By Ralph Geertsema, OP Lumijärvi, and John Wass

Introduction

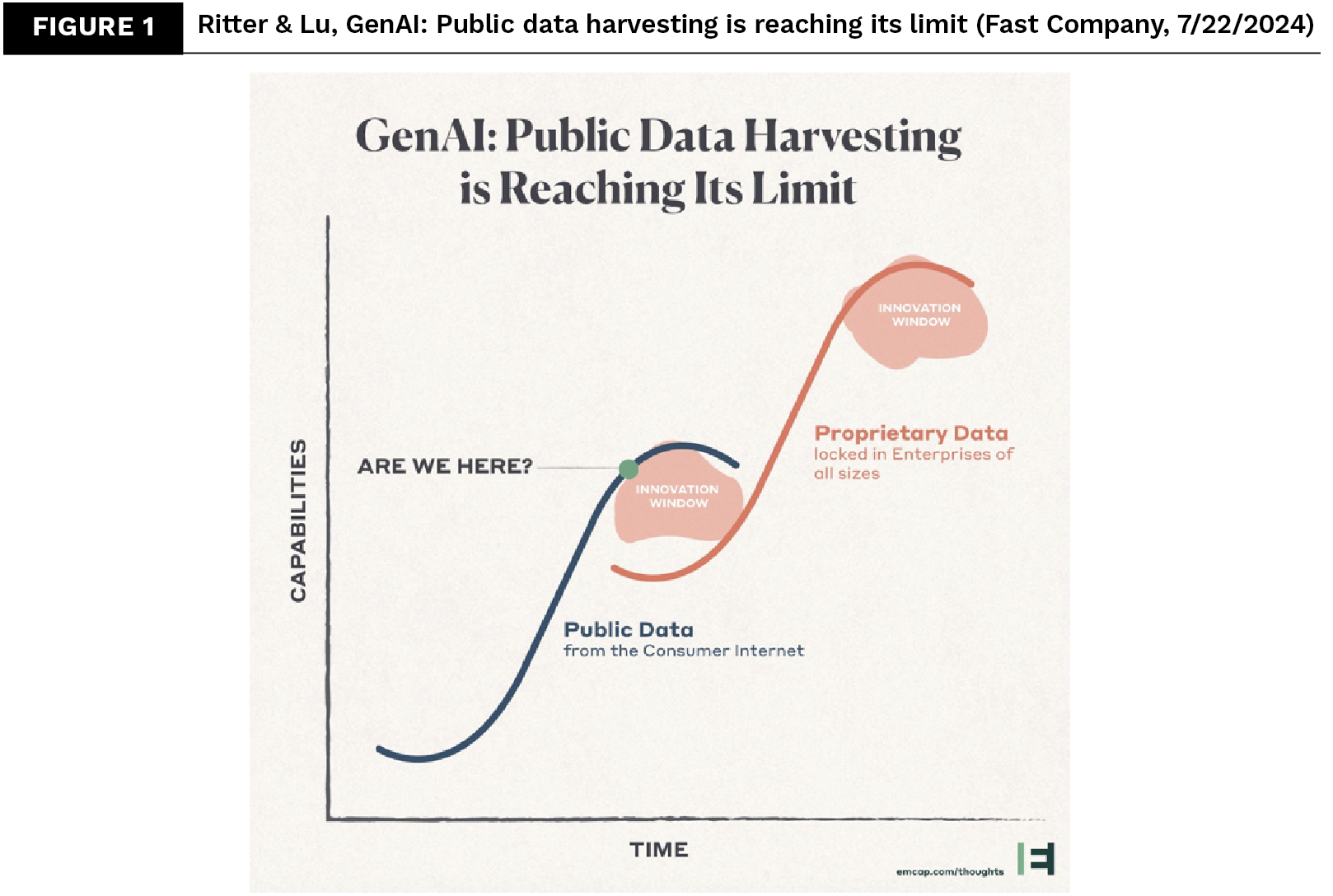

Over the recent years, AI has conquered the world by storm and has been widely used so far for GenAI with LLMs and chatbots in companies. Results are great and it seems that employees are enthusiastic to adapt new tools to increase their productivity. However, most of these tools are based upon public data and intelligence gathered from it. Ritter and Lu have asserted that the next way in AI will concentrate on enterprises’ own data. We foresee that this next wave of AI will also open up opportunity to utilize the immense power of AI to improve companies’ performance and profitability in particular.

