By Jean-Marc Ollagnier, Sybille Berjoan and Regina Maruca

Accenture’s recent survey of 700 C-suite executives of large businesses in Europe reveals confidence that new global leaders can emerge from this region. They also identify the primary barriers to that end—and the ingredients needed to succeed.

Europe’s large companies need much more than a return to pre-pandemic strategies to be competitive in the coming years. That’s not a negative statement, though. It’s a challenge, which, if accepted, could lead to significant market wins over the long term, in addition to an estimated net job creation of 5.7 million across Europe by 2030.

But there’s not a lot of running room. Large companies in Europe are recovering more slowly from the pandemic than their peers in the US and China. In a best-case scenario, according to Accenture’s new global survey, European companies on average are expected to get back to their pre-Covid-19 profit levels by mid-2022. Meanwhile, APAC companies expect to recover to those levels by the end of 2021, and North American companies, on average, are targeting early 2022.

One major reason why that’s the case: Europe lags most in the domains linked most closely to the digital economy: tech, and software and platforms. That isn’t surprising news, given where European companies were just prior to the pandemic. In 2019, just 3 of the top 20 High Tech companies were European (and European companies held 8% of the global market share), and 3 of the top 20 Software and Platforms companies were European (with European companies holding 7% of the global market share) in 2019. But it still presents a considerable hurdle.

The heartening news is that Europe nonetheless has a strong foundation on which to build, and at least one clear advantage. Before the pandemic, European companies held more than a quarter of leading positions in every industry except for Technology and Software. And European businesses lead overall on sustainability efforts. In fact, half of the most sustainable companies globally are European. That last is a critical point, as the promise of blending sustainable and digital transformations to create value has become clear (See TEBR, March 2021: “Why Fixing the Planet is also about Seizing Business Opportunities”.)

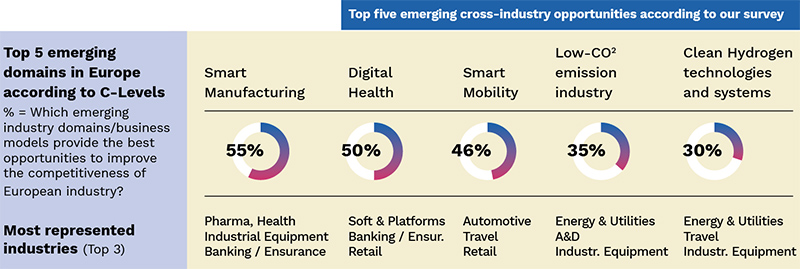

Our current global research, which included 700 European C-level executives of large companies in a survey that spanned 11 industries and 13 countries affirms this1. Our findings in fact show sharp increasing demand for sustainability correlating with powerful emerging industries in Smart Manufacturing, Digital Health, Smart Mobility, and Energy Transition (including low-CO2-emissions industry, and clean hydrogen technologies and systems). These areas have implications that cross traditional industry lines, as the chart below shows.

More specifically, our research finds that the top three emerging domains in Europe represent an enormous market with outsized growth potential: a threefold increase in market size for digital health between 2020 and 2025, a threefold increase in market size for smart mobility in that same period, and a 2X increase in market size for smart manufacturing.

A much-needed surge

Where Europe needs to surge, then, is in digital adoption, including Artificial Intelligence, 5G, hybrid cloud, and clean hydrogen; companies also need to integrate those investments, strategically, with sustainability efforts. Early signs of this happening are positive. We found, for example, that 88% of European companies plan to increase their investments in digital transformation (and in linking digital to sustainability transformation) in 2021.

However, making this spending worthwhile means engaging in a broader effort: building the ecosystems needed to power innovation and delivery and ensuring the readiness of the workforce to contribute. Productive momentum and lasting success will additionally turn on the ability of European governments and the EU to set new policy based on collaborative discourse.

Ecosystems

According to the World Economic Forum, some 60% – 70% of new value created in the economy by 2030 will be based on digitally enabled platforms2. To that end, business leaders need to develop business models that eschew vertical integration in favor of cross-industry collaboration and innovation. New ecosystems must also tap the expertise of startups and the academic communities, to help keep cutting-edge ideas at the fore.

