By Jean-Marc Ollagnier, Svenja Falk and Laura Wright

Despite the challenging business environment, European executives are optimistic about their organization’s future growth. By embracing Total Enterprise Reinvention, European companies can exceed their goals and thrive amid the economic headwinds.

KEY TAKEAWAYS

- Europe has a unique opportunity to accelerate its path to reinvention by leveraging its strengths in areas such as sustainability, innovation, and social responsibility.

- To do this, Europe must focus on creating a more unified and coordinated approach to innovation, investing in digital infrastructure and skills, and fostering a culture of entrepreneurship and risk-taking.

- By embracing these strategies, Europe can position itself as a global leader in the new economy, driving sustainable growth, creating jobs, and improving quality of life for citizens across the continent.

Despite growing concerns around Europe’s business competitiveness, it is perhaps surprising that there is a growing sense of optimism among European executives in 2023. Accenture’s recent research found that just less than two-thirds (65%) of European executives think the current business environment is the most challenging, a smaller proportion than their US and Chinese counterparts (74% and 81% respectively).1

European executives are feeling confident. Nearly nine out of ten of those Accenture surveyed in October through November 2022 believed their organisation was on track to achieve its annual growth goals – and four-fifths reported their organisations are well positioned to capture future growth.2 And this is despite the economic challenges which have hit Europe harder than other geographical regions. The economic fallout from ongoing geopolitical instability, including the war in Ukraine, was most dramatic here, causing supply chain disruptions, energy price shocks, and a spiralling cost of living crisis across the continent.

Companies are now turning resilience into ambitious plans for change – the boldest among them view the current environment as a unique opportunity to reinvent themselves to pursue new paths for growth and thrive over the long term.

Companies are now turning resilience into ambitious plans for change – the boldest among them view the current environment as a unique opportunity to reinvent themselves to pursue new paths for growth and thrive over the long term.

A challenging time for Europe

Despite some silver linings in the macroeconomic data, the environment in Europe continues to be tough.3 Nearly a fifth (19%) of European executives cite rising energy costs as the top challenge to profit margins. And the outlook for the energy crisis remains uncertain. Europe has experienced a tight labour market since the pandemic: talent shortages are at the highest levels in a decade, with a 2.9% job vacancy rate in Q3FY22.4 Plus more than nine out of ten (91%) European companies are off pace to meet their net-zero targets if they don’t at least double the pace of emissions reduction by 2030.5 Meanwhile, the US Inflation Reduction Act could be a significant headwind to European competitiveness by enticing European manufacturing businesses to take advantage of tax breaks and subsidies on the other side of the Atlantic. There are similar green manufacturing incentives in Japan and Korea, further tempting businesses to invest and move operations outside of Europe. This led the European Commission to present the Green Deal Industrial Plan for the Net-Zero Age at the beginning of February 2023.6

