategic management, international business, growth strategies, and managing the multinational. Prior to entering academia, Professor Toulan worked as a management consultant for McKinsey and Company, as well as a researcher at the U.S. President’s Council of Economic Advisers.

Omar Toulan is Professor of Strategy and International Management at IMD Business School in Switzerland. Professor Toulan holds his PhD from the Sloan School of Management at MIT. His areas of expertise include strategic management, international business, growth strategies, and managing the multinational. Prior to entering academia, Professor Toulan worked as a management consultant for McKinsey and Company, as well as a researcher at the U.S. President’s Council of Economic Advisers.

Niccolò Pisani is Associate Professor of Strategy and International Business at the University of Amsterdam Business School. He holds a PhD in Management from IESE Business School. Among the topics of his scholarly enquiry are global strategy, sustainability, and offshoring. His research has been published in top-tier academic journals and practitioner-oriented outlets. Prior to entering academia, Dr Pisani worked several years for Sanlorenzo, one of the world’s leading manufacturers in the luxury yachting industry. He also worked as a researcher for Merrill Lynch in its San Francisco office.

Niccolò Pisani is Associate Professor of Strategy and International Business at the University of Amsterdam Business School. He holds a PhD in Management from IESE Business School. Among the topics of his scholarly enquiry are global strategy, sustainability, and offshoring. His research has been published in top-tier academic journals and practitioner-oriented outlets. Prior to entering academia, Dr Pisani worked several years for Sanlorenzo, one of the world’s leading manufacturers in the luxury yachting industry. He also worked as a researcher for Merrill Lynch in its San Francisco office.