By Olli-Pekka Lumijärvi, Olga Nissen, and Alexandra Selmer

Tough times don´t last, tough people and tough companies do. This statement is exemplified by 206 companies of 1,621 listed Nordic companies that were able to achieve different metrics of growth amid disruptions like COVID-19, the energy crisis, and the Russia-Ukraine war. Here is a look into what some of these companies did differently.

Background

In 2022 alone, 66% of the companies, over 1,000 firms, increased their revenues compared to 2021, with a median annual growth of 12.1%. This suggests effective price adjustments with inflation and the identification of new growth areas.

In 2022, our exploration into the impact of COVID-19 on listed Nordic companies, detailed in “Strategies for Sudden Shock” (The European Business Review, May-June 2022), revealed surprising resilience. Despite challenges, 160 companies out of approximately 1,900 listed companies studied, managed to increase revenues, profits, and market capitalizations in 2020. Expanding on this research, we extended our analysis to cover the five-year period from 2018 to 2022, covering significant disruptions such as COVID-19, the energy crisis, supply chain disruptions, and geopolitical tensions including the Russia-Ukraine war. In our study, we assessed the performance of 1,621 listed Nordic companies during this volatile period.

From 2018 to 2022, the global economy averaged a growth rate of 2.4%, with annual fluctuations ranging from a 3.1% decline to a 6.2% increase. Meanwhile, the Nordic countries experienced modest annual GDP growth, averaging 1.7%, with variations ranging from -2.4% to 6.8%.

Key Findings

Out of 1,621 listed companies:

- 206 companies achieved annual revenue growth compared to 169 in the previous period (2016-2020).

- 10 companies consistently increased profits annually, up from 7 companies in the previous period.

- 18 companies saw annual increases in market capitalization, a decrease from 56 companies in the previous period.

- One company managed to improve revenue, profit, and market capitalization over the entire five-year period (another achieved this in 2016-2020 but was not the same firm).

The most notable difference was in market capitalization improvements compared to results in 2020, with fewer companies able to increase their value consistently. Despite Nordic stock markets showing growth between 6% and 10% from 2018 to 2022, the year 2022 proved challenging with a decline ranging from 4% to 28%.

Analysis by Company Size

Analyzing the 5-year data by company size, we noticed the following:

- Large Companies (Revenues > €1 billion): Out of 180 large firms, 39 (22%) achieved annual revenue growth, with only one large firm improving profits each year.

- Small and Medium Size Companies (Revenues < €1 billion): Among 1,441 firms in this segment, 167 (12%) achieved annual revenue growth, with nine small firms consistently improving profits.

These results mirror our previous findings, highlighting a larger proportion of revenue growth among the large companies.

2022 Performance

In 2022 alone, 66% of the companies, over 1,000 firms, increased their revenues compared to 2021, with a median annual growth of 12.1%. This suggests effective price adjustments with inflation and the identification of new growth areas. However, only 17% of companies saw profit increases. Large companies (87%) demonstrated more adeptness in revenue growth compared with small and medium-sized firms (63%), with 42% of large companies also improving profits, versus 14% of small and medium-sized companies.

