In the dynamic landscape of cryptocurrency, safe storage emerges as a critical consideration. Each wallet option offers unique benefits and drawbacks, directly affecting how users manage and secure their digital assets. This analysis explores the functionalities of both custodial and non-custodial solutions, empowering users to make an informed decision tailored to their individual risk tolerance and investment goals.

With the ever-growing popularity of crypto wallets, the question of has become paramount. Choosing between custodial and non-custodial wallets can feel like navigating a financial labyrinth. Each option offers distinct advantages and disadvantages, directly impacting how you control and safeguard your digital assets.

Understanding the Basics

With the custodial option, convenience reigns supreme. Users hand over control of their private keys to a third-party service provider. These providers act as middlemen, safeguarding your digital assets and fending off cyberattacks. This simplified approach makes crypto security more approachable for beginners, offering a layer of protection many find comforting.

Custodial wallets prioritise ease of use but at a cost. Unlike non-custodial alternatives, users relinquish control of their private keys to a third party. These parties hold your crypto assets, promising protection against cyberattacks and simplifying wallet security for beginners. This convenience comes with a trade-off: you trust a third party to manage your funds securely.

The primary characteristics encompass simplicity of usage, the capacity to carry out activities such as purchasing, selling, and trading within the platform, and dependence on the security protocols of the supplier. Risks include the possibility of losing money as a result of hacking, account restrictions, or service shutdown. Personal identity may also be required for services in order to comply with regulations.

Under arrangements, the supplier keeps track of and encrypts the user’s private keys in order to enable transactions over their platform. Custodial wallets are convenient and easy to use, but there are Security and privacy issues that come with using them.

Use Cases

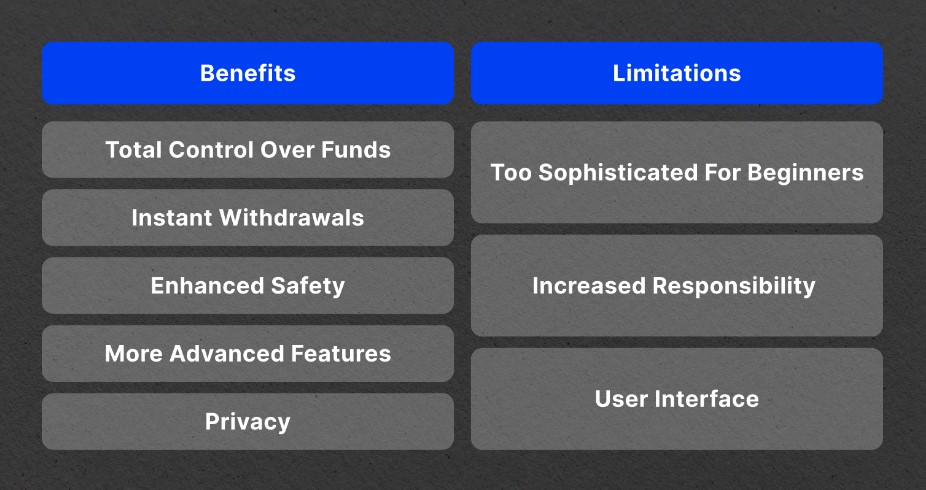

Non-custodial wallets can be used in a variety of ways, allowing users to diversify their trading options and enjoy the advantages of decentralisation.

- Transact freely: Make crypto transactions without limitations or fees potentially imposed by custodial services. This can be particularly appealing to users who engage in frequent trading or prefer decentralised exchanges (DEXs) with lower fees.

- Maximise Privacy: Bypass KYC and AML checks, offering a greater degree of anonymity for transactions. It’s important to note that regulations surrounding KYC/AML compliance can vary by location, so staying informed is crucial.

- Explore Uncharted Cryptos: Gain access to a wider universe of cryptocurrencies, potentially including new or niche projects not yet listed on custodial exchanges. This allows users to explore innovative ventures and potentially capitalize on early investment opportunities.

- Resist Censorship: No central authority can freeze or restrict access to your funds. This fosters a sense of financial independence and empowers users to manage their assets without fear of arbitrary intervention.

- Embrace Decentralisation: Fully participate in the self-governed nature of blockchain technology. By holding their own private keys, users actively contribute to the decentralised ethos of cryptocurrency and avoid reliance on centralised institutions.

However, this control comes with responsibility. Users must securely manage their private keys and recovery phrases, as losing them can result in permanent loss of access to their crypto.

Top Choices on the Market in 2024

There are many advanced and practical choices on the market that you can consider, each with its unique advantages and features. Let’s explore.

