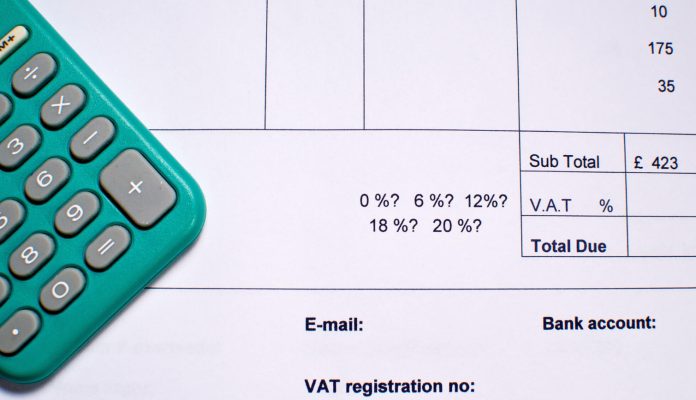

Value Added Tax (VAT) is a tax charged on the sale of goods and services in several nations around the world. It is a consumption tax that the end consumer eventually pays, but it is collected and remitted to the government by services. VAT returns are a means for businesses to report how much they have collected and paid on their sales and purchases during an offered duration. Businesses can ensure accurate VAT return filings by using VAT number validation API. But the question remains – are VAT returns monthly?

The short answer of this question is, VAT returns can be monthly, quarterly, or annually, depending upon the business’s turnover and the VAT scheme they are registered under.

Frequency of VAT returns

The frequency of VAT returns depends upon the policies and laws of each nation. In some countries, businesses must submit VAT returns every month; in others, they must send them quarterly. Companies might also need to submit VAT returns annually.

Numerous factors identify the frequency of VAT returns that a company needs to submit:

- Turnover of the business: In most countries, the turnover of a business is a crucial factor in determining the regularity of VAT returns. Companies with higher turnover usually need to send VAT returns more frequently than businesses with lower turnover.

- VAT registration status: The VAT enrollment condition of a company can likewise impact the regularity of VAT returns. Businesses called to register for VAT are usually required to send VAT returns more regularly than businesses not registered for VAT.

- Country-specific rules: The regularity of VAT returns can additionally differ depending upon the regulations of the country where the company is located. Some countries require monthly VAT returns, while others call for quarterly or annual ones.

Monthly VAT returns

In lots of nations, businesses are required to submit monthly VAT returns. This is usually the instance in countries with high VAT rates, such as the European Union. In these nations, businesses are required to report their VAT responsibility and VAT spent every month. This suggests that services must keep comprehensive documents of their sales and acquisitions for every month to calculate their VAT obligation correctly.

Quarterly VAT returns

In other countries, businesses must submit VAT returns every quarter. This is usually the situation in countries with reduced VAT rates. In these nations, businesses are called to report their VAT liability and also VAT paid for each quarter. This implies that companies should keep thorough records of their quarterly sales and purchases to calculate their VAT obligation accurately.

Annually VAT Returns

In some nations, businesses are just called to send VAT returns annually. This is commonly the instance in countries with meager VAT prices. Companies must report their VAT obligation and VAT spent for the entire year in these countries. This means companies should maintain in-depth records of their sales and acquisitions for the year to determine their VAT responsibility accurately.

Conclusion

In conclusion, VAT returns can be monthly, quarterly, or yearly, depending upon the business’s turnover and the VAT scheme they are signed up under. The frequency of VAT returns is determined by turnover, enrollment status, and country-specific policies. In some nations with high VAT rates, businesses must send monthly VAT returns. In contrast, companies might need to send quarterly or annual VAT returns in various countries with lower VAT prices. Regardless of the frequency, businesses should keep comprehensive records of their sales and purchases to determine their VAT responsibility accurately.

Giddh offers free VAT return filing services for UK small businesses and entrepreneurs, helping streamline the tax process and ensure compliance. This makes it a valuable tool for managing finances while staying up-to-date with VAT regulations.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.