By Kamil J. Mizgier

In every industry sector, companies are striving to overcome organisational hurdles to enhance their efficiency and productivity. Within the risk management space, bridging the silos is crucial, given the rapid spread of risk events and the necessity for effective communication to promptly address and mitigate losses. The integration of enterprise risk management, insurance, and business continuity management proves instrumental in making companies more resilient, as evidenced by the successful case studies outlined in this article.

The Challenge With A Siloed Approach To Risk Management

Siloed risk management practices originate from the traditional organisational structure where each department operates independently, focusing on its specific objectives without considering the broader organisational goals. Despite the evolution of management practices, siloed risk management persists in mature organisations due to established departmental cultures, lack of cross-functional communication, and resistance to change.

Within the risk management space, bridging the silos is crucial, given the rapid spread of risk events and the necessity for effective communication to promptly address and mitigate losses.

Furthermore, different industries have unique risk methodologies that have often been developed for different purposes. For instance, the financial sector may focus on credit and market risks, while manufacturing might prioritise operational and supply chain risks. However, some companies like Swiss Steel Group and Katoen Natie have successfully transformed their risk management practices by integrating risk considerations into strategic decision-making processes across all business units and functions.

Stéphane Martin, CEO of Smart Risk Consulting, and co-founder of the Risk-In conference1 has long championed the philosophy of bridging silos to better manage risks. In contrast to the negative connotations associated with “breaking down barriers,” Martin emphasises the positive aspects of collaboration in risk management. He believes that by bridging silos, organisations can create something innovative and superior to traditional approaches. Martin asserts, “Risk management is all about collaboration. I wanted the conference to focus on bridging the silos to create something new and better than in the past by bringing senior leaders from different functions in one room to discuss risk challenges and opportunities together.”

This ethos reflects a fundamental shift in mindset, highlighting the importance of interconnectedness and synergy across organisational functions. To overcome these challenges, Martin advocates for a holistic and integrated approach to risk management. By bridging silos, organisations can leverage diverse perspectives and expertise to develop comprehensive risk management strategies that align with their overarching business objectives.

Enterprise Risk Management, Business Continuity And Resilience

To address the shortcomings of siloed risk management approaches, companies have increasingly embraced Enterprise Risk Management (ERM). ERM promotes a comprehensive and systematic approach to managing all potential risks, emphasising the need to address them holistically rather than in isolation.

Harvard Business Review recognised ERM as a significant concept in 2004, listing it among their “Breakthrough Ideas.2” However, twenty years later, companies still struggle to implement ERM systems and procedures, and one can ask, why is this the case?

ERM promotes a comprehensive and systematic approach to managing all potential risks, emphasising the need to address them holistically rather than in isolation.

To begin with, designing an ERM system that is comprehensive and fits well with the existing organisational structure can be complex and requires significant investments in talent and technology. Secondly, establishing metrics that accurately reflect the risks and their impact on the organisation is difficult. Third, which is not unique to digital transformation, the resistance to change, lack of understanding, and the need for a cultural shift towards risk awareness can hinder ERM adoption.

And finally, the dynamic nature of the business environment, with its ever-changing risks, makes it hard to maintain an effective ERM system.

The professional experience of Jean-Paul Duperron, VP of Internal Audit, IC/SOx and Risk Management at Swiss Steel Group is rich in experiences, adaptations to socio-economic contexts and resilience in challenging situations. He says: “Leadership comes with trust, grows with professional experience, and settles with a profound sense of collaborative work to get the best of the teams and colleagues. Shaping an integrated approach to internal assurance, both in people’s mindset as well as in the management system, requires a synchronized, interactive exchange of information and a shared vocabulary.”

Simply put, teamwork can make the dream work. The key to overcoming challenges associated with siloed risk management requires a tailored approach that considers the unique aspects of each organisation, continuous education and communication, and a flexible system that can adapt to new risks and business changes.

