The Covid-19 pandemic has birthed an array of challenges which has consequently related in finding solutions, altering the way of life as we once knew it. Working from home to dilute the spread of the virus has caused a surge in demand for smart devices and technology such as laptops and computers.

The silent beating heart of all smart devices starts with a chip. Computer chips have been widely sought after, not only because more tech is being brought, but also, they play a big part in mining cryptocurrency. For this very reason, chip producers like Nivdia have introduced a cap on their chips, preventing miners from purchasing them.

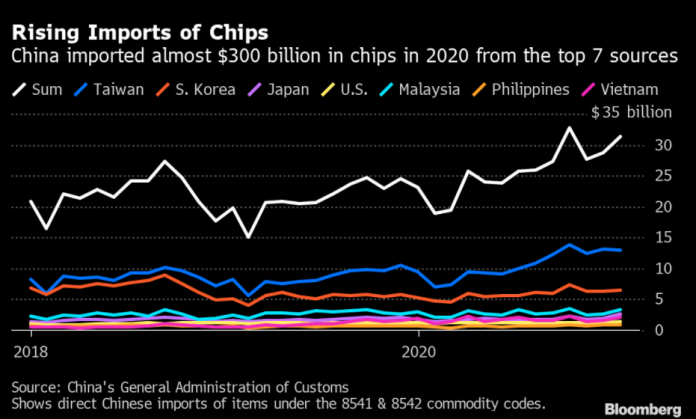

Naturally, the demand for them has undoubtedly created a shortage in the chip market, dubbed ‘Chipageddon’. Cisco, a leading tech chip manufacturer, has claimed that the shortages we are currently experiencing are set to last for another 6 months. Countries are making an active effort to adjust to the demands, importing chips in high volumes.

The pandemic has created a shortage in semiconductor chips which go in almost everything. Although this may not seem like a very big issue on the surface, underneath, it affects many industries.

The automotive industry has taken drastic measures as they face chip shortages. Jaguar Land Rover has halted production and temporarily closed two of their factories facing global chip shortages. Other car manufacturers such as Stellantis are considering replacing digital speedometers with old-fashioned analogue ones to allow production to keep flowing. But how will the shortage affect smart wearables?

Smart Wearables Market

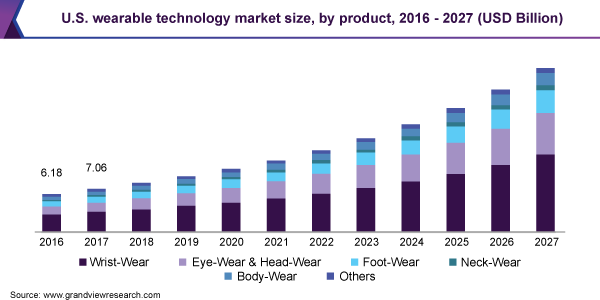

The smart wearables market has grown leaps and bounds over the past few years. But the pandemic has helped to elevate it. Smart wearable technology can be used in a range of different ways.

The first is for personal use and, thanks to the nature of the virus, many have been inclined to buy a smartwatch over the pandemic which helps them monitor their body better as consumers become health conscious.

Secondly, smart wearables have helped businesses cope with changes made by the pandemic. Smart glasses have helped to make manufacturing processes easier, allowing board members to dial in on conference calls and see the entire process without needing to travel for a face-to-face visit, keeping to government guidelines and restrictions.

The use of smart wearables has and will continue to increase over time as they become a key part of life and business. As innovation in the sector continues, we can see more products will continue to become a normal part of life. Eye wear and head wear is set to increase massively over the years as consumers and businesses begin to see their potential.

However, the shortages in chips will result in a decline. As less products become available to buy, and with increasing demands, prices will go up.

The impact of the pandemic

As the pandemic continues to push across the globe, lockdown rules have created a much-needed appetite for electronics. As a result, it is pumping up sales of computers and laptops, making remote work more accessible and less impactful. Sale in other gadgets and subscriptions have also taken off over the pandemic as many looked for different ways to occupy their time. This includes gaming devices and tablets.

Many industry insiders believe the issue with chip shortages will not be resolved until much later this year, leaving big organisations hanging in the balance between releasing new tech and developing new tech and products. The backlog from the pandemic and push on semiconductor chips has created a backlog that would take about 40 weeks to fulfil orders coming in from car manufacturers; time car manufacturers simply do not have.

Increased prices

As with all products that are short in supply and high in demand, consumers will need to consider how the price of electronics will go up. Also, getting and finding some products will be hard.

Large tech organisations like Apple and Samsung have the capacity and buying power to ensure they have priority over chips, ensuring the launch of their products is on time as well as reducing falls in sales.

Unfortunately this does mean, smaller companies that do not have the equity or position to buy chips will undoubtedly suffer. This also means as consumers, there is a chance there will be a decrease in new tech from other companies compared to the big brands.