Cybersecurity is not a recent term in the financial industry. Banking institutions have been using it to protect their systems, data, and transactions to avoid fraud and identity thefts.

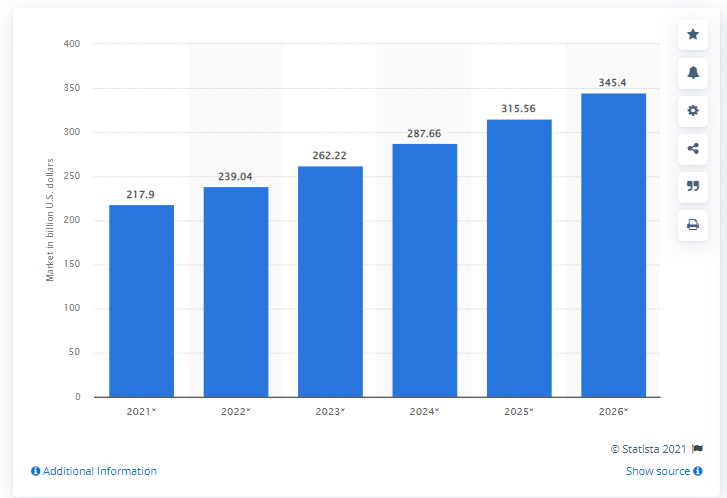

According to Statista, by 2026, the global cybersecurity market size is forecast to grow to 345.4 billion U.S. dollars. Similarly, India crossed over 500 million dollars in 2020, which would rise to 800 million dollars by 2022.

This means that Cybersecurity in the banking industry is a relatively not new concept, but it will increase exponentially in the future.

However, Did you ever think about it? :

- Why is it so important?

- What are the challenges of Cybersecurity in the banking industry?

- And what are the use-cases of it?

Not yet? Don’t worry; you will learn about them in this article. Let’s first start with the importance of Cybersecurity in the banking industry.

Cybersecurity in Banking Industry: Importance

1. Prevent Financial Losses

The banking industry holds the data of millions of people, and this data can help hackers in many ways. For example, if someone hacks your bank account using your ID info, they can steal all your money in seconds, not to mention that it is almost impossible to recover stolen money.

In such cases, banks are left with three options:

- They can compensate money

- Freeze the account in which fraud has occurred

- Close down the entire branch where fraud has happened.

But banks do not prefer two out of all these three options. Compensating money can be costly, and freezing accounts may result in a loss of customers.

With the help of Cybersecurity in the banking industry, banks can minimize these losses and protect their accounts from fraud. Technology like biometric authentication and Artificial Intelligence (AI) can help credit institutions save money.

Furthermore, it will protect customers’ accounts and increase customers’ trust in the banking industry.

2. Protect Customer Data

The banking industry is expanding daily, and with that expansion comes a great deal of responsibility. Financial authorities now need to prioritize the security of their customers’ data and transactions since it can be used for multiple purposes:

