The right systems, strategies, and tools can make your business spend management process seamless and efficient — whether you’re managing project costs or handling procurement expenses.

If you’re not optimizing your spend management process, you run the risk of burning through your resources without even knowing how or where they went.

This post covers five tips that can help you get on top of your business spending and make the process as painless as possible.

But first…

What is spend management?

Essentially, spend management is the process businesses use to strategically gather, analyze, control, and track the money spent creating and managing products and services.

The spend management process includes all the business activities associated with the procurement cycle, including budgeting, sourcing, contract and supplier management, order requisition, product development, inventory management, and travel expenses.

An organized and systemized business spending can improve your financial health, help your company maintain legal compliance, enhance your products and services, double your conversion rate, and develop better supplier relationships.

Spend management differs from expense management.

Expense management is a system for processing, paying, and auditing employee-initiated expenses.

On the other hand, spend management is the bigger picture since it’s a process for controlling and improving how a business spends money. An expense management process should be a part of your spend management structure.

Spend management includes strategic procurement activities, such as when you choose ecommerce platforms, among other things.

Strategies to streamline managing your business spending

Let’s look into five top strategies to help you develop, stay on top of, and efficiently implement your spend management processes.

1. Establish a spend management policy

The spend management process can take up a lot of time and energy, especially in the areas of procurement and suppliers, where you could lose tons of money if you’re not doing it right.

This makes it crucial to ensure everyone across your company complies with spending procedures and proposed recommendations, whether it is paying for travel expenses or purchasing articles for your marketing efforts.

A comprehensive expense policy helps ensure compliance to spending procedures, minimizing fraud risks and avoiding unnecessary expenses.

Most expense policies include a complete list of employee expenses that will or will not cover, the maximum amount limit they are authorized to spend under specific categories, and the standard procedure for expense claims.

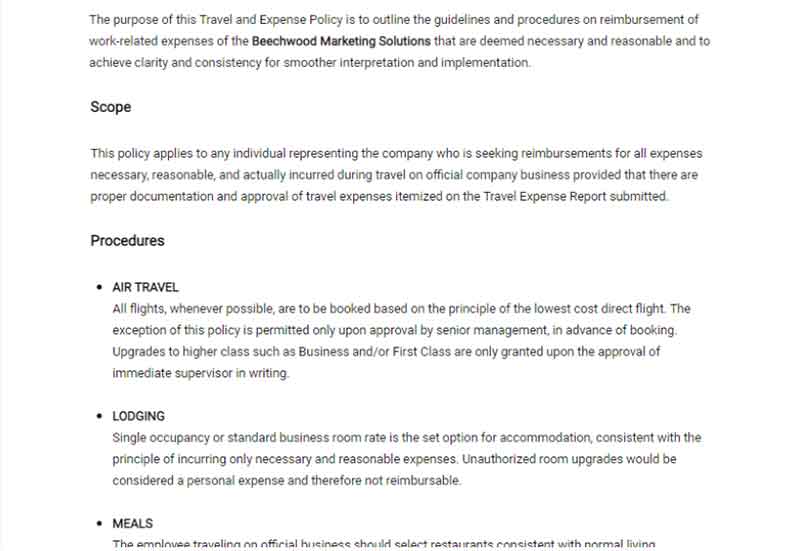

Below is an excellent example of a travel and expense policy from Beechwood Marketing Solutions.

The policy clearly describes the procedures for specific expense categories when traveling.

You can also create expense policy templates to ensure consistency and accuracy in the expense filing, documenting, and claiming.

Establish a comprehensive, enforceable, and equitable expense policy that applies to everyone to control your company spending better, improving your spend management process.

It can also streamline the expense recording process and detect unnecessary and out-of-line spending.

2. Implement processes to track spending easily

Develop a reliable reporting system that allows your employees to submit receipts, required documents, and expense reports with ease—having such a system in place keeps you from straying off course your business roadmap due to poorly managed finances.

Leverage modern technology to document paper receipts and other expense-related information, allowing employees to capture images of their paper-based documents.

For instance, use powerful Human Resource (HR) software with the appropriate tools that can support online or cloud-based expense tracking, submitting, and image uploading.