In Automotive, to take one example, 48% of the new value created by 2030 will be related to mobility and digital devices3. And the Catena-X network, formed in March 21, is on the case4. This network is made up of automotive manufacturers and suppliers, dealer associations, and equipment suppliers including the providers of applications, platforms and infrastructure. Its goal is to create a uniform standard for data exchange along the entire automotive value chain (the European International Data Spaces Association (IDS) standard forms the basis for data exchange in the network). Network participants expect this to yield more efficient quality and logistics processes, greater transparency in terms of sustainably reduced CO2 emissions, and simplified master data management. The network will also make it possible to create digital twins of the automobiles, forming a basis for innovation. Pilot projects are currently expected to focus on five areas: quality management, logistics, maintenance, supply chain management and sustainability.

Workforce

Reskilling the workforce will support employment growth, with promising opportunities to do so including enhanced STEM development, life-long learning programs, and industry-specific training.

With the pandemic persisting as we conducted our interviews, health and safety remained the top “people” issue for European companies across all industries; 72% of our respondents felt this way.

But two other challenges were also significant, related to the effect of automation on jobs (47%) and reskilling/upskilling (45%). Automotive and Energy & Utilities executives (57% for both) cited automation as a significantly pressing issue, as did Comms & Media and Industrial executives (53% for both). Reskilling appeared most pressing for Banking/ Insurance (56%) Energy & Utilities, and Retail, Pharma and Industrial Equipment executives (52%).

There’s good news here in that 86% of companies in our study plan to upskill/reskill up to 25% of their workers in the next three years to keep pace with their company’s need. That adds up to 7 million up- and re-skilled workers. The challenge lies in moving from plan to continuous practice.

European governments and the EU

Some of the biggest challenges facing European companies are external. In their digital transformation efforts, for example, our survey participants cited a lack of harmonized rules and standards for use of tech in their industry sector, as well as regulatory barriers, among their top challenges. Similar issues stymie sustainable transformation, they reported, including lack of regulatory certainty, guidance, and standards.

As one consumer goods CEO from Italy said: “Within Europe, we need a strong cohesion, and with cohesion, we can – as team players – achieve a quantum leap in the standards of European Cooperation.” An executive in the communications and media field, in Poland, concurred: “We desperately need a European industrial policy.”5

The top concrete actions that our survey respondents identified as priorities for the EU and European governments are as follows:

To help companies achieve their digital goals, executives expect the EU and European governments to: invest in emerging technologies (47% ranked this first); advance European standards on cybersecurity (38%); and invest in training schemes and upskilling programs related to digital (37%).

To support sustainability, our respondents look to the EU and European governments to prioritize: supporting relevant skills development initiatives at national and European levels (35%); investing in hubs and networks to scale up and commercialize breakthrough technologies (25%); and supporting the recognition of existing corporate governance guidelines, e.g. ESG reporting requirements (25%).

To help develop the much-needed workforce, C-levels expect the EU and European governments to: invest in industry specific upskilling/ reskilling programs (43% ranked this first among priorities); Invest in training programs for emerging industry segments (35%); and invest in training schemes and upskilling programs to develop specific skills (34%).

BUILD ON MOMENTUM

Describing what’s needed is the easy part. Executing the necessary changes in organizations and governments will be far more difficult. But courageous leaders will persevere. There’s already momentum on which they can build. And lasting rewards in sight.

About the Authors

Jean-Marc Ollagnier is the chief executive officer of Accenture in Europe, with management oversight of all industries and services in Europe. Based in Paris, he is also a member of Accenture’s Global Management Committee.

Sybille Berjoan leads the Accenture Research European team and drives the European Thought Leadership agenda. She’s based in Paris.

Regina Maruca is senior principal at Accenture Research and is based in Boston.

References

- 1 Accenture Research interviewed 700 C-suite executives from large companies (50% above $10bn revenues) in 11 industries and 13 countries via online surveys in March-April 2021. Each interview took 30 minutes. Subsequently, we conducted phone interviews with 35 C-suite executives from 11 industries and 14 countries via phone in February-March 2021. Each interview took ~40 minutes. The full report is available at Europe’s new dawn (accenture.com).

- 2 Shaping the Future of Digital Economy and New Value Creation > Platforms | World Economic Forum (weforum.org)

- 3 Accenture Research, 2020. Mobility X | Accenture

- 4 https://catena-x.net/de/

- 5 Accenture Research in-depth interviews on Europe industries rebound and reinvention, February – March 2021.