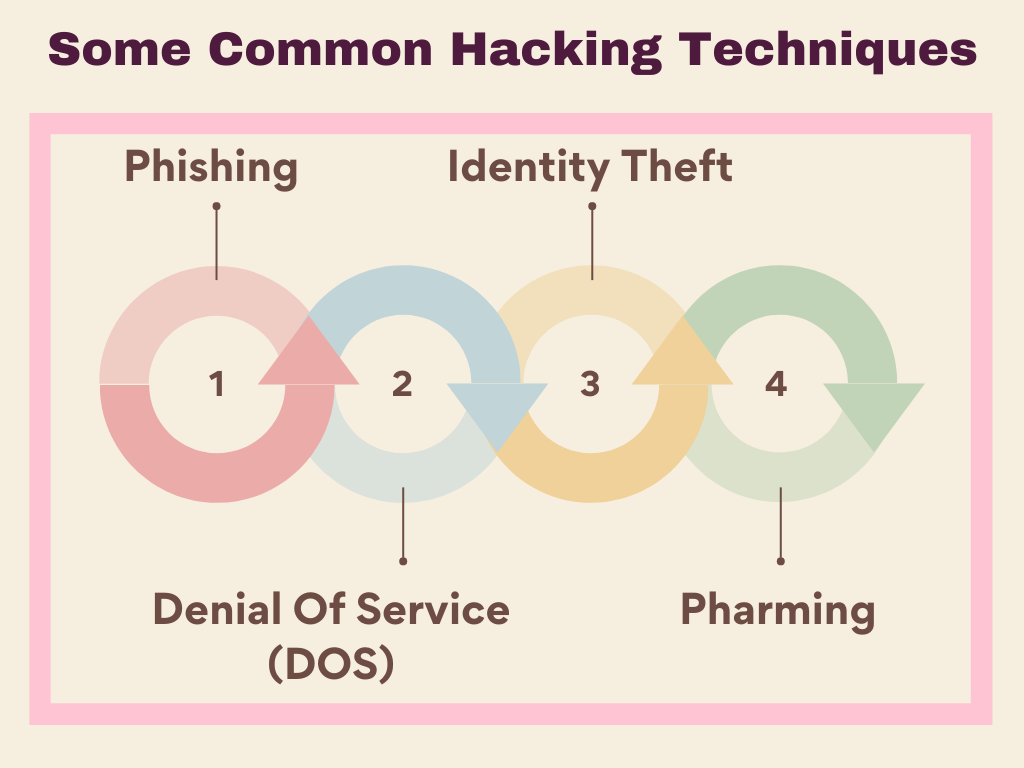

• Phishing: This technique uses fake emails like official emails, but they contain links to malware. Hackers use this technique to steal customers’ sensitive data like passwords, credit card numbers, etc.

• Identity Theft: This refers to changing a person’s personal information without their consent and then using it for harmful purposes.

• Denial Of Service (DOS): A DOS attack works by sending traffic from unrelated sources towards a server on which an organization’s website is hosted. It causes the server to overload and shut down, resulting in the organization losing its site temporarily.

• Pharming: This technique is used by fraudsters to redirect users from an authentic website to a fake website. Hackers use it to steal the information required for online transactions. Therefore, this technique puts customers’ data at risk and financial security.

Moreover, all these techniques share one thing: They use sensitive personal information for personal and financial gains. In addition to this, if hackers get access to these techniques, they can misuse them for other purposes as well. That is why Cybersecurity in the banking industry is so important.

Some big organizations have already started using it. For example, Citigroup has introduced biometric authentication for all its US customers.

3. Preserve Bank’s Reputation

Banks must follow strict regulations, so it takes them quite some time to adopt new technology. However, with the increased number of cyberattacks, they are now more open to Cybersecurity.

The increase in cyberattacks has also hurt the reputation of banks. According to a study by Kaspersky Lab, out of 1000 consumers surveyed in the UK, Germany, India, and USA, 94% of consumers said they would switch banks if their data got into the wrong hands.

The study also revealed that 60% of consumers take their time when choosing a bank because they are afraid of becoming a victim of a cyberattack.

