Introduction

Interest savings accounts are a safe way to gain some profit from your own money holding without the risk of losing it. However, bank interest rates typically do not exceed 1-1.5%. And I can bet most of us would like to get more than it. For example, 5% or even 10% gain looks more alluring, isn’t it? While some bank organizations such as Netspend offer you a 5% interest, there are usually some tricks to capitalize on you. A better alternative should exist. And in fact, it does, but it is beyond the traditional bank institutions. Today, some online banks and other financial organizations provide an interest rate of up to 12% on your deposits. And these options usually imply dealing with cryptocurrencies. They are mostly decentralized and less regulated. Thus, such investments can be associated with certain risks. On the other hand, it is the best alternative for the traditional savings accounts providing higher interest rates. Anyway, cryptocurrency gains traction nowadays, and people more often give it a chance.

Here is the best crypto saving accounts and bitcoin lendings by Reddit users opinion

The crypto savings accounts work exactly like traditional ones. The major risks result from the price fluctuations and decentralized nature of cryptocurrency. But is any other currency immune from fluctuations? Nonetheless, some crypto alternatives can boast an option of daily withdrawals that means you can cash in on them on a regular basis. Apart from that, for those who are willing to get crypto, a crypto interest account might be a really good start. It will help you not only preserve some coins but also make a profit.

Interest savings accounts of this kind are a comparatively new phenomenon as cryptocurrency has come into common use not so long ago. But this alternative succeeded to claim momentum among the broad audience. However, it is not a perfect solution for everyone. High-interest rates always seem attractive, but they go together with additional concerns. Thus, before grasping the nettle, one should dig deeper into the topic. So, let’s look into how crypto savings accounts work and what the best 5%+ interest alternatives are.

What Are Crypto Interest Accounts And How They Work?

In a nutshell, a crypto savings account is the type of interest accounts that allows you to benefit from an interest rate for keeping your money in a particular financial organization. By depositing your money, you agree that a company will loan your assets out to other people or businesses. For example, BlockFi provides interest savings accounts as well as crypto loans and even cryptocurrency trading. The company allows operating with BTC, ETH, LTC, GUSD, USDC, PAX, PAXG, and USDT. The highest interest rate reaches 8.6% (6% for Bitcoin). Using crypto loans for business purposes is a popular phenomenon now. On the other hand, anyone can benefit from them.

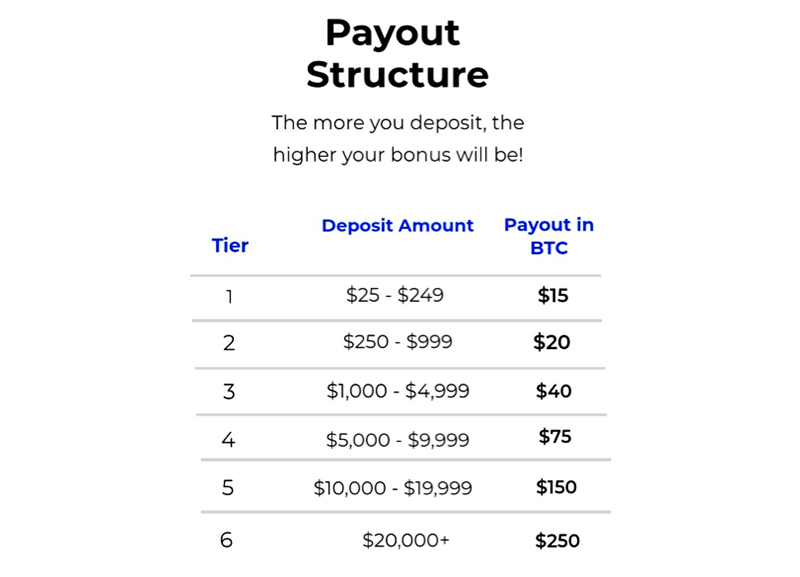

Now you can get up to 12% APY and $250 and extra bonus in BlockFi.

As you can see, crypto savings accounts are very similar to traditional bank interest accounts. So, what are the differences? First of all, the interest rate itself is higher due to the decentralized nature of cryptocurrency that deprives investors of some essential guarantees. For example, most banks protect their clients’ deposits by insurance from the FDIC (Federal Deposit Insurance Corporation). As for crypto savings accounts providers, they do not have this insurance. Thus, to attract investors financial organizations have to give them an incentive to tilt the balance in the favor of crypto savings accounts. Plus, companies providing crypto interest accounts are usually more flexible. Returning to the BlockFi example, they do not limit your transactions and you can capitalize on monthly interest payments. However, some companies can put particular limitations on withdrawals by charging fees if you liquidate your savings before a certain date.

Banks usually begrudge a high interest rate. So, the fair maximum they can afford is 5%. And if they really do allow you to benefit from it, get ready to face a lot of limitations from the amount of money held to the restrictions on withdrawals. In this case, fees can be exorbitant. On the other hand, providers of crypto interest accounts encourage their investors with bonuses and user-friendly apps. Thus, BlockFi endows customers with bonuses depending on the deposit amount.