Sources of Strength and Weaknesses to Address

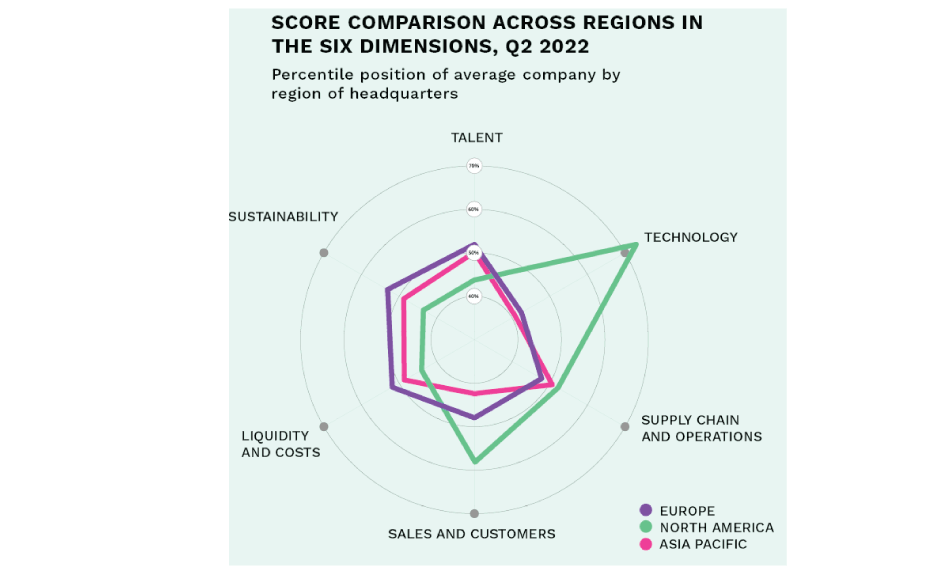

Seeking to understand how European companies stack up against their global counterparts, Accenture’s researchers analysed the strengths and weaknesses of firms across Europe, North America, and Asia Pacific. We compared company performance across six areas: talent, technology, supply chain and operations, sales and customers, liquidity and costs, and sustainability.

As the figure shows, European businesses perform better in embedding sustainability throughout their organisations, and they lead in talent and unlocking people’s potential. They also perform well at driving down costs and improving liquidity. This goes some way in explaining their relative strength in profitability. Revenue growth for companies in Europe is slower than in North America and Asia Pacific, whereas profit performance (as measured by earnings before interest and tax [EBIT]) is relatively high. This reveals a tendency to squeeze value from existing operations, rather than using that liquidity to invest in new revenue streams or technology. When they do invest in technology, they use it to optimise rather than to reinvent business models, a shortcoming also exposed by their weakness in customer and sales.

By their own admission, European executives report that just 16.9% of their company’s global revenue is invested in transformation initiatives, compared to 20% amongst US companies.7 What’s more, European companies fell $388 billion short of matching North America’s R&D investment pace over the past five years.8 To pick up the slack, European companies must shift from eking out value from existing revenue streams to investing in new growth.

Closing the Gap in Technology

Now, the greatest challenge Europe faces is one of long-term competitiveness. And it all starts with technology.

A small group of companies is adopting a deliberate, continuous strategy of “Total Enterprise Reinvention”; they are quietly and systematically changing the game and their industries, driving a new strategic imperative. These are the “Reinventors”. Powered by advancements in technologies such as artificial intelligence (AI) and cloud computing, they embrace Total Enterprise Reinvention to grow and lead in today’s volatile environment. Yet only 6% of European companies surveyed emerged as Reinventors, compared to 8% of those in North America and 9% in Asia Pacific.9

The digital core is central to Total Enterprise Reinvention.

As a whole, European companies are behind in using technology for top-line value creation. This includes the creation of digital business models as well as the adoption of a digital culture. Less than half stand above the global average for technology penetration and mastery according to Accenture’s survey. Meanwhile, just 16% of European executives assess their current available technology as a significant enabler in the execution of their transformation programmes. It is perhaps unsurprising then, that the majority (90%) of European companies fall into the “Transformers” category, that is, companies embracing technology as a core part of their transformation, but sporadically across the enterprise, and often as distinct and siloed projects. In North America, this group accounted for 84% of companies, and 86% in Asia Pacific.

The good news is that European businesses are closing the gap. Over the past two years, they have accelerated technology implementation far more than their international peers: in cloud services, AI and automation, and cybersecurity. They are also undaunted in the face of economic uncertainty: when asked if there were to be a recession in their main markets in 2023, 87% said they would speed up their reinvention programmes, compared to 73% in North America and 64% in Asia Pacific.

The Path Forward: Evolving from Transformers to Reinventors

While European businesses have built extraordinary resilience in recent years, they must now evolve from Transformers to Reinventors to address the unique structural challenges they face. For them, the journey to reinvention begins by focusing on their strengths in the energy transition and talent while resolving their deficits in technology and customer needs.