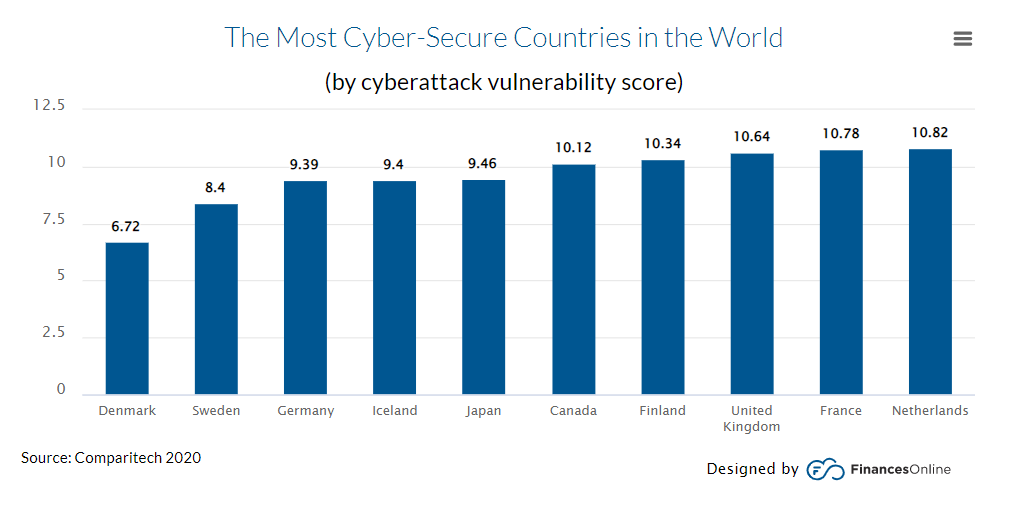

Therefore, banks need to restore their reputation by introducing new technology like AI, data encryption, etc., for better security. Furthermore, according to Comparitech’s 2020 report, the most cyber-safe countries in the world are Denmark (6.72), Sweden (8.40), Germany (9.39), Ireland (9.40), and Japan (9.46) based on cyberattack vulnerability scores.

4. Avoid Penalties For FDIC Non-Compliance

The next most considerable importance of Cybersecurity in the banking industry is avoiding penalties from FDIC. If a bank does not follow the Federal Deposit Insurance Corporation (FDIC) regulations, it can impose hefty fines and even shut down that particular bank.

Some of the fines that FDIC imposes on banks for non-compliance are:

• Up to $1 million per violation.

• In severe cases, a year in prison may be imposed.

• Forced ratification of contracts violations in some cases.

And many others.

So, imagine what would happen if a bank’s security was compromised due to a hack? That is why banks should implement security measures to prevent such a situation. FinTech companies can provide cybersecurity solutions using blockchain technology to help banks improve their security standards.

Besides, some financial institutions hire blockchain developers to help them use this technology for their purposes. Accordingly, here are some examples of how blockchain can be used in financial institutions to improve cybersecurity:

- Using blockchain, financial institutions can store sensitive information about their clients in a decentralized database. It will help them stay compliant with regulations and avoid hefty fines imposed by FDIC.

- Banks can also use blockchain to share information about the customer without compromising their identity and security. It can be beneficial to prevent fraud and money laundering cases in the future.

- By integrating blockchain technology into their systems, banks can create a scalable and efficient system that will prevent security breaches like:

- Phishing attacks to access customers’ sensitive information.

- Man in the middle (MITM) attacks.

- DDoS Attack.

- Some experts say that as blockchain is decentralized, it is more secure than conventional databases because it is nearly impossible to hack. The encryption technology used in blockchain also makes it more secure than conventional systems.

- Blockchain protects sensitive information by splitting it into pieces and storing it on different nodes, decentralizing the whole system. This way, hackers will not find or misuse any information even if they manage to access a single block.

5. Digitization Of Services

Another importance of cyber security in banking is the digitization of services. As we know, more and more people prefer online bank account management to the old brick-and-mortar institutions. They can do everything from their computers or mobile phones that they could do at a physical branch.

For example:

• Direct deposit means customers don’t have to wait days to get their paychecks.

• Purchasing shares of a company is now as easy as buying vegetables at the local supermarket.

• Transferring money to another country has never been easier because all you need is an internet connection and bank account number or routing number.

As digitalization becomes more popular, banks spend vast chunks of their revenue upgrading their systems. But, these huge costs are not being returned to banks because people have already mastered the art of managing their bank accounts online.

This is why there’s a massive need for cyber security in the banking industry because, without it, all that investment will go down the drain.

So, you can see how critical cybersecurity is to banks and other financial institutions. It is now time to count down the banking industry’s challenges.

Cybersecurity in Banking Industry: Challenges

1. Balancing Security And Convenience

Although cybersecurity is essential to banks, they also need to provide convenience to their customers. If a bank’s security measures are too strict, many people may switch their accounts to a bank with less stringent regulations.

On the other hand, if the security provided by a bank is not convenient, then there will be huge costs because of the extra security measures. More money will need to be spent on additional personnel, software, and hardware for the bank’s security system.

Therefore, banks must come up with the right balance of convenience and security to survive in the long run.

