Lease accounting tasks require accuracy. Make one mistake and you risk becoming non-compliant to rigid accounting standards which leads to hefty penalties among other disastrous repercussions.

That is why you should forego any manual lease accounting workflow and replace them with automated solutions.

These systems can heighten your efficiency and accuracy and preserve your constant adherence to ASC 842, IFRS 16, and GASB 87.

If you’re searching for the best solution to help your business achieve those things, check out these five lease accounting tools:

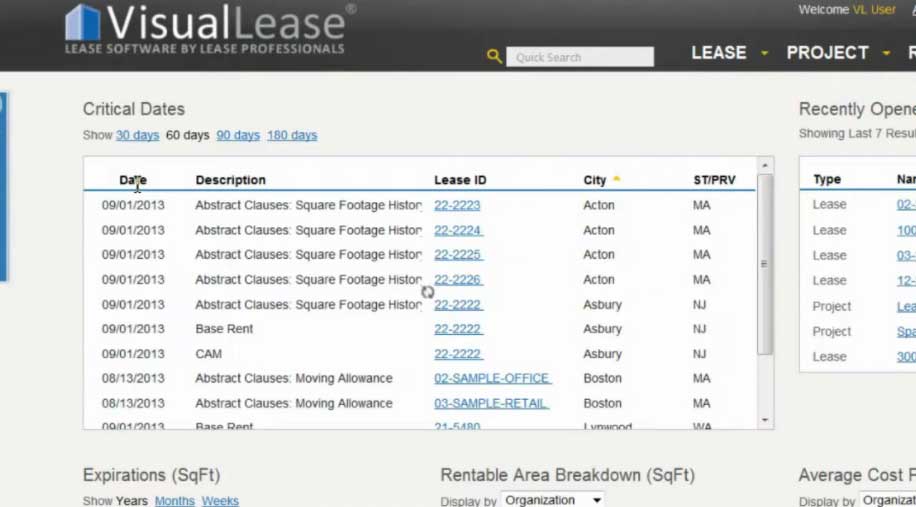

1. Visual Lease

Visual Lease is a SaaS platform also designed to simplify your compliance with accounting standards. Integrated with enterprise resource planning (ERP) systems, it is ideal for real estate and equipment leases.

Its lease accounting features let you take control of your data, simplify reporting and compliance, and connect ERP and accounting information. Specifically, these functions include:

- Lease reporting (with a collection of hundreds of templates)

- Journal entry reports

- General ledger and accounts payable integration

- Finance and operating leases classification

Visual Lease also has lease administration functionalities such as ad hoc reporting, date alerts, and CAM and operating expense analysis. In this way, you can streamline your portfolio management and follow the correct reporting requirements.

Visual Lease has supported many companies in streamlining their workflows, especially those transitioning from manual-heavy processes. It also seamlessly integrates lease administration and lease accounting functions.

However, some features are not user-intuitive (e.g., drop-down date, ad hoc reports, input key, etc). Users even reported the need for improvements to ease the lifecycle management of leased assets.

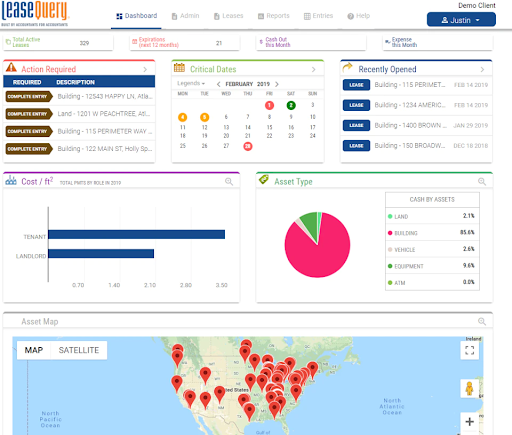

2. LeaseQuery

LeaseQuery is a robust platform that simplifies lessee and lessor accounting for GASB 87 and lessee accounting for ASC 842 and IFRS 16. It has a proven track record for helping numerous businesses transition seamlessly in their compliance.

LeaseQuery has features for accurate financial management, such as critical date reminders and a reporting suite for lease analysis.

The software also contains customizable role-based access, data entry validation, audit trail reporting, and other controls to maintain data integrity.

Finance teams, accounting firms, and government organizations can benefit from LeaseQuery’s accounting intelligence with these functions:

- Borrowing rate charts

- Contingent rent

- ROU asset and lease liability calculation

- Custom calendars

- Practical expedient application, and

- Assessment of lease and non-lease components.

Multi-currency, and translation, and remeasurement are even available to accommodate international lease accounting workflows.

Generally, LeaseQuery is secure and straightforward with its one-click journal entry accessibility, centralized document repository, and SSL data encryption, among others.

Clients only wish LeaseQuery had easier-to-use search functions, plus other information auditors often examine. Some reports can also be tedious to generate.

