Like many other things in the modern world (such as our road transport systems, for example), company boards operate according to the arrangements that were valid when they came into being, but many of which can no longer be taken for granted. What to do?

E.O. (Edward Osborn) Wilson, the Harvard social biologist, was asked, “Will we solve the crises of the next hundred years?” “Yes, if we are honest and smart,” said Wilson. “The real problem of humanity is the following: we have palaeolithic emotions, medieval institutions, and accelerating God-like technology. And it is terrifically dangerous, and it is now approaching a point of crisis overall.” This sombre assessment could also apply to the world of governance. Before directors become defensive or indignant, let me explain and set up this “provocation” for looking for better ways to design a board operating model – which includes the systems, processes, structures, ways of working and use of technology, necessary to be effective and efficient.

Firstly, regarding palaeolithic emotions, despite our greater levels of self-awareness and behaviour policing, we still have limbic brains. And these still play far greater roles in overriding our neocortices than we give them credit for. We may think we are far better than early mankind at making big decisions, rationally, but most of the evidence shows otherwise. We still see the full plethora of human deficiencies affecting decision-making: bias in its many forms, hubris, complacency, naivety, and greed.

Secondly, regarding boards as medieval institutions, while not medieval, by and large, the unitary board model is a throwback to the late 1800s. It has remained largely unamended, structurally and in role, despite scrutiny and responsibilities having gone off the charts, and social, economic, and technological circumstances today being unrecognisably different.

Governance models are caught in a time warp from an era when information arrived by train or steamship or telegraph, technology was non-existent or moved at a different pace, where regulatory oversight and controls were few, and litigation was extremely rare or at least limited.

Today, information is instantaneous and overwhelming, investment is democratised and dispersed, capital is highly mobile and no longer patient, i.e. it doesn’t come just from a few monied (and presumably astute) individuals or families, and broader stakeholder demands and expectations are rampant and hard to predict.

“In nineteenth century literature the board is often conceptualised as the body which supervises the management on behalf of the shareholders.” For many – if not most – boards, this role has not changed. (The Board of Directors: Composition, Structure, Duties and Powers, Davies. P.L., 2000)

One could argue that, in theory, a medieval institution bestows some benefits if it is highly trusted, but a 2022 PwC business research survey shows that, while 87 per cent of business executives believe that consumers highly trust their company, only 30 per cent of consumers actually do.3. Building and maintaining a sustainable brand and social licence to operate is a fundamental task that is defeating many boards.

Thirdly, and lastly, regarding “accelerating god-like technology”, we are on the threshold of the fifth industrial revolution and Web 5.0. It is only now dawning on many executives and boards the disruptive but also liberating power that AI will bring, but we are well short of being on the front foot with how to harness this immense power and how best to govern it, both as individual companies and collectively across economies and society.

So where does this leave us, and what is the actionable insight worth reflecting on?

I will make the case that we are approaching a crossroads in enterprise governance and cannot continue without confronting the reality that “more of the same” will likely not be adequate. Consequently, I will argue for a new type of governance construct, a networked board operating model, not suitable for every board, but one that may well help some boards to be more “fit for purpose”.

In doing so, this conceptual paper aims to:

- address an observed deficit in thinking (and lack of debate) about fundamentally new or less-conventional board governance models; and, more specifically,

- examine the power of network theory applied as a possible solution, that is “hiding in plain sight”.

Crisis? What crisis?

Look at research into the challenges of governing a large, listed enterprise today, or even a large not-for-profit, and you will see plenty of anecdotal evidence that the directors are struggling, even though many won’t admit to it. Here is a sample of different data points.

In PWC’s annual board survey (2022, covering over 700 public-company board respondents, internationally), fewer than two-thirds (65 per cent) of directors say their board understands the internal processes and controls around ESG.4

In another recent joint PWC and Conference Board survey5 of executives (not NEDs):

- 89 per cent want one or more of their directors replaced;

- 50 per cent of executives say their boards do not understand the impact of digital technologies, and 40 per cent say they do not understand the company’s climate strategy;

- Only 33 per cent say their boards ask probing questions;

- Only 50 per cent say their boards have a strong understanding of cybersecurity and data privacy vulnerabilities and the impact of digital transformation and emerging technology;

- 48 per cent believe their boards do not fully understand shareholder priorities;

- 57 per cent do not think their boards fully understand the concerns of stakeholders other than shareholders.

