By Tina Saebi, Lasse Lien and Nicolai Foss

Business models define how companies create, deliver and capture value. But business models are not static – they need to be adapted to changing conditions. This article discusses what causes managers to change their existing business models.

The Idea in Brief

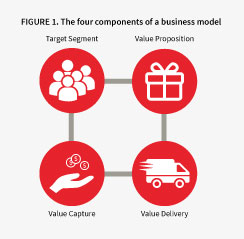

Business models define how companies create, deliver and capture value. They specify the company’s value proposition, target customers, and mechanisms for value delivery and value capture (see Figure 1 below).

But business models are not static – they need to be adapted to changing conditions. So what causes managers to change their existing business models? Are they more likely to adapt business models under conditions of perceived threat or under perceived opportunity? In other words, is the carrot or the stick more likely to induce business model change and adaptation? Using the financial crisis as a natural experiment that simultaneously created both threats and opportunities, we attempted to find out more about this question.

A Bit of Theory: Two Opposing Views

How do you react under conditions of threat? Imagine that you are confronted with numbers showing declining margins or a diminishing customer base. Does this spell “stick to what you know best, now is not the time to experiment” (risk-averse) or does it spell “we surely must try something new, the old ways are no longer working” (risk-seeking)?

What about an unexpected growth of your customer base, or surprisingly high margins in some part of your business? Would such surprises indicate that you may need to change something to fully capitalise on the opportunity (risk-seeking), or does it tell you that the status-quo is working really well and should not be tampered with (risk averse?)

Proponents of threat-rigidity theory predict that managers are more likely to be risk-averse under conditions of perceived threat, but to engage in more risk-taking behaviour when facing an opportunity. In contrast, proponents of prospect theory predict the exact opposite: managers are more risk seeking under conditions of threat than under conditions of opportunity.

We wanted to figure out which of these opposing predictions hold true when it comes to business model adaptation. Changing an existing business model is in most cases costly, with an uncertain outcome. Therefore, it seems reasonable to consider business model adaptation a risky undertaking. Figure 2 summarises our hypotheses.

[ms-protect-content id=”9932″]

Method

In 2010, Professor Lasse Lien and Eirik Knudsen from the Norwegian School of Economics collected data on a representative sample of 1195 Norwegian companies’ experiences during the financial crisis. Using CEOs as respondents, data was collected on how firms were affected by the recession in the wake of the financial crisis, and which measures the firms undertook to adapt their business model in response to this. In our sample there were firms that were both positively and negatively affected by the recession. We defined threat as the perception of being negatively affected, and opportunity as being positively affected. For a more detailed account of our method, data collection and statistical analysis, please see our full journal article published in Long Range Planning.

Findings

Our research findings show that managers are more likely to adapt their business model under conditions of perceived threats than under conditions of perceived opportunity. To be more precise, we found that the more severe the external threat, the more likely that the firm would change their business model. While an increase in the perceived opportunities only increased the likelihood of status quo. So, our main finding is in line with prospect theory. Managers are more willing to take on the risk of adapting business models when faced by a significant threat, and less willing to do so when faced by an opportunity.

Are firms equally subject to this pattern? The short answer is “no”, among other things because some firms are more used to making modifications to their business models than others, and such firms become better equipped to do so. Specifically, we find that those firms that have strategic orientations that emphasise flexibility and seizing opportunities are more likely to make business model adaptations for any level of recession impact than firms more oriented towards cost and process efficiencies. This effect also holds whether the firms are faced with either a threat or an opportunity. So in a sense practice makes perfect, also in the context of business model adaptations.

For the full paper, please check «What drives business model adaptation? The impact of opportunities, threats and strategic orientation» by Tina Saebi, Lasse Lien and Nicolai Foss. Published in: Long Range Planning, 2016.

[/ms-protect-content]

About the Authors

Tina Saebi is Associate Professor in International Strategy at the Norwegian School of Economics (NHH) and research director for the theme Business Model Innovation at the Center for Service Innovation (CSI). Her research focusses on business model design for entrepreneurs as well as the drivers, barriers and facilitators of business model innovation in established, international companies.

Tina Saebi is Associate Professor in International Strategy at the Norwegian School of Economics (NHH) and research director for the theme Business Model Innovation at the Center for Service Innovation (CSI). Her research focusses on business model design for entrepreneurs as well as the drivers, barriers and facilitators of business model innovation in established, international companies.

Lasse B. Lien is Professor of Strategy at the Norwegian School of Economics (NHH) and director of the Center for Strategy, Organization and Performance (S T O P). His research focusses on strategy and business cycles, strategic human capital, and the ownership and boundaries of the firm.

Lasse B. Lien is Professor of Strategy at the Norwegian School of Economics (NHH) and director of the Center for Strategy, Organization and Performance (S T O P). His research focusses on strategy and business cycles, strategic human capital, and the ownership and boundaries of the firm.

Nicolai J. Foss is Professor of Organization Theory and Human Resource Management at the Bocconi University, Milano. A prolific contributor to the management research literature, his research focusses on the performance effects of organisational design and HRM, and the drivers and consequences of firm-level entrepreneurship.

Nicolai J. Foss is Professor of Organization Theory and Human Resource Management at the Bocconi University, Milano. A prolific contributor to the management research literature, his research focusses on the performance effects of organisational design and HRM, and the drivers and consequences of firm-level entrepreneurship.