Overall Winners

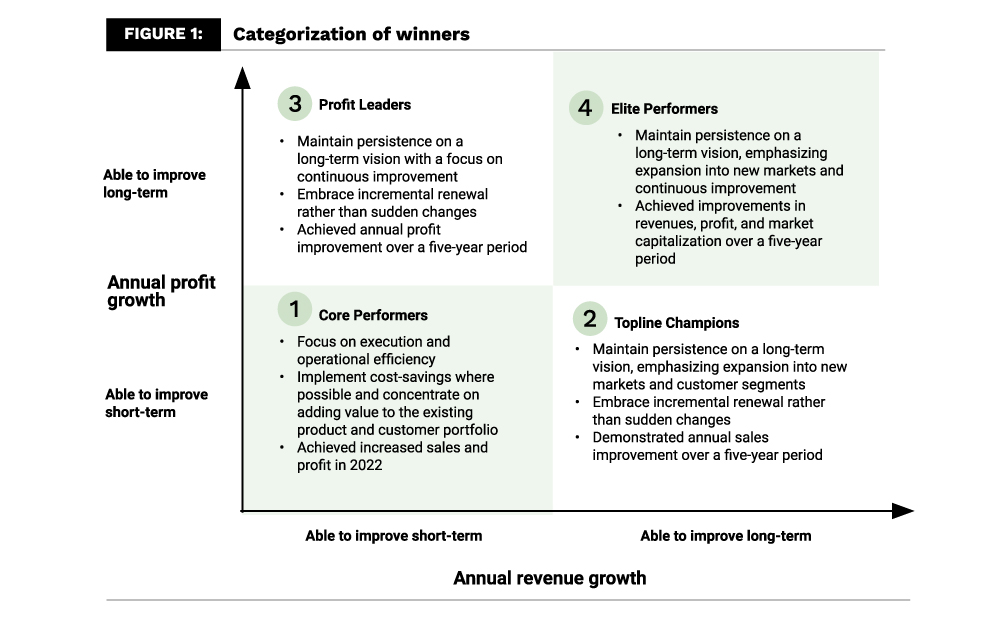

Our analysis shows that winners – companies that either improved their top and bottom line or market cap or combination of these – can be categorized into four groups depending on the company’s focus and time horizon of strategic actions (see Figure 1).

1. Core Performers – sales and profit improved in 2022

Companies that strategically focused on improving sales and implementing cost-saving measures successfully enhanced their revenue and profit margins. Our analysis identified 240 companies, comprising 15% of the sample, that fall in the category of Core Performers.

Case Norsk Hydro: Achieving Record Financial Performance Amid Global Challenges

Norsk Hydro, a leading company with €2 billion in annual revenue, specializes in aluminum and renewable energy. In 2022, the company achieved its best financial performance to date, with both sales and profits increasing by double-digit percentages. This success came despite formidable challenges, including an energy crisis, geopolitical tensions, inflation, and a sharp decline in aluminum demand.

Entering 2022, Norsk Hydro benefited from historically strong aluminum markets, a rebound fueled by the recovery from the COVID-19 pandemic. However, the company’s true test came as it navigated a rapidly changing economic environment. President and CEO Hilde Merete Aasheim highlights the company’s resilience: “Our record performance underscores the effectiveness of our improvement initiatives and robust margin management across the organization. It illustrates how essential it is to be both robust and adaptable when faced with fast-evolving conditions.”

Norsk Hydro’s ability to thrive amid such volatility demonstrates the critical importance of strategic resilience and operational flexibility. By focusing on continuous improvement and margin optimization, the company has positioned itself to not only withstand but excel in the face of global economic fluctuations.

2. Topline Champions – sales improved annually from 2018-2022

These companies dedicated themselves to building and scaling new revenue streams consistently over a five-year period. Among our study sample, we identified 51 firms, comprising 3%, as Topline Champions who achieved annual sales growth each year from 2018 to 2022.

Case Elisa: Leveraging Long-Term Strategy for Sustained Growth

Elisa, a Finnish telecommunications and digital services company with a 140-year history, has demonstrated remarkable growth, expanding its revenues from €1,832 million to €2,130 million between 2018 and 2022. This success is largely attributed to a strong commitment to a strategic vision centered on growth within its core markets of Finland and Estonia, while simultaneously expanding its international digital service offerings and enhancing operational efficiency and quality.

CFO Jari Kinnunen highlights the company’s customer-centric approach: “We have focused on organic growth by understanding and responding to customer needs. As pioneers in offering unlimited mobile data with pricing based on speed tiers, we’ve successfully adapted this strategy for both 4G and 5G networks. Our customers appreciate the value of speed, and this has fueled our growth.”

Companies that strategically focused on improving sales and implementing cost-saving measures successfully enhanced their revenue and profit margins.