Then, from a NEDs perspective, in a McKinsey 2022 Global Survey of boards,6 directors report both a growing number of days spent on board work – an almost 20 per cent increase in 2022 over 2020. “Yet despite that additional time spent, many directors do not report a corresponding increase in their boards’ overall impact on value creation.” Of course COVID explains something, but it doesn’t explain everything.

In 2020/21, I led joint research with EY in Australia,7 interviewing non-executive directors of many of their largest clients, and we had consultations also with governance partners in the UK and EU.

It showed that for some boards, not all, the current model is nearing its use-by date and may be ill-suited to the demands of “stakeholder capitalism”, a digitised VUCA world where events move faster and with greater amplification, and with an almost unmanageable compliance-and-reporting load on boards.

The task of governing has never been a trivial one, legally speaking, but today, the time, capacity, and knowledge demands placed on part-time directors and the diminishing “risk versus return” equation means that, for many, the NED game is not worth the candle. As an aside, there is an interesting conversation to be had about where this leaves shareholders and other stakeholders if the “best and brightest” go elsewhere (a vexing question for another day).

What are the external forces at play reshaping governance?

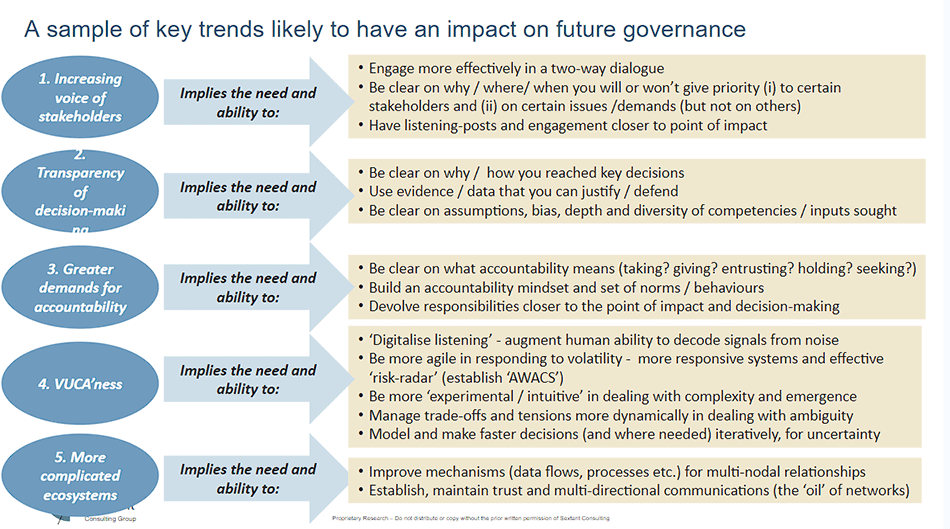

The joint EY research considered key trends impacting governance.

We can argue whether the trends (summarised in the accompanying figure) will have the same level of impact, board by board, but there is no avoiding the fact that these forces are (and will be) having a significant influence.

Think about the demands of “stakeholder capitalism” and the need to tap into expectations from multiple constituencies in a way that boards are suitably and reliably informed.

Then consider the growing set of topics and disciplines that boards need to have some mastery over: sustainability in its broadest sense, including impact (the UN SDGs) and, specifically, climate change. Add in AI and digital transformation, cybersecurity, and diversity. These are not trivial topics. Then add the growing set of regulatory and disclosure requirements, some of them, but not all, relating to “ES and G”. Finally, add the general vagaries and demands of operating in a “VUCA” world, while achieving and improving required shareholder performance.

