By Krishna Subramanyan

Blockchain carbon tracking, AI-powered environmental, social, and governance (ESG) reporting, and digital green bonds are just some of the ways we can revolutionise climate finance. But, the gap between available funding and the required support for global climate adaptation has reached $1.8 trillion annually in 2025. This figure has been highlighted by the notable absence of major financial institutions at COP29 as required by 2030 for emerging economies. Traditional finance isn’t meeting this challenge, but fintech is stepping in with practical solutions.

Transforming carbon trading

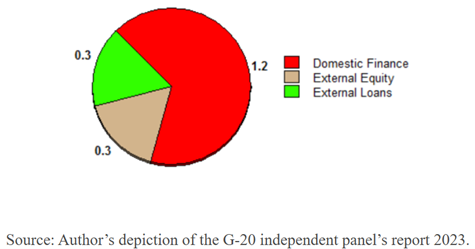

The most immediate opportunity for these technologies lies in carbon market trading coupled with offering innovative financing mechanisms through fintech. This would see economies invest in energy efficiency such as renewables and carbon sequestration while moving away from carbon-intensive industries. To quantify, about $0.6 trillion for these investments is expected to come from private debt and equity flows, leaving a remaining $1.2 trillion to be raised. Drawing on research from Frank Lysy, former World Bank economist, grassroots financing and other related technologies may hold the key.

The Paris Agreement’s framework, specifically Article 6.4, has introduced a new way to trade carbon credits internationally. This mechanism is expected to reduce NDCs by $250 billion annually by allowing countries to trade carbon credits across borders. For fintech companies, this creates a clear opportunity: developing the technology infrastructure needed to operate these new carbon and grassroots financing markets efficiently and transparently.

Considering this, in 2025 we could see enabling regulatory framework accelerate the development and adoption of blockchain-based carbon tracking solutions. Blockchain’s inherent transparency and immutability make it ideal for verifying carbon offsets and strengthening trust within the market. Additionally, digital Environmental, Social, and Governance (ESG) reporting is set to evolve. These tools will likely integrate AI and machine learning to enable real-time reporting, better data visualisation and increased regulatory compliance.

Scaling green investment

Last year, green bonds accounted for over $475 billion in investments. This substantial growth reflects the growing interest from governments, corporations, and financial institutions in financing ESG-focused projects. Such financial instruments are becoming powerful tools for tackling environmental challenges, proving that sustainable investment can be both financially viable and environmentally responsible.

Over the next 12 months, the fintech industry should brace itself for a tech-driven shift towards sustainable finance. With its unique position, fintechs can harness their agility and technological expertise to develop scalable solutions.

A collaborative effort from key players across the industry will be essential as partnerships between fintechs, traditional financial institutions and regulators can help bridge the gap between ambition and execution. Initiatives such as Decentralised Finance (DeFi) platforms for climate investment and AI-driven risk assessment models for green projects could become mainstream tools in advancing climate action.

Our role in addressing climate change extends far beyond direct funding. We are critical market influencers, shaping the signals that can guide capital flows and determine the pace of global sustainable practices. 2025 could see fintech making steps towards tangible climate action.

Krishna Subramanyan

Krishna Subramanyan

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)