Alexia Michiels, Partner at Resilience Institute believes that “Strengthening human resilience is an essential step to make organizations more resilient and equip them to speed up the most urgent transformations. Our ambition is to accelerate leaders’ awareness about these issues. Powered by a robust assessment, we generate insights for our clients about human resilience, strengths, and risks across their entire organization.” Strengthening human resilience, by nature, applies to all departments and therefore should be at the heart of ERM.

Resilient leaders can transform business continuity plans to make them integral components of effective corporate risk management. Siloed approaches to business continuity planning, on the other hand, often result in fragmented responses during crises. By integrating business continuity efforts across functions and conducting comprehensive risk assessments, organisations can enhance their resilience to unforeseen disruptions.

The Role Of Insurance And Captives In The Risk Ecosystem

Organisations can mitigate certain risks through insurance and captives, but these strategies are often managed in silos without considering broader organisational objectives. Integrating insurance and captive strategies into overall risk management frameworks can optimise risk transfer and financing strategies.

And despite in-depth risk mapping capabilities and comprehensive mitigation plans in place, organisations can still be blindsided by unforeseen events. These events, ranging from natural disasters to global pandemics, can have far-reaching consequences that disrupt operations, jeopardise financial stability, and challenge the very existence of the business. In such scenarios, the role of risk managers becomes pivotal in steering organisations through turbulent times.

In the face of unprecedented events, risk managers must pivot quickly and adapt their strategies to mitigate emerging risks effectively. This often entails rapid decision-making, scenario planning, and collaboration across organisational silos. Risk managers play a critical role in coordinating responses, assessing the impact of the event on various facets of the business, and implementing contingency measures to minimise losses and ensure business continuity.

Moreover, risk managers contribute valuable insights and expertise to senior leadership, guiding strategic decisions and resource allocations during times of crisis. By leveraging their understanding of the organisation’s risk profile and vulnerabilities, risk managers help steer the organisation towards resilience and recovery.

As regulatory pressures mount, Environmental, Social, and Governance (ESG) considerations are emerging as a paramount concern, representing a significant opportunity for risk managers to engage in ESG risk reporting.

Carl Leeman, CRO of Katoen Natie International S.A., says: “Captive owners, who establish captive insurance subsidiaries to underwrite the risks of their parent companies, may encounter disruptive events that deviate from their initial risk assumptions and business plans.” In such cases, captive owners must assess the impact of the event on their captive’s operations and financial stability. Furthermore, they should adapt the captive to the needs of their company and not to the habits of the traditional insurance market or most of the existing captive companies. He notes: “Risk and/or insurance managers are sometimes disconnected from other corporate functions, however, in our company people know what their responsibilities are, but they are also encouraged to stay connected and communicate between businesses and corporate functions; we talk with each other. Insurance, claims, safety, legal and environment fall under Corporate Risk Management, this quite unique centralized approach is very efficient for the Katoen Natie group of companies.”

To mitigate the repercussions of unforeseen events, captive owners may leverage various risk management strategies, such as reinsurance arrangements, capital injections, or adjusting underwriting practices. Additionally, captive owners often collaborate closely with their captive managers and advisors to reassess risk exposures, evaluate potential losses, and devise proactive risk mitigation measures.

Insurance companies need to have a broader stakeholder engagement to work on opportunities to tackle challenges. They need to approach collaboration to solve problems in a similar way to how the aviation industry does it: by sharing knowldgeto continuously improve safety in the airways.

In essence, effective risk management is not solely about anticipating and preventing foreseeable risks but also about how organisations and captive owners respond to unexpected disruptions. By fostering a culture of agility, resilience, and proactive risk management, organisations and captive owners can cope with uncertainties with confidence and emerge stronger from adversity.

This is also one of the reasons why Silvia Signoretti co-founded and developed the Swiss InsurTech Hub, a non-profit organisation promoting digitisation and innovation in the insurance sector. She notes: “The association acts as a dynamic launchpad for enhanced visibility and exposure, offering diverse avenues to spotlight innovative solutions and garner well-deserved recognition.”

The mission of Swiss InsurTech Hub is to enable the dialogue and exchange of the diverse participants of the ecosystem, including innovators, experts, partners, academics, and diverse technologies, from Switzerland and around the world.

