By Martin Hirt and Paul Willmott

Digitization is rewriting the rules of competition, with incumbent companies most at risk of being left behind. Below, Martin Hirt and Paul Willmott of McKinsey & Company identify the forces that are changing the market and list the six critical decisions that CEOs must make to address the strategic challenge posed by the digital revolution.

Many incumbents responded effectively to threats from the first wave of internet competitors 15 years ago, some of which in any event dissipated with the dot-com crash. Today’s challenge is different. Robust attackers are scaling up with incredible speed, inserting themselves artfully between you and your customers and zeroing in on lucrative value-chain segments.

The digital technologies underlying these competitive thrusts may not be new, but they are being used to new effect. Staggering amounts of information are accessible as never before — from proprietary big data to new public sources of open data. Analytical and processing capabilities have made similar leaps with algorithms scattering intelligence across digital networks.

As these technologies gain momentum, they are profoundly changing the strategic context: altering the structure of competition, the conduct of business, and, ultimately, performance across industries. To stay ahead of the unfolding trends and disruptions, leaders across industries will need to challenge their assumptions and pressure-test their strategies.

Opportunities and Threats

Digitization often lowers entry barriers, causing long-established boundaries between sectors to tumble. At the same time, the “plug and play” nature of digital assets causes value chains to disaggregate, creating openings for focused, fast-moving competitors. New market entrants often scale up rapidly at lower cost than legacy players can, and returns may grow rapidly as more customers join the network.

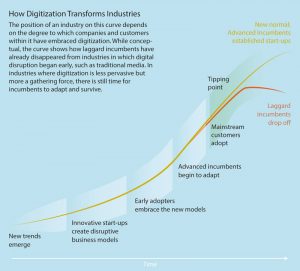

Digital capabilities increasingly will determine which companies create or lose value. Those shifts take place in the context of industry evolution, which can follow a well-worn path: new trends emerge and disruptive entrants appear, their products and services embraced by early adopters. Advanced incumbents then begin to adjust to these changes, accelerating the rate of customer adoption until the industry’s level of digitization — among companies but perhaps more critically, among consumers as well — reaches a tipping point. Eventually, what was once radical is normal, and unprepared incumbents run the risk of becoming the next Blockbuster. Others, which have successfully built new capabilities, become powerful digital players. The opportunities for leaders include:

• Enhancing interactions among customers, suppliers, stakeholders, and employees. For many transactions, consumers and businesses increasingly prefer digital channels, making content universally accessible by mixing media, tailoring messages for context, and adding social connectivity. These channels lower the cost of transactions and record them transparently, which can help in resolving disputes.

• Improving management decisions as algorithms crunch big data from social technologies or the Internet of Things. Better decision-making helps improve performance across business functions.

• Enabling new business or operating models, such as peer-to-peer product innovation or customer service. Telstra crowdsources customer service, so that users support each other to resolve problems without charge. New business or operating models can disintermediate existing customer–supplier relations.

The upshot is that digitization will change industry landscapes as it gives life to new sets of competitors. Some players may consider your capabilities a threat even before you have identified them as competitors. Indeed, the forces at work today will bring immediate challenges, opportunities — or both — to literally all digitally connected businesses.

Seven Forces at Work

Our research and experience with leading companies point to seven trends that could redefine competition.

1. New pressure on prices and margins

Digital technologies create near-perfect transparency, making it easy to compare prices, service levels, and product performance. This dynamic can commoditize products and services as consumers demand comparable features and simple interactions.

2. Competitors emerge from unexpected places

Digital dynamics often undermine barriers to entry and long-standing sources of product differentiation. Web-based service providers of insurance, for instance, can compete effectively by mining data on risks and on the incomes and preferences of customers. New competitors can often be smaller companies that will never reach scale but still do a lot of damage to incumbents.

3. Winner-takes-all dynamics

Digital businesses reduce transaction and labour costs, increase returns to scale from aggregated data, and enjoy increases in the quality of digital talent and intellectual property as network effects kick in. The cost advantages can be significant: online retailers may generate three times the level of revenue per employee as even the top-performing discounters. Comparative advantage can materialize rapidly in these information-intensive models — not over the multiyear spans most companies expect.

4. Plug-and-play business models

As digital forces reduce transaction costs, value chains disaggregate. Third-party products and services can be quickly integrated into the gaps. Amazon, for instance, offers businesses logistics, online retail “storefronts”, and IT services. For many businesses, it may not pay to build out those functions at competitive levels of performance, so they simply plug an existing offering into their value chains. With a license, individuals or small groups can be up and running their own firms.

5. Growing talent mismatches

Software replaces labour in digital businesses. For example about half of the processes in banks can be fully automated. Computers increasingly are performing complex tasks as well. “Brilliant machines”, like IBM’s Watson, are poised to take on the work of many call-centre workers. Even knowledge-intensive areas, such as oncology diagnostics, are susceptible to challenge by machines. Digitization will encroach on a growing number of knowledge roles within companies as they automate many frontline and middle management jobs. A key challenge for senior managers will be sensitively reallocating the savings from automation to the talent needed to forge digital businesses.

6. Converging global supply and demand

Digital technologies know no borders, and the customer’s demand for a unified experience is raising pressure on global companies to standardize offerings. In the B2C domain, for example, many US consumers are accustomed to e-shopping in the United Kingdom for new fashions. They have come to expect payment systems that work across borders, global distribution, and a uniform customer experience.