Gemini

Renowned for its user-friendly interface and robust security features, Gemini is a popular choice for beginners and experienced investors alike. Regulated by numerous agencies, Gemini offers a vast selection of over 80 cryptocurrencies for trading and safekeeping. Additionally, they provide strong earning potential through cryptocurrency interest accounts, making it an attractive option for those seeking to grow their holdings.

Coinbase

As a household name in the cryptocurrency space, Coinbase offers a secure and convenient platform for buying, selling, and storing digital assets. Their user-friendly interface makes it easy for newcomers to navigate the world of crypto, while robust security measures ensure the safety of your holdings. Coinbase also offers a variety of educational resources and tools, empowering users to make informed investment decisions. However, it’s important to note that their selection of tradable cryptocurrencies may be more limited compared to other custodial wallets.

Binance

A global leader in cryptocurrency exchanges, Binance offers a comprehensive custodial wallet solution alongside its advanced trading platform. Binance caters to experienced investors with a vast selection of over 350 cryptocurrencies available for trading and custodial storage. They boast high liquidity and competitive fees, making them ideal for active traders. However, the platform’s interface can be complex for beginners, and regulations surrounding Binance’s operations may vary depending on your location.

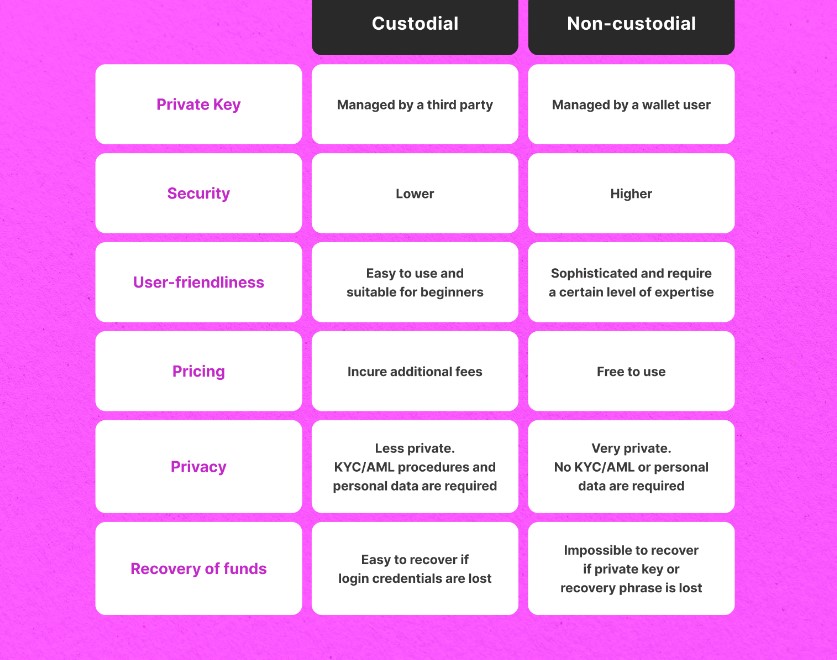

Critical Differences from Regular Alternatives

As discussed, the biggest differentiating factor for custodial wallets is their third-party integration, enhancing the security levels for users and giving them peace of mind against cyber threats. However, they are also much simpler due to limited responsibilities on the owner’s part. Since third parties take care of the technical details and other complex matters, users can just deposit, trade or withdraw funds without extra hassle.

On the flip side, non-custodial wallets are cheaper and more anonymous since there is no need to involve extra parties within your operations. Custodians require fees for their rendered services, and in some cases, the fees might be too steep for your financial capabilities. The same is true for anonymity, as many users enjoy their ability to stay anonymous when they transact with crypto.

Also, the control comes with an anonymity trade-off. Non-custodial wallets often bypass Know-Your-Customer (KYC) and Anti-Money Laundering (AML) checks, which can raise regulatory eyebrows. These protocols are crucial for verifying counterparties and transactions preventing issues like stolen funds or security breaches. Skipping KYC/AML is like inviting trouble – think shady characters at the casino.

Finally, regular wallets don’t have advanced recovery options. While there are backup keys or cold storage options, if you lose your passwords, there are no effective ways to recover funds. With non-custodial wallets, fund recovery becomes much easier and plausible, even in dire circumstances.

Final Takeaways

Custodial wallets are user-friendly and accommodate newcomers well. They might charge hefty fees but offer easy access and security. Non-custodial wallets grant complete control over your private keys (like owning your car keys). These can be free but require more effort to manage securely.

Non-custodial wallets are gaining traction as security becomes a top priority. Consider factors like security measures, regulations, and features like supported currencies or staking options when choosing a wallet. Some users even combine both types for a balance. Remember, security reigns supreme – choose a wallet that keeps your crypto safe.

All the photos in the article are provided by the company(s) mentioned in the article and are used with permission.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.