Some directors may think this is manageable and they are up to the challenge, but we need to be realistic. Even if (and it’s a big “if”) management is doing its job well and providing clear, well-researched, actionable insights to the board, we cannot assume that the majority of part-time, external directors will independently (i.e. with an independence of thought):

- know what their key stakeholders, including staff, expect and feel;

- be able to interpret weak signals from noise;

- be able to apply their own knowledge (gained over decades) in a markedly different environment where heuristics may not count for much; or

- remain adequately alert to and tapped into key events and developments internally and externally.

Governing effectively in the face of these pressures is a real stretch, even for the most accomplished of directors. NEDs could look to clock up more and more hours at and between board meetings and strategy days, but how realistic is that? Will they become more effective and efficient in their stewardship and oversight tasks?

In short, the pressures being placed on non-executive directors as part-timers, operating in a “rickety old governance model” that is still largely “manual”, means increasingly that failures in governance are “an accident waiting to happen”. Directors in particular should be concerned as the heat is turning up, but instead are responding “like a frog in the pot”.

If the above issues resonate with you, I would encourage you to ask yourself:

- Are these pressures and changes accelerating and enduring on your board(s)? Or likely to abate?

- Are you already noticing or experiencing signs of strain or dissonance?

- Are the impacts potentially consequential (or just marginal or trivial)?

- If yes to two of the three, what do we do about it?

The conclusion about the current state of boards (in the EY research) was that boards are caught between two shifting tectonic plates: (i) the outside pace of change moving faster than boards are responding; and (ii) also the inside pace of change (within management and the organisation) moving faster than non-executive directors are able or willing to do.

As Jack Welch said, “If the rate of change on the outside exceeds the rate of change on the inside, the end is near.”8

If you accept the argument that some boards are really struggling (and it is generally not for a lack of effort), then as a board chair or director you have four evident choices:

- Do we do nothing, ignore this, and hope it will pass?

- Do we double down on the existing ways of doing things, by adding more processes and procedures and control systems?

- Do we go back to governance basics (whatever that may mean), some mix of de minimis duties and reject or ignore other imposed expectations or responsibilities? Or

- Do we consider a different construct that is better able to address new realities inside and outside of the boardroom?

I next address the last question (iv) through the lens of a networked board construct. This is not simply or solely a structural option. To be responsive and effective to the forces at play, all the elements of board operating models need to be considered and designed to be fit for purpose, i.e., processes, use of technology, types of skills, behavioural dimensions, and thinking styles – and yes, structures too – need to be rethought and reimagined.

What might a networked board look like, and how might it operate?

First, let us acknowledge that there are plenty of examples of the power of social networks and networked organisational models (I’ll exclude technology networks or network platforms as an even-more-potent category). To cite just three notable “superpowers”:

First, networks are associated with greater levels of responsiveness, speed, and agility, hence their suitability to a VUCA context.

Provan and Kenis (2007) state: “Networks are frequently discussed as adaptable, flexible forms (Huxham and Vangen 2005) that are ‘light on their feet’ (Powell 1990). It is their flexibility that gives networks their advantage over hierarchies, which can be cumbersome and bureaucratic.” And, “These same organisations can reduce or even break their current relationships and develop ties to others, as needs and tasks change (Larson 1992). This flexibility allows networked organisations to respond quickly to competition and other environmental threats, as well as to opportunities.”

Second is their ability to achieve the “1+1=3″ effect, i.e., synergistic benefits. Provan and Kenis again: “Through networks, organisations can quickly and efficiently work with one another to achieve specific goals that require combined resources and expertise that hierarchies alone could not readily accomplish” (Kapucu and Van Wart 2006).

Third is their ability to make sense of, and navigate through, “complexity”. Provan and Kenis observe that: “The advantages of network coordination in both public and private sectors are considerable, including enhanced learning, more efficient use of resources, increased capacity to plan for and address complex problems, greater competitiveness, and better services for clients and customers.”

Network thinking is a powerful way of responding to the “complicatedness” and, frequently, complexity that enterprises and their boards are dealing with.

For those of you who would rather avoid reading literature reviews, I would note that networked governance is not a novel concept, but is applied almost exclusively in the context of governance over multiple linked entities, not for a single board or enterprise.