2. Effectively Managing The Risk Of Breaches

Another challenge faced by banks is to manage the risk of breaches effectively. They may have the most secure system in place, but hackers can still find ways to compromise these systems.

That is why banks must test their system regularly for vulnerabilities. They also need to continuously update their security systems with the latest technologies available to remain one step ahead of hackers.

3. Financial Impact Of Breaches

Not only does cybersecurity affect customers, but it also has a direct impact on the bank’s bottom line. When hackers successfully breach a bank’s system and gain access to sensitive information, there’s no telling what they’ll do with it.

This can be terrifying because it could result in lawsuits against the bank or even government regulations that change its operation. These changes will affect a bank’s profit margins because additional costs will be deducted from their revenue.

4. Constant Evolution Of Threats And Vulnerabilities

Another cybersecurity challenge faced by banks is the constant evolution of threats and vulnerabilities. Hackers are constantly updating their techniques to get around new security measures.

Therefore, banks may need to continuously update their cyber security protocols to stay ahead of hackers every step of the way. Also, it requires a lot of time and money because banks need to hire more personnel, spend vast amounts on software, and buy new hardware for their security systems.

5. Efficient Protection Against Advanced Threats

In addition to the constant evolution of threats and vulnerabilities, banks also need to focus on efficient protection against advanced threats. Furthermore, hackers are becoming more sophisticated by the day, which means that a bank’s security system will struggle to keep up.

This is especially problematic because the more time hackers have to unleash their attack, the higher the chances of successfully breaching a bank’s system. This means that banks need to invest in new technologies for defense against these advanced threats to ensure cyber security.

These were some of the cybersecurity challenges faced by banks. If you are interested in learning about use cases for Cybersecurity in Banking, you can keep reading this blog.

5 Use Cases for Cybersecurity in Banking

1. Fraud Monitoring And Prevention

When customers use their bank accounts, they must provide personal information for verification purposes. Hackers can abuse this information by transferring money to their accounts or creating unauthorized transactions.

Banks will need to incorporate more advanced technologies like machine learning algorithms to prevent fraud. These tools can learn how customers use their bank accounts and detect “suspicious” transactions.

2. Identify Compromised Devices

These days, many credit card fraud cases can be traced back to hacked personal computers or mobile phones. Hackers will seek out any device with access to a person’s bank account and then try to hijack it to run their transactions.

Since this can be difficult to detect, banks will need “threat intelligence” tools that will allow them to keep track of any suspicious behavior on the account holder’s end.

3. Payment Security

Sending bank customers bogus emails that look to come from their banks is one of the most prevalent ways hackers obtain information. These emails will ask the bank customers to verify their information by clicking on a link or providing their security credentials.

This way, hackers can gain access to a person’s bank account because they now have all the personal and financial information they need. Banks will need “phishing protection tools” to keep track of these fraudulent emails to protect their customers.

4. Data Retrieval

Before a bank customer can withdraw or transfer money, they must provide the proper data such as account numbers and PINs. Banks must always be on guard for stolen credentials because these can give hackers direct access to the targeted person’s bank account.

Banks can protect their customers by requiring additional security measures before money can be withdrawn or transferred. For example, they can ask for verification codes sent through text messages generated every time a transaction is made.

5. Data Protection Tools

One of the most fundamental reasons we need to focus on cyber security is that hackers can use stolen customer credentials to access sensitive company data. If a hacker manages to infiltrate a bank’s system, they can steal any information in the server, including personal and financial data.

This is very dangerous because it can lead to identity theft or fraud—Banks must-have tools in place that will keep hackers out of their data storage.

Conclusion

As you can see, banks will need top-of-the-line technology to protect their customers and company data from hackers. If they don’t focus on cyber security, they can expect significant losses in the future due to stolen records or leaked customer information.

This article should have given you some examples or use cases for cybersecurity in banking. Why is it important to banks and other financial institutions? What challenges will banks face when they incorporate cybersecurity into their business model?

Although, if you are searching for banking software development companies in India that can help you with your banking needs or any other financial software development? Feel free to contact PixelCrayons; we will provide you with the best cost-effective solution per your requirement.