The right tools let your accounting teams, approving authorities, and managers access and approve or reject reports using their tablets, smartphones, or laptops. This streamlines the expense reporting, reimbursement, and spend management process.

A tool with robust spending and expense reporting features will also help your finance team spot trends and gain valuable insights to help identify and address spend management process gaps.

3. Automate critical aspects of your spend management

A manual spend management process means using a mountain paper.

Not only is this approach inefficient, but it also leaves plenty of room for data errors and inaccuracies, causing you potentially massive deficits and headaches down the line.

Simplify a critical aspect of your spend management process by using an automated expense management software that simplifies your employees’, accounting team’s, and supervisors’ expense reporting.

This minimizes the long and tedious back and forth emails and paper shuffling, especially when you’re working with several service providers, such as a social media marketing agency.

You can speed up your collaboration and track spending more efficiently, allowing everyone to get more crucial and value-adding things done.

Additionally, automate critical areas that will streamline your business processes and bring in more revenue.

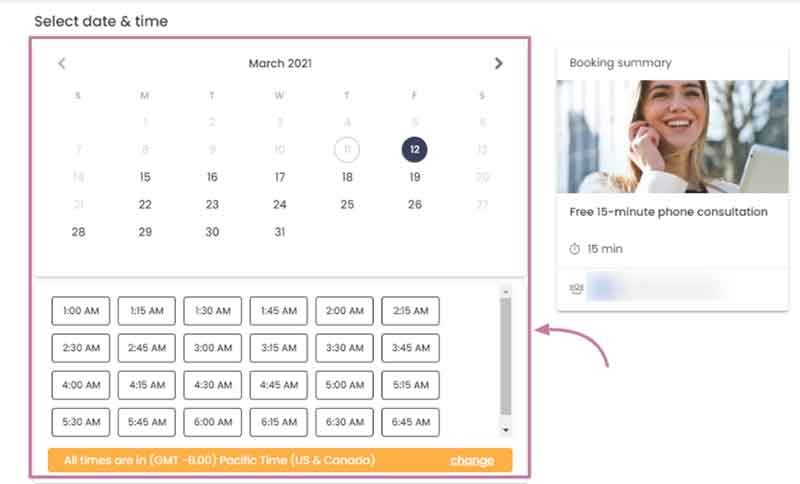

For instance, the vcita appointment booking plugin for WordPress lets you create custom calendars for your offered services and the corresponding available time slots.

This streamlines securing client bookings, and you save on personnel costs since they won’t need to process the bookings, allowing your clients to pick and schedule appointments 24/7.

Automate where you can to save time and money, helping you manage your business spending more efficiently.

4. Digitize and centralize your spending data

One of the most effective ways to simplify your expense reporting and, in turn, your spend management process is to digitize and centralize your data.

With a digital central data hub, employees can easily upload their expense reports and related documents, and managers and finance personnel can access, organize, review, and analyze the information efficiently.

Integrating your other systems, such as your robust project management software, can simplify your expense and spending tracking across your teams and projects.

Digitized and centralized expense-related documents and workflows can also improve your data’s accuracy and reduce potential errors.

All these eliminate repetitive and manual processes that hinder your employees’ productivity, allowing them to focus on core tasks such as increasing your ecommerce conversion rate.

5. Inform and implement best practices across your company

Optimize your spend management process’ and expense policies’ effectiveness by getting all your employees involved.

Educate everyone in your company on identifying, establishing, and tracking spend management across your business.

Doing so helps you develop a cost-conscious culture in your company, equipping your employees to find cost-efficient opportunities. This could be anything from automating client booking to combining social media and email marketing initiatives.

Final thoughts

Regardless of your company’s size, getting a handle on your spend management will save you a considerable amount of time, money, and energy.

Assess how your employees and business manage spending to eliminate time-consuming and inefficient processes and cut down on unnecessary expenses.

As your business grows, so will your procurement, inventory management, suppliers, and other related expenses. This can make it increasingly challenging to manage your company spending over time.

Develop an effective and efficient spend management process to help you set strategic approaches, from formulating an expense policy and automating to centralizing, to make better financial business decisions.