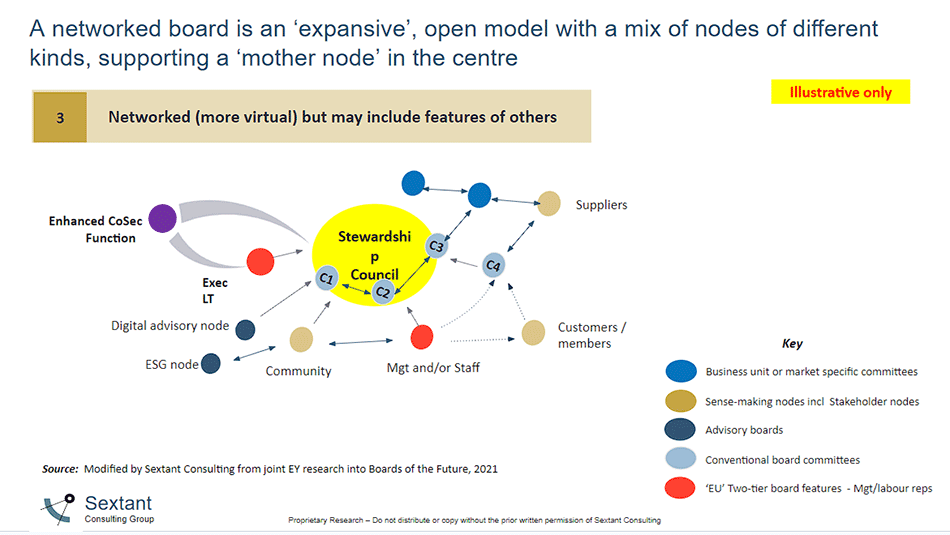

Here is what a networked governance model could look like.

Design logic, role, and high-level purpose

The intent is that by networking together a set of contributing bodies, the board is able to achieve a force-multiplier effect, i.e., these entities have a multiplicative effect as “sensors” in detecting emergence, as forums that engage in two-way dialogue and debate, and as contributors that provide particular expertise. In effect, the network enables a virtual, augmented board.

Crucially, in terms of mindset, the board recognises the limitations of its abilities and the advantages of harnessing the vigilance, vantage points, vision, and views of others. It sees governance not as a closed system, but as an open system, as a “team sport”.

A networked model is non-linear, to mirror the external forces at play that don’t follow straight-lines, that have all kinds unidentified systems’ effects upon each other, and that are impossible (or it is unwise) to neatly package up and allocate in a more functionally organised, board committee way.

Unlike a conventional model, for a networked board, the whole is greater than the sum of its parts. As Russell Ackoff said: “A system is never the sum of its parts; it’s the product of their interaction,” which is along the same lines as Metcalf’s Law.

Here are six key design features that have been identified to distinguish a networked board model and that also enable it to respond more effectively to a VUCA world.

Feature 1: Nodes and feelers (“listening posts”) that work together with different company insiders and outsiders, on particular governance tasks and / or on advisory tasks which tap broader expertise. Nodes are a detection and transmission mechanism, moving information and insights back and forth.

Such a governance ecosystem could enable the board to move with more fluidity and agility, if it devolved some decision-making to particular “nodes” on certain topics.

Feature 2: Sense-making is dispersed (“devolved”) horizontally, outwards, not just vertically downwards, and sense-checking (verifying and testing) is also more widely distributed (achieving what M.G. Taylor would have called “Vantage Point” power).

In this way, the enhanced board, and the executive itself, is far more likely to be more agile and responsive to emergence and rapid developments as context changes; more able to separate “signal from noise”.

Feature 3: Decision-making is also “dispersed outwards” (and not only devolved downwards, as is usually the case) with clear delegations of authority (DOAs). A core design principle is to accelerate decision-making where needed by pushing that responsibility closer to the edges of the network, i.e., to the points of interaction with the nodes.

A recent McKinsey study indicated that: “Leaders are growing increasingly frustrated with broken decision-making processes, slow deliberations, and uneven decision-making outcomes. Fewer than half of the 1,200 respondents of a McKinsey survey report that decisions are timely, and 61 per cent say that at least half the time they spend making decisions is ineffective.”10

Feature 4: There would be a mix of different nodes serving different purposes. Some may be focused on engaging with specific constituencies on particular topics, e.g., perspectives amongst customers or supply chain partners; others focused on particular communities or catchments (geographic, socioeconomic); others may be topic-specific, e.g., ESG.