In recent years, Elisa has extended its reach beyond Finland and Estonia, with a strategic emphasis on international digital services. The company has introduced advanced software solutions for network optimization using AI, designed for other operators and built on Elisa’s own expertise. This expansion includes some strategic bolt-on acquisitions. Another domain is industrial Software solutions designed for optimizing processes in manufacturing industry. CFO Kinnunen further explains: “We aim to grow close to our core business. By leveraging our core business capabilities, we offer network optimization solutions with AI for other operators and industrial software solutions for manufacturing sector. This has facilitated our expansion into 20 countries through targeted acquisitions.”

Looking ahead, Elisa’s management remains focused on sustaining top-line growth, setting ambitious targets for double-digit expansion in global digital services.

3. Profit Leaders – bottom line improved in 2018-2022

Achieving consistent profit growth year-over-year from 2018 to 2022 is challenging. Our research identified 10 companies, comprising just 0.6% of the total sample, as Profit Leaders. These firms demonstrated the ability to improve their bottom line annually throughout the entire five-year period.

Case Alma Media: Transforming from Print to Digital for Long-Term Growth

Alma Media, a Finland-based digital services and media company, operates across 12 countries with a diverse portfolio encompassing recruitment, housing and commercial property, mobility, media, and information services. From 2018 to 2022, the company achieved substantial growth, with sales increasing from €255 million to €308 million and its operating margin rising from 19.8% to 25.9%.

The foundation of Alma Media’s recent success was laid nearly two decades ago. Recognizing early on the transformative potential of digital technology, the management committed to a comprehensive digital transformation strategy. By 2022, the digital segment had grown to represent 81% of total revenue, up from just 5% in 2005.

CEO Kai Telanne elaborates on this long-term vision: “Our strategy for the past 20 years has been consistent: grow our digital footprint, transform our traditional print business, and expand internationally. We’ve executed over 70 acquisitions and divestitures, primarily selling off print assets while acquiring digital capabilities. This approach has allowed us to secure top positions in our markets.” Alma Media’s successful shift to digital is complemented by a significant cultural transformation. CEO Telanne reflects on the evolution: “We transitioned from being a slow-moving media company with fixed long-term plans to a dynamic organization capable of adapting to new scenarios each year. We now develop 2-3 scenarios at the start of the year and adjust our strategy quarterly if needed. This flexibility has enhanced our resilience and agility, enabling us to navigate global crises effectively.”

This cultural shift toward greater adaptability and scenario planning has been instrumental in Alma Media’s ability to respond swiftly to external challenges, ensuring continued growth and profitability in a rapidly evolving industry landscape.

4. Elite Performers – revenues, profit and market cap improved in 2018-2022

Achieving annual improvements in both revenue and profit over a five-year period is impressive. Even more exceptional is achieving concurrent growth in market capitalization. Our study identified only one exceptional company that successfully improved all three measures—revenue, profit, and market capitalization.

Case FirstFarms: Cultivating Success Through Diversification and Circular Operations

FirstFarms, a Danish agricultural and food products company, achieved record performance in 2022 despite challenging conditions, including unpredictable markets, extreme weather, and high inflation. With annual revenues of around €56 million and approximately 300 employees, FirstFarms operates across 20 locations in five EU countries and strives to be one of Europe’s best-run and most profitable companies in its sector.

A cornerstone of FirstFarms’ success has been its long-term commitment to risk diversification both in production and geographically. Recently, the company has complemented this approach with a strong emphasis on circular operations, particularly in optimizing efficiency and sustainability.

CFO Michael Hyldgaard underscores the importance of diversification: “Our extensive risk diversification, spanning both geography and operational branches, significantly enhances our earnings stability. Efficient and circular management of our operations, especially in areas like pig production, ensures effective control over our value chains.”

A cornerstone of FirstFarms’ success has been its long-term commitment to risk diversification both in production and geographically.

