Crypto ownership in Europe is quickly ramping up. As adoption and business utilisation increase, the number of people who own crypto assets is rising rapidly. However, it’s not so clear-cut. Certain countries have much higher adoption rates, which has an impact on how businesses leverage the technology.

As the number of people holding crypto increases, the perception of it will change, altering the way it’s used and integrated into our lives. Adoption rates are growing exponentially, but what does this mean for you? Let’s dive deeper.

The current state of crypto ownership in Europe

There are an estimated 742m people living in Europe. Of those, approximately 31m hold crypto, accounting for 4% of the population.

According to the European Central Bank’s financial stability publication, as many as 10% of households could own crypto. With an average of 2.3 persons per household, the per household and per capita figures align closely, indicating a 9% to 10% ownership rate is likely accurate.

Although average crypto ownership in Europe is around 9%, the figures differ significantly by country. In 2022, around 18% of the Slovenian population held crypto, compared to just 5% of French citizens.

With countries like Slovenia, Croatia, Estonia, Lithuania, and the Netherlands having some of the highest crypto ownership rates in the world, it’s evident that countries that invest more in digital infrastructure and financial technology (Fintech) typically have a higher crypto ownership rate.

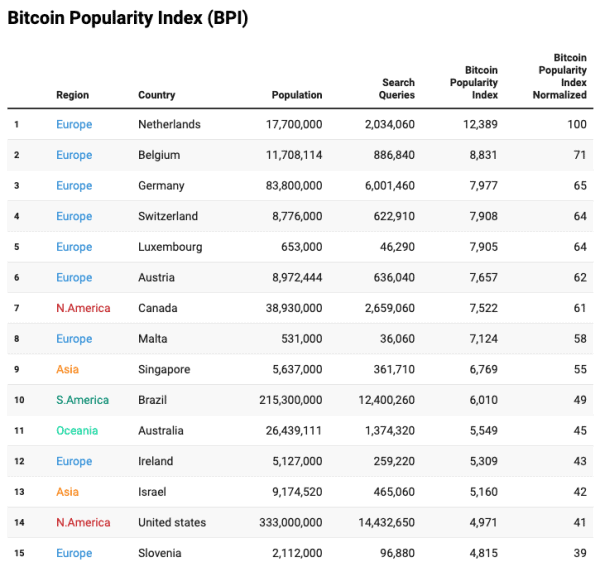

The Bitcoin Popularity Index takes search query data from various countries and normalises it on a per-capita basis to show national preferences for Bitcoin. European countries account for 9/15 of the top entries, highlighting the continent’s positive sentiment toward crypto.

How have crypto adoption rates changed?

The percentage of people who own crypto surged significantly in recent years. Statistics from Visual Capitalist show that the crypto ownership growth rate in Europe has surged by 60% between 2023 and 2024, rising from 31m to 49m holders.

Europe has the third-highest rate of adoption globally. It outpaces North America, Asia, and Africa but falls behind South America and Oceania, with both regions boasting a percentage change of over 100%.

In the United Kingdom, the number of people holding crypto has surged over the past five years. In 2020, an estimated 5% of people held crypto assets. However, that figure rose 140% to 12% by 2024, indicating a significant change in attitude toward the asset class.

It’s clear that crypto ownership rates are on the rise, and Europe is at the forefront of the movement. With adoption rates rising by double-digit percentages yearly, we could see an influx of millions of people into the crypto space over the next few years.

The benefits of increased adoption

Increased crypto adoption comes with many benefits that will impact businesses and the average person. Some of the most substantial include:

Security

Using a crypto payment gateway can also protect businesses from fraud and other malicious activities. Companies are forced to deal with fraud risks like chargebacks, identity theft, and account takeovers, which can cause substantial losses, affecting users and businesses.

However, the blockchain is immutable, so bad actors cannot falsify records. Moreover, transactions are publicly viewable and irreversible, so it’s impossible to lie about sending a payment. Crypto also offers secure identity verification, helping to prevent identity theft and account hijacking.

Transparency

Outside of preventing fraud, crypto integration has several other benefits for businesses relating to transparency. The blockchain offers a permanent, decentralised way to store important information. Data is fragmented, encrypted, and distributed across many devices, eliminating any chance of loss.

The enhanced transparency offered by crypto technology can also help businesses build trust with customers. The public can verify every transaction, and the company cannot sell user data, enhancing customer privacy.

Reduced costs

Crypto integration can even save businesses money. Instead of relying on intermediary services like banks and payment processors, businesses can use crypto to facilitate peer-to-peer transactions, reducing reliance on paid services and improving settlement times.

Cross-border payments pose significant challenges to businesses. Fees for wire transfers and currency conversions are expensive. However, crypto payments can be sent globally at no additional cost, enabling companies to transact in new regions with customers that otherwise wouldn’t be attainable.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.