Not all nodes are created equal. Some may have more devolved decision-making rights than others. Some may have more participants. Some may look or act like conventional board committees; others may have purely advisory (non-binding) powers.

Feature 5: The model would be enabled and supported by an enhanced CoSec function, to help with “fact checking” of data, analysis, and “what-ifs”, scanning, listening, and sense-making; provision of “bias-busting services” (e.g., red team reviews).

Crucially, the CoSec function (call it the “governance intelligence team” to convey its true design intent and role) enables the smooth flow of information back and forth between nodes, plus board and executive. It also acts as a “network administrator”, ensuring that the necessary enablement is in place for the nodes to operate seamlessly.

A more muscular function could include not just corporate lawyers but data scientists and analysts, modellers, scenario planners, sociologists, behavioural economists and scientists – to provide the cross-disciplinary thinking and analytical grunt to stress-test the complex or multifaceted decisions coming to the executive and board.

The team also reduces the board’s unhealthy reliance on management for insights and intelligence, for example where all customer, supplier, and staff feedback is gathered and curated by the executive.

Feature 6: The main “mother node” is where most of the more material, legally onerous decision-making rights lie – the retained or residual rights, after delegating other decisions to specific nodes as required.

As the nodes handle most of the sense-making and external detecting which influences boards’ stewardship (i.e., long-term decision-making), the “mother node” tends to deal more with the classic governance duties of oversight and compliance.

That does not mean that none of the oversight tasks happen in the nodes. For example, the customer node or supplier node may be providing important feedback about how well external-facing compliance or other commitments (or brand promises) etc. are being delivered or fulfilled.

Conditions for success

What are the critical factors or elements that need to be in place and met for a networked model to be efficient and effective? There are nine main conditions for success, not in prioritised sequence:

- “Hard centres and soft edges”. This means that the nodes need to have a core set of responsibilities or mandates that are well defined, limited in their ambits, and specific to each of them and to their agreed sphere (or constituency). Away from their core responsibilities (i.e., at the boundaries of their mandates), there is scope and expectation that nodes identify, “share and flag”, and redirect other topics that may not precisely fit their remit to a more appropriate node(s). This then requires

- Clarity of focus and clear delegations of authority (DOAs) that are more widely dispersed horizontally, not just vertically (down to management). Releasing some control is essential to achieve speed and agility (and localisation) of response. Directors need to be willing to accept this trade-off. This is not a mechanism that will work for “control freaks”, and assumes that NEDs don’t cling to the illusion that they are exercising “real” control.

- Therefore, this requires the board to change its mindset about its role, to see itself not as the “chief comptroller” and orchestrator but as an integrator and synthesiser. This means an expanded view of governance that goes beyond “Corporate governance is the system by which companies are directed and controlled” (Cadbury Report, 1992).11 The “build” on this definition is that boards see their roles as facilitators of effective strategic decisions and monitors of actions taken. Nodes would help to achieve this and provide suitable optics on both aspects.

- Regulation and governance codes are not used as a convenient excuse for not considering or adopting a networked board model, e.g., exposing the NED members of nodes to directors’ liabilities, or the “comply or explain” approach of “governance codes of best practice” (such as the ASX’s Corporate Governance Principles and Recommendations).

- Levels of trust therefore also need to be high and worked on continuously, even more than in a unitary board. Transparency is the facilitator and expeditor of trust.Provan and Kenis (2007) say: “For understanding network-level interactions, however, it is the distribution of trust that is critical and whether or not it is reciprocated among network members.”