Four steps to prepare for Total Enterprise Revolution:

1. Build your digital core

- Establish a digital foundation using cloud, data, and AI to scale new processes and innovations across the enterprise.

- Amplify the power of digital through compressed transformation and use the digital core to scale innovations that reinvent business and operating models.

Elevate cybersecurity to the CEO level, not only to share accountability but to ensure it’s embedded in the growth strategy.

2. Speed your energy transition

- Work across your ecosystem to advance net-zero and circular principles for global competitiveness.

- Prioritise your transition to clean energy.Energy efficiency plays an important role in reducing emissions and costs.

- Invest in “carbon intelligence” and environmental, social, and governance (ESG) reporting and hold leadership accountable for progress.

3. Align to new customer needs

- See customers within the context of their full lives. Use human and machine intelligence to understand customers and their motivations in a holistic and dynamic way.

- Solve shifting customer scenarios. Abandon one-size-fits-all offerings for more personalised products and services.

- Simplify marketing operations to drive innovation and efficiency. Create simple and unified experiences for customers by integrating customer-facing functions across a single data and experience platform.

4. Make talent strategy core to your business strategy

- Place people at the centre of reinvention. Establish your chief human resources officer (CHRO) as the catalyst for change.

- Access and create talent in innovative ways.

- Infuse a culture of inclusion across the organisation. Invest in employee well-being and engagement.

A Stronger Europe: Now or Never

European companies have already shown they can weather the storms of the past few years, and not only survive but thrive amid the economic headwinds. Having proven their resilience, European companies’ next great challenge is to build long-term competitiveness. Sustained investment in technology-driven transformation is the path to stronger growth. These unprecedented times call for an unprecedented response from European companies. A bold and visionary approach to transformation is required to reach a new performance frontier. Accenture’s analysis has shown that companies embracing Total Enterprise Reinvention outperform their peers in revenue growth and create sustainable value.10

This is a pivotal moment for a stronger Europe. As optimism toward the future builds, the time to strike is now.

About the Author

Jean-Marc Ollagnier is the Chief Executive Officer of Accenture in Europe and a member of Accenture’s global management committee.

Jean-Marc Ollagnier is the Chief Executive Officer of Accenture in Europe and a member of Accenture’s global management committee.

Svenja Falk is Managing Director and leads Accenture Research Europe. She also is deputy chairwoman on the Council on Digital Sovereignty in Germany and honorary professor at the Justus Liebig University Giessen.

Svenja Falk is Managing Director and leads Accenture Research Europe. She also is deputy chairwoman on the Council on Digital Sovereignty in Germany and honorary professor at the Justus Liebig University Giessen.

Laura Wright is a Research Manager and leads Europe Thought Leadership at Accenture Research.

Laura Wright is a Research Manager and leads Europe Thought Leadership at Accenture Research.

References

- Accenture, Business Strengths Survey of 2000 C-Suite leaders in 10 markets (N=1,450 in Europe [France, Germany, Italy, Netherlands, Nordics, Spain, Switzerland and the United Kingdom]. N=250 in China. N=350 in the United States. Fielded October-November 2022. Cross-industry).

- Accenture, Business Strengths Survey, 2022.

- International Monetary Fund, World Economic Outlook Update, January 2023.

- Eurostat, Job Vacancy Statistics, accessed 19 December 2022.

- Accenture, Accelerating Global Companies towards Net Zero by 2050, 2022.

- European Commission, The Green Deal Industrial Plan for the Net-Zero Age, 2023

- Accenture, Business Strengths Survey, 2022.

- Accenture Research analysis based on S&P Capital IQ. Excludes financial services companies. The cumulative figure is based on the sample of companies covered in the analysis and is arrived at by applying the North American rate of investment in R&D to European companies to arrive at the approximate shortfall. Sample Size: 1,843 of which Europe: 909, North America: 486 and Asia Pacific: 448.

- Accenture, Total Enterprise Revolution, 2023.

- Accenture, Total Enterprise Revolution, 2023.