7. Relentlessly evolving business models – at higher velocity

Digitization isn’t a one-stop journey. A case in point is music, where the model has shifted from selling tapes and CDs (and then MP3s) to subscription models, like Spotify’s. In transportation, digitization (a combination of mobile apps, sensors in cars, and data in the cloud) has propagated a powerful non-ownership model best exemplified by Zipcar, whose service members pay to use vehicles by the hour or day. Google’s ongoing tests of autonomous vehicles indicate even more radical possibilities to shift value. As the digital model expands, auto manufacturers will need to adapt to the swelling demand of car buyers for more automated, safer features.

Managing the Strategic Challenges: Six Big Decisions

Rethinking strategy in the face of these forces involves difficult decisions and trade-offs. Here are six of the thorniest.

Decision 1: Buy or sell businesses in your portfolio?

The portfolio of businesses within a company may have to be altered if it is to achieve its desired financial profile or to assemble needed talent and systems. Beauty product and fragrance retailer Sephora, for example, recently acquired Scentsa, a specialist in digital technologies that improve the shopping experience. Sephora officials said they bought the company to keep its technology out of competitors’ reach and to help develop in-store products more rapidly.

Decision 2: Lead your customers or follow them?

In some situations, the right decision may be to forego digital moves — particularly in industries with high barriers to entry, regulatory complexities, and patents that protect profit streams. Digital efforts risk cannibalizing products and services and could erode margins. Yet inaction is equally risky. In-house data on existing buyers can help incumbents with large customer bases develop insights (for example, in pricing and channel management) that are keener than those of small attackers. Brand advantages too can help traditional players outflank digital newbies.

Decision 3: Cooperate or compete with new attackers?

A large incumbent in an industry that’s undergoing digital disruption can feel like a whale attacked by piranhas. While in the past, there may have been one or two new entrants entering your space, there may be dozens now. PayPal, for example, is taking slices of payment businesses. Companies can neutralize attacks by rapidly building copycat propositions or even acquiring attackers. However, it’s not feasible to defend all fronts simultaneously, so cooperation with some attackers can make more sense than competing.

Decision 4: Diversify or double down on digital initiatives?

As digital opportunities and challenges proliferate, deciding where to place new bets is a growing headache for leaders. Diversification reduces risks but often small initiatives, however innovative, don’t get enough funding to endure or are easily replicated by competitors. One answer is to think like a private-equity fund, seeding multiple initiatives but being disciplined enough to kill off those that don’t quickly gain momentum and to bankroll those with genuinely disruptive potential. The alternative is to double down in one area, which may be the right strategy in industries with massive value at stake.

Decision 5: Keep digital businesses separate or integrate them with current nondigital ones?

Integrating digital operations directly into physical businesses can create additional value — for example, by providing multichannel capabilities for customers or by helping companies share infrastructure, such as supply-chain networks. However, it can be hard to attract and retain digital talent in a traditional culture, and turf wars between the leaders of the digital and the main business are commonplace. Moreover, different businesses may have clashing views on, say, how to design and implement a multichannel strategy.

The UK department-store chain John Lewis bought additional digital capabilities with its acquisition of the UK division of Buy.com, in 2001, ultimately combining it with the core business. Hybrid approaches involving both stand-alone and well-integrated digital organizations are possible, of course, for companies with diverse business portfolios.

Decision 6: Delegate or own the digital agenda?

Advancing the digital agenda takes lots of senior-management time and attention. Customer behaviour and competitive situations are evolving quickly, and an effective digital strategy calls for extensive cross-functional orchestration that may require CEO involvement.

Faced with the need to sort through functional and regional issues related to digitization, some companies are creating a new role: chief digital officer (or the equivalent). This a common way to introduce outside talent with a digital mind-set to provide a focus for the digital agenda. Walgreens, a well-performing US pharmacy and retail chain, hired its president of digital and chief marketing officer (who reports directly to the CEO) from a top technology company six years ago. Her efforts have included leading the acquisition of drugstore.com, which still operates as a pure play. The acquisition upped Walgreens’ skill set, and drugstore.com increasingly shares its digital infrastructure with the company’s existing site: walgreens.com.

Relying on chief digital officers to drive the digital agenda carries some risk of balkanization. Some of them, lacking a CEO’s strategic breadth and depth, may sacrifice the big picture for a narrower focus — say, on marketing or social media. Others may serve as divisional heads, taking full P&L responsibility for businesses that have embarked on robust digital strategies but lacking the influence or authority to get support for execution from the functional units. Alternatively, CEOs can choose to “own” and direct the digital agenda personally, top down.

Regardless of the organizational or leadership model a CEO and board choose, it’s important to keep in mind that digitization is a moving target. The emergent nature of digital forces means that harnessing them is a journey, not a destination — a relentless leadership experience and a rare opportunity to reposition companies for a new era of competition and growth.

About the Authors

Martin Hirt is a director in McKinsey’s Taipei office and leader of the firm’s global strategy practice. Paul Willmott is a director in the London office and leader of McKinsey’s global digital initiative. McKinsey & Company is a global management consultant firm. This article is excerpted from “Strategic principles for competing in the digital age,” McKinsey Quarterly, May 2014.

The authors would like to acknowledge the contributions of ‘Tunde Olanrewaju and Meng Wei Tan to this article.

![“Does Everyone Hear Me OK?”: How to Lead Virtual Teams Effectively iStock-1438575049 (1) [Converted]](https://www.europeanbusinessreview.com/wp-content/uploads/2024/11/iStock-1438575049-1-Converted-100x70.jpg)