We see that there is a huge potential for AI across multiple business functions. Especially, we have already seen how the new wave of AI enables integrated financial forecasting and product profitability analysis across finance, marketing, and sales.

Enhancing product profitability

One of the basic questions any company needs to answer is what product-services mix to offer to which customer segments. To answer that question accurately and in a data-driven manner, management needs to understand better the profitability of their services, products, and customers in a timely fashion.

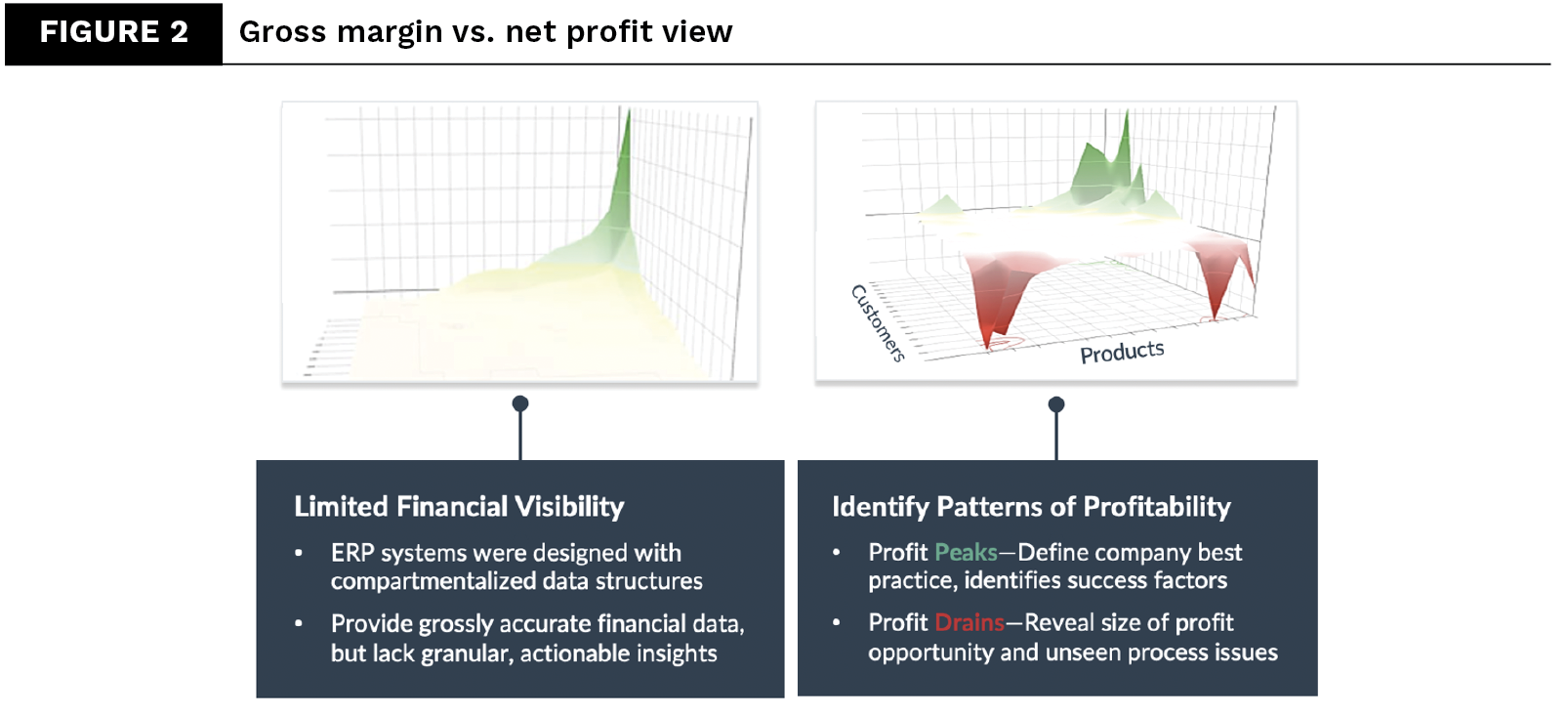

Most companies analyze their product and customer data by gross margin. The main reason is simply that this data is somewhat easily available from ERPs. When it comes to fixed costs, many companies do not allocate those to the products or the customer. The primary cause is that it is difficult, and you need to apply, for example, an activity-based costing principle. This is not easy, mainly because the data you need is not only in the ERP but in various production and logistic systems and Excel sheets. In addition, master data about products and customers is always a challenge in any company, especially due to acquisitions and system changes.

The capability of AI to perform complex and large-scale data harmonization and integration at speed is phenomenal and has never been seen before.

The unique value that AI can bring to the product profitability domain is three-fold and these are real boosters to some major drawbacks of the past. First, the capability of AI to perform complex and large-scale data harmonization and integration at speed is phenomenal and has never been seen before. This is especially relevant in setting up allocation engines and maintaining and keeping product profitability systems up to date. Once the algorithm has “learned” how an allocation or assignment of cost should happen, this will automatically be applied to similar transactions.

Second, the ability to drive multiple views over the data by customer and market segment or by product and / or services is unprecedented at this speed and multi-dimensionality. Third, once the time dimension is added to this data set, we can start to understand causality, which means that we can understand what actions lead to which outcomes. Altering pricing, special promotions, and campaigns are always assumed to drive sales and revenues, but what happens to profitability has been impossible to track at scale and in detail up to now.