- Smooth flow of information. Communication is the “grease” of networks and supports trust-building. Mechanisms and enablers need to be in place to ensure that information flows fast, reliably (without distortion), and efficiently (seamlessly) to where it is needed. This is achieved both via technology and by “behavioural” factors. It would also be expedited by a beefed-up CoSec function (see below)

- Sophisticated capabilities in stakeholder or “constituency” management and alignment. This requires processes, virtual or physical fora, technology and systems, attitudes and behaviours that support a two-way dialogue and reliable decoding of stakeholder messages.As one interviewee in the original research put it: “There may be a need for a new type of role on boards, a sort of ‘ecosystem manager’. This role would help identify people / constituencies whose voice needs to be heard at the board level, before cultivating these relationships.”

- Technology- and data-powered. Here is where board 4.0 (the web 4.0 moniker) makes its impact in terms of enablement and “augmented intelligence” applied to decision-making. Technology will be intrinsic to reducing non-value-adding reading and checking by boards (as a capacity-liberator). AI will reduce the procedural checking burden and will also be a significant support for sense-checking by boards. To achieve that end, AI systems will be independently governed and vetted, elevating trust. AI will supplement NEDs, not substitute them.

- Establishment and leverage of an expanded or augmented CoSec function and team, with technology to assist, as outlined in Feature 5 above.

In conclusion

The future governance trends that we identified suggest that transformational thinking and responses (rather than incrementalism) are required. These forces are considerable and are not going to abate: the increased agenda and expectations, greater scrutiny, the resulting volume of board work, the rate and extent of external change, etc.

Now is not the time to give in to inertia and cling to conventional models, uncritical or unimaginative thinking, or the consensual hallucination that we can somehow beat the odds of the forces bearing down on boards and enterprise governance more broadly.

The networked governance model offers the “force-multiplier” power of different constituents and vantage points, joined up conversations, better “signal antenna” and “risk radar”, a more agile “battle rhythm” with faster, more widely shared and dispersed “decision-making” and responses.

In short, a 21st-century response is needed for fifth-industrial-revolution dynamics, drawing on the capabilities and thinking of Web 5.0.

So, my challenge to you is to think about whether we can afford to design a better mousetrap? Or should we borrow and repurpose something already being used, in order to do something creative and unconventional?

About the Author

Dr. Dean Blomson’s executive expertise comes from an impressive career as a strategy and transformation advisor and executor (including in transactions); from his research and experience teaching on MBA programmes as an industry professor, and in board roles (both governance boards and advisory boards). His passion is helping executives to make better decisions so that businesses outperform and “avoid the avoidable” mistakes that often befall them.

Dr. Dean Blomson’s executive expertise comes from an impressive career as a strategy and transformation advisor and executor (including in transactions); from his research and experience teaching on MBA programmes as an industry professor, and in board roles (both governance boards and advisory boards). His passion is helping executives to make better decisions so that businesses outperform and “avoid the avoidable” mistakes that often befall them.

References

- https://harvardmagazine.com/breaking-news/james-watson-edward-o-wilson-intellectual-entente

- https://www.oecd.org/daf/ca/corporategovernanceprinciples/1857291.pdf

- https://www.pwc.com/us/en/services/consulting/library/consumer-intelligence-series/trust-new-business-currency.html

- https://www.pwc.com/us/en/services/governance-insights-center/library/annual-corporate-directors-survey.html

- https://www.conference-board.org/press/press-release-board-effectiveness-2023

- https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/five-ways-to-increase-your-boards-long-term-impact

- With EY’s Global Centre for Board Matters https://www.ey.com/en_au/board-matters/board-of-the-future

- Quoted by Allison, S. (10 February 2014). The responsive organisation: Coping with new technology and disruption. https://www.forbes.com/sites/scottallison/2014/02/10/the-responsive-organization-how-to-cope-with-technology-and-disruption/?sh=29f457943cdd

- Keith G. Provan, Patrick Kenis, “Modes of Network Governance: Structure, Management, and Effectiveness”, Journal of Public Administration Research and Theory, Volume 18, Issue 2, April 2008, Pages 229–52

- “What is decision making?” McKinsey Explainers https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-decision-making#:~:text=Decision%20making%20is%20simply%20the,complex

%20in%20an%20organizational%20context. - “Report of the Commitee on the Financial Aspects of Corporate Governance” https://www.icaew.com/technical/corporate-governance/codes-and-reports/cadbury-report

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)