One more thing to bear in mind while dealing with crypto savings accounts is that they are not crypto wallets. It means that it is impossible to gain interest by keeping your cryptocurrency in a wallet. It is private and your funds cannot be loaned out to anybody else. Thus, they will not give you any extra profit. Yet, some savings account providers might limit your ability to manage your deposits. Hence, in some cases, you will not be able to withdraw your funds or exchange cryptocurrency at any given moment. But it is always up to you what to do with your coins if you keep them in a wallet.

To sum up, crypto savings accounts are something in the middle between a traditional interest account and a way of investing. They have the most benefits of the former as well as a certain risk associated with the latter.

Other 5%+ Crypto Interest Savings Accounts

We have already discussed the example of BlockFi to illustrate how crypto savings accounts work. But this is not the only decent option. Let’s look into other providers.

YouHodler

This is a Swiss platform whose name is the acronym for “Hold On for Dear Life”. It is suitable for long-term cryptocurrency investments providing APY from 3% to 12%. The minimum deposit is $100 and you can benefit from a wide range of cryptocurrencies. The number of coins reaches 22. Weekly interest payouts are also possible.

Here is information how to get bonus in YouHodler

Crypto.com

The platform can boast a variety of coins to choose from. There are 26 cryptocurrencies and about 8 stablecoins. The APY varies between 3% and 12% depending on the currency choice. For example, if you favor stablecoins, your deposit can bring you up to 12% interest. But if you prefer keeping funds in such cryptocurrencies as Bitcoin or Ethereum, you can rely on up to 6.5% APY. Besides, the platform is pretty flexible in terms of funds management. Thus, you can capitalize on daily interest and withdraw your money anytime.

Nexo

This is one of these rare examples providing guarantees that can be compared with bank alternatives. The company keeps $100 million in insurance to ensure the safety of users’ deposits. Another upside is the possibility of daily interest payouts that you can get in 24 hours after the request. As for the interest rate, it reaches 12%. Plus, Nexo does not put limitations on the minimum deposit or make you pay monthly fees.

Celsius Network

Apart from high interest rates, the company provides bonuses for the first deposit and the loyalty program. The loyalty rewards include additional bonuses in their native cryptocurrency called CEL and the opportunity to benefit from the highest interest rate of 18.55%. Unfortunately, the loyalty program is not available for US users. The overall APY varies between 2.50% and 13.99%. Competitors can barely surpass this rate. Plus, no requirements for the minimal deposit are set and you can withdraw savings weekly.

Things to Consider While Choosing a Crypto Savings Account

Picking the first available option from the list is not the best way to start with crypto savings accounts. Before coming up with a decision, observe the preferred platforms in more detail. Besides, there are a number of aspects to take into consideration while choosing a company.

- Trustworthiness: the safety of your own funds is your first priority. As crypto interest accounts are not protected by insurance from FDIC, you need to check other ways the company upholds a good reputation. In this regard, some of them form a private insurance pool, others can boast various reliability proofs, etc.

- Cryptocurrency options: there are a lot of coins in the market. And by far not every savings account provider supports all of them. If you have already made your own choice on the coin you want to invest, search for a provider who accepts it.

- Market access: providing you do not have a crypto wallet with some coins in it, you may like the idea of selecting a provider that can give you an opportunity to buy some coins on the platform. Unfortunately, not every company provides market access. So, this issue is also to be checked in advance.

And last but not least, if you are not sure which cryptocurrency would serve your purpose best, spend some time delving into it. Coins are not equal. They are different because of numerous reasons. For example, some of them are less inclined to fluctuations. And others are pinned to particular fiat currencies. Lastly, for some, you can make money online without investment. Just weigh up the pros and cons and pick the best one.

In Wrapping Up

Alternatives for traditional interest savings accounts grow in popularity as well as cryptocurrencies do. Thus, for many people, crypto savings accounts are a sure-fire way to gain some profit. However, the higher interest rates go together with increased risks. And these risks are not only related to the savings account provider, but also to the cryptocurrency you prioritize. Plus, crypto platforms are not backed up with federal insurance and sometimes have certain limitations concerning the minimal deposit, transactions, etc. But don’t bank interest savings accounts have their own downsides?

Interest savings accounts are often treated as the way to make oneself safe against a financial crunch. In this regard, a crypto interest account is rather a way to invest wisely. Of course, some providers give you a chance to capitalize on monthly or weekly interest payouts. But experts usually recommend avoiding investing more than you cannot afford to lose. Even when it comes to crypto savings accounts.

Disclaimer: This article contains sponsored marketing content. It is intended for promotional purposes and should not be considered as an endorsement or recommendation by our website. Readers are encouraged to conduct their own research and exercise their own judgment before making any decisions based on the information provided in this article.