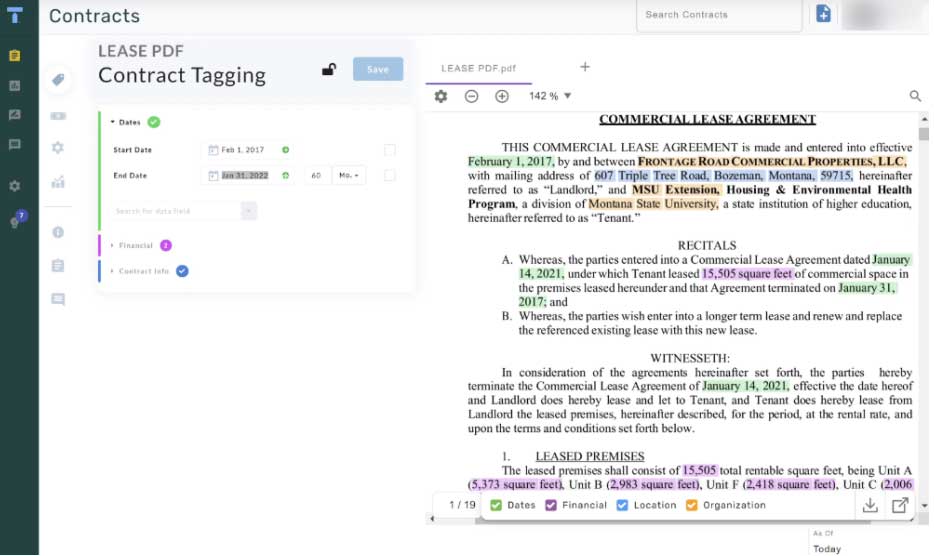

3. Trullion

Trullion is a leading lease accounting SaaS that empowers companies to comply with ASC 842, IFRS 16, and GASB 87.

The platform uses artificial intelligence (AI) to automate workflows and compliance and stay true to your source data.

For instance, Trullion’s AI and optical character recognition capabilities extract relevant data from your uploaded PDF lease contracts in minutes.

Trullion also lets you generate reports and contract accounting calculations in the prescribed formats for compliance.

These documents contain viewable computation formulas and entries connected to their original data sources (accessible with a single click only). These features are ideal for streamlining your audit trails.

Additionally, Trullion can detect new, modified, or deleted assets, incorporate them into reports, and present visual adjustment history timelines for your reference.

These powerful functionalities promote financial transparency and give controllers, auditors, and CFOs a single source of truth. Accounting teams and firms can also boost their workflow efficiency, reporting accuracy, and confidence in their data.

Trullion as a SaaS is user-intuitive, well-rounded, and high-performing. Users claim it has an automatic data extraction accuracy rate of 95% and that they haven’t encountered any bugs.