This strategic focus enables FirstFarms to maintain resilience and profitability even in adverse conditions. The management’s efforts are geared toward maximizing operational efficiency while reducing dependence on external factors, aiming to achieve greater energy self-sufficiency. Chairman Henrik Hougaard elaborates on this vision: “We prioritize making ourselves as energy independent as possible against external factors beyond our control. The next phase involves developing a stable and profitable business model that capitalizes on the energy we generate.”

By integrating these principles, FirstFarms is positioned not only to navigate current challenges but also to build a sustainable and profitable future.

Conclusions

Despite a decade marked by substantial disruptions, Nordic companies have proven their resilience and adaptability. Our study reveals that strategic focus and robust operational frameworks have empowered certain firms to not only survive but thrive amid uncertainty. On average, large companies outperformed small and medium-sized companies, possibly due to their access to a larger pool of resources, better access to capital and more diversified operations, making them more resilient to economic shocks. Companies that effectively manage revenues, profits, and market capitalization provide valuable insights into resilience, innovation, and long-term strategic planning. As we continue navigating a volatile global economy, these findings emphasize the critical importance of adaptability and strategic foresight in sustaining business growth and performance.

Key Takeaways for Business Leaders

- Embrace Strategic Resilience: Companies that adapted quickly to economic shocks by focusing on resilience in their operations saw sustained growth in revenues and profits. Implementing robust risk management and agile strategies can bolster your company’s ability to weather economic uncertainties.

- Leverage Long-term Growth Plans: Successful firms like Elisa demonstrated the value of long-term commitment to strategic goals, particularly in areas like digital transformation and market expansion. Ensure your growth plans are adaptable but based on a clear, long-term vision.

- Prioritize Revenue Diversification: Diversifying revenue streams and markets helped companies like FirstFarms and Norsk Hydro mitigate the impacts of external shocks. Explore new markets and product lines to reduce dependency on single sources of income.

- Apply Effective Cost-Cutting Tools: Employing cost reduction as a part of a growth strategy focusing on eliminating inefficiencies and optimizing processes using automation, digitalization and AI technology.

- Invest in Innovation and Efficiency: Continuous investment in innovation and efficiency, as seen in Alma Media’s transformation, can drive sustainable profit growth even in turbulent times. Focus on modernizing operations and leveraging technology to enhance productivity and competitiveness.

- Emphasize Agility: The ability to adjust quickly to changing market conditions, evident from the performance in 2022, highlights the importance of adaptability. Foster a culture of flexibility and readiness to pivot in response to new challenges and opportunities.

Our findings demonstrate that amid global economic volatility and various shocks, companies can emerge as leaders by demonstrating adaptability, innovation, and strategic agility.

About the Authors

Olli-Pekka Lumijärvi, Ph.D. (Econ.), Managing Director, Profit Isle, a former Managing Director at Accenture, he is based in Boston.

Olli-Pekka Lumijärvi, Ph.D. (Econ.), Managing Director, Profit Isle, a former Managing Director at Accenture, he is based in Boston.

Olga Nissen, Ph.D. (Computational Mathematics and Cybernetics), VP, head of Transformation at Tryg A/S, a former Partner at McKinsey Digital and Accenture’s Head of European technology M&A and Private Equity practice. She is based in Copenhagen.

Olga Nissen, Ph.D. (Computational Mathematics and Cybernetics), VP, head of Transformation at Tryg A/S, a former Partner at McKinsey Digital and Accenture’s Head of European technology M&A and Private Equity practice. She is based in Copenhagen.

Alexandra Selmer, D.Sc. (Elect. Engineering), MBA, PwC’s lead of Intelligent Procurement and a member of Financial Services Consulting, a former strategy senior consultant at Danske Bank and Accenture, she is based in Helsinki.

Alexandra Selmer, D.Sc. (Elect. Engineering), MBA, PwC’s lead of Intelligent Procurement and a member of Financial Services Consulting, a former strategy senior consultant at Danske Bank and Accenture, she is based in Helsinki.

References

-

World Bank, MSCI, Orbis company database, annual reports, company presentations, senior executive interviews

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)