She adds: “Insurance companies need to have a broader stakeholder engagement to work on opportunities to tackle challenges. They need to approach collaboration to solve problems in a similar way to how the aviation industry does it: by sharing knowledge to continuously improve safety in the airways. Being part of an ecosystem allows companies to absorb different perspectives. In that way, startups can help them to redefine classic insurance processes by adopting innovative technologies.”

Sharing Best Practices

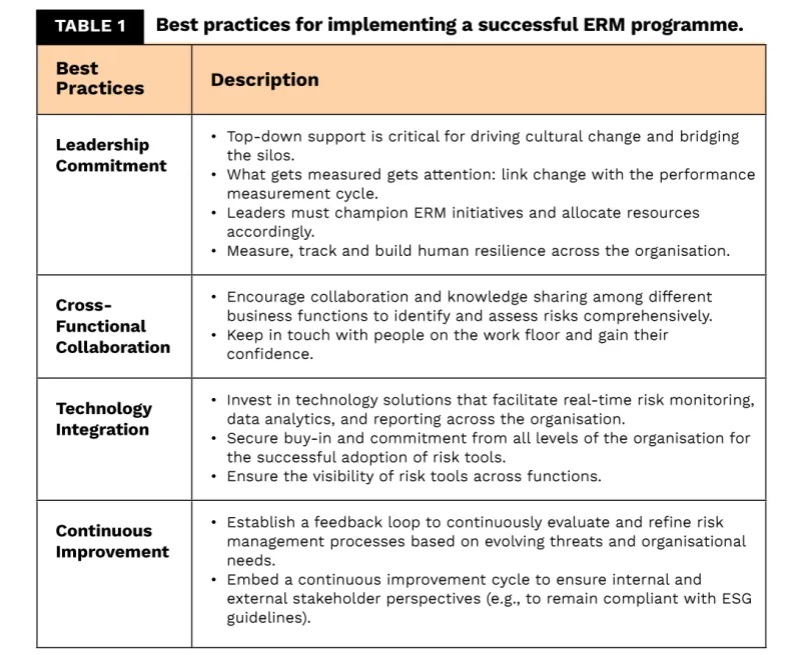

The proactive approach to bridging silos in risk management aligns with the ethos of the Risk-In conference, which aims to bring together top talent from various industries to collaborate on advancing the field and finding new solutions to problems that historically were addressed in isolation. Table 1 outlines several best practices for implementing an effective ERM programme.

These practices have proven successful for organisations to bridge the silos in the past and are considered fit for purpose. Martin concludes: “In terms of best practices, it is a fact that risk management should be in the line of business and help solve business problems.”

As organisations and captive owners continue to evolve, embracing innovation, collaboration, and adaptability will be key to enhancing resilience and driving sustainable growth. By leveraging insights from diverse perspectives and adopting transformative technologies, they can deal with uncertainty with confidence, turning challenges into opportunities for long-term success.

About the Author

Dr. Kamil J. Mizgier is the founder and CEO of SciRisk, a risk management consulting firm. He is the former Global Supplier Relationship and Risk Management Leader at Dow with 15 years of experience in implementing risk management strategies across industry sectors. Before this role, he led enterprise risk modelling projects and teams, among others, at BNY Mellon and UBS. He has published a number of articles in academic and practitioner journals, and he is a frequent public speaker. He obtained his master’s degree in applied physics at the Warsaw University of Technology and a PhD in supply chain management at ETH Zurich.

Dr. Kamil J. Mizgier is the founder and CEO of SciRisk, a risk management consulting firm. He is the former Global Supplier Relationship and Risk Management Leader at Dow with 15 years of experience in implementing risk management strategies across industry sectors. Before this role, he led enterprise risk modelling projects and teams, among others, at BNY Mellon and UBS. He has published a number of articles in academic and practitioner journals, and he is a frequent public speaker. He obtained his master’s degree in applied physics at the Warsaw University of Technology and a PhD in supply chain management at ETH Zurich.

References

-

https://www.risk-in.com/

-

L. Buchanan, “Breakthrough Ideas for 2004,” Harvard Business Review 2 (2004): 13–16