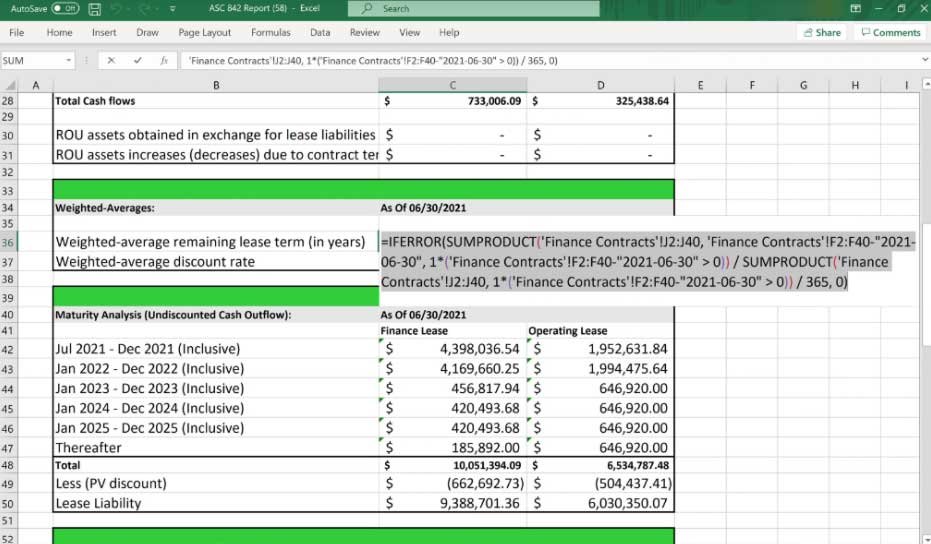

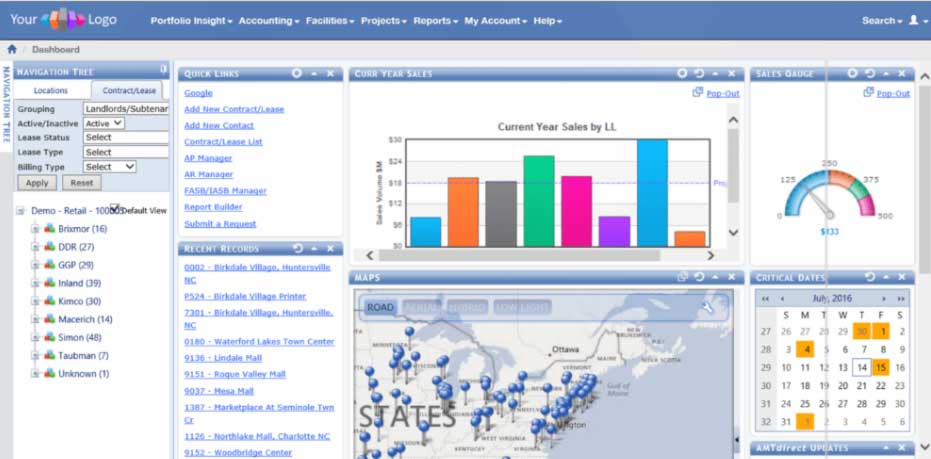

4. AMTdirect

AMTdirect (now part of MRI software) has a comprehensive lease accounting software for real estate and equipment. This fully integrated solution helps you comply with ASC 842, IFRS 16, and GASB 87.

It boasts of providing comprehensive features and business benefits such as:

- Lessor accounting. Lease receivables linked to headless payables, whether the tenant is an intercompany or a third-party organization

- Lease level accounting. Audit trail available for every lease of all balance sheet computations, including opening and closing liability, amortization, depreciation, interest, etc., for each period in the company’s accounting calendar

- Dual reporting. Group and Entity reporting, plus ASC 842 and IFRS 16 dual reporting, for businesses mandated to declare (on the balance sheet) the impact of the leases across several entities within a global group

Companies of any size and industry can benefit from using AMTdirect. The platform has served clients in construction, retail, manufacturing, hospitality, healthcare, real estate, business services, and restaurants.

In particular, users liked AMTdirect’s cloud-based database that made their documents always accessible. However, they reported several kinks, feature limitations, unreliable reports, lack of user-intuitiveness, and cumbersome lease accounting workflows.

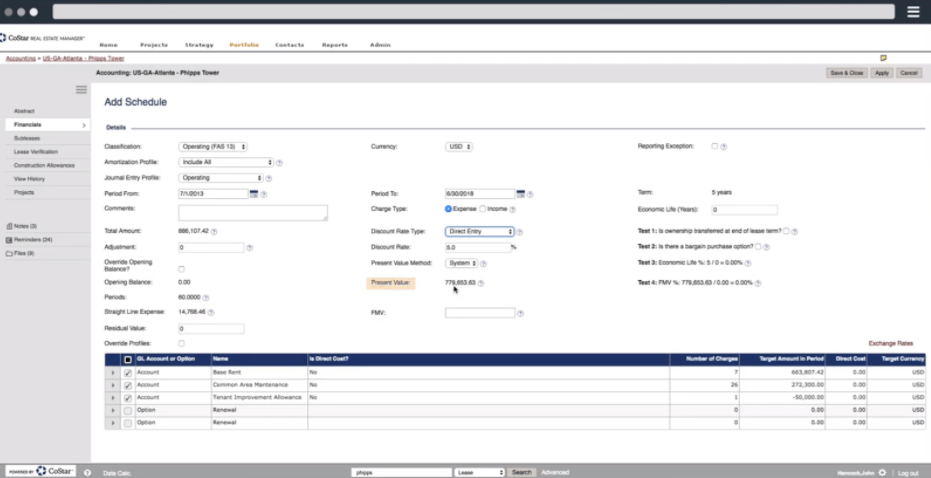

5. CoStar Real Estate Manager

CoStar Real Estate Manager is a suite of technologies for real estate and lease management processes.

It simplifies lease administration for sub-leased tenants, leased locations, and owned properties. The software is suitable for equipment lease managers, service providers, corporate real estate departments, restaurants, and retailers.

CoStar Real Estate Manager offers several lease accounting and lease administration functionalities:

- Advanced remeasurement

- Discount rate automation

- Retrospective true-up functionality

- Mapping to several GL codes and accounting systems

- Advanced expense payment tracking

- Personalized dashboards and list pages

- Date calculator, clause bank, and other built-in apps

- Taxable charge computations for VAT, GST, HST, and others

- Select standard clauses for abstract insertion

- Property and cost center synchronization, etc.

With these features, you can increase your accounting accuracy, streamline payments, remove information silos, make smarter business decisions, and more.

Many companies also like doing several other real estate tasks with the software, e.g., searching for properties, obtaining in-depth information, and promoting listings.

Some downsides to this cloud-based solution are its hefty price tag, complex navigation, and difficulty transitioning from previously used software.

Let the best software handle your lease accounting processes.

Delegate tedious workflows to the best lease accounting software for your business. Explore these and other solutions from software reviews, and choose one that optimizes your efficiency and accuracy.

Consider also how it meets your accounting, audit, and compliance needs, including expectations for factors such as onboarding and customer service.

Overall, your selected solution should give excellent value for your money and deliver on its promises to support your lease accounting processes.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.