This is where AI can act as an enabler to bring the different domains and data sources (sales, marketing, finance) together and show its real strength. In fact, there are companies that can analyze their product, service, and customer profitability at net profit level using AI and create a competitive advantage by choosing the right customers and producing the right products and services at the right cost (see figure 2).

Case example

Many retailers still look at their business through the traditional lenses of revenue and gross margin. This lens creates blind spots that can cost retailers 10–20 per cent of their profits. One $10bn US retailer had a large and promotionally active loyalty program focused on increasing their revenue. When looked at through the lens of profitability utilizing an AI-based solution, it turned out that 35 per cent of their highest loyalty tier customers were unprofitable. These over-promoted loyalty customers had one common characteristic that was easily identified. The company quickly took action to: 1) slightly reduce promotional spending to unprofitable customers, 2) focus promotions away from a particular set of low-profit services (made unprofitable by promotions), and 3) restructure the loyalty program incentives to reward more profitable products and purchasing behavior. The result was a 5 per cent increase in company profitability with continued revenue growth.

As the case example shows, with AI, imperfect data is not a limitation and the company created a visibility to net profit for every transaction. This creates a great platform for various use cases in companies such as:

- Cost optimization: break down your general ledger and dynamically assign costs down to every transaction from your business and analyze costs across production, marketing, and sales to optimize profitability.

- Customer segmentation and product mix: cluster your customers, products, and operations data into clear segments of high profit, low profit, and losses for customer segment and product strategic decision-making.

In addition, you can do revenue forecasting by predicting product demand and revenue by integrating market trends and sales data.

Conclusions

What we can see with the start of using AI for product profitability is that it will start to bring insights into the company that can lead to further, deeper insights in the following domains:

- Revenue and sales forecasting

- Demand and capacity planning and forecasting

- Integrated Sales and Operations planning

The use of AI in the product profitability space is proving to be a big step forward in this domain, bringing product profitability fully back into the spotlight. This will lead to much better accessible, faster and more accurate insights for companies in their evaluation of profitable and loss-making products, segments, and markets.

Ralph Geertsema

Ralph Geertsema Olli-Pekka Lumijärvi

Olli-Pekka Lumijärvi John Wass

John Wass