Property markets globally have recovered from the valuation declines recorded at the height of the financial crisis, but in large part, this has been restricted to quality product, in quality locations. Whilst theory would imply that a good degree of the projected positive re-valuation has already taken place, prospects for the sector remain healthy with pockets of solid growth expected where portfolio managers have the ability to enhance cash-flows, re-position assets and add value. Market experience now as always, will be key.

Why Property, Why Now?

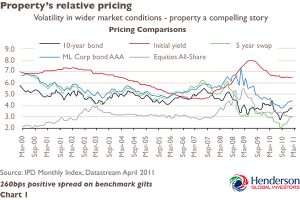

It has been well over a year since the major European economies emerged with the aid of unprecedented monetary and fiscal support from recession. Growth, however, remains patchy and uneven with lingering sovereign debt fears, geopolitical uncertainties and planned austerity measures all contributing to undermine market confidence and dampen financial market activity. In response, bond yields remain historically low in core Europe, cash deposit rates offer little reward and equity dividend payments remain uncertain. It is for this reason that investors hunting for yield have been attracted to commercial property given its high income generating characteristics (see chart 1). This may sound controversial given that commercial property is very much dependent upon tenant demand; with broad occupier market requirements weak given the likelihood of subdued economic output, falling real income growth, higher taxes, restricted credit and high unemployment. But for risk averse investors, good quality real estate, let on long leases to financially strong tenants still offers very attractive returns in an ever uncertain financial world.

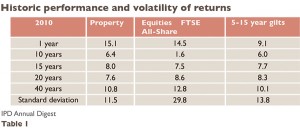

The comparative performance of property vis-à-vis other major asset classes is one of its principal attractions. As table 1 shows, in the UK, property should make up a significant component of any multi-asset portfolio as it has delivered stronger returns over most time periods compared to equities and government bonds – with a third of the volatility attached to equities.

[ms-protect-content id=”9932″]Global property markets were unable to weather the credit storm but the UK, being the most open, transparent global property market, has been at the forefront of the rebound in real estate valuations and investor demand since mid 2009. This is because international investors favour the UK lease structure, where the institutional market remains dominated by leases of 10-15 years or more and market value–based, upward only, rent reviews still dominate. This has provided the foundation for shrewd investors capable of looking beyond the short-term economic malaise to acquire strong assets at historically attractive pricing. In 2010, UK property returned 15.1% according to IPD, the industry benchmark, against 14.5% and 9.1% respectively for equities and gilts.

The UK Market in 2011

2010 turned out much as expected with initial strong capital gains giving way to more modest growth as the year progressed. A further significant broad upturn in real estate values are unlikely in the near term, but those investors less reliant on debt – namely overseas investors, the UK institutions and REITs, who remain the dominant buyers in the UK and are under pressure to acquire assets and put capital to good use – will ensure pockets of out-performance. In those markets where real positive rental projections exist, namely Central London offices and prime retail locations, demand has remained firm and if anything, become even more selective. Investing in this market place, however, is likely to remain challenging as the limited prime stock available to purchase attracts aggressive bids from risk averse investors, pushing prices close to past peak levels. Global property investors are understandably cautious, but higher prices become inevitable while investors continue to be unwilling to compromise on location or the quality and length of the income.

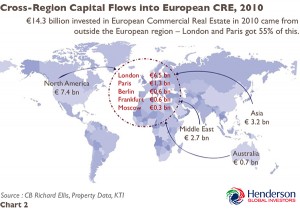

Additionally, overseas interest in the UK market is likely to continue. International investors have in recent times driven the turnaround in UK investment sentiment and activity. Supported by the weakness of sterling, they have favoured the central London market because of its liquidity, cyclical nature and market size. Over the last decade transactions in the capital’s office sector have on average accounted for nearly 30% of all investments and as chart 2 shows, North American, Far and Middle Eastern investors have all competed for product directly with the UK property companies and institutions.

Continuing Attractiveness of Central London

For investors who get their timing and strategy right, returns in central London can be impressive. The capital’s office market returned 22% alone in 2010, with the last 12 months proving to be quite dramatic for both occupational and investment markets, as prime rental values surged and yields sharpened against the long-term average.

Although the yield play is coming to a close, the case for investing in central London offices has not diminished. Henderson forecasts indicate total annualised returns of just below 10% per annum over the next five years from March 2011, largely based on a return to healthy rental growth. The news on the capital’s leasing markets continues to be positive and rental growth in both prime and non-prime locations is recovering much earlier than originally anticipated. Prime London rents have experienced rapid growth and there is more to come, however, non-prime buildings have the bigger potential for growth in the medium term.

Investors have already turned to short income plays in certain parts of central London in an effort to develop and reposition assets for the projected rise in rents and valuations. This is strengthened by the improvement in activity – particularly evident in the City – where a spate of large occupier deals have pushed take up levels well above their long-run average. West End take up is also at long-run average levels and vacancy rates across both markets should continue to fall over the next 18 months, provided there are no further economic shocks.

There are yet more reasons to be optimistic about the prospects for central London. The completion of Crossrail, the major new rail installation across the capital, will also create new business centres to support the growing demand for London’s internationally traded services, thus increasing the medium-term prospects for growth providing yet more rewards for investors. Additionally, the expected rise in job creation by 2012, aided by more robust economic growth and business investment, coincides with a significant amount of churn generated by known lease expiries. Given the scarcity of the current development pipeline, a legacy of the tight financing conditions witnessed since 2007, an early return to pre-letting is likely and this should also underpin rental growth and valuation uplifts.

Although the significant positive shift in pricing across the central London market since mid 2009 has left investors questioning the returns available in the medium term, stubbornly high inflation levels and a poor government bond outlook imply that liability matching investors will continue to target property given its income yield component. And given that the primary concern for investors across all asset classes remains the underlying economic picture, investors will be buoyed by the capital’s improved market balance. Central London firms have significant exposure to global markets and the buoyancy of emerging markets should support healthy medium-term leasing activity. Moreover, there is a close relationship between central London performance and world trade, and forecasts suggest fairly buoyant global growth over the next five years.

It’s our belief that as long as macroeconomic policy continues to dominate domestic and international property activity, investors are likely to remain focused on the more globally established real estate markets such as London, rather than the less mature, more opaque markets across Europe and Asia.

About the Author

Michael Keogh, Associate Director of Research, Property Joining Henderson Global Investors in January 2009, Michael forecasts economic and property markets across the UK and Europe, analysing long term property trends, investment and economic cycles to project future performance and output. Michael is involved in advising Fund Managers in the acquisition, disposal and development of assets within the European